TSX VENTURE COMPANIES

BULLETIN TYPE: Cease Trade Order

BULLETIN DATE: July 2, 2010

TSX Venture Companies

A Temporary Cease Trade Order has been issued by the Ontario Securities

Commission on July 2, 2010, against the following Companies for failing to

file the documents indicated within the required time period:

Period

Ending

Symbol Tier Company Failure to File (Y/M/D)

("EEI") 1 Echo Energy Canada Inc. audited annual financial 09/12/31

statements

management's discussion & 09/12/31

analysis

interim financial 10/03/31

statements

management's discussion & 10/03/31

analysis

certification of annual

and interim filings

("NLI") 2 Newlook Industries Corp. audited annual financial 09/12/31

statements

management's discussion & 09/12/31

analysis

interim financial 10/03/31

statements

management's discussion & 10/03/31

analysis

certification of annual

and interim filings

Upon revocation of the Temporary Cease Trade Order, the Company's shares

will remain suspended until the Company meets TSX Venture Exchange

requirements. Members are prohibited from trading in the securities of the

company during the period of the suspension or until further notice.

TSX-X

---------------------------------------------------------------------------

ACCEND CAPITAL CORPORATION ("ADP.P")

BULLETIN TYPE: Halt

BULLETIN DATE: July 2, 2010

TSX Venture Tier 2 Company

Further to the TSX Venture Exchange Bulletin dated June 2, 2010, effective

at the opening Monday, July 5, 2010, trading in the shares of the Company

will be halted, the Company having failed to complete a Qualifying

Transaction within 24 months of its listing.

TSX-X

---------------------------------------------------------------------------

BEAUMONT SELECT CORPORATIONS INC. ("BMN.A")

BULLETIN TYPE: Normal Course Issuer Bid

BULLETIN DATE: July 2, 2010

TSX Venture Tier 1 Company

TSX Venture Exchange has been advised by the Company that pursuant to a

Notice of Intention to make a Normal Course Issuer Bid dated June 29, 2010,

it may repurchase for cancellation, up to 819,155 Class A shares in its own

capital stock. The purchases are to be made through the facilities of TSX

Venture Exchange during the period July 2, 2010 to July 1, 2011. Purchases

pursuant to the bid will be made by Macquarie Private Wealth Inc. on behalf

of the Company.

TSX-X

---------------------------------------------------------------------------

BELLAIR VENTURES INC. ("BVI.P")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: July 2, 2010

TSX Venture Tier 2 Company

Effective at the opening Monday, July 5, 2010, shares of the Company will

resume trading. Please refer to the Company's news release dated June 29,

2010 for further information.

TSX-X

---------------------------------------------------------------------------

BUCHANS MINERALS CORPORATION ("BMC")

(formerly Royal Roads Corp. ("RRO"))

BULLETIN TYPE: Name Change

BULLETIN DATE: July 2, 2010

TSX Venture Tier 1 Company

Pursuant to a resolution passed by shareholders June 22, 2010, the Company

has changed its name as follows. There is no consolidation of capital.

Effective at the opening Monday, July 5, 2010, the common shares of Buchans

Minerals Corporation will commence trading on TSX Venture Exchange and the

common shares of Royal Roads Corp. will be delisted. The Company is

classified as a "Mineral Exploration/Development" company.

Capitalization: Unlimited shares with no par value of

which 112,127,490 shares are issued

and outstanding

Escrow: Nil Escrowed Shares

Transfer Agent: Computershare Investor Services Inc.

Trading Symbol: BMC (new)

CUSIP Number: 11801R 10 8 (new)

TSX-X

---------------------------------------------------------------------------

CAPSTOCK FINANCIAL INC. ("CPK.H")

(formerly Capstock Financial Inc. ("CPK.P"))

BULLETIN TYPE: Transfer and New Addition to NEX, Symbol Change, Reinstated

for Trading

BULLETIN DATE: July 2, 2010

TSX Venture Tier 2 Company

In accordance with TSX Venture Policy 2.4, Capital Pool Companies, the

Company has not completed a Qualifying Transaction within the prescribed

time frame. Therefore, effective the opening Monday July 5, 2010, the

Company's listing will transfer to NEX, the Company's Tier classification

will change from Tier 2 to NEX, and the Filing and Service Office will

change from Vancouver to NEX.

As of July 5, 2010, the Company is subject to restrictions on share

issuances and certain types of payments as set out in the NEX policies.

The trading symbol for the Company will change from CPK.P to CPK.H. There

is no change in the Company's name, no change in its CUSIP number and no

consolidation of capital. The symbol extension differentiates NEX symbols

from Tier 1 or Tier 2 symbols within the TSX Venture market.

Effective at the opening Monday, July 5, 2010 trading will be reinstated

in the securities of the Company (CUSIP 14069J 10 7).

TSX-X

---------------------------------------------------------------------------

CVC CAYMAN VENTURES CORP. ("CKV.P")

BULLETIN TYPE: New Listing-CPC-Shares

BULLETIN DATE: July 2, 2010

TSX Venture Tier 2 Company

This Capital Pool Company's ('CPC') Prospectus dated April 26, 2010 has

been filed with and accepted by TSX Venture Exchange and the British

Columbia and Alberta Securities Commissions effective May 3, 2010, pursuant

to the provisions of the British Columbia and Alberta Securities Acts. The

Common Shares of the Company will be listed on TSX Venture Exchange on the

effective date stated below.

