Toronto, Ontario, Canada -- December 17, 2021 -- InvestorsHub

NewsWire -- Leveljump Healthcare Corp. (TSXV: JUMP) (OTCQB: JMPHF) (FSE: 75J) ("Leveljump" or the

"Company"), a Canadian leader in B2B telehealth solutions, is

pleased to announce that, subject to regulatory approval, it has

agreed to acquire an additional 2.3% minority equity interest in

Real Time Medical Inc. ("RTM"), a private Ontario company, in

exchange for 392,875 units (a "Unit") of Leveljump. Each Unit will

be issued at a price of $0.50 per Unit with each Unit being

comprised of three (3) Leveljump common shares at a deemed price of

$0.15 per share and one (1) share purchase warrant of Leveljump,

each warrant entitling the holder to acquire one additional common

share of Leveljump at a price of $0.35 per common share on or

before December 31, 2023.

Leveljump will now own a 16.9% interest in RTM.

Closing of the RTM purchase is subject to the consent of the TSX

Venture Exchange (the "Exchange"). For further information

regarding the Company's interest in RTM, please see the Company's

news release dated November 25, 2021.

All securities issued will be subject to a hold period of four

months and one day pursuant to applicable securities laws.

Shaw Companies

Leveljump has agreed to exercise its right of first refusal to

purchase a further 1.5% minority interest in each of Shaw Lens Inc.

and Shaw Vision Inc. for a total price of $15,000. The Company will

be advised in approximately 30 days if it will receive the full

allotment of the 1.5% interest or if other shareholders of the Shaw

companies will also exercise their rights and if the shares will be

pro-rated amongst all existing shareholders who make a claim to

purchase the shares.

If the Company receives the full allotment of the shares for

sale it will then own approximately 25.3% in the Shaw

companies.

For further information regarding the Company's interest in Shaw

Lens Inc. and Shaw Vision Inc., please see the Company's news

release dated August 31, 2021.

Management Purchase of Shares

Subject to the consent of the Exchange and, where required,

disinterested shareholder approval, both the CEO and CFO of the

Company have agreed to convert an aggregate of $240,000 in accrued

salary into common shares of the Company at an issue price of $0.12

per share for a total of 2,000,000 shares.

Under Exchange rules, an aggregate of up to $120,000 of the

accrued salary may be converted into 1,000,000 shares without prior

disinterested shareholder approval. The remaining $120,000

(1,000,000 shares) will be converted once disinterested shareholder

approval has been obtained. Such approval is expected to be sought

at the next annual meeting of shareholders to be held in Q2

2022.

IHF Purchase Update

The purchase of the IHF centers announced on September 28, 2021

is targeting to close towards the end of January 2022. Financing

has been secured and the Company is awaiting license transfer

permission from the Ministry of Health in order to close the

transaction. Management is working with the seller to transfer all

vendor accounts and ensure a smooth transition.

Telehospital Purchase

The Company is underway with its diligence and audit of

Telehospital and working diligently on licensing and transition

planning for the acquisition.

For further information regarding this transaction, please see

the Company's news release dated October 1, 2021.

CTS Operations Update

CTS continues to see strong demand for its services and 2021 Q4

appears to continue this trend. The switchover from the Company's

legacy PACS system to the new RamSoft PACS will be completed in Q1

2022 and will offer a more efficient workflow for radiologist users

and hospital clients. The switch will help reduce costs of goods

sold and increase gross margins.

Director and Management Options

Leveljump has issued options to each of its three new

independent directors as disclosed in the news release on December

7th, 2021. Each of the new directors will receive

300,000 options that will vest at a rate of 1/12 per month and are

exercisable at a price of $0.20 prior to December 31, 2023. The

independent directors will also receive a monthly stipend of $800

per month.

The two executive directors have each been issued 500,000

options that will vest at a rate of 1/12 per month and are

exercisable at a price of $0.20 prior to December 31, 2023.

Additionally, the CEO and CFO have each been issued 1,800,000

options, which will represent their total employment option grant

over the next 3 years, that will vest at a rate of 1,000,000 on

January 1, 2022, and 400,000 on January 1, 2023, and 400,000 on

January 1, 2024. The exercise price on the options is $0.25 per

share, exercisable prior to December 31, 2025.

About Leveljump Healthcare

Leveljump Healthcare Corp., (TSXV: JUMP) (OTCQB: JMPHF) (FSE: 75J)

is a healthcare company with a focus on profitable telehealth

solutions as well as primary care services in radiology. The

Company's subsidiary, CTS, provides off-site radiology readings for

hospital emergency rooms and is a leader in the teleradiology space

in Ontario. As part of our growth strategy, we are acquiring

healthcare companies that have strong revenue and cash flow, with

room for organic growth.

ON BEHALF OF THE BOARD OF DIRECTORS OF

LEVELJUMP HEALTHCARE CORP.

Mitchell Geisler, Chief Executive Officer

info@leveljumphealthcare.com

(833) 840-2020

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

INFORMATION

This news release contains "forward-looking information"

within the meaning of applicable securities laws relating to the

Company's business plans and the outlook of the Company's industry.

Although the Company believes, in light of the experience of its

officers and directors, current conditions and expected future

developments and other factors that have been considered

appropriate, that the expectations reflected in this

forward-looking information are reasonable, undue reliance should

not be placed on them because the Company can give no assurance

that they will prove to be correct. Actual results and developments

may differ materially from those contemplated by these statements.

The statements in this press release are made as of the date of

this release and the Company assumes no responsibility to update

them or revise them to reflect new events or circumstances other

than as required by applicable securities laws. The Company

undertakes no obligation to comment on analyses, expectations or

statements made by third parties in respect of the Company,

Canadian Teleradiology Services, Inc., their securities, or their

respective financial or operating results (as applicable).

Neither the Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the Exchange)

accepts responsibility for the adequacy or accuracy of this

release.

The securities being offered have not been, and will

not be, registered under the United States Securities Act of 1933,

as amended (the "U.S. Securities Act") or any U.S. state securities

laws, and may not be offered or sold in the United States or to, or

for the account or benefit of, United States persons absent

registration or an applicable exemption from the registration

requirements of the U.S. Securities Act and applicable U.S. state

securities laws. This press release does not constitute an offer to

sell or the solicitation of an offer to buy securities in the

United States, nor in any other jurisdiction.

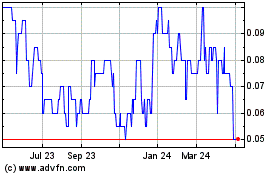

Leveljump Healthcare (TSXV:JUMP)

Historical Stock Chart

From Dec 2024 to Jan 2025

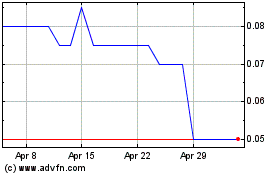

Leveljump Healthcare (TSXV:JUMP)

Historical Stock Chart

From Jan 2024 to Jan 2025