TSX VENTURE COMPANIES

ALDRIN RESOURCE CORP. ("ALN")

BULLETIN TYPE: Private Placement-Non-Brokered, Amendment

BULLETIN DATE: July 20, 2010

TSX Venture Tier 2 Company

Further to the bulletin dated March 30, 2010 with respect to a private

placement of 14,000,000 units at a price of $0.50 per unit, TSX Venture

Exchange has been advised that the finder's fee payable to Haywood

Securities Inc. of $229,148.00 should have included 397,096 Warrants

that are exercisable into common shares at $0.75 per share for an 18-

month period.

TSX-X

------------------------------------------------------------------------

AMAYA GAMING GROUP INC. ("AYA")

BULLETIN TYPE: New Listing-IPO-Shares

BULLETIN DATE: July 20, 2010

TSX Venture Tier 1 Company

The Company's Initial Public Offering ("IPO") Prospectus dated July 8,

2010 was filed with and accepted by TSX Venture Exchange (the

"Exchange") and filed with and receipted by the Autorite des marches

financiers, and the Alberta, British Columbia, and Ontario Securities

Commissions on July 8, 2010, pursuant to the provisions of the Quebec,

British Columbia, Alberta and Ontario Securities Acts. The common shares

of the Company will be listed and admitted to trading on TSX Venture

Exchange, on the effective date stated below.

The Company is classified as a "Computer Systems Design and Related

Services" company (NAICS number 541510).

Offering: A minimum of 5,000,000 and a maximum of

7,500,000 common shares

Share Price: $1.00

Warrants: A minimum of 2,500,000 warrants to purchase

2,500,000 common shares and a maximum of

3,750,000 warrants to purchase 3,750,000

common shares

Warrants Exercise Price: $1.50 for a period of 12 months following

the closing of the IPO.

Agents: Canaccord Genuity Corporation and

Desjardins Securities Inc.

Agent's fee: A cash commission of up to 8% of the gross

proceeds

Agent's Option: Non-transferable compensation options to

purchase a number of common shares equal to

8% of the number of units issued under

the offering, for a period of 24 months

from the date of the closing. The warrants

entitle the Holder to purchase one common

share at a price of $1.00 per share over a

period of 24 months following the closing.

Listing Date: At the close of business (5:01 EDT) on July

21, 2010

Commencement Date: The common shares will commence trading on

TSX Venture Exchange at the opening

Wednesday, July 21, 2010, upon confirmation

of closing

The closing of the IPO is scheduled to occur before the market opening

on July 15, 2010. It is expected that the gross proceeds of the closing

will be $5,000,000 for a total of 5,000,000 common shares. A further

notice will be issued upon receipt of closing confirmation.

Corporate jurisdiction: Canada

Capitalization: unlimited common shares with no par value

of which 35,000,000 common shares will be

issued and outstanding

Escrowed Shares: 24,525,599 common shares, and 880,000

options will be escrowed according to

National Policy 45-106.

430,910 common shares will be escrowed

according to a Tier 1 Value Escrow

Agreement.

Transfer Agent: Computershare Investor Services Inc. -

Montreal & Toronto

Trading Symbol: AYA

CUSIP Number: 02314F 10 3

For further information, please refer to the Company's Prospectus dated

July 8, 2010.

Company contact: David Baazov, President and Chief Executive

Officer

Company address: 8639 Dalton Road

Montreal (Quebec) H4T 1V5

Company phone number: (514) 744-3122

Company fax number: (514) 744-5114

E-mail address: david@amayagaming.com

Website: www.amayagaming.com

GROUPE DE JEUX AMAYA INC. ("AYA")

TYPE DE BULLETIN : Nouvelle inscription - Appel public a l'epargne -

Actions

DATE DU BULLETIN : Le 20 juillet 2010

Societe du groupe 2 TSX croissance

Dans le cadre d'un premier appel public a l'epargne, le prospectus de la

societe date du 8 juillet 2010 de la societe a ete depose et accepte par

Bourse de croissance TSX (la "Bourse"), et a ete depose et vise par

l'Autorite des marches financiers, et les commissions de valeurs

mobilieres d'Alberta, Colombie-Britannique, et d'Ontario le 8 juillet

2010 en vertu des dispositions de la Loi des valeurs mobilieres du

Quebec, Alberta, Colombie-Britannique et d'Ontario. Les actions

ordinaires de la societe seront inscrites et admises a la negociation a

la date indiquee ci-apres.

La societe est categorisee comme une "societe de Conception de systemes

informatiques et services connexes" (numero de SCIAN 541510).