The Company has completed its initial distribution of securities to the

public. The gross proceeds received by the Company for the Offering were

$250,000 (2,500,000 common shares at $0.10 per share).

Commence Date: At the opening Monday, July 5, 2010,

the Common shares will commence

trading on TSX Venture Exchange.

Corporate Jurisdiction: British Columbia

Capitalization: Unlimited common shares with no par

value of which 4,500,000 common shares

are issued and outstanding

Escrowed Shares: 2,040,000 common shares

Transfer Agent: Computershare Investor Services Inc.

Trading Symbol: CKV.P

CUSIP Number: 12661B 10 0

Sponsoring Member: Union Securities Ltd.

Agent's Options: 250,000 non-transferable options. One

option to purchase one share at $0.10

per share up to 24 months.

For further information, please refer to the Company's Prospectus dated

April 26, 2010.

Company Contact: Mar Bergstrom

Company Address: 2919 West 13th

Vancouver, BC V6K 2T8

Company Phone Number: (778) 230-8162

Company Fax Number: (604) 688-8030

Company Email Address: marlonett@shaw.ca

Seeking QT primarily in the Mining sector.

TSX-X

---------------------------------------------------------------------------

DIVERSINET CORP. ("DIV")

BULLETIN TYPE: Shares for Debt

BULLETIN DATE: July 2, 2010

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 150,000 shares at a deemed value of $0.36 per share to settle

outstanding debt for $54,000.

Number of Creditors: 5 Creditors

Insider / Pro Group Participation:

Insider=Y/ Amount Deemed Price

Creditor Progroup=P Owing per Share # of Shares

Albert Wahbe Y $27,000.00 $0.36 75,000

Ravi Chiruvolu Y $ 6,750.00 $0.36 18,750

Greg Milavsky Y $ 6,750.00 $0.36 18,750

Philippe Tardif Y $ 6,750.00 $0.36 18,750

James B. Wigdale Jr. Y $ 6,750.00 $0.36 18,750

The Company shall issue a news release when the shares are issued and the

debt extinguished.

TSX-X

---------------------------------------------------------------------------

EACOM TIMBER CORPORATION ("ETR")

BULLETIN TYPE: Private Placement-Brokered, Property-Asset or Share Purchase

Agreement

BULLETIN DATE: July 2, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Brokered Private Placement announced March 29, 2010:

Number of Shares: 290,000,000 shares

Purchase Price: $0.50 per share

Number of Placees: 82 placees

Insider / Pro Group Participation:

Insider=Y/

Name ProGroup=P/ # of Shares

Lansdowne UK Strategic Y 40,000,000

Investment Master Fund Ltd.

Radcliffe Foundation Y 2,600,000

Terry A. Lyons Y 600,000

Gainey Consultants Inc. Y 200,000

(John Reynolds)

Rick N. Collins Y 200,000

Timber Country Investment Corp. Y 400,000

(Jaspaul Rick Harbins Doman)

Agent's Fee: Genuity Capital Markets G.P. and

Canaccord Financial Ltd. acted as

co-lead agents

(i) 6% cash plus 6% Agent Options

exercisable for $0.50 for 24 months

(Genuity Capital Markets G.P. and

Canaccord Financial Ltd. now

"Canaccord Genuity Corp.")

Property-Asset or Share Purchase Agreement:

TSX Venture Exchange has accepted for filing documentation with respect to

the acquisition of seven sawmills and an equity interest in an eighth

sawmill located in Eastern Canada from Domtar Corporation in consideration

of $80 million, plus the value of the working capital of approximately

$46.5 million for a total purchase price of approximately $126.5 million

satisfied as to approximately $102.5 million in cash and the issuance of

48,070,712 in common shares of EACOM at a price of $0.50 per share. The

shares will be issued to Domtar Inc.

TSX-X

---------------------------------------------------------------------------

ENCORE RENAISSANCE RESOURCES CORP. ("EZ)

BULLETIN TYPE: Warrant Term Extension, Remain Suspended, Correction

BULLETIN DATE: July 2, 2010

TSX Venture Tier 2 Company

CORRECTION:

Further to the TSX Venture Exchange Bulletin dated June 30, 2010, the

bulletin should have read as follows:

TSX Venture Exchange has consented to the extension in the expiry date of

the following warrants:

Private Placement:

# of Warrants: 3,750,000

Original Expiry Date of Warrants: June 26, 2010

New Expiry Date of Warrants: June 26, 2011

Exercise Price of Warrants: $0.15

These warrants were issued pursuant to a private placement of 10,000,000

shares with 5,000,000 share purchase warrants attached, which was accepted

for filing by the Exchange effective June 26, 2009.

Trading in the Company's securities will remain suspended.

TSX-X

---------------------------------------------------------------------------

ESTRELLA INTERNATIONAL ENERGY SERVICES LTD. ("EEN")

(formerly Everest Ventures Corp. ("EVE.P"))

BULLETIN TYPE: Reinstated for Trading, Qualifying Transaction-Completed/New

Symbol, Name Change and Consolidation, Company Tier Reclassification

BULLETIN DATE: July 2, 2010

TSX Venture Tier 2 Company

Reinstated for Trading:

The common shares of Everest Ventures Corp. (the "Company") have been halted

since March 26, 2010 pending completion of a Qualifying Transaction. In

conjunction with the completion of the Qualifying Transaction, trading in

the common shares of the Company will be reinstated at the opening Monday,

July 5, 2010.

