Immunotec Inc. (TSX VENTURE:IMM), a Canadian based company and a leader in the

wellness industry (the "Company"), today released its 2012 Third quarter results

for the period ended July 31, 2012.

Third Quarter 2012 Highlights:

(All amounts are in CAD dollars.)

-- Network sales reached $11.7M, an increase of 23.1% as compared to the

same period in the previous year.

-- Total Revenue reached $13.0M an increase of 22.7% as compared to the

same period of the previous year.

-- Expenses as a percentage of total revenues improved to 24.2% as compared

to 26.0% of total sales for the same quarter last year.

-- Adjusted EBITDA increased to $628 thousand or 4.8% of total revenues,

compared to $283 thousand or 2.7% of total revenues over the same

quarter last year. This represents a major improvement over the prior

year.

-- Net profit of $265 thousand, compares favorably to $107 thousand for the

same period a year earlier.

"This was the largest quarterly revenue ever recorded for Immunotec" said Bob

Henry, Immunotec's Chairman and CEO. "We have been able to recruit nearly 30,000

new consultants over the last nine months, representing an increase of 40% over

prior year. This is an affirmation of the strength of our compensation plan and

the opportunity that we provide to our Consultants."

Condensed financial results for the third quarter and year-to-date period, ended

July 31, 2012 are as follows:

-- During the third quarter, Network sales reached $11.7M in 2012 as

compared to $9.5M for the same period in 2011, an increase of 23.1% or

$2.2M. Other revenues which include revenues of products sold to

licensees, freight and shipping, charge backs and educational material

purchased by our network, were $1.3M in Q3 of 2012, a small increase of

$0.2M, as compared to $1.1M for the same period in 2011.

-- After nine months, Network sales reached $32.0M in 2012 as compared to

$27.5M for the same period in 2011, an increase of 16.4% or $4.5M. Other

revenues amounted to $3.6M in 2012, a decrease of $0.6M, directly

attributable to a reduction in export sales, compared to $4.2M for the

same period last year.

-- Sales incentives are the most significant expense and consist of

commissions, performance bonuses and other discretionary incentive cash

bonuses to qualifying distributors. During the quarter, the Company paid

$5.9M in sales incentives for an average of 50.0% of total Network sales

and the same percentage as the last year. For the nine-month period

ended July 31, 2012, the Company paid $16.2M in sales incentives for an

average of 50.8% of total Network sales this represents a small decline

as compared to 51.7% for the same period in 2011.

-- Margin before expenses, as a percentage of net sales, increased in the

third quarter ending July 31, 2012 at 29.2% as compared to 29.0% for the

same quarter in 2011. For the nine-month period ended July 31, 2012, the

Company recorded an average of 28.4% of total Revenues and a small

decline compared to 28.7% for the same period in 2011.This decrease is

primarily attributed to a reduction in Export sales to licensees which

usually provide a higher contribution margin.

-- Selected expenses in the third quarter of 2012 were $3.2M as compared to

$2.8M for the same period in 2011. They now represent 24.2% of total

revenues as compared to 26.0% of total revenues a year earlier. For the

nine-month period ended July 31, 2012, operating expenses were $9.0M

representing 25.3% of total revenues compared to 28.5% of total revenues

for the same period a year earlier.

-- The adjusted EBITDA, a non GAAP financial measure, for the three-month

period ended July 31, 2012, was $628 thousand which represents an

increase of $345 thousand or 122% over adjusted EBITDA for the same

period ended July 31, 2011. For the nine-month period ended July 31,

2012, adjusted EBITDA was $1.3M which represents an improvement of $1.0M

or 425% over adjusted EBITDA for the same period in 2011.

-- Net profit for the quarter ended July 31, 2012 totalled $265 thousand,

as compared to a net profit of $107 thousand for the same period a year

earlier. For the nine-month period ended July 31, 2012, net profit was

$162 thousand as compared to a net loss of $1.2M for the same period in

2011. This net improvement, after nine months in 2012, over the previous

year reducing the net loss by $1.3M resulted primarily due from revenue

growth in Mexico which mitigated other jurisdiction decreases while

reducing certain corporate expenses.

About Immunotec Inc.

Immunotec is a world class business opportunity supported by unique

scientifically proven products that improve wellness. Headquartered with

manufacturing facilities near Montreal, Canada, the Company also has

distribution capacities to support its commercial activities in Canada and

internationally to the United States, Europe, Mexico and the Caribbean.