Offre : Un minimum de 5 000 000 actions ordinaires

et un maximum de 7 500 000

Prix par action : 1,00 $

Bons de souscription : Un minimum de 2 500 000 bons permettant

d'acquerir 2 500 000 actions ordinaires et

un maximum de 3 750 000 bons permettant

d'acquerir 3 750 000 actions ordinaires.

Prix d'exercice des bons : 1,50 $ pendant une periode de 12 mois

suivant la cloture du PAPE

Agent : Canaccord Genuity Corp et Valeurs

mobilieres Desjardins inc.

Remuneration de l'agent : Une commission en especes jusqu'a 8 % du

produit brut

Option de l'agent : Options de remuneration non-transferables

pour acheter des un nombre d'actions

correspondant a 8 % du nombre d'Unites

emises aux termes du placement, pour une

periode de 24 mois apres la cloture. Chaque

bon de souscription permet au titulaire de

souscrire a une action ordinaire au prix de

1,00 $ l'action pendant une periode de 24

mois suivant la cloture.

Date d'inscription

a la cote : A la fermeture des affaires (17H01 HAE) le

20 juillet 2010

Date d'entree en vigueur : Les actions ordinaires de la societe

seront admises a la negociation a Bourse de

croissance TSX a l'ouverture des affaires

mercredi le 21 juillet 2010, sous reserve

de la confirmation de la cloture.

La cloture du premier appel publique a l'epargne est prevue avant

l'ouverture des marches le 21 juillet 2010. Il est prevu que le produit

brut de la cloture sera 5 000 000 $, pour un total de 5 000 000 actions

ordinaires. Un avis additionnel sera emis apres reception de la

confirmation de la cloture.

Juridiction de la societe : Canada

Capitalisation: Un nombre illimite d'actions ordinaires

sans valeur nominale, dont 35 000 000

actions ordinaires seront emises et en

circulation

Titres entierces : 24 525 599 actions ordinaires et

880 000 options d'achat d'actions aux

termes de l'Instruction generale 46-201.

430 910 actions ordinaires aux terms d'une

convention d'entierecement de valeur du

group 1.

Agent des transferts : Services aux Investisseurs Computershare

inc. - Montreal & Toronto

Symbole au telescripteur : AYA

Numero de CUSIP : 02314F 10 3

Pour plus d'informations, veuillez vous referer au prospectus de la

societe date du 8 juillet 2010.

Contact de la societe : M. David Baazov, President et CEO

Adresse de la societe : 8639 rue Dalton

Montreal (Quebec) H4T 1V5

Telephone de la societe : (514) 744-3122

Telecopieur de la societe : (450) 744-5114

Courriel de la societe : david@amayagaming.com

Site web de la societe: www.amayagaming.com

TSX-X

------------------------------------------------------------------------

ANGLO CANADIAN OIL CORP. ("ACG")

BULLETIN TYPE: Halt

BULLETIN DATE: July 20, 2010

TSX Venture Tier 2 Company

Effective at the opening, July 20, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

TSX-X

------------------------------------------------------------------------

ANGLO CANADIAN OIL CORP. ("ACG")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: July 20, 2010

TSX Venture Tier 2 Company

Effective at 9:00 a.m. PST, July 20, 2010, shares of the Company resumed

trading, an announcement having been made over StockWatch.

TSX-X

------------------------------------------------------------------------

AROWAY MINERALS INC. ("ARW")

BULLETIN TYPE: Halt

BULLETIN DATE: July 20, 2010

TSX Venture Tier 2 Company

Effective at 11:18 a.m. PST, July 20, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

TSX-X

------------------------------------------------------------------------

ATHABASCA URANIUM INC. ("UAX")

(formerly BOE Capital Corp. ("BOC"))

BULLETIN TYPE: Name Change

BULLETIN DATE: July 20, 2010

TSX Venture Tier 2 Company

Pursuant to a resolution passed by directors on July 7, 2010, the

Company has changed its name to Athabasca Uranium Inc. There is no

consolidation of capital.

Effective at the opening Wednesday, July 21, 2010, the common shares of

Athabasca Uranium Inc. will commence trading on TSX Venture Exchange and

the common shares of BOE Capital Corp. will be delisted. The Company is

classified as a 'Mineral Exploration and Development' company.

Capitalization: unlimited shares with no par value of which

15,000,000 shares are issued and

outstanding

Escrow: 3,600,000 are subject to a 36-month staged

release escrow

Transfer Agent: Computershare Investor Services Inc.

Trading Symbol: UAX (new)

CUSIP Number: 04682Q 10 9 (new)

TSX-X

------------------------------------------------------------------------

ATW GOLD CORP. ("ATW")

BULLETIN TYPE: Halt

BULLETIN DATE: July 20, 2010

TSX Venture Tier 1 Company

Effective at the opening, July 20, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

TSX-X

------------------------------------------------------------------------

ATW GOLD CORP. ("ATW")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: July 20, 2010

TSX Venture Tier 1 Company

Effective at 9:30 a.m. PST, July 20, 2010, shares of the Company resumed

trading, an announcement having been made over StockWatch.

