Regulatory News:

Legrand (Paris:LR):

Consolidated statement of

income........................................2 Consolidated

statement of comprehensive income...............2 Consolidated

balance sheet.................................................3

Consolidated statement of cash

flows...................................5 Notes to the consolidated

financial statements.....................6

Consolidated statement of income

9 months ended

(in € millions)

September 30, 2024

September 30, 2023

Net sales

6,229.0

6,307.3

Operating expenses

Cost of sales

(2,982.6)

(3,004.2)

Administrative and selling expenses

(1,664.2)

(1,615.1)

Research and development costs

(290.8)

(276.9)

Other operating income (expenses)

(101.7)

(137.3)

Operating profit

1,189.7

1,273.8

Financial expenses

(110.6)

(66.0)

Financial income

79.0

59.1

Exchange gains (losses)

(16.4)

0.4

Financial profit (loss)

(48.0)

(6.5)

Profit before tax

1,141.7

1,267.3

Income tax expense

(307.8)

(329.8)

Share of profits (losses) of

equity-accounted entities

0.0

0.0

Profit for the period

833.9

937.5

Of which:

- Net profit attributable to

the Group

833.7

937.2

- Minority interests

0.2

0.3

Basic earnings per share (euros)

3.183

3.528

Diluted earnings per share (euros)

3.160

3.503

Consolidated statement of comprehensive income

9 months ended

(in € millions)

September 30, 2024

September 30, 2023

Profit for the period

833.9

937.5

Items that may be reclassified

subsequently to profit or loss

Translation reserves

(94.4)

9.3

Cash flow hedges

(11.1)

(3.9)

Income tax relating to components of other

comprehensive income

(0.9)

0.4

Items that will not be reclassified to

profit or loss

Actuarial gains and losses after deferred

taxes

0.7

(0.1)

Other

0.0

0.0

Comprehensive income for the

period

728.2

943.2

Of which:

- Comprehensive income

attributable to the Group

729.1

942.9

- Minority interests

(0.9)

0.3

Consolidated balance sheet

(in € millions)

September 30, 2024

December 31, 2023

Non-current assets

Intangible assets

2,361.4

2,436.9

Goodwill

6,614.3

5,476.2

Property, plant and equipment

837.4

848.3

Right-of-use assets

276.2

260.8

Other investments

42.3

27.7

Other non-current assets

157.5

145.5

Deferred tax assets

143.3

141.0

TOTAL NON CURRENT ASSETS

10,432.4

9,336.4

Current assets

Inventories (Note 4)

1,360.8

1,222.3

Trade receivables (Note 5)

1,059.9

969.9

Income tax receivables

223.2

192.7

Other current assets

274.0

302.9

Other current financial assets

0.8

1.8

Cash and cash equivalents

1,834.6

2,815.4

TOTAL CURRENT ASSETS

4,753.3

5,505.0

TOTAL ASSETS

15,185.7

14,841.4

(in € millions)

September 30, 2024

December 31, 2023

Equity

Share capital (Note 6)

1,049.0

1,056.1

Retained earnings

6,337.1

6,126.5

Translation reserves

(553.2)

(459.9)

Equity attributable to equity holders of

Legrand

6,832.9

6,722.7

Minority interests

8.6

12.0

TOTAL EQUITY

6,841.5

6,734.7

Non-current liabilities

Long-term provisions

181.3

176.8

Provisions for post-employment

benefits

135.4

136.2

Long-term borrowings (Note 7)

4,627.1

4,089.0

Deferred tax liabilities

959.2

930.3

TOTAL NON-CURRENT LIABILITES

5,903.0

5,332.3

Current liabilities

Trade payables

923.7

936.5

Income tax payables

70.1

61.9

Short-term provisions

160.7

153.9

Other current liabilities

873.7

888.1

Short-term borrowings (Note 7)

412.3

732.3

Other current financial liabilities

0.7

1.7

TOTAL CURRENT LIABILITIES

2,441.2

2,774.4

TOTAL EQUITY AND LIABILITIES

15,185.7

14,841.4

Consolidated statement of cash flows

9 months ended

(in € millions)

September 30, 2024

September 30, 2023

Profit for the period

833.9

937.5

Adjustments for non-cash movements in

assets and liabilities:

– Depreciation and impairment of tangible

assets

100.8

92.3

– Amortization and impairment of

intangible assets

83.4

86.8

– Amortization and impairment of

capitalized development costs

17.1

22.4

– Amortization and impairment of

right-of-use assets

61.1

56.0

– Amortization of financial expenses

3.9

2.8

– Impairment of goodwill

0.0

0.0

– Changes in long-term deferred taxes

21.8

38.8

– Changes in other non-current assets and

liabilities

35.1

12.8

– Unrealized exchange (gains)/losses

(6.7)