The Company files its consolidated financial statements, its management and

discussion analysis report, its press releases and such other required documents

on the SEDAR database at www.sedar.com and on the Company's website at

www.immunotec.com. The common shares of the Company are listed on the TSX

Venture Exchange under the ticker symbol IMM.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS: Certain statements contained in

this news release are forward-looking and are subject to numerous risks and

uncertainties, known and unknown. For information identifying known risks and

uncertainties and other important factors that could cause actual results to

differ materially from those anticipated in the forward-looking statements,

please refer to the heading Risks and Uncertainties in Immunotec's most recent

Management's Discussion and Analysis, which can be found at www.sedar.com.

Consequently, actual results may differ materially from the anticipated results

expressed in these forward-looking statements.

Interim Consolidated Statements of Financial Position

(Unaudited)

(Stated in Canadian dollars)

July 31, October 31,

2012 2011

$ $

----------------------------------------------------------------------------

ASSETS

Current assets

Cash 3,159,246 2,561,969

Trade and other receivables 1,295,556 659,004

Inventories 2,812,455 3,324,740

Prepaid expenses 447,206 393,119

----------------------------------------------------------------------------

7,714,463 6,938,832

Non-current assets

Property, plant and equipment 6,021,961 5,931,411

Intangible assets 1,685,114 2,000,217

Goodwill 833,559 833,559

Deferred income tax assets 2,675,734 2,725,367

Non-refundable research and development tax

credits 337,971 337,971

----------------------------------------------------------------------------

11,554,339 11,828,525

----------------------------------------------------------------------------

19,268,802 18,767,357

----------------------------------------------------------------------------

LIABILITIES

Current liabilities

Payables 1,263,102 935,800

Accrued liabilities 2,918,224 2,464,967

Provisions 459,278 671,201

Customer deposits 345,168 288,192

Income taxes 74,416 58,576

Current portion of long- term debt 116,071 312,320

----------------------------------------------------------------------------

5,176,259 4,731,056

Long-term debt 1,990,343 2,077,787

----------------------------------------------------------------------------

7,166,602 6,808,843

----------------------------------------------------------------------------

EQUITY

Share capital 3,465,350 3,465,548

Other equity - Stock options 1,927,710 1,903,039

Contributed surplus 11,336,849 11,337,796

Accumulated other comprehensive income 264,534 306,595

Deficit (4,892,243) (5,054,464)

----------------------------------------------------------------------------

12,102,200 11,958,514

----------------------------------------------------------------------------

19,268,802 18,767,357

----------------------------------------------------------------------------

Interim Consolidated Statements of Changes in Equity

(Unaudited)

Nine-month periods ended July 31,

(Stated in Canadian dollars except for number of shares)

Other equity

- Stock Contributed

Share capital options surplus

--------------------------

Number $ $ $

----------------------------------------------------------------------------

Balance at November 1,

2010 69,994,300 3,465,548 1,894,040 11,337,796

Net loss for the

period - - - -

Foreign currency

translation

adjustments - - - -

----------------------------------------------------------------------------

Total comprehensive loss

of the period: - - - -

Share-based compensation - - (1,405) -

----------------------------------------------------------------------------

Balance at July 31, 2011 69,994,300 3,465,548 1,892,635 11,337,796

----------------------------------------------------------------------------

Balance at November 1,

2011 69,994,300 3,465,548 1,903,039 11,337,796

Net profit for the

period - - - -

Foreign currency

translation

adjustments - - - -

----------------------------------------------------------------------------

Total comprehensive

income of the period: - - - -

Repurchase of shares (4,245) (198) - (947)

Share-based compensation - - 24,671 -

----------------------------------------------------------------------------

Balance at July 31, 2012 69,990,055 3,465,350 1,927,710 11,336,849

----------------------------------------------------------------------------

Accumulated

other

comprehensive

income Deficit Total

$ $ $

------------------------------------------------------------------

Balance at November 1,

2010 - (3,650,834) 13,046,550

Net loss for the

period - (1,237,382) (1,237,382)

Foreign currency

translation

adjustments 197,412 - 197,412

------------------------------------------------------------------

Total comprehensive loss

of the period: 197,412 (1,237,382) (1,039,970)

Share-based compensation - - (1,405)

------------------------------------------------------------------

Balance at July 31, 2011 197,412 (4,888,216) 12,005,175

------------------------------------------------------------------

Balance at November 1,

2011 306,595 (5,054,464) 11,958,514

Net profit for the

period - 162,221 162,221

Foreign currency

translation

adjustments (42,061) - (42,061)

------------------------------------------------------------------

Total comprehensive

income of the period: (42,061) 162,221 120,160

Repurchase of shares - - (1,145)

Share-based compensation - - 24,671

------------------------------------------------------------------

Balance at July 31, 2012 264,534 (4,892,243) 12,102,200

------------------------------------------------------------------

Interim Consolidated Statements of Comprehensive Income (Loss)

(Unaudited)

Three-month and nine-month periods ended July 31,

(Stated in Canadian dollars except for number of shares)