TSX-X

------------------------------------------------------------------------

BOLERO RESOURCES CORP. ("BRU")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 20, 2010

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced April 6, 2010:

Number of Shares: 715,000 shares

Purchase Price: $0.35 per share

Warrants: 715,000 share purchase warrants to purchase

715,000 shares

Warrant Exercise Price: $0.50 for a two year period

Number of Placees: 1 placee

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

has issued a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). Note

that in certain circumstances the Exchange may later extend the expiry

date of the warrants, if they are less than the maximum permitted term.

TSX-X

------------------------------------------------------------------------

BLACKHAWK RESOURCE CORP. ("BLR")

BULLETIN TYPE: Halt

BULLETIN DATE: July 20, 2010

TSX Venture Tier 1 Company

Effective at the opening, July 20, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

TSX-X

------------------------------------------------------------------------

BLACKHAWK RESOURCE CORP. ("BLR")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: July 20, 2010

TSX Venture Tier 2 Company

Effective at 9:15 a.m. PST, July 20, 2010, shares of the Company resumed

trading, an announcement having been made over StockWatch.

TSX-X

------------------------------------------------------------------------

BONANZA RESOURCES CORPORATION ("BRS")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: July 20, 2010

TSX Venture Tier 2 Company

Effective at 9:00 a.m. PST, July 20, 2010, shares of the Company resumed

trading, an announcement having been made over StockWatch.

TSX-X

------------------------------------------------------------------------

CANACOL ENERGY LTD. ("CNE") ("CNE.DB")

BULLETIN TYPE: Prospectus-Debenture Offering, Share Offering, New

Listing-Debentures

BULLETIN DATE: July 20, 2010

TSX Venture Tier 1 Company

Effective July 13, 2010, the Company's Prospectus dated July 12, 2010

was filed with and accepted by TSX Venture Exchange, and filed with and

receipted by the Alberta, Ontario, British Columbia, Saskatchewan,

Manitoba, New Brunswick, Nova Scotia, Prince Edward Island and

Newfoundland and Labrador Securities Commissions, pursuant to the

provisions of the Securities Acts of each respective province.

TSX Venture Exchange has been advised that closing occurred on July 16,

2010, for gross proceeds of $45,125,433.20.

Offering: $41,500,000 of convertible debentures

4,421,260 common shares

Share Price: $0.82 per share

Agents: Canaccord Genuity Corp.

FirstEnergy Capital Corp.

Cormark Securities Inc.

Citigroup Global Markets Canada Inc.

Mackie Research Capital Corp.

Agent's Commission: 4.5% of the gross proceeds

Details of the Debentures:

Maturity Date: June 30, 2015

Interest: 8% per annum

Conversion: The Debentures are convertible, in whole or

in part, at any time prior to the maturity

date at a price of $1.0526 of principal

per share, being the conversion rate of 950

common shares per $1,000 principal amount.

For further information, please refer to the Company's Prospectus dated

July 12, 2010.

New Listing:

Effective at the opening Wednesday, July 21, 2010, the debentures of the

Company will commence trading on TSX Venture Exchange. The Company is

classified as a 'Mineral and Oil and Gas Exploration' company.

Corporate Jurisdiction: Alberta, Ontario, British Columbia,

Saskatchewan, Manitoba, New Brunswick,

Nova Scotia, Prince Edward Island and

Newfoundland and Labrador

Capitalization: $41,500,000 of principal issued and

outstanding

Transfer Agent: Olympia Trust Company of Canada

Trading Symbol: CNE.DB

CUSIP Number: 134808 AA 2

Clearing and Settlement: The Debentures will clear and settle

through CDS.

Board Lot: The Debentures are in denominations of

$1,000 and will trade in a board lot size

of $1,000 face value.

TSX-X

------------------------------------------------------------------------

CANACO RESOURCES INC. ("CAN")

BULLETIN TYPE: Halt

BULLETIN DATE: July 20, 2010

TSX Venture Tier 2 Company

Effective at 11:22 p.m. PST, July 19, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

TSX-X

------------------------------------------------------------------------

CANACO RESOURCES INC. ("CAN")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: July 20, 2010

TSX Venture Tier 2 Company

Effective at the opening, July 20, 2010, shares of the Company resumed

trading, an announcement having been made over StockWatch.