16.3

– Share of (profits)/losses of

equity-accounted entities

0.0

0.0

– Other adjustments

12.2

0.2

– Net (gains)/losses on sales of

activities and assets

0.9

1.4

Changes in working capital

requirement:

– Inventories (Note 4)

(160.3)

43.9

– Trade receivables (Note 5)

(100.9)

(32.8)

– Trade payables

(7.1)

7.3

– Other operating assets and

liabilities

(23.9)

61.1

Net cash from operating

activities

871.3

1,346.8

– Net proceeds from sales of fixed and

financial assets

5.2

1.0

– Capital expenditure

(107.0)

(111.3)

– Capitalized development costs

(20.3)

(22.4)

– Changes in non-current financial assets

and liabilities

(10.7)

(65.0)

– Acquisitions and disposals of

subsidiaries, net of cash

(1,186.0)

(99.7)

Net cash from investing

activities

(1,318.8)

(297.4)

– Proceeds from issues of share capital

and premium (Note 6)

0.0

0.0

– Net sales/(buybacks) of treasury shares

and transactions under the liquidity contract (Note 6)

(45.0)

(228.5)

– Dividends paid to equity holders of

Legrand

(547.0)

(504.0)

– Dividends paid by Legrand

subsidiaries

0.0

0.0

– Proceeds from long-term financing

801.5

704.1

– Repayment of long-term financing* (Note

7)

(71.5)

(42.2)

– Debt issuance costs

(15.3)

(3.2)

– Increase/(reduction) in short-term

financing

(617.9)

(144.7)

– Acquisitions of ownership interests with

no gain of control

(20.0)

(9.2)

Net cash from financing

activities

(515.2)

(227.7)

Translation net change in cash and cash

equivalents

(18.1)

3.7

Increase (decrease) in cash and cash

equivalents

(980.8)

825.4

Cash and cash equivalents at the beginning

of the period

2,815.4

2,346.8

Cash and cash equivalents at the end of

the period

1,834.6

3,172.2

Items included in cash flows:

– Interest paid during the period**

80.5

51.5

– Income taxes paid during the period

301.5

* Of which €58.3 million corresponding to

lease financial liabilities repayment for the 9 months ended

September 30, 2024 (€55.0 million for the 9 months ended September

30,

2023).

** Interest paid is included in the net

cash from operating activities; of which €8.4 million interest on

lease financial liabilities for the 9 months ended September 30,

2024 (€6.5 million for the 9 months ended September 30, 2023).

Notes to the consolidated financial statements

KEY

FIGURES.....................................................................................................7

NOTE 1 -

INTRODUCTION..................................................................................8

NOTE 2 - SIGNFICANT TRANSACTIONS AND EVENTS FOR THE PERIOD.....8

NOTE 3 - CHANGES IN THE SCOPE OF

CONSOLIDATION.............................8 NOTE 4 -

INVENTORIES....................................................................................10

NOTE 5 - TRADE

RECEIVABLES.......................................................................10

NOTE 6 - SHARE

CAPITAL.................................................................................10

NOTE 7 - LONG-TERM AND SHORT-TERM

BORROWINGS............................11 NOTE 8 - SEGMENT

INFORMATION................................................................13

NOTE 9 - SUBSEQUENT

EVENTS.....................................................................16

KEY FIGURES

(in € millions)

9 months ended September 30,

2024

9 months ended September 30,

2023

Net sales

6,229.0

6,307.3

Adjusted operating profit

1,276.1

1,363.5

As % of net sales

20.5%

21.6%

20.6 % before acquisitions⁽¹⁾

Operating profit

1,189.7

1,273.8

As % of net sales

19.1%

20.2%

Net profit attributable to the Group

833.7

937.2

As % of net sales

13.4%

14.9%

Normalized free cash flow

1,046.5

1,112.9

As % of net sales

16.8%

17.6%

Free cash flow

749.2

1,214.1

As % of net sales

12.0%

19.2%

Net financial debt at September

30

3,204.8

2,153.7

(1) At 2023 scope of consolidation and

excluding Russia.

Adjusted operating profit is defined as operating profit

adjusted for: i/ amortization and depreciation of revaluation of

assets at the time of acquisitions and for other P&L impacts

relating to acquisitions, ii/ impacts related to disengagement from

Russia (impairment of assets and effective disposal) and, iii/

where applicable, impairment of goodwill.

