Los Andes Announces Completion of the Consolidation of the Vizcachitas Property, Closing of Private Placement Financing and Appo

December 21 2010 - 5:55PM

Marketwired Canada

Los Andes Copper Ltd. ("Los Andes" or the "Company") (TSX VENTURE:LA)(PINK

SHEETS:LSANF) is pleased to announce that the Company has completed the

consolidation of the Vizcachitas property (see the Company's news releases dated

September 29, 2010 and November 30, 2010), and a private placement financing in

the amount of approximately $2.6 million. In addition, Los Andes announces that

Messrs. Eduardo Covarrubias, Pedro Covarrubias and Gonzalo Delaveau have joined

the Company's board of directors.

Consolidation of Vizcachitas

Los Andes has completed the acquisition (the "TBC Transaction") from Turnbrook

Corporation ("TBC") of all of the issued and outstanding securities of Gemma

Properties Group Limited ("GPGL"). GPGL owns 99 of the 100 issued and

outstanding shares of Inversiones Los Patos S.A. ("Los Patos"). The owner of the

remaining share in Los Patos has also transferred that share to Los Andes. Los

Patos is the legal and beneficial owner of 49% of the issued and outstanding

shares of Sociedad Legal Minera San Jose Uno de Lo Vicuna, El Tartaro y Piguchen

de Putaendo (the "SLM"), and the SLM is the legal and beneficial owner of the

mining concessions (the "SJ Concessions") that form the central portion of the

Vizcachitas property. With the remaining 51% of the SLM which is already

beneficially owned by the Company, the entire resource contained in the

Vizcachitas property is now under unified ownership, and Los Andes is in a

position to take the steps necessary for the property's ultimate development.

In accordance with the terms and conditions of the TBC Transaction, Los Andes

issued to TBC 35,000,000 common shares in the capital stock of Los Andes at a

deemed price of $0.15 per share, together with 13,000,000 warrants to purchase

Los Andes common shares, exercisable at a price of $0.15 per share to December

21, 2013. All shares issued to TBC, including those shares issuable on exercise

of the warrants, are subject to a hold period from the date of issuance to April

22, 2011.

Closing of Private Placement Offering

Concurrently with the TBC Transaction, Los Andes also closed a private placement

financing (the "Financing") in the amount of approximately $2.6 million through

the issuance of 17,333,333 common shares at a price of $0.15 per share. The

shares issued pursuant to the Financing are also subject to a hold period from

the date of issuance to April 22, 2011. The proceeds from the Financing will be

used for repayment of debt, a final water rights payment, exploration,

advancement of the Company's scoping study and general working capital purposes

(see the Company's Filing Statement dated November 18, 2010 on www.sedar.com).

Los Andes now has a total of 145,932,599 shares issued and outstanding. As a

result of the completion of the TBC Transaction and the Financing, TBC holds

37,786,039 Los Andes shares, which represents 25.89% of the total number of Los

Andes shares currently issued and outstanding. Pursuant to applicable securities

legislation TBC is considered to be a "control person" of Los Andes.

Corporate - Board of Directors

Los Andes would like to welcome Messrs. Eduardo Covarrubias, Pedro Covarrubias

and Gonzalo Delaveau to the Company's board of Directors, as nominees of TBC. In

order to facilitate the TBC Transaction, Messrs. Roger Moss, John Nugent and

Donald Siemens have tendered their resignations to the Company's board of

directors. Mr. Roger Moss will continue as President of the Company. Los Andes

thanks Messrs. Nugent and Siemens for their contributions to the Company and

wishes them the best in all future endeavors.

All transactions contemplated herein are subject to securities regulatory

approvals. The securities of Los Andes Copper Ltd. have not been registered

under the United States Securities Act of 1933, as amended, or the securities

laws of any U.S. State, and may not be offered or sold in the United States or

to any "US Person" (as defined in Regulation S under the Securities Act of 1933)

absent registration or an exemption from registration.

About Vizcachitas

The Vizcachitas Project offers potential for a low strip, open pit operation in

an area of low elevation with excellent infrastructure, including water and

power in central Chile. The Vizcachitas deposit occurs in the same metallogenic

belt as the giant copper-molybdenum porphyries Rio Blanco-Los Bronces, Los

Pelambres and El Teniente. Based on 35,255 metres of drilling in 130 diamond

drill holes, the project contains an indicated resource of 515 million tonnes

grading 0.39% copper and 0.011% molybdenum and an inferred resource of 572

million tonnes grading 0.34% copper and 0.012% molybdenum at a 0.30% copper

equivalent cutoff. Additional information about the Vizcachitas Project is

available in the National Instrument 43-101 Technical Report prepared by AMEC

and filed by the Company on SEDAR on August 29, 2008, and on our website at

www.losandescopper.com.

This document contains certain forward looking statements which involve known

and unknown risks, delays and uncertainties not under the Company's control

which may cause actual results, performance or achievements of the Company to be

materially different from the results, performance or expectation implied by

these forward looking statements.

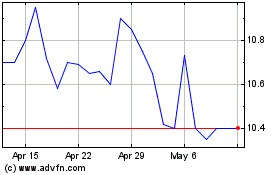

Los Andes Copper (TSXV:LA)

Historical Stock Chart

From Feb 2025 to Mar 2025

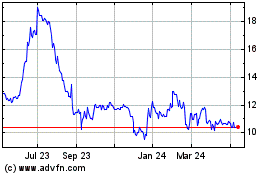

Los Andes Copper (TSXV:LA)

Historical Stock Chart

From Mar 2024 to Mar 2025