TSX-X

------------------------------------------------------------------------

CAVAN VENTURES INC. ("CVM")

BULLETIN TYPE: Warrant Price Amendment, Warrant Term Extension,

Amendment

BULLETIN DATE: July 20, 2010

TSX Venture Tier 2 Company

Further to the bulletin dated July 14, 2010 with respect to the warrant

price reduction and the extension to the term of 900,000 outstanding

warrants, original expiry date of the warrants should have been July 18,

2010, not July 25, 2010. The extension to July 25, 2012 remains

unchanged.

TSX-X

------------------------------------------------------------------------

CHRISTOPHER JAMES GOLD CORP. ("CJG")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: July 20, 2010

TSX Venture Tier 2 Company

Effective at the opening, July 20, 2010, shares of the Company resumed

trading, an announcement having been made over StockWatch.

TSX-X

------------------------------------------------------------------------

ELECTRIC METALS INC. ("EMI")

(formerly Electric Metals Inc. ("EMI.A"))

BULLETIN TYPE: Symbol Change

BULLETIN DATE: July 20, 2010

TSX Venture Tier 2 Company

Effective at the opening on July 21, 2010, the trading symbol for

Electric Metals Inc. will change from ('EMI.A') to ('EMI'). There is no

change in the Company's name, no change in its CUSIP number and no

consolidation of capital. The Company is classified as a 'Mining'

company.

TSX-X

------------------------------------------------------------------------

FORAN MINING CORPORATION ("FOM")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 20, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced May 5 and July 12, 2010:

Number of Shares: 4,166,667 Units

(Each Unit consists of one common share and

one share purchase warrant.)

Purchase Price: $0.12 per Unit

Warrants: 4,166,667 share purchase warrants to

purchase 4,166,667 shares

Warrant Exercise Price: $0.12 for a period of 24 months from the

closing date

Number of Placees: 1 placee

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Units

Darren Morcombe Y 4,166,667

No Finder's Fee

TSX-X

------------------------------------------------------------------------

FLYING A PETROLEUM LTD. ("FAB")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 20, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced June 9, 2010:

First Tranche:

Number of Shares: 7,410,000 shares

Purchase Price: $0.05 per share

Warrants: 7,410,000 share purchase warrants to

purchase 7,410,000 shares

Warrant Exercise Price: $0.10 for a two year period

Number of Placees: 16 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Stephen Pearce Y 300,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly. Note that in certain circumstances the Exchange may

later extend the expiry date of the warrants, if they are less than the

maximum permitted term.

TSX-X

------------------------------------------------------------------------

GOLDEN SHARE MINING CORPORATION ("GSH")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 20, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced July 16, 2010:

Number of Shares: 400,000 common shares

Purchase Price: $0.10 per common share

Warrants: 400,000 warrants to purchase 400,000 common

shares

Warrant Exercise Price: $0.15 over 24 months following the closing

of the Private Placement.

Number of Placees: 1 Placee

The Company has confirmed the closing of the above-mentioned Private

Placement by way of a news release.

CORPORATION MINIERE GOLDEN SHARE ("GSH")

TYPE DE BULLETIN : Placement prive sans l'entremise d'un courtier

DATE DU BULLETIN : Le 20 juillet 2010

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de la documentation en vertu

d'un placement prive sans l'entremise d'un courtier, tel qu'annonce le

16 juillet 2010:

Nombre d'actions : 400 000 actions ordinaires

Prix : 0,10 $ par action ordinaire

Bons de souscription : 400 000 bons de souscription permettant de

souscrire a 400 000 actions ordinaires

Prix d'exercice des bons : 0,15 $ par action pendant une periode de

24 mois suivant la cloture du placement

prive.

Nombre de souscripteurs : 1 souscripteur

La societe a confirme la cloture de ce placement prive par voie d'un

communique de presse.

TSX-X

------------------------------------------------------------------------

GREATER CHINA CAPITAL INC. ("GCA.P")

BULLETIN TYPE: Remain Halted

BULLETIN DATE: July 20, 2010

TSX Venture Tier 2 Company

Further to TSX Venture Exchange Bulletin dated July 6, 2010, effective

at 11:30 a.m. PST, July 20, 2010 trading in the shares of the Company

will remain halted pending receipt and review of acceptable

documentation regarding the Qualifying Transaction pursuant to Listings

Policy 2.4.

TSX-X

------------------------------------------------------------------------

IBERIAN MINERALS CORP. ("IZN")

BULLETIN TYPE: Private Placement-Non-Brokered, Convertible Debenture/s

BULLETIN DATE: July 20, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced June 8, 2010:

Convertible Debenture: $3,609,750

Conversion Price: Convertible into shares at $0.56 of

principal outstanding.