TSX Venture Exchange has accepted for filing the Company's Qualifying

Transaction described in its Filing Statement dated June 14, 2010. As a

result, at the opening on July 5, 2010 the Company will no longer be

considered a Capital Pool Company. The Qualifying Transaction includes

the following:

Qualifying Transaction - Completed:

Pursuant to an arms-length Merger Agreement dated April 30, 2010 the

Company has acquired all of the issued and outstanding shares of Estrella

Overseas Limited ("Estrella"). As consideration, the shareholders of

Estrella were issued 100,167,501 shares of the Company at a deemed price of

$1.00 per share. 47,403,355 of the Company shares issued to the former

shareholders of Estrella will be subject to a TSX Venture Exchange Tier 1

Value Security escrow agreement.

Insider / Pro Group Participation:

Name Insider=Y/ # of Post

Pro Group=P consolidated Shares

Warren Levy Y 5,761,978

Brian Kornegay Y 1,099,377

Gustavo Carrido Y 177,500

Carlos Contreas Y 288,500

Remo Mancini Y 161,000

John Zaozirny Y 315,000

Four Third LLC Y 39,600,000

(Seth Taube and Brook Taube)

For a complete description of the Qualifying Transaction, the related

transactions, and the business of the Company please refer to the Filing

Statement of the Company dated June 14, 2010 as filed on SEDAR.

The Exchange has been advised that the above transactions have been

completed.

Name Change and Consolidation:

Pursuant to a resolution passed by shareholders on June 11, 2010 the

Company has changed its name from Everest Ventures Corp. to Estrella

International Energy Services Ltd. and the Company has effectively

consolidated its capital on a five point two seven six two five (5.27625)

old for one (1) new basis.

Effective at the opening Monday, July 5, 2010, the common shares of

Estrella International Energy Services Ltd. will commence trading on TSX

Venture Exchange and the common shares of Everest Ventures Corp. will be

delisted.

Company Tier Reclassification:

In accordance with Policy 2.5, the company has met the requirements for a

Tier 1 company. Therefore, effective at the opening July 5, 2010, the

company's Tier classification will change from Tier 2 to Tier 1.

Capitalization: Unlimited common shares with no par

value of which 102,167,501 common

shares are issued and outstanding

Escrow: 48,730,055 common shares

Transfer Agent: Olympia Trust Company

Symbol: EEN (new)

CUSIP Number: 29758 W 102 (new)

The Company is classified as an "Oil and Gas Contract Drilling" company.

Company Contact: Bryan Kornegay

Company Address: Carlos Pellegrini 1023, 1st floor

Buenos Aires, Argentina, C1009ABU

Company Phone Number: +1 (561) 779-8878

Company Fax Number: +1 (561) 828-2245

Company Email Address: bkornegay@estrellasp.com

TSX-X

---------------------------------------------------------------------------

FOUNDATION RESOURCES INC. ("FDN")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: July 2, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Brokered Private Placement announced May 7, 2010:

First Tranche:

Number of Shares: 4,765,000 flow-through shares

510,000 non flow-through shares

Purchase Price: $0.42 per flow-through share

$0.35 per non flow-through share

Warrants: 2,892,500 share purchase warrants to

purchase 2,892,500 shares

Warrant Exercise Price: $0.50 for an eighteen-month period

Number of Placees: 17 placees

Agent's Fee: $114,439.50 cash, 71,429 Corporate

Finance Units and 283,720 Agent's

Options payable to Canaccord Genuity

Corp.

$38,146.50 cash and 85,530 Agent's

Options payable to Fraser MacKenzie

Limited

Agent's Options are exercisable at

$0.35 per unit for 18 months and units

are under the same terms as the non

flow-through units to be issued

pursuant to the private placement.

The Corporate Finance Units are under

the same terms as the non flow-through

units to be issued pursuant to the

private placement.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly. Note

that in certain circumstances the Exchange may later extend the expiry date

of the warrants, if they are less than the maximum permitted term.

TSX-X

---------------------------------------------------------------------------

GIGA CAPITAL CORPORATION ("GIG.H")

(formerly Giga Capital Corporation ("GIG.P"))

BULLETIN TYPE: Transfer and New Addition to NEX, Symbol Change, Remain

Suspended

BULLETIN DATE: July 2, 2010

TSX Venture Tier 2 Company

In accordance with TSX Venture Exchange Policy 2.4, Capital Pool Companies,

the Company has not completed a qualifying transaction within the

prescribed time frame. Therefore, effective Monday, July 5, 2010, the

Company's listing will transfer to NEX, the Company's Tier classification

will change from Tier 2 to NEX, and the Filing and Service Office will

change from Calgary to NEX.

As of July 5, 2010, the Company is subject to restrictions on share

issuances and certain types of payments as set out in the NEX policies.

The trading symbol for the Company will change from GIG.P to GIG.H. There

is no change in the Company's name, no change in its CUSIP number and no

consolidation of capital. The symbol extension differentiates NEX symbols

from Tier 1 or Tier 2 symbols within the TSX Venture market.

Further to the TSX Venture bulletin dated April 1, 2010, trading in the

shares of the Company will remain suspended. Members are prohibited from

trading in the securities of the Company during the period of the

suspension or until further notice.

TSX-X

---------------------------------------------------------------------------

GOLDBARD CAPITAL CORPORATION ("GDB")

(formerly Goldbard Capital Corporation ("GDB.P"))

BULLETIN TYPE: Reinstated For Trading, Qualifying Transaction-Completed/New

Symbol

BULLETIN DATE: July 2, 2010

TSX Venture Tier 2 Company

Reinstated For Trading:

Further to TSX Venture Exchange Bulletin dated March 31, 2010, the Company

has now completed its Qualifying Transaction.

