TSX VENTURE COMPANIES

BRAVO VENTURE GROUP INC. ("BVG")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 11, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to the second and final tranche of a Non-Brokered Private Placement

announced October 6, 2009 and October 14, 2009:

Number of Shares: 287,079 shares

Purchase Price: $0.45 per share

Warrants: 143,540 share purchase warrants to

purchase 143,540 shares

Warrant Exercise Price: $0.50 for a two year period

Number of Placees: 3 placees

Finders' Fees: Union Securities Ltd. - $2,621.13 and

5,825 Broker Warrants that are exercisable

into common shares at $0.45 per share for

a two year period.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does

not close promptly. Note that in certain circumstances the Exchange may

later extend the expiry date of the warrants, if they are less than the

maximum permitted term.

TSX-X

-----------------------------------------------------------------------

COLONIA ENERGY CORP. ("CLA")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: November 11, 2009

TSX Venture Tier 2 Company

Effective at the opening, November 11, 2009, shares of the Company

resumed trading, an announcement having been made over StockWatch.

TSX-X

-----------------------------------------------------------------------

CULANE ENERGY CORP. ("CLN")

BULLETIN TYPE: Halt

BULLETIN DATE: November 11, 2009

TSX Venture Tier 2 Company

Effective at 10:35 a.m. PST, November 11, 2009, trading in the shares

of the Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

TSX-X

-----------------------------------------------------------------------

CULANE ENERGY CORP. ("CLN")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: November 11, 2009

TSX Venture Tier 2 Company

Effective at 11:30 a.m. PST, November 11, 2009, shares of the Company

resumed trading, an announcement having been made over Canada News

Wire.

TSX-X

-----------------------------------------------------------------------

DUALEX ENERGY INTERNATIONAL INC. ("DXE")

BULLETIN TYPE: Prospectus-Unit Offering

BULLETIN DATE: November 11, 2009

TSX Venture Tier 2 Company

Effective November 3, 2009, the Company's Prospectus dated November 2,

2009 was filed with and accepted by TSX Venture Exchange, and filed

with and receipted by the Alberta, British Columbia, and Ontario

Securities Commissions, pursuant to the provisions of the Securities

Acts of each respective province.

TSX Venture Exchange has been advised that closing occurred on November

10, 2009, for gross proceeds of $5,771,000.

Agents: Clarus Securities Inc.

Jennings Capital Inc.

Offering: 14,427,500 Units

(Each Unit consists of one common share

and one-half of one share purchase

warrant.)

Unit Price: $0.40 per Unit

Warrant Exercise

Price/Term: $0.50 for a one year period

$0.60 in the second year

Agents' Fee: $403,970 in cash and 1,009,925 Agent's

Warrants

Each Agent's Warrant is exercisable for

one common share at a price of $0.40 until

November 10, 2011.

Over-allotment Option: The Company has granted the Agents an

option to purchase up to an additional 2,164,125 Units at a price of

$0.40 per Unit exercisable in whole or in part not later than 30 days

after the closing date.

TSX-X

-----------------------------------------------------------------------

FIRE RIVER GOLD CORP. ("FAU")

BULLETIN TYPE: New Listing-Shares

BULLETIN DATE: November 11, 2009

TSX Venture Tier 2 Company

Effective at the opening Thursday, November 12, 2009, the common shares

of the Company will commence trading on TSX Venture Exchange. The

Company is classified as an 'Exploration/Development' company.

The Company is presently trading on the Canadian National Stock

Exchange.

Corporate Jurisdiction: British Columbia

Capitalization: Unlimited common shares with no par value

of which 29,623,857 common shares are

issued and outstanding

Escrowed Shares: 5,418,001 common shares are subject to

staged release escrow

Transfer Agent: Computershare Investor Services Inc.

Trading Symbol: FAU

CUSIP Number: 31811Q 10 6

For further information, please refer to the Company's Listing

Application dated November 9, 2009 available on SEDAR.

Company Contact: Mr. Harry Barr

Company Address: 2303 West 41st Avenue

Vancouver, BC, V6M 2A3

Company Phone Number: (604) 685-1870

Company Fax Number: (604) 685-6550

Company Email Address: info@firerivergold.com

TSX-X

-----------------------------------------------------------------------

GOLDEYE EXPLORATIONS LIMITED ("GGY")

BULLETIN TYPE: Private Placement-Brokered-Non-Brokered, Amendment

BULLETIN DATE: November 11, 2009

TSX Venture Tier 2 Company

Further to TSX Venture Exchange Bulletin dated October 9, 2009, please

note the following amendments:

Agent's Fee should

have read: An aggregate of 392,000 broker warrants.

