Katanga Announces Second Quarter Results

August 07 2009 - 3:15PM

Marketwired Canada

Katanga Mining Limited (TSX:KAT) ("Katanga" or the "Company") today announces

its financial results for the calendar quarter and the six months ended June 30,

2009.

Highlights during and subsequent to the three months ended June 30, 2009

- Total sales for the quarter were US$62.3 million, comprising US$47.9 million

(10,478 tonnes) for copper cathode, US$14.0 million (500 tonnes) for cobalt

metal, and US$0.4 million (560 tonnes) for cobalt concentrate sales.

- The Company reported a net loss for the quarter ended June 30, 2009 of US$57.5

million (US$0.09 per share). This loss includes non-recurring restructuring

expenses of $15.9 million.

- The completion of the refurbishment of the existing facilities to a production

capacity of 70,000 tonnes of copper and 4,000 tonnes of cobalt per annum is

expected in the third quarter and expenditure on the refurbishment is forecast

to be under budget.

- As per the Company's press releases dated April 28, 2009 and May 22, 2009, the

Company announced a US$ 250 million rights offering during the quarter. The

rights offering included a standby commitment to ensure that US$ 250million was

raised. Further, a US$50 million bridge loan was obtained and partially drawn

down on during the quarter to fund the ongoing operations of the Company and

subsequently repaid using a portion of the proceeds of the rights offering.

- As per the Company's press release dated June 2, 2009, the Company received

notices of exchange from all lenders under the US$ 265.3 million mandatorily

convertible facility to exchange in full their respective loan participations.

The total amount outstanding under the Facility as at that date was US$270.2

million, which includes accrued and capitalized interest. In connection with the

exchange, the Company issued an additional 971,023,329 common shares.

- As per the Company's press release dated June 10, 2009, the Company completed

the early liquidity closing in relation the rights offering and as a result,

gross proceeds of US$172.3 million were raised by issuing 492,379,266 common

shares of the Company. The Company used US$32.5 million of the funds to repay

the partly drawn bridge facility owing to Glencore Finance (Bermuda) Limited.

Subsequent to the second quarter, as per the Company's press release dated July

7, 2009, the rights offering was completed and the Company raised additional

gross proceeds of US$77.7 million by issuing an additional 225,657,016 common

shares of the Company.

- As a result of the exchange of the US$ 265.3 million mandatorily convertible

facility and completion of the rights offering the Company's total issued and

outstanding common shares increased to 1,895,380,413.

- As per the Company's press released date July 27, 2009, on July 25, 2009, the

Company signed an amended Kamoto Copper Company ("KCC") Joint Venture Agreement

(the "AJVA") with La Generale des Carrieres et des Mines ("Gecamines"). The key

areas of the new AJVA are: to release the Dikuluwe and Mashamba West Deposits;

to merge the DRC Copper and Cobalt Project ("DCP") and KCC joint ventures; and

address requirements of the Government of the Democratic Republic of Congo

resulting from the review of mining partnerships with Gecamines.

Operations and Project Summary for the quarter ended June 30, 2009

Underground (KTO)

During the quarter ended June 30, 2009, 255,129 tonnes of ore was mined with an

average copper grade of 4.02% and cobalt grade of 0.51%. This represents a 32%

increase on the previous quarter. The Company continues to use external

consultants to evaluate the use of bulk mining methods to improve efficiency and

safety and work with mine contractors to increase development, backfill and roof

supports.

Open Pit (T17)

425,372 tonnes of ore was produced (a 106% increase from the previous quarter)

with a copper grade of 1.29% and a cobalt grade of 0.83%, this is largely as a

direct result of the mobilization of the mining fleet that took place in the

first quarter.

Kamoto Concentrator

476,750 tonnes of ore was processed from both the underground and the open pit

mines from which 46,447 tonnes of concentrate was produced, an increase from the

first quarter due to the increase in underground and open pit extraction and

commissioning of the CM3 mill in March. Refurbishment of CM1 and BM1 mills is

continuing and remains on schedule.