Maturity date: December 31, 2011

Interest rate: 7% per annum

Number of Placees: 7 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / Principal Amount

Claude Dauphin Y $1,056,500

Jesus Fernandez Y 265,000

Mark Irwin Y 300,000

Pierre Lorinet Y 530,000

Daniel Vanin Y 400,000

Jeremy Weir Y 530,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

has issued a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s).

TSX-X

------------------------------------------------------------------------

ICIENA VENTURES INC. ("IIE")

BULLETIN TYPE: Halt

BULLETIN DATE: July 20, 2010

TSX Venture Tier 2 Company

Effective at the opening, July 20, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

TSX-X

------------------------------------------------------------------------

ICIENA VENTURES INC. ("IIE")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: July 20, 2010

TSX Venture Tier 2 Company

Effective at the opening, July 20, 2010, shares of the Company resumed

trading, an announcement having been made over StockWatch.

TSX-X

------------------------------------------------------------------------

ISEEMEDIA INC. ("IEE")

BULLETIN TYPE: Halt

BULLETIN DATE: July 20, 2010

TSX Venture Tier 1 Company

Effective at the opening, July 20, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

TSX-X

------------------------------------------------------------------------

ISEEMEDIA INC. ("IEE")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: July 20, 2010

TSX Venture Tier 1 Company

Effective at 8:30 a.m. PST, July 20, 2010, shares of the Company resumed

trading, an announcement having been made over StockWatch.

TSX-X

------------------------------------------------------------------------

KLONDIKE GOLD CORP. ("KG")

BULLETIN TYPE: Warrant Price Amendment, Warrant Term Extension

BULLETIN DATE: July 20, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has consented to the reduction in the exercise

price of the following warrants:

Private Placement:

# of Warrants: 9,090,905

Original Expiry Date

of Warrants: July 25, 2010

New Expiry Date

of Warrants: July 25, 2013

Original Exercise Price

of Warrants: $0.10

New Exercise Price

of Warrants: $0.10 from July 26, 2010 to July 25, 2011

$0.15 from July 26, 2011 to July 25, 2012

$0.20 from July 26, 2012 to July 25, 2013

These warrants were issued pursuant to the first tranche of a private

placement of 9,090,905 shares with 9,090,905 share purchase warrants

attached, which was accepted for filing by the Exchange effective August

20, 2008.

TSX-X

------------------------------------------------------------------------

KLONDIKE SILVER CORP. ("KS")

BULLETIN TYPE: Warrant Price Amendment, Warrant Term Extension

BULLETIN DATE: July 20, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has consented to the reduction in the exercise

price and extension in the expiry date of the following warrants:

Private Placement:

# of Warrants: 4,650,000

Original Expiry Date

of Warrants: July 25, 2010

New Expiry Date

of Warrants: July 25, 2013

Original Exercise Price

of Warrants: $0.25

New Exercise Price

of Warrants: $0.10 until July 25, 2011

$0.15 from July 26, 2011 to July 25, 2012

$0.20 from July 26, 2012 to July 25, 2013

Forced Exercise Provision: If the closing price for the Company's

shares is $0.125 or greater from July 26,

2010 to July 25, 2011, $0.1875 or greater

from July 26, 2011 to July 25, 2012, $0.25

or greater from July 26, 2012 to July 25,

2013, for a period of 10 consecutive

trading days, then the warrant holders will

have 30 days to exercise their warrants;

otherwise the warrants will expire on the

31st day.

These warrants were issued pursuant to the first tranche of a private

placement of 4,650,000 shares with 4,650,000 share purchase warrants

attached, which was accepted for filing by the Exchange effective August

1, 2008.

TSX-X

------------------------------------------------------------------------

NORONT RESOURCES LTD. ("NOT.WT")

BULLETIN TYPE: New Listing-Warrants

BULLETIN DATE: July 20, 2010

TSX Venture Tier 2 Company

Effective at the opening Wednesday, July 21, 2010, the common share

purchase warrants of the Company will commence trading on TSX Venture

Exchange. The Company is classified as a 'Mineral

Exploration/Development' company.

Corporate Jurisdiction: Ontario

Capitalization: 722,150 warrants are issued and outstanding

Transfer Agent: Computershare Trust Company of Canada

Trading Symbol: NOT.WT

CUSIP Number: 65626P 13 5

The warrants were issued pursuant to the Company's Notice of Variation

and Extension dated December 1, 2009. Each warrant entitles the holder

to purchase one common share of the Company at a price of $4.00 per

share and will expire on December 16, 2014.