Each broker warrant entitles the holder to

acquire one common share at $0.08 for a

one-year period and $0.10 in the second

year.

Commission should

have read: $18,440 payable in cash

All other terms and conditions remain the same.

TSX-X

-----------------------------------------------------------------------

HALO RESOURCES LTD. ("HLO")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 11, 2009

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect

to the first tranche of a Non-Brokered Private Placement announced

October 19, 2009:

Number of Shares: 6,000,000 flow-through shares

Purchase Price: $0.05 per share

Warrants: 3,000,000 share purchase warrants to

purchase 3,000,000 shares

Warrant Exercise Price: $0.15 for a one year period

$0.20 in the second year

Number of Placees: 1 placee

Finder's Fee: $15,000 and 420,000 compensation warrants

exercisable at $0.05 for a period of two

years into one flow-through common share

and one-half of one share purchase warrant

with the same terms as above, payable to

Limited Market Dealer Inc.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does

not close promptly. (Note that in certain circumstances the Exchange

may later extend the expiry date of the warrants, if they are less than

the maximum permitted term.)

TSX-X

-----------------------------------------------------------------------

ISEEMEDIA INC. ("IEE")

BULLETIN TYPE: Halt

BULLETIN DATE: November 11, 2009

TSX Venture Tier 1 Company

Effective at 6:12 a.m. PST, November 11, 2009, trading in the shares of

the Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

TSX-X

-----------------------------------------------------------------------

ISEEMEDIA INC. ("IEE")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: November 11, 2009

TSX Venture Tier 1 Company

Effective at 7:30 a.m. PST, November 11, 2009, shares of the Company

resumed trading, an announcement having been made over Canada News

Wire.

TSX-X

-----------------------------------------------------------------------

KLONDIKE SILVER CORP. ("KS")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 11, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced October 27, 2009 and

amended on November 10, 2009:

Number of Shares: 2,500,000 flow-through shares

Purchase Price: $0.065 per share

Warrants: 2,500,000 share purchase warrants to

purchase 2,500,000 shares

Warrant Exercise Price: $0.10 for a two year period

$0.15 for the remaining three years

Number of Placees: 1 placee

Finder's Fee: $2,925 payable to Union Securities Ltd.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does

not close promptly.

TSX-X

-----------------------------------------------------------------------

KODIAK ENERGY INC. ("KDK")

BULLETIN TYPE: Delist

BULLETIN DATE: November 11, 2009

TSX Venture Tier 2 Company

Effective at the close of business, November 12, 2009, the common

shares of Kodiak Energy, Inc. will be delisted from TSX Venture

Exchange at the request of the Company.

TSX-X

-----------------------------------------------------------------------

LEGACY OIL + GAS INC. ("GLM.A")

(formerly Glamis Resources Ltd. ("GLM.A"))

BULLETIN TYPE: Name Change

BULLETIN DATE: November 11, 2009

TSX Venture Tier 2 Company

Pursuant to a resolution passed by shareholders September 25, 2009, the

Company has changed its name as follows. There is no consolidation of

capital.

Effective at the opening Thursday, November 12, 2009, the common shares

of Legacy Oil + Gas Inc. will commence trading on TSX Venture Exchange,

and the common shares of Glamis Resources Ltd. will be delisted. The

Company is classified as an 'Oil and Gas Exploration and Production'

company.

Capitalization: Unlimited shares with no par value of

which 373,412,397 shares are issued and

outstanding

Escrow: 39,365,032 escrowed shares

Transfer Agent: Olympia Trust Company

Trading Symbol: GLM.A (unchanged)

CUSIP Number: 524701 10 9 (new)

TSX-X

-----------------------------------------------------------------------

LOMIKO METALS INC. ("LMR")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: November 11, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pertaining

to a Share Purchase Agreement between Lomiko Metals Inc. (the

"Company") and Brian Gusko (the "Vendor"), whereby the Company has

acquired the exclusive rights to develop 100% of 1,900 hectares of

Chilean mineral claims, which are applied for and currently held 50/50

by the Company and the Vendor. In consideration, the Company will pay

a total of $50,000 and issue 1,000,000 common shares to the Vendor.