Effective at the opening Monday, July 5, 2010, trading will be reinstated

in the securities of the Company. (CUSIP # 38075Y 10 5).

Qualifying Transaction-Completed:

TSX Venture Exchange has accepted for filing the Company's Qualifying

Transaction described in its Filing Statement dated June 17, 2010. As a

result, at the opening Monday, July 5, 2010, the Company will no longer be

considered a Capital Pool Company. The Qualifying Transaction involves the

arm's length acquisition (the Acquisition) of an earn-in option (the

Option) to acquire up to an undivided 70% interest in a Qualifying Property

located near Whitehorse in the Yukon (the Pepper Project). Consideration is

cash of $250,000 paid over four years, 400,000 common shares issuable over

three years, $350,000 exploration expenditures in 2010 and an additional

$1,650,000 of exploration expenditure over the next four years, and

completion of a Feasibility Study. The operator of the Pepper Project will

be the Company.

In connection with the Acquisition, the Company will pay an arm's length

finder a finder's fee of $27,000 in cash at closing.

As a condition of the Acquisition, all existing holders of escrowed shares

of Goldbard have agreed to sell, within escrow, pursuant to the terms of a

CPC Escrow Agreement, a total of 5,000,000 escrowed shares to XDL Resources

Inc. (XDL), at a price of $0.11 per share, for an aggregate consideration

of $550,000 XDL is controlled by Dennis Bennie and Yaron Conforti, who will

be Principals of the Company.

Upon completion of the transactions, a total of 5,000,000 common shares

will be subject to the CPC Escrow Agreement, all of which will be held by

new Principals. As there will be no new Principals created through the

Acquisition, there will be no shares subject to a Tier 2 Escrow Agreement.

The Exchange has been advised that the above transactions have been

completed.

Insider / Pro Group Participation:

Insider=Y/

Name ProGroup=P # of Shares

Dennis Bennie Y 4,500,000

Yaron Conforti Y 500,000

The Company is classified as a "mining" company.

Further information on the Acquisition can be found in the Filing Statement

of the Company dated June 17, 2010, as filed on SEDAR.

Capitalization: Unlimited common shares with no par

value of which 12,600,000 common

shares are issued and outstanding

Escrow: 5,000,000 Common Shares will be

subject to a CPC escrow agreement

Transfer Agent: Computershare Trust Company of Canada

Trading Symbol: GDB (same symbol as CPC, but with

.P removed)

Company Contact: Yaron Conforti, Chief Executive Officer

Company Address: 30 St Clair Avenue West, Suite 901

Toronto, Ontario M4V 3A1

Company Phone Number: (416) 250-6500 ext. 1289

Company Fax Number: (416) 644-9988

TSX-X

---------------------------------------------------------------------------

GRIZZLY DISCOVERIES INC. ("GZD")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 2, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

the first tranche of a Non-Brokered Private Placement:

Number of Shares: 3,197,095 Units

(Each Unit consists of one common

share and one Unit Warrant.)

1,400,000 FT Units

(Each Flow-Through Unit consists of

one flow-through common share and one

FT Unit Warrant.)

Purchase Price: $0.30 per Unit

$0.35 per Flow-Through Unit

Warrants: 3,197,095 Unit Warrants to purchase

3,197,095 common shares

1,400,000 FT Unit Warrants to purchase

1,400,000 common shares

Warrant Exercise Price: Units Warrants: $0.50 for a one year

period

FT Unit Warrants: $0.60 for a one year

period

Number of Placees: 7 placees

Insider / Pro Group Participation:

Insider=Y/

Name ProGroup=P/ # of Shares

Ben Hubert Y 1,400,000 FT Units

Brian Testo Y 100,000 Units

Grizzly Gold Inc. Y 120,000 Units

(Brian Testo)

No Finder's Fee

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

TSX-X

---------------------------------------------------------------------------

KLONDIKE SILVER CORP. ("KS")

BULLETIN TYPE: Warrant Price Amendment, Warrant Term Extension

BULLETIN DATE: July 2, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has consented to the reduction in the exercise price

of the following warrants:

Private Placement:

# of Warrants: 6,115,000

Original Expiry Date of Warrants: July 6, 2010

New Expiry Date of Warrants: July 6, 2013

Forced Exercise Provision: If the closing price for the Company's

shares is $0.125 (until July 6, 2011),

$0.1875 (from July 7 2011 to July 6,

2012) or $0.25 (from July 8, 2012 to

July 6, 2013), or greater for a period

of 10 consecutive trading days, then

the warrant holders will have 30 days

to exercise their warrants; otherwise

the warrants will expire on the 31st

day.

Original Exercise Price of Warrants: $0.20

New Exercise Price of Warrants: $0.10 until July 6, 2011

$0.15 until July 6, 2012

$0.20 until July 6, 2013

These warrants were issued pursuant to a private placement of 6,115,000

shares with 6,115,000 share purchase warrants attached, which was accepted

for filing by the Exchange effective July 7, 2008.

TSX-X

---------------------------------------------------------------------------

KWG RESOURCES INC. ("KWG")

BULLETIN TYPE: Halt

BULLETIN DATE: July 2, 2010

TSX Venture Tier 1 Company

Effective at 11:11 a.m. PST, July 2, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to

the provisions of Section 10.9(1) of the Universal Market Integrity Rules.