TSX-X

------------------------------------------------------------------------

OPEL INTERNATIONAL INC. ("OPL")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: July 20, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Brokered Private Placement announced June 10, 2010:

Number of Shares: 25,164,665 shares

Purchase Price: $0.30 per share

Warrants: 12,582,330 share purchase warrants to

purchase 12,582,330 shares

Warrant Exercise Price: $0.50 until July 21, 2012

Number of Placees: 65 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Wayne White P 300,000

Alamy Holdings Inc. P 300,000

Kayjay Realty Inc. P 60,000

Jay Smith P 333,334

Robert Sali P 1,000,000

Michael W. Mansfield P 100,000

Donato Sferra P 100,000

Michael Gesualdi P 50,000

Vito Rizzuto P 50,000

Denis Colbourne Y 40,000

Samuel Peralta Y 40,000

Michel J. Lafrance Y 25,000

N. Dale Lafrance Y 25,000

Lawrence R. Kunkel Y 70,000

Francisco Middleton Y 333,330

Agent's Fee: $668,556.05 and 2,476,134 compensation

warrants payable to IBK Capital Corp. Each

compensation warrant is exercisable into

one common share at a price of $0.30 per

share until July 21, 2014.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly. Note that in certain circumstances the Exchange may

later extend the expiry date of the warrants, if they are less than the

maximum permitted term.

TSX-X

------------------------------------------------------------------------

PENDULUM CAPITAL CORPORATION ("PND.P")

BULLETIN TYPE: New Listing-CPC-Shares

BULLETIN DATE: July 20, 2010

TSX Venture Tier 2 Company

This Capital Pool Company's ('CPC') Prospectus dated April 9, 2010 has

been filed with and accepted by TSX Venture Exchange, Alberta and

British Columbia Securities Commissions effective April 14, 2010,

pursuant to the provisions of the Alberta and British Columbia

Securities Acts. The Common Shares of the Company will be listed on TSX

Venture Exchange on the effective date stated below.

The Company has completed its initial distribution of securities to the

public. The gross proceeds received by the Company for the Offering were

$300,000 (3,000,000 common shares at $0.10 per share).

Commence Date: At the opening Wednesday, July 21, 2010 the

Common shares will commence trading on TSX

Venture Exchange.

Corporate Jurisdiction: Alberta

Capitalization: Unlimited common shares with no par value

of which 7,000,000 common shares are issued

and outstanding

Escrowed Shares: 4,000,000 common shares

Transfer Agent: Olympia Trust Company

Trading Symbol: PND.P

CUSIP Number: 70686Q 10 6

Sponsoring Member: Macquarie Private Wealth Inc.

Agent's Options: 300,000 non-transferable stock options. One

option to purchase one share at $0.10 per

share up to 24 months from date of listing.

For further information, please refer to the Company's Prospectus dated

April 9, 2010.

Company Contact: Jana Lillies

Company Address: 1600, 333 - 7th Avenue SW

Calgary, AB T2P 2Z1

Company Phone Number: (403) 538 8454

Company Fax Number: (403) 444 5042

Company Email Address: jana@kasten.ca

TSX-X

------------------------------------------------------------------------

REGENT PACIFIC PROPERTIES INC. ("RPP.P")

BULLETIN TYPE: Suspend-Failure to Complete a Qualifying Transaction

within 24 months of Listing

BULLETIN DATE: July 20, 2010

TSX Venture Tier 2 Company

Further to the TSX Venture Exchange Bulletin dated June 18, 2010,

effective at the opening Wednesday, July 21, 2010, trading in the shares

of the Company will be suspended, the Company having failed to complete

a Qualifying Transaction within 24 months of its listing.

Members are prohibited from trading in the securities of the Company

during the period of the suspension or until further notice.

TSX-X

------------------------------------------------------------------------

SHIELD GOLD INC. ("SHG")

(formerly Shield Gold Inc. ("SHG.P"))

BULLETIN TYPE: Qualifying Transaction-Completed/New Symbol, Private

Placement-Non-Brokered, Resume Trading

BULLETIN DATE: July 20, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's Qualifying

Transaction described in its Filing Statement dated March 31, 2010. As a

result, at the opening Wednesday, July 21, 2010, the shares of the

Company will resume trading and the Company will no longer be considered

a Capital Pool Company. The Qualifying Transaction includes the

following:

Qualifying Transaction:

The Company entered into a Mineral Property Option Agreement with Eloro

Resources Inc. dated October 15, 2009 as amended, pursuant to which the

Company has an option to acquire a 50% interest in Eloro's Summit-Gaber

property.

For further information, please see the Company's Filing Statement dated

March 31, 2010.

Private Placement:

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement as follows:

Number of Shares: 600,000 common shares and 2,600,000 flow

through shares

Purchase Price: $0.05 per share

Warrants: 3,200,000 share purchase warrants to

purchase 3,200,000 shares

Warrant Exercise Price: $0.10 until July 16, 2012

Number of Placees: 12 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Paul Ankcorn Y 100,000

Howard Sinclair-Jones Y 200,000

Paul Ferguson Y 200,000

Finder's Fee: $8,800 and 220,000 compensation options

with each compensation option permitting

the holder to purchase one common share

unit with the same terms as under the

financing at $0.10 up to July 16, 2012

payable to Integral Wealth Securities

Limited.