TSX-X

-----------------------------------------------------------------------

LUCARA DIAMOND CORP. ("LUC")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: November 11, 2009

TSX Venture Tier 2 Company

Effective at the opening, November 11, 2009, shares of the Company

resumed trading, an announcement having been made over StockWatch.

TSX-X

-----------------------------------------------------------------------

MERC INTERNATIONAL MINERALS INC. ("MRK")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 11, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced November 4, 2009:

Number of Shares: 7,288,648 flow through shares

Purchase Price: $0.43 per share

Number of Placees: 28 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Michael Byron Y 70,000

Donald Ross P 500,000

William Washington P 58,000

Kerry Smith P 120,000

Thomas Seltzer P 25,000

Laurie Goad P 30,000

John Tait Y 58,139

Mark Begg P 58,139

Finder's Fee: an aggregate of $138,937 payable to Dundee

Securities Corporation, National Bank

Financial, Jones Gable & Company Limited,

Northern Securities Inc., Wellington West

Capital Inc., Raymond James Ltd., Limited

Market Dealer Inc. and MAK Allen & Day

Capital Partners

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

has issued a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s).

TSX-X

-----------------------------------------------------------------------

NEVADO VENTURE CAPITAL CORPORATION ("NVD.P")

BULLETIN TYPE: Halt

BULLETIN DATE: November 11, 2009

TSX Venture Tier 2 Company

Effective at the opening, November 11, 2009, trading in the shares of

the Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

TSX-X

-----------------------------------------------------------------------

NEVADO VENTURE CAPITAL CORPORATION ("NVD.P")

BULLETIN TYPE: Remain Halted

BULLETIN DATE: November 11, 2009

TSX Venture Tier 2 Company

Further to TSX Venture Exchange Bulletin dated November 11, 2009,

effective at 6:27 a.m. PST, November 11, 2009 trading in the shares of

the Company will remain halted pending receipt and review of acceptable

documentation regarding the Qualifying Transaction pursuant to Listings

Policy 2.4.

TSX-X

-----------------------------------------------------------------------

PAREX RESOURCES INC. ("PXT")("PXT.WT")

BULLETIN TYPE: New Listing-Shares and Warrants, Private Placement-

Brokered,

Private Placement-Non-Brokered

BULLETIN DATE: November 11, 2009

TSX Venture Tier 2 Company

Effective at the opening Thursday, November 12, 2009, the common shares

and warrants of Parex Resources Inc (Parex or the Company) will

commence trading on TSX Venture Exchange. The Company is classified as

an 'oil and gas exploration and development' company.

Pursuant to a Plan of Arrangement (the Arrangement) involving Parex,

Pluspetrol Resources Corporation N.V. (Pluspetrol), its wholly owned

subsidiary, 1462627 Alberta Ltd., and Petro Andina Resources Inc.

(Petro Andina), a TSX issuer, the Company acquired the Colombian and

Trinidad and Tobago exploration assets formerly owned by Petro Andina.

Pursuant to the Arrangement Pluspetrol indirectly acquired all of the

outstanding Class A shares of Petro Andina (the Petro Andina Shares)

and each holder of Petro Andina Shares (the Petro Andina Shareholder)

ultimately received, for each Petro Andina Share held: (a) $7.65 in

cash, (b) one common share of Parex (the Parex Share), and (c) one-

tenth of one share purchase warrant of Parex. Each whole warrant of

Parex (the Parex Warrant) entitles the holder to purchase one Parex

Share at a price of $3.00 per share until December 6, 2009.

In connection with the Arrangement the Company completed a brokered

private placement (the Brokered Private Placement) consisting of

6,670,000 subscription receipts (the Subscription Receipts) at a price

of $3.00 per Subscription Receipt for gross proceeds of about $20

million. Each Subscription Receipt was subsequently converted into one

Parex Share for no additional consideration, upon satisfaction of

certain conditions, including completion of the Arrangement. The

underwriters for the Brokered Private Placement constituted a syndicate

of investment dealers co-lead by FirstEnergy Capital Corp. and Scotia

Capital Inc.

The Company also completed a non-brokered private placement (the Non-

Brokered Private Placement) of 3,333,333 Parex Shares at a price of

$3.00 per share for gross proceeds of about $10,000,000. The Non-

Brokered Private Placement was made to proposed directors, officers,

and employees of Parex.