TSX-X

---------------------------------------------------------------------------

LANDER ENERGY CORPORATION ("LAE.H")

(formerly Lander Energy Corporation ("LAE.P"))

BULLETIN TYPE: Transfer and New Addition to NEX, Symbol Change, Reinstated

for Trading

BULLETIN DATE: July 2, 2010

TSX Venture Tier 2 Company

In accordance with TSX Venture Exchange Policy 2.4, Capital Pool Companies,

the Company has not completed a qualifying transaction within the

prescribed time frame. Therefore, effective Monday, July 5, 2010, the

Company's listing will transfer to NEX, the Company's Tier classification

will change from Tier 2 to NEX, and the Filing and Service Office will

change from Toronto to NEX.

As of July 5, 2010, the Company is subject to restrictions on share

issuances and certain types of payments as set out in the NEX policies.

The trading symbol for the Company will change from LAE.P to LAE.H. There

is no change in the Company's name, no change in its CUSIP number and no

consolidation of capital. The symbol extension differentiates NEX symbols

from Tier 1 or Tier 2 symbols within the TSX Venture market.

Effective at the opening Monday, July 5, 2010, trading will be reinstated

in the securities of the company.

TSX-X

---------------------------------------------------------------------------

MATAMEC EXPLORATIONS INC. ("MAT")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 2, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the documentation with respect

to a Non-Brokered Private Placement, announced on June 29, 2010:

Number of Shares: 468,750 common shares

Purchase Price: $0.16 per share

Warrants: 234,375 warrants to purchase 234,375

common shares.

Warrant Exercise Price: $0.25 over 24 months following the

closing of the private placement

Number of Placees: 1 placee

The Company has confirmed the closing of the private placement.

MATAMEC EXPLORATIONS INC. ("MAT")

TYPE DE BULLETIN : Placement prive sans l'entremise d'un courtier

DATE DU BULLETIN : Le 2 juillet 2010

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de la documentation en vertu

d'un placement prive sans l'entremise d'un courtier, tel qu'annonce le

29 juin 2010:

Nombre d'actions : 468 750 actions ordinaires

Prix : 0,16 $ par action

Bons de souscription : 234 375 bons de souscription

permettant de souscrire a 234 375

actions ordinaires.

Prix d'exercice des bons : 0,25 $ pour les 24 mois suivant la

cloture du placement prive

Nombre de souscripteurs : 1 souscripteur

La societe a confirme la cloture du placement prive

TSX-X

---------------------------------------------------------------------------

MODULE RESOURCES INCORPORATED ("MLE")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 2, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced December 23, 2009:

Number of Shares: 450,000 flow through shares

Purchase Price: $0.10 per share

Number of Placees: 5 placees

Insider / Pro Group Participation:

Insider=Y/

Name ProGroup=P/ # of Shares

Bruce W. Downing Y 50,000

David Schussler Y 250,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

TSX-X

---------------------------------------------------------------------------

NORTHERN SPIRIT RESOURCES INC. ("NS")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: July 2, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pursuant to the

payment of finders' fees and gross overriding royalties to arm's-length

parties in connection with the Company entering into two Production Sharing

Agreements dated March 25, 2010 ("PSA's") with the Government of Belize, as

follows:

Finder's Fees

Name # of Shares

Errin Kimball 100,000

Belize Lake View Properties 400,000

Limited (John Usher)

Gross Overriding Royalties

Name Percentage

Russel Moore and Mereniuk 1.5% of the production from the PSA's

convertible into 300,000 common shares

Family Trust at any time until May 1, 2011

Russel Moore, Mereniuk 3.5% of the production from the PSA's

Family Trust, Belize Lake View

Properties Limited

The Company announced the PSA's in its news release dated April 16, 2010.

TSX-X

---------------------------------------------------------------------------

OTISH ENERGY INC. ("OEI")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: July 2, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing a purchase and royalty

agreement dated June 10, 2010 between Otish Energy Inc. (the 'Company') and

Cynthia L. MacDonald, whereby the Company will acquire a 100% interest in

33 mineral claims known as the RB Claims located in the Abitibi area of

Quebec.

Total consideration consists of $2,500 in cash payments and 250,000 shares

of the Company.

In addition, there is a 2% net smelter return relating to the acquisition.

The Company may at any time purchase 1% of the net smelter return for

$1,000,000 in order to reduce the total net smelter return to 1%.

TSX-X

---------------------------------------------------------------------------

PREMIUM EXPLORATION INC. ("PEM")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement, Private

Placement-Brokered, Resume Trading

BULLETIN DATE: July 2, 2010

TSX Venture Tier 2 Company

Property-Asset or Share Purchase Agreement:

TSX Venture Exchange has accepted for filing the Plan of Merger Agreement,

dated June 17, 2010, between Premium Exploration Inc. (the "Company"), its

wholly owned subsidiary Premium Exploration USA Inc.("Premium USA") and

Clearwater Mining Corporation, ("Clearwater") and Rod Nicholls and Ellen

Steiner (Shareholders"), whereby the Company through its subsidiary will

acquire 100% of the shares of Clearwater Mining Corporation, from the

Shareholders, which holds the Friday-Petsite, Buffalo Gulch, Dixie,

Deadwood, Gallagher, mineral properties in Idaho USA. These properties are

subject to various NSR (0.75 -1%).