$400 payable to Canaccord Genuity Corp.

The Exchange has been advised that the above transactions have been

completed.

Capitalization: unlimited shares with no par value of which

15,643,236 shares are issued and

outstanding

Escrow: 5,343,236 shares

Symbol: SHG (same symbol as CPC but with .P

removed)

Company Contact: Howard Sinclair Jones, President

Company Address: 20 Adelaide Street East, Suite 301

Toronto, Ontario M5C 2T6

Company Phone Number: (416) 360-8006

Company Fax Number: (416) 361-1333

Company Email Address: hsj@shieldgold.com

TSX-X

------------------------------------------------------------------------

SITEBRAND INC. ("SIB")

BULLETIN TYPE: Private Placement- Non-Brokered

BULLETIN DATE: July 20, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced April 29, 2010:

Number of Shares: 2,115,000 common shares

Purchase Price: $0.075 per common share

Warrants: 2,115,000 warrants to purchase 2,115,000

common shares

Warrant Exercise Price: $0.15 for a period of 18 months following

the closing of the Private Placement

Number of Placees: 7 placees

Insider / Pro Group Participation:

Insider = Y /

Name ProGroup = P / Number of shares

1429102 Ontario Inc. Y 266,667

Creg Steers P 440,000

Mavrix 501 P 65,000

Mavrix 507 P 130,000

The Company has confirmed the closing of the above-mentioned Private

Placement by way of press release dated June 29, 2010.

SITEBRAND INC. ("SIB")

TYPE DE BULLETIN : Placement prive sans l'entremise d'un courtier

DATE DU BULLETIN : Le 20 juillet 2010

Societe du groupe 2 de TSX croissance

Bourse de croissance TSX a accepte le depot de la documentation en vertu

d'un placement prive sans l'entremise d'un courtier, tel qu'annonce le

29 avril 2010 :

Nombre d'actions : 2 115 000 actions ordinaires

Prix : 0,075 $ par action ordinaire

Bons de souscription : 2 115 000 bons de souscription permettant

de souscrire a 2 115 000 actions ordinaires

Prix d'exercice des bons : 0,15 $ pendant une periode de 18 mois

suivant la cloture du placement prive.

Nombre de souscripteurs : 7 souscripteurs

Participation Initie / Groupe Pro :

Initie = Y /

Nom Groupe Pro = P / Nombre d'actions

1429102 Ontario Inc. Y 266 667

Creg Steers P 440 000

Mavrix 501 P 65 000

Mavrix 507 P 130 000

La societe a confirme la cloture du placement prive par voie de

communique de presse date du 29 juin 2010.

TSX-X

------------------------------------------------------------------------

TERREX ENERGY INC. ("TER")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 20, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced June 23, 2010:

Number of Shares: 15,169,932 shares

Purchase Price: $0.185 per share

Warrants: 2,000,000 share purchase warrants to

purchase 2,000,000 shares

Warrant Exercise Price: $0.185 for a five year period

The warrants are subject to vesting conditions (and will vest and become

exercisable as to one-third on each of the first, second and third six

month periods from the date of grant).

Number of Placees: 1 placee

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P /

Marquarie Resource

Capital Canada Ltd. Y

Finder's Fee: $140,321.87 payable to Leede Financial

Markets Inc.

$56,128.75 payable to Nova Bancorp

Securities Ltd.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly.

TSX-X

------------------------------------------------------------------------

TRISTAR GOLD INC. ("TSG")

(In substitution for: Brazauro Resources Corporation ("BZO"))

BULLETIN TYPE: Substitutional Listing, Resume Trading

BULLETIN DATE: July 20, 2010

TSX Venture Tier 2 Company

Substitutional Listing:

TSX Venture Exchange Inc. has been advised that the common shares of

TriStar Gold Inc. will be listed in substitution for the currently

listed common shares of Brazauro Resources Corporation.

Effective at the opening Wednesday, July 21, 2010, the common shares of

TriStar Gold Inc. will commence trading on TSX Venture Exchange Inc.,

and the common shares of Brazauro Resources Corporation will be

delisted. The Company is classified as a 'Mineral Exploration' company.

