Kincora Copper Announces Letter of Intent to Acquire New Mongolian Property

January 16 2012 - 5:00AM

Marketwired Canada

Kincora Copper Limited (TSX VENTURE:KCC) (the "Company") is pleased to announce

that it has entered into a letter of intent with Forbes & Manhattan Inc. ("F &

M"), a Canadian merchant bank, and Temujin Mining Corp. ("Temujin"), a closely

held private company, whereby the Company would acquire from Temujin all of the

issued and outstanding shares of Golden Grouse LLC ("Golden Grouse"), a

Mongolian company which holds certain mineral exploration licenses adjoining the

Company's Bronze Fox project in Mongolia referred to as the Manlai Licences (the

"Acquisition"). As consideration for the shares of Golden Grouse, the Company is

to issue to Temujin approximately 35,000,000 shares of the Company, which shares

are intended to be dividended out by Temujin to its shareholders concurrent with

the closing of the Acquisition.

The Manlai Licences are located immediately to the western and northern

boundaries of the Company's Buyant License 15000X; in an area of known porphyry

copper deposits. The Bronze Fox Intrusive Complex (BFIC) copper-gold resources

owned by Kincora and Tourmaline Hills Intrusive Complex (THIC) exploration

target which is the subject of the proposed Acquisition are both located just

over 100 kilometres to the north-north-east of the giant copper-gold deposit Oyu

Tolgoi, within the same geological group.

Licence 15075X (Southern) Manlai is approximately 480 km south of Ulaanbaatar

and 190 km north of the Chinese border. The licence area is 24,670.37 hectares.

Licence 15076X (Northern) Manlai is approximately 460 km south of Ulaanbaatar

and 205 km north of the Chinese border. The licence area is 15,208.54 hectares.

The Manlai Licences lie on an east-west trending splay off the Zuunbayan fault

zone, which is also thought to control the location of porphyry style copper and

gold mineralization at Suvarga, Tsagaan Suvarga, Shuteen and Olut Ulaan and

possibly Kharmagtai. This equates to a belt with a 150 km strike length.

The Manlai Licences contain both the Bronze Fox and Tourmaline Hills Prospects

that are underlain by an intrusive centre referred to as the Bronze Fox

Intrusive Complex (BFIC) and Tourmaline Intrusive Complexes (THIC).

Porphyry style alteration at BFIC and THIC and associated mineralisation has a

typical pro-grade high temperate assemble with biotite and magnetite and quartz

sheet veins and stockwork containing varying percentages of chalcopyrite. A

direct relationship does exist between elevated copper and gold grades. The THIC

has significant quartz and tourmaline veining and brecciation in the southern

margins of the intrusive complex. The southern anomaly is more likely to be

associated with an epithermal target. This target was not previously drilled or

trenched by Ivanhoe.

"This transaction suits the Company's strategic goals and will add a significant

tenement to the Company's prospect pool of promising targets," stated Igor

Kovarsky, President and CEO of the Company. "On closing of the Acquisition, our

tenement will encompass two of Ivanhoe's former high priority prospects, the

Bronze Fox and Tourmaline Hills."

Concurrent with the Acquisition it is intended that F & M, together with certain

of its affiliates, associates and other investors, will subscribe for units of

the Company (the "Units") for proceeds of up to $2,800,000, and that certain

insiders and other investors may also subscribe for Units with proceeds to the

Company of up to a further $3,200,000 for combined proceeds of up to $6,000,000

(the "Offering"). The Units are to be priced at $0.35 per Unit and will be

comprised of one share and one share purchase warrant (the "Warrants") with each

Warrant entitling the holder to acquire a further share of the Company at a

price of $0.50 per share for a term of 24 months following the closing of the

Offering. If, at any time after 12 months from the closing of the Offering, the

shares of the Company trade at $0.70 per share or higher on a volume weighted

adjusted price basis for a period of 30 days, the Company will have the right to

accelerate the expiry date of the Warrants to a date that is 30 days from the

date of notice of such acceleration.

As a condition of the closing of the Acquisition and the Offering, the Company

has agreed to appoint one nominee of F & M to the board of the Company on

closing and to put forward a further nominee of F & M for election to the board

at the next annual general meeting of the Company. In this regard Mr. Altai

Khangai has agreed to step down from the board in order to allow for the F & M

nominee to be appointed. It is intended that Mr. Khangai will again be nominated

for election to the board at the next annual general meeting of the Company, at

which time it is proposed to increase the size of the board from six to eight

members.

Closing of the Acquisition and the Offering remain subject to the completion of

a satisfactory due diligence review by both F & M and the Company, the execution

of a definitive agreement and the receipt of all necessary regulatory approvals

including the acceptance of the TSX Venture Exchange.

Bill Nielson, P.Geo., of Temujin is the Qualified Person who has reviewed and

approved the scientific and technical information contained in this news

release.

About Kincora Copper

Kincora Copper Limited is a mining exploration and development company focused

on copper/gold deposits in Mongolia. Its key asset is the Bronze Fox (Buyant

License) copper-gold deposit located in southeast Mongolia along the Oyu Tolgoi

copper belt. The Bronze Fox (Buyant License) is located approximately 140km to

the northeast of the world-class Oyu Tolgoi copper/gold project, and is 250km

from the Chinese border.

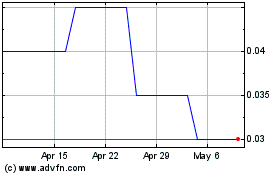

Kincora Copper (TSXV:KCC)

Historical Stock Chart

From Jun 2024 to Jul 2024

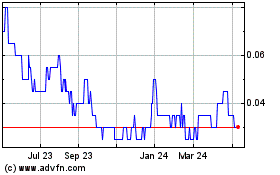

Kincora Copper (TSXV:KCC)

Historical Stock Chart

From Jul 2023 to Jul 2024