In consideration of this transaction, the company will issue 1,250,000

common shares to Rod Nicholls and 1,750,000 common shares to Ellen Steiner

In addition the TSX Venture Exchange has accepted for filing the Revised

royalty agreement , dated June 17, 2010, between Premium Exploration Inc.

(the "Company"), its wholly owned subsidiary Premium Exploration USA Inc.

("Premium USA") and Kria Resources Ltd,("Kria") and Valencia Ventures Inc.

("Valencia") with respect to the Buffalo Gulch mineral properties in Idaho,

USA

In consideration of this transaction, the company will pay $585,000 (in

cash or shares), to Kria Resources Ltd and $500,000 (cash or shares) to

Valencia Ventures Inc and a 0.75% NSR on the Buffalo Gulch Project each to

Kria and Valencia.

Insider / Pro Group Participation:

Insider=Y/

Name ProGroup=P # of Shares

Ellen Steiner Y 1,750,000 shares

Further information on this transaction is available in the Company's news

releases dated June 18, 2010 and July 2, 2010.

Private Placement-Brokered:

TSX Venture Exchange has accepted for filing documentation with respect

to a Brokered Private Placement announced April 19, 2010 and June 9, 2010:

Number of Shares: 40,000,000 shares

Purchase Price: $0.25 per share

Warrants: 20,000,000 share purchase warrants to

purchase 20,000,000 shares

Warrant Exercise Price: $0.35 for an 18 month period

Number of Placees: 38 placees

Insider / Pro Group Participation:

Insider=Y/

Name ProGroup=P/ # of Shares

Barney Lee Y 60,000

John Karagiannidis P 56,000

Marie-Claude Gobeil P 20,000

Pierre Colas P 72,000

Ivano Veschini P 50,000

Wilf Struck Y 40,000

Agent's Fee: Industrial Alliance Securities Ltd.,

in a syndicate with Dundee Securities

Corporation, and Byron Securities

Limited.

Industrial Alliance Securities Ltd.

receives $497,350 and 1,989,400

non-transferable warrants, each

exercisable for one unit with terms as

above.

Dundee Securities Corporation receives

$178,150 and 712,600 non-transferable

warrants, each exercisable for one

unit with terms as above.

Byron Securities Limited receives

$24,500 and 98,000 non-transferable

warrants, each exercisable for one

unit with terms as above.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

(Note that in certain circumstances the Exchange may later extend the

expiry date of the warrants, if they are less than the maximum permitted

term.)

Resume Trading:

Effective at opening Monday, July 5, 2010, shares of the Company will

resume trading.

TSX-X

---------------------------------------------------------------------------

RAIN RESOURCES INC. ("RAN.H")

(formerly Rain Resources Inc. ("RAN.P"))

BULLETIN TYPE: Transfer and New Addition to NEX, Symbol Change, Remain

Suspended

BULLETIN DATE: July 2, 2010

TSX Venture Tier 2 Company

In accordance with TSX Venture Policy 2.4, Capital Pool Companies, the

Company has not completed a Qualifying Transaction within the prescribed

time frame. Therefore, effective at the opening Monday, July 5, 2010, the

Company's listing will transfer to NEX, the Company's Tier classification

will change from Tier 2 to NEX, and the Filing and Service Office will

change from Vancouver to NEX.

As of July 5, 2010, the Company is subject to restrictions on share

issuances and certain types of payments as set out in the NEX policies.

The trading symbol for the Company will change from RAN.P to RAN.H. There

is no change in the Company's name, no change in its CUSIP number and no

consolidation of capital. The symbol extension differentiates NEX symbols

from Tier 1 or Tier 2 symbols within the TSX Venture market.

Further to the TSX Venture Exchange Bulletin dated April 5, 2010, trading

in the Company's securities will remain suspended.

TSX-X

---------------------------------------------------------------------------

RAINY RIVER RESOURCES LTD. ("RR")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: July 2, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for expedited filing documentation

pertaining to an option agreement dated June 16, 2010 between Rainy River

Resources Ltd. (the 'Company') and the vendors, Daniel Teeple and Julia

Teeple, pursuant to which the Company has an option to acquire a 100%

interest in the patented mineral rights in pt section 36 SW, totalling

approximately 164 acres, situated in Tait Township in the Rainy River

District of northwestern Ontario. In consideration, the Company will pay a

total of $100,000 and issue a total of 50,000 shares as follows:

DATE CASH SHARES CUMMULATIVE

WORK EXPENDITURES

On approval $10,000 10,000 nil

Year 2 $20,000 10,000 nil

Year 3 $20,000 10,000 nil

Year 4 $20,000 10,000 nil

Year 5 $30,000 10,000 nil

In addition, there is a 2% net smelter return relating to the acquisition.

The Company may purchase 1% of the net smelter return for $1,000,000.

TSX-X

---------------------------------------------------------------------------

REUNION GOLD CORPORATION ("RGD")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 2, 1010

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced May 7, 2010:

Number of Shares: 52,500,000 shares

Purchase Price: $0.10 per share

Warrants: 52,500,000 share purchase warrants to

purchase 52,500,000 shares

Warrant Exercise Price: $0.20 for a two year period

Number of Placees: 37 placees

Insider / Pro Group Participation:

Insider=Y/

Name ProGroup=P/ # of Shares

Alain Krushnisky Y 375,000

Carole Plante Y 50,000

Vijay Kirpalani Y 500,000

Mackenzie Financial Y 8,500,000

Corporation

Christian Owen P 500,000

Richard Cohen P 250,000

Loraine Oxley Y 500,000

Andrew Mickelson P 950,000

Doug Flegg P 750,000

Leanne M. Baker Y 500,000

Peter Nixon Y 300,000

Ilan Bahar P 150,000

Jason Neal P 1,450,000

Christine Harman P 750,000

538800 B.C. Ltd. Y 350,000

(D. Bruce McLeod,

Donald McLeod,

Catherine Seltzer)

D. Bruce McLeod Y 350,000

Dundee Resources Limited Y 19,250,000

James Arnott Crombie Y 300,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

(Note that in certain circumstances the Exchange may later extend the

expiry date of the warrants, if they are less than the maximum permitted

term.)