Luilu Processing Plant

In the three months ended June 30, 2009 the Company achieved production of 9,516

tonnes of copper cathode and 595 tonnes of cobalt metal (a 9% and 22% increase

on the previous quarter production respectively) following the refurbishment of

the leach residue flotation system and improvements that are currently underway

to the design of the bus-bars.

Project Review

In May 2009, and according to schedule, the #2 residue belt filter was

commissioned and brought into operation, as was the oxide re-pulp tank. In the

same month, the vacuum pumps and Z2 thickener were also commissioned. In June

2009, the copper leach filter press and residue flotation tailings tank were

commissioned.

Commissioning of the roaster will be moved back a month, due to a delay with the

delivery of refractory supplies. Commissioning is now scheduled for September

2009. The additional phase 2 scope, including the refurbishment of the ferric

removal system, the refurbishment of mills CM1 and BM1 and the installation of a

fume extraction system in the copper leach house are expected to be on schedule.

Katanga's Financial Statements and Management Discussion and Analysis for the

quarter are filed on SEDAR,

About Katanga Mining Limited

Katanga Mining Limited operates a major mine complex in the Democratic Republic

of Congo producing refined copper and cobalt. The company has the potential to

become Africa's largest copper producer and the world's largest cobalt producer.

Katanga is listed on the Toronto Stock Exchange under the symbol KAT.

Forward-looking Information

This press release contains "forward-looking information" within the meaning of

Canadian securities legislation, concerning the business, operations and

financial performance and condition of Katanga. Generally, these forward-looking

statements can be identified by the use of forward-looking terminology such as

"plans", "expects" or "does not expect", "is expected", "budget", "scheduled

estimates", "forecasts", "intends", "anticipates", "does not anticipate", or

"believes", or variations of such words and phrases or state that certain

actions, events or results "may, "could", "would", "might", "will" or "will be

taken", "occur", or "be achieved". Forward-looking statements are based on the

opinions and estimates of management as of the date such statements are made,

and they are subject to known and unknown risks, uncertainties and other factors

that may cause the actual results, level of activity, performance or

achievements of Katanga to be materially different from those expressed or

implied by such forward-looking statements, including but not limited to :risks

relating to the refurbishment of existing facilities; unexpected events during

construction, expansion and start-up; variations in ore grade, tonnes mined;

future prices of copper and cobalt; possible variations in ore reserves, grade

or recovery rates; failure of plant, equipment or processes to operate as

anticipated; political unrest and insurrection; acts of terrorism; accidents,

labor disputes and other risks of the mining industry; delays in the completion

of development or construction activities, as well as those factors discussed

herein or referred to in the current annual information form of the Company

filed with the securities regulatory authorities in Canada and available at

www.sedar.com. Although management of Katanga has attempted to identify

important factors that could cause actual results to differ materially from

those contained in forward-looking statements, there may be other factors that

cause results not to be as anticipated, estimated or intended. There can be no

assurance that such statements will prove to be accurate, as actual results and

future events could differ materially from those anticipated in such statements.

Accordingly, readers should not place undue reliance on forward-looking

statements. Katanga does not undertake to update any forward-looking statements

that are incorporated herein, except in accordance with applicable securities

laws.

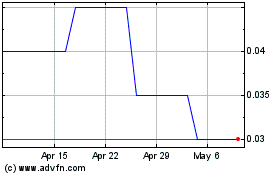

Kincora Copper (TSXV:KCC)

Historical Stock Chart

From Jun 2024 to Jul 2024

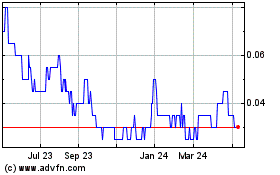

Kincora Copper (TSXV:KCC)

Historical Stock Chart

From Jul 2023 to Jul 2024