For further information, please refer to the Petro Andina's Information

Circular dated September 29, 2009 as well as its news releases dated

September 3, September 29, October 1, October 30, and November 6, 2009,

all as filed on SEDAR.

Private Placement - Brokered:

TSX Venture Exchange has accepted for filing documentation with respect

to the Brokered Private Placement for the Company previously announced

in a news release by Petro Andina on September 3, 2009:

Number of Shares: 6,670,000 shares

Purchase Price: $3.00 per share

Number of Placees: 72 placees

Agent's Fee: FirstEnergy Capital Corp and Scotia

Capital Inc. acted as co-lead underwriters

on behalf of a syndicate of underwriters

that included CIBC World Markets Inc.,

Peters & Co. Limited, Raymond James Ltd.,

and Wellington West Capital Markets Inc.

(collectively, the Underwriters.) In

consideration for their services, the

Company agreed to pay the Underwriters a

fee equal to 6% of the gross subscription

proceeds received by the Company, being

$1,200,600.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

issued a news release on November 6, 2009 announcing the closing of the

Brokered Private Placement.

Private Placement - Non-Brokered:

TSX Venture Exchange has accepted for filing documentation with respect

to the Non-Brokered Private Placement for the Company previously

announced in a news release by Petro Andina on September 3, 2009.

Number of Shares: 3,333,333 common shares

Purchase Price: $3.00 per share

Number of Placees: 27 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Morrissey Hawthorne Inc.

(Curtis Bartlett) Y 495,512

John F. Bechtold Y 33,400

Robert J. Engbloom Y 80,000

Wayne Foo Y 495,512

Barry B. Larson Y 167,000

Norman McIntyre Y 333,400

Areah Investments Limited

(Ron Miller) Y 330,512

Miller Family Trust

(Ron Miller, Trustee) Y 165,000

W.A. Peneycad Y 66,667

Kenneth Pinsky Y 135,000

David Taylor Y 267,000

Paul Wright Y 80,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

issued a news release on November 6, 2009 announcing the closing of the

Non-Brokered Private Placement.

Corporate Jurisdiction: Alberta

Capitalization: Unlimited common shares with no par value

of which 59,217,051 common shares are

issued and outstanding

Escrowed Shares: Nil common shares

Transfer Agent: Valiant Trust Company

Trading Symbol: PXT

CUSIP Number: 69946Q 10 4

Capitalization on Warrants: 4,921,372 Share Purchase Warrants

issued

One share purchase warrant to purchase one common share at $3.00 per

share to December 6, 2009

Warrant Trading Symbol: PXT.WT

Warrant CUSIP Number: 69946Q 11 2

Company Contact: Kenneth Pinsky

Vice-President, Finance and Chief

Financial Officer

Company Address: 1000,311 6th Ave. S.W.

Calgary, Alberta T2P 3H2

Company Phone Number: (403) 265-4800

Company Fax Number: (403) 265-8216

TSX-X

-----------------------------------------------------------------------

SUPREME RESOURCES LTD. ("SPR")

BULLETIN TYPE: Private Placement-Brokered, Amendment

BULLETIN DATE: November 11, 2009

TSX Venture Tier 2 Company

AMENDMENT:

Further to the TSX Venture Exchange Bulletin dated November 10, 2009,

the Exchange has accepted an amendment with respect to a Non-Brokered

Private Placement announced September 18, 2009 and amended on October

16, 2009. The Agent's fee is payable to both Raymond James Ltd.

($5,000 and 50,000 shares) and Wealth Creation Preservation ($18,960

and 189,600 shares).

TSX-X

-----------------------------------------------------------------------

TRIGON URANIUM CORP. ("TEL")

BULLETIN TYPE: Consolidation, Remain Halted

BULLETIN DATE: November 11, 2009

TSX Venture Tier 2 Company

Pursuant to a special resolution passed by shareholders October 26,

2009, the Company has consolidated its capital on a 4 old for 1 new

basis. The name of the Company has not been changed. Trading in the

shares of the Company will remain halted.

Effective at the opening Thursday, November 12, 2009, the common shares

of Trigon Uranium Corp. will commence trading on TSX Venture Exchange

on a consolidated basis.

Post - Consolidation

Capitalization: unlimited shares with no par value of

which 15,755,596 shares are issued and

outstanding

Escrow 1,081,246 shares are subject to escrow

Transfer Agent: Computershare Investor Services Inc.