TSX-X

---------------------------------------------------------------------------

RODINIA LITHIUM INC. ("RM")

BULLETIN TYPE: Regional Office Change

BULLETIN DATE: July 2, 2010

TSX Venture Tier 2 Company

Pursuant to Policy 1.2, TSX Venture Exchange has been advised of, and

accepted the change of the Filing and Regional Office from Vancouver to

Toronto.

TSX-X

---------------------------------------------------------------------------

ROYAL ACQUISITION CORP. ("RAZ.P")

BULLETIN TYPE: New Listing-CPC-Shares, Halt

BULLETIN DATE: July 2, 2010

TSX Venture Tier 2 Company

This Capital Pool Company's ('CPC') Prospectus dated April 13, 2010 has

been filed with and accepted by TSX Venture Exchange, Alberta and British

Columbia Securities Commissions and the Saskatchewan Financial Services

Commission effective April 13, 2010, pursuant to the provisions of the

Alberta, British Columbia and Saskatchewan Securities Acts. The Common

Shares of the Company will be listed on TSX Venture Exchange on the

effective date stated below.

The Company has completed its initial distribution of securities to the

public. The gross proceeds received by the Company for the Offering were

$1,000,000 (5,000,000 common shares at $0.20 per share).

Commence Date: At the opening Monday, July 5, 2010

the Common shares will commence

trading on TSX Venture Exchange.

Trading in the common shares will be

immediately halted upon commencement

of trading pending dissemination of a

news release pertaining to the

Company's Qualifying Transaction.

Corporate Jurisdiction: Alberta

Capitalization: Unlimited common shares with no par

value of which 8,000,000 common shares

are issued and outstanding

Escrowed Shares: 3,000,000 common shares

Transfer Agent: Olympia Trust Company

Trading Symbol: RAZ.P

CUSIP Number: 78005A108

Sponsoring Member: Canaccord Capital Corporation

Agent's Options: 500,000 non-transferable stock

options. One option to purchase one

share at $0.20 per share up to 24

months from date of listing.

For further information, please refer to the Company's Prospectus dated

April 13, 2010.

Company Contact: Dennis Nerland

Company Address: 2800, 715 - 5th Avenue SW

Calgary, AB, T2P 2X6

Company Phone Number: (403) 299-9600

Company Fax Number: (403) 299-9601

Company Email Address: dln@snclaw.com

TSX-X

________________________________________

SAMEX MINING CORP. ("SXG")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 2, 2010

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced June 10, 2010:

Number of Shares: 3,647,334 shares

Purchase Price: $0.30 per share

Warrants: 1,823,668 share purchase warrants to

purchase 1,823,668 shares

Warrant Exercise Price: $0.35 for a two year period

Number of Placees: 3 placees

Finder's Fee: $3,000 payable to Raymond James Ltd.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

(Note that in certain circumstances the Exchange may later extend the

expiry date of the warrants, if they are less than the maximum permitted

term.)

TSX-X

---------------------------------------------------------------------------

SEYMOUR VENTURES CORP. ("SEY")

(formerly Verb Exchange Inc. ("VEI"))

BULLETIN TYPE: Name Change and Consolidation, Symbol Change, Private

Placement-Non-Brokered

BULLETIN DATE: July 2, 2010

TSX Venture Tier 2 Company

Name Change and Consolidation:

Pursuant to a resolution passed by shareholders May 26, 2010, the Company

has consolidated its capital on a 25 old for 1 new basis. The name of the

Company has also been changed as follows.

Effective at the opening Monday, July 5, 2010, the common shares of Seymour

Ventures Corp. will commence trading on TSX Venture Exchange, and the

common shares of Verb Exchange Inc. will be delisted. The Company is

classified as a 'Technology' company.

Post - Consolidation

Capitalization: Unlimited shares with no par value of

which 11,793,711 shares are issued and

outstanding (including shares issued

pursuant to the Private Placement

below)

Escrow: Nil shares

Transfer Agent: Computershare Trust Company of Canada

Trading Symbol: SEY (new)

CUSIP Number: 818764 10 2 (new)

Private Placement-Non-Brokered:

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced May 13, 2010:

Number of Shares: 8,000,000 shares

Purchase Price: $0.095 per share

Warrants: 8,000,000 share purchase warrants to

purchase 8,000,000 shares

Warrant Exercise Price: $0.125 for a one year period

Number of Placees: 9 placees

Insider / Pro Group Participation:

Insider=Y/

Name ProGroup=P/ # of Shares

0881607 B.C. Ltd. Y 6,100,000

(Robert Chisholm)

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

(Note that in certain circumstances the Exchange may later extend the

expiry date of the warrants, if they are less than the maximum permitted

term.)