Corporate Jurisdiction: British Columbia

Capitalization: unlimited common shares without par value

of which 29,599,803 common shares are

issued and outstanding

Escrowed Shares: NIL common shares

Transfer Agent: Valiant Trust Company

Trading Symbol: TSG (new)

CUSIP Number: 89678B 10 9 (new)

For further information please refer to the Listing Application of

TriStar Gold Inc. dated July 20, 2010 which is available under TriStar

Gold Inc.'s SEDAR profile and Brazauro Resources Corporation's

Management Information Circular dated June 10, 2010 which is available

under Brazauro Resources Corporation's SEDAR profile.

Company Contact: Patricia Perdomo

Company Address: 16360 Park Ten Place, Suite 217

Houston, Texas, 77084

Company Phone Number: (281) 579-3400

Company Fax Number: (281) 579-9799

Company Email Address: info@tristarau.com

Resume Trading:

Effective at the opening, Wednesday, July 21, 2010, shares of TriStar

Gold Inc. will resume trading, Brazauro Resources Corporation having

completed its Plan of Arrangement with Eldorado Gold Resources

Corporation. See the Exchange's bulletin dated July 19, 2010.

TSX-X

------------------------------------------------------------------------

WAR EAGLE MINING COMPANY INC. ("WAR")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 20, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to the second tranche of a Non-Brokered Private Placement announced June

17, 2010:

Number of Shares: 4,008,334 shares

Purchase Price: $0.06 per share

Warrants: 2,004,167 share purchase warrants to

purchase 2,004,167 shares

Warrant Exercise Price: $0.15 for an eighteen month period

The warrants are subject to an acceleration clause if the common shares

of the Issuer are traded on the Exchange at a price of $0.30 for 20

consecutive trading days.

Number of Placees: 10 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Robert Sali P 500,000

Rob Blanchard P 150,000

David Lyall P 1,000,000

David Horton P 150,000

James Gellman P 400,000

Peter Brown P 1,000,000

Finder's Fee: $12,908 and 225,133 finder's warrants

payable to Primary Ventures Corporation.

$600 payable to Jennifer Upsdell

$4,140 and 69,000 finder's warrants payable

to Haywood Securities Inc.

$1,800 and 30,000 finder's warrants payable

to Dundee Securities Corp.

$1,440 and 24,000 finder's warrants payable

to GMP Securities Corp.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly.

TSX-X

------------------------------------------------------------------------

Z-GOLD EXPLORATION INC. ("ZGG")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: July 20, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the documentation relating

to an Option Agreement dated June 30, 2010, in connection with the

acquisition of 96 mineral claims located in the Casa Berardi Township in

the Rouyn-Noranda Mining Division, Province of Quebec. The consideration

payable by the Company consists in the payment of $15,000 and the

issuance of 900,000 common shares.

The Vendor will retain a 2% Net Smelter Royalty where 50% of which may

be repurchased for a sum of $1,000,000.

For further information, please refer to the Company's press release

dated July 2, 2010.

EXPLORATION Z-GOLD INC. ("ZGG")

TYPE DE BULLETIN : Convention d'achat de propriete, d'actif ou d'actions

DATE DU BULLETIN : Le 20 juillet 2010

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de documents relativement a

une convention d'option datee du 30 juin 2010, concernant l'acquisition

par la societe de 96 claims miniers situes dans le canton Casa Berardi

dans la division miniere de Rouyn-Noranda, province de Quebec. La

consideration payable par la societe consiste au paiement de 15 000 $ et

l'emission de 900 000 actions ordinaires.

Le vendeur conservera une royaute "NSR" de 2,0 % dont 50 % peut-etre

rachetee pour une somme de 1 000 000 $.

Pour plus d'information, veuillez vous referer au communique de presse

emis par la societe le 2 juillet 2010.

TSX-X

------------------------------------------------------------------------

NEX COMPANIES

RANGER ENERGY LTD. ("RGG.H")

BULLETIN TYPE: Halt

BULLETIN DATE: July 20, 2010

NEX Company

Effective at the opening, July 20, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

TSX-X

------------------------------------------------------------------------

RANGER ENERGY LTD. ("RGG.H")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: July 20, 2010

NEX Company

Effective at 9:15 a.m. PST, July 20, 2010, shares of the Company resumed

trading, an announcement having been made over StockWatch.

TSX-X

------------------------------------------------------------------------

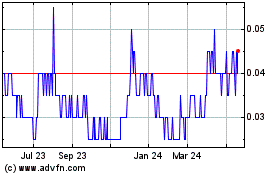

Klondike Silver (TSXV:KS)

Historical Stock Chart

From Nov 2024 to Dec 2024

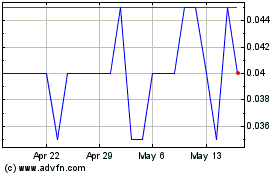

Klondike Silver (TSXV:KS)

Historical Stock Chart

From Dec 2023 to Dec 2024