CUSIP Number: 89619C 20 8 (new)

TSX-X

-----------------------------------------------------------------------

ULTRA URANIUM CORP. ("ULU")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: November 11, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for expedited filing documentation of

a Mineral Property Option Agreement dated October 27, 2009 between the

Company and International Alliance Resources Inc. (the "optionor")

whereby the Company has been granted an option to acquire an 80%

interest in the Anne Mark Gold Project, comprised of 30 claim units and

covering an area of approximately 6.2 square kilometers, and the Plata

North Gold Project, comprised of 64 claim units covering an area of

approximately 13 square kilometers, both located in the Selwyn Basin,

Mayo Mining Division in the Yukon.

The consideration payable to the Optionor is a total of: $400,000 in

cash payments and 3,000,000 common shares of the Company payable in

stages over a five year period.

The properties are subject to a 2% net smelter return royalty.

TSX-X

-----------------------------------------------------------------------

VAST EXPLORATION INC. ("VST.WT")

BULLETIN TYPE: New Listing-Warrants

BULLETIN DATE: November 11, 2009

TSX Venture Tier 2 Company

Effective at the opening Thursday, November 12, 2009, warrants of the

Company will commence trading on TSX Venture Exchange. The Company is

classified as an 'Oil & Gas' company.

Corporate Jurisdiction: Ontario

Capitalization: 12,500,000 warrants with no par value of

which 12,495,000 warrants are issued and

outstanding

Transfer Agent: Equity Transfer Services Inc.

Trading Symbol: VST.WT

CUSIP Number: 92237U 11 3

These warrants were issued pursuant to a private placement financing

accepted by the Exchange on June 24, 2009. Each warrant entitles the

holder to purchase one common share at a price of $0.50 per share and

will expire on June 5, 2011.

TSX-X

-----------------------------------------------------------------------

NEX COMPANIES

DUNCAN PARK HOLDINGS CORPORATION ("DPH.H")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 11, 2009

NEX Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced September 30, 2009:

Number of Shares: 30,000,000 shares

Purchase Price: $0.01 per share

Number of Placees: 14 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Ian McAvity Y 2,500,000

Eric Salsberg Y 2,500,000

Ronald Arnold Y 2,500,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does

not close promptly.

TSX-X

-----------------------------------------------------------------------

EXCHEQUER RESOURCE CORP. ("EXQ.H")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 11, 2009

NEX Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced September 18, 2009:

Number of Shares: 10,510,000 shares

Purchase Price: $0.05 per share

Warrants: 10,510,000 share purchase warrants to

purchase 10,510,000 shares

Warrant Exercise Price: $0.10 for a one year period

Number of Placees: 41 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Murray McInnes P 100,000

Andrew Williams P 250,000

David Shepherd P 250,000

David Elliott P 1,000,000

Kenneth C. Phillippe Y 300,000

H.B. Hemsworth Y 100,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does

not close promptly.

TSX-X

-----------------------------------------------------------------------

STONE RESOURCES LIMITED ("SRH.H")

(formerly Fairchild Investments Ltd. ("FIC.H"))

BULLETIN TYPE: Name Change

BULLETIN DATE: November 11, 2009

NEX Company

Pursuant to a special resolution passed March 21, 2008, the Company has

changed its name as follows. There is no consolidation of capital.

Effective at the opening Thursday, November 12, 2009, the common shares

of Stone Resources Limited will commence trading on TSX Venture

Exchange, and the common shares of Fairchild Investments Ltd. will be

delisted. The Company is classified as a 'Mining' company.

Capitalization: 100,000,000 shares with no par value of

which 77,279,078 shares are issued and

outstanding

Escrow: 0 shares

Transfer Agent: Computershare Trust Company of Canada

Trading Symbol: SRH.H (new)

CUSIP Number: G85128 10 9 (new)

TSX-X

-----------------------------------------------------------------------

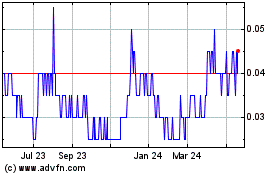

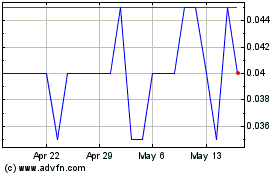

Klondike Silver (TSXV:KS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Klondike Silver (TSXV:KS)

Historical Stock Chart

From Dec 2023 to Dec 2024