TSX-X

---------------------------------------------------------------------------

SHAW COMMUNICATIONS INC. ("SJR.A")

BULLETIN TYPE: Declaration of Dividend

BULLETIN DATE: July 2, 2010

TSX Venture Tier 1 Company

The Issuer has declared the following dividends:

Dividend per Share: $0.073125

Payable Date: September 29, 2010; October 28, 2010

and November 29, 2010

Record Date: September 15, 2010; October 15, 2010

and November 15, 2010

Ex-dividend Date: September 13, 2010; October 13, 2010

and November 10, 2010 respectively

TSX-X

---------------------------------------------------------------------------

SHELBY VENTURES INC. ("SLY.H")

(formerly Shelby Ventures Inc. ("SLY.P"))

BULLETIN TYPE: Transfer and New Addition to NEX, Symbol Change, Remain

Suspended

BULLETIN DATE: July 2, 2010

TSX Venture Tier 2 Company

In accordance with TSX Venture Policy 2.4, Capital Pool Companies, the

Company has not completed a Qualifying Transaction within the prescribed

time frame. Therefore, effective at the opening Monday, July 5, 2010, the

Company's listing will transfer to NEX, the Company's Tier classification

will change from Tier 2 to NEX, and the Filing and Service Office will

change from Vancouver to NEX.

As of July 5, 2010, the Company is subject to restrictions on share

issuances and certain types of payments as set out in the NEX policies.

The trading symbol for the Company will change from SLY.P to SLY.H. There

is no change in the Company's name, no change in its CUSIP number and no

consolidation of capital. The symbol extension differentiates NEX symbols

from Tier 1 or Tier 2 symbols within the TSX Venture market.

Further to the TSX Venture Exchange Bulletin dated April 5, 2010, trading

in the Company's securities will remain suspended.

TSX-X

---------------------------------------------------------------------------

SPIDER RESOURCES INC. ("SPQ")

BULLETIN TYPE: Halt

BULLETIN DATE: July 2, 2010

TSX Venture Tier 2 Company

Effective at 10:15 a.m. PST, July 2, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to

the provisions of Section 10.9(1) of the Universal Market Integrity Rules.

TSX-X

---------------------------------------------------------------------------

UNDERWORLD RESOURCES INC. ("UW")

BULLETIN TYPE: Halt

BULLETIN DATE: July 2, 2010

TSX Venture Tier 2 Company

Effective at 5:36 a.m. PST, July 2, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to

the provisions of Section 10.9(1) of the Universal Market Integrity Rules.

TSX-X

---------------------------------------------------------------------------

VALIANT MINERALS LTD. ("VTM.H")

(formerly Valiant Minerals Ltd. ("VTM.P"))

BULLETIN TYPE: Transfer and New Addition to NEX, Symbol Change, Remain

Suspended

BULLETIN DATE: July 2, 2010

TSX Venture Tier 2 Company

In accordance with TSX Venture Policy 2.4, Capital Pool Companies, the

Company has not completed a Qualifying Transaction within the prescribed

time frame. Therefore, effective at the opening Monday, July 5, 2010, the

Company's listing will transfer to NEX, the Company's Tier classification

will change from Tier 2 to NEX, and the Filing and Service Office will

change from Vancouver to NEX.

As of July 5, 2010, the Company is subject to restrictions on share

issuances and certain types of payments as set out in the NEX policies.

The trading symbol for the Company will change from VTM.P to VTM.H. There

is no change in the Company's name, no change in its CUSIP number and no

consolidation of capital. The symbol extension differentiates NEX symbols

from Tier 1 or Tier 2 symbols within the TSX Venture market.

Further to the TSX Venture Exchange Bulletin dated March 24, 2010, trading

in the Company's securities will remain suspended.

TSX-X

---------------------------------------------------------------------------

ZZZ CAPITAL CORP. ("ZAP.H")

(formerly ZZZ Capital Corp. ("ZAP.P"))

BULLETIN TYPE: Transfer and New Addition to NEX, Symbol Change, Remain

Suspended

BULLETIN DATE: July 2, 2010

TSX Venture Tier 2 Company

In accordance with TSX Venture Policy 2.4, Capital Pool Companies, the

Company has not completed a Qualifying Transaction within the prescribed

time frame. Therefore, effective at the opening Monday, July 5, 2010, the

Company's listing will transfer to NEX, the Company's Tier classification

will change from Tier 2 to NEX, and the Filing and Service Office will

change from Vancouver to NEX

As of July 5, 2010, the Company is subject to restrictions on share

issuances and certain types of payments as set out in the NEX policies.

The trading symbol for the Company will change from ZAP.P to ZAP.H. There

is no change in the Company's name, no change in its CUSIP number and no

consolidation of capital. The symbol extension differentiates NEX symbols

from Tier 1 or Tier 2 symbols within the TSX Venture market.

Further to the TSX Venture Exchange Bulletin dated April 5, 2010, trading

in the Company's securities will remain suspended.

TSX-X

---------------------------------------------------------------------------

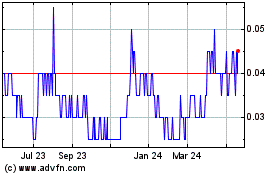

Klondike Silver (TSXV:KS)

Historical Stock Chart

From Jan 2025 to Feb 2025

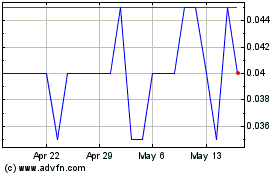

Klondike Silver (TSXV:KS)

Historical Stock Chart

From Feb 2024 to Feb 2025