IBEX Shareholders Approve Sale of the Company

April 03 2024 - 11:36AM

IBEX Technologies Inc. (“IBEX” or the “Company”) (TSX Venture: IBT)

is pleased to announce that at an annual and special meeting held

today, IBEX shareholders approved the previously-announced proposed

amalgamation (the “

Amalgamation”) of IBEX and

15720273 Canada Inc., a newly-incorporated wholly-owned subsidiary

of BBI Solutions OEM Limited (“

BBI”), whereby BBI

will acquire all of the issued and outstanding shares of IBEX at a

price of $1.45 per share in cash. The total consideration is

approximately $37.9 million.

The Amalgamation was approved by IBEX

shareholders with a positive vote of approximately 99.83% of the

shares voted and by a positive vote of approximately 99.80% of the

“minority” shares voted as required by applicable securities

regulations. More than 75% of IBEX’s outstanding shares as of the

record date were voted at the meeting.

Closing of the Amalgamation is expected to take

place on Monday, April 8, 2024. IBEX first announced the

transaction with BBI on February 9, 2024.

Fasken Martineau DuMoulin LLP is acting as

legal counsel to IBEX in connection with the Amalgamation.

ABOUT IBEX

IBEX manufactures and markets proteins for

biomedical use through its wholly-owned subsidiary

IBEX Pharmaceuticals Inc. (Montréal, QC).

For more information, please visit the Company’s

website at www.ibex.ca.

ABOUT BBI

BBI is an international provider of immunoassay

products and services to the global diagnostics and life sciences

industries. The company offers high-performance recombinant and

native reagents across the entire immunodiagnostic workflow,

including antigens, antibodies, enzymes and complementary reagents.

It also offers a one-stop service for lateral flow assay

development and lateral flow point of care manufacturing. Our core

purpose is serving the science of diagnostics and in doing so we

supply the majority of the main IVD players globally.

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

Safe Harbor Statement

All of the statements contained in this news

release, other than statements of fact that are independently

verifiable at the date hereof, are forward-looking statements. Such

statements, as they are based on the current assessment or

expectations of management, inherently involve numerous risks and

uncertainties, known and unknown. Some examples of known risks are:

the impact of general economic conditions, general conditions in

the pharmaceutical industry, changes in the regulatory environment

in the jurisdictions in which IBEX does business, stock market

volatility, fluctuations in costs, and changes to the competitive

environment due to consolidation or otherwise. Consequently, actual

future results may differ materially from the anticipated results

expressed in the forward-looking statements. In particular,

completion of the proposed acquisition of IBEX by BBI is subject to

numerous conditions, termination rights and other risks and

uncertainties, including the ability of IBEX to satisfy closing

conditions. Accordingly, there can be no assurance that the

proposed transaction with BBI will occur, or that it will occur on

the timetable or on the terms and conditions contemplated. IBEX

disclaims any intention or obligation to update these statements,

except if required by applicable laws.

Contact:

Paul BaehrChairman, President & CEOIBEX

Technologies Inc.514-344-4004 x 143

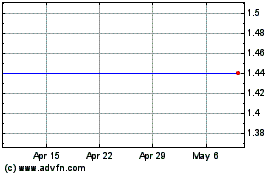

Ibex Technologies (TSXV:IBT)

Historical Stock Chart

From Mar 2025 to Apr 2025

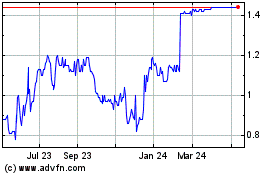

Ibex Technologies (TSXV:IBT)

Historical Stock Chart

From Apr 2024 to Apr 2025