For the three-month period For the nine-month period

ended July 31, ended July 31,

2012 2011 2012 2011

$ $ $ $

----------------------------------------------------------------------------

Revenues

Network sales 11,745,818 9,540,766 31,983,983 27,473,893

Other revenue 1,334,122 1,115,894 3,559,212 4,218,179

----------------------------------------------------------------------------

13,079,940 10,656,660 35,543,195 31,692,072

Variable costs

Cost of goods sold 2,279,372 1,833,175 6,070,755 5,524,949

Sales incentives -

Network 5,872,291 4,773,420 16,243,951 14,203,931

Other variable

costs 1,106,989 961,154 3,144,149 2,869,059

----------------------------------------------------------------------------

Margin before

expenses 3,821,288 3,088,911 10,084,340 9,094,133

----------------------------------------------------------------------------

Expenses

Administrative 1,652,175 1,550,710 4,651,953 4,782,410

Marketing and

selling 1,260,565 959,162 3,666,334 3,527,444

Quality and

development costs 250,497 256,144 656,630 733,009

Depreciation and

amortization 229,294 273,272 692,556 811,674

Other expenses 2,824 (161,610) 24,671 496,015

----------------------------------------------------------------------------

Operating income

(loss) 425,933 211,233 392,196 (1,256,419)

----------------------------------------------------------------------------

Net finance

expenses 73,314 47,133 153,687 316,890

----------------------------------------------------------------------------

Profit (loss) before

income taxes 352,619 164,100 238,509 (1,573,309)

Income taxes

(recovery)

Current 8,278 15,020 23,733 19,704

Deferred 79,602 41,985 52,555 (355,631)

----------------------------------------------------------------------------

Net profit (loss) 264,739 107,095 162,221 (1,237,382)

----------------------------------------------------------------------------

Other comprehensive

income (loss), net

of income tax

Foreign currency

translation

adjustments 14,792 10,005 (42,061) 197,412

----------------------------------------------------------------------------

Total comprehensive

income (loss) for

the period 279,531 117,100 120,160 (1,039,970)

----------------------------------------------------------------------------

Total basic and

diluted net profit

(loss) per share 0.00 0.00 0.00 (0.02)

----------------------------------------------------------------------------

Weighted average

number of common

shares outstanding

during the period

Basic and diluted 69,994,063 69,994,300 69,994,063 69,994,300

----------------------------------------------------------------------------

Interim Consolidated Statements of Cash Flows

(Unaudited)

Nine-month periods ended July 31,

(Stated in Canadian dollars)

2012 2011

$ $

----------------------------------------------------------------------------

Operating activities

Net profit (loss) 162,221 (1,237,382)

Adjustments for:

Depreciation of property, plant and

equipment 275,505 345,765

Amortization of intangible assets 417,052 465,909

Gain on settlement of contingent

consideration liability - (56,950)

Unrealized foreign exchange (20,520) 293,911

Accreted interest - 44,436

Interest expense measured at amortized cost 58,171 47,355

Future income taxes 52,555 (355,631)

Share- based compensation 24,671 (1,405)

Interest paid (61,295) (47,355)

Interest received 3,124 -

----------------------------------------------------------------------------

Cash received prior to working capital

variation 911,484 (501,347)

Net change in non- cash working capital 452,531 (130,394)

----------------------------------------------------------------------------

Net cash provided by (used in) operating

activities 1,364,015 (631,741)

----------------------------------------------------------------------------

Investing activities

Additions to property, plant and equipment (366,386) (104,770)

Additions to intangible assets (105,135) (154,823)

----------------------------------------------------------------------------

Net cash used in investing activities (471,521) (259,593)

----------------------------------------------------------------------------

Financing activities

Reimbursement of long- term debt (84,353) -

Reimbursement of demand loan - (133,333)

Reimbursement of other liability (200,203) (83,572)

Repurchase of shares (1,145) -

----------------------------------------------------------------------------

Net cash used in financing activities (285,701) (216,905)

----------------------------------------------------------------------------

Net increase (decrease) in cash during the

period 606,793 (1,108,239)

Cash at the beginning of the period 2,561,969 2,936,456

Effect of foreign exchange rate fluctuations

on cash (9,516) (17,747)

----------------------------------------------------------------------------

Cash at the end of the period 3,159,246 1,810,470

----------------------------------------------------------------------------

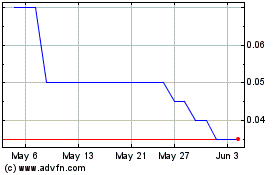

International Metals Min... (TSXV:IMM)

Historical Stock Chart

From Dec 2024 to Jan 2025

International Metals Min... (TSXV:IMM)

Historical Stock Chart

From Jan 2024 to Jan 2025