Normalized free cash flow is defined as the sum of net cash from

operating activities - based on a working capital requirement

representing 10% of the last 12 months’ sales and whose change at

constant scope of consolidation and exchange rates is adjusted for

the period considered - and net proceeds of sales from fixed and

financial assets, less capital expenditure and capitalized

development costs.

Free cash flow is defined as the sum of net cash from operating

activities and net proceeds from sales of fixed and financial

assets, less capital expenditure and capitalized development

costs.

Net financial debt is defined as the sum of short-term

borrowings and long-term borrowings, less cash and cash equivalents

and marketable securities.

The reconciliation of consolidated key figures with the

financial statements is available in the appendices to the first

nine months 2024 results press release.

NOTE 1 - INTRODUCTION

This unaudited consolidated financial information is presented

for the 9 months ended September 30, 2024. It does not include all

the information required by International Financial Reporting

Standards (IFRS) and it should be read in conjunction with

consolidated financial statements for the year ended December 31,

2023 as established in the Universal Registration Document

deposited under visa no D.24-0270 with the French Financial Markets

Authority (AMF) on April 10, 2024.

All the amounts are presented in millions of euros unless

otherwise indicated. Some totals may include rounding

differences.

The unaudited consolidated financial statements have been

prepared in accordance with the International Financial Reporting

Standards (IFRS) and International Financial Reporting

Interpretations Committee (IFRIC) interpretations adopted by the

European Union and applicable or authorized for early adoption from

January 1, 2024.

None of the IFRS standards issued by the International

Accounting Standards Board (IASB) that have not been adopted for

use in the European Union are applicable to the Group.

NOTE 2 - SIGNFICANT TRANSACTIONS AND EVENTS FOR THE

PERIOD

No significant transactions or events are to be reported during

the period.

NOTE 3 - CHANGES IN THE SCOPE OF CONSOLIDATION

The contributions to the Group’s consolidated financial

statements of companies acquired since the end of 2022 were as

follows:

2023

March 31

June 30

September 30

December 31

Full consolidation method

Voltadis

Balance sheet only

6 months' profit

9 months' profit

12 months' profit

A. & H. Meyer

Balance sheet only

6 months' profit

9 months' profit

12 months' profit

Power Control

Balance sheet only

Balance sheet only

9 months' profit

12 months' profit

Encelium

Balance sheet only

6 months' profit

9 months' profit

12 months' profit

Clamper

Balance sheet only

Balance sheet only

Balance sheet only

11 months' profit

Teknica

Balance sheet only

4 months' profit

MSS

Balance sheet only

2024

March 31

June 30

September 30

Full consolidation method

Voltadis

3 months' profit

6 months' profit

9 months' profit

A. & H. Meyer

3 months' profit

6 months' profit

9 months' profit

Power Control

3 months' profit

6 months' profit

9 months' profit

Encelium

3 months' profit

6 months' profit

9 months' profit

Clamper

3 months' profit

6 months' profit

9 months' profit

Teknica

3 months' profit

6 months' profit

9 months' profit

MSS

Balance sheet only

6 months' profit

9 months' profit

ZPE Systems

Balance sheet only

Balance sheet only

Balance sheet only

Enovation

Balance sheet only

Balance sheet only

Netrack

Balance sheet only

Balance sheet only

Davenham

Balance sheet only

Balance sheet only

VASS

Balance sheet only

Balance sheet only

UPSistemas

Balance sheet only

During the first nine months of 2024, the main acquisitions were

as follows:

- ZPE Systems, Inc. in the United States. ZPE Systems is a

leading American specialist in serial console servers that enable

remote access and management of network IT equipment in

datacenters. Based in Fremont, California, ZPE Systems employs over

140 people, reporting annual sales of more than $80 million,

- Enovation, the Dutch leader in healthcare software in the

market for connected health and assisted living. Enovation is based

in Rotterdam, employs over 350 people and has annual sales of over

€60 million;

- Netrack, an Indian specialist in server and network rack

manufacturing, notably for datacenters. Based in Bangalore and

employing over 250 people, Netrack reports annual revenue of around

€10 million;

- Davenham, an Irish specialist in low-voltage power distribution

systems (protection, switching, metering and energy distribution)

for datacenters, including hyperscalers. Davenham is based in

Dublin, employing 350 people and reports annual revenue of around

€120 million, mostly in Europe and in the United States;

- VASS, the Australian leader in busbars, mostly for datacenters.

Based in Ingleburn, near Sydney, and employing close to 40 people,

VASS reports annual revenue of just under €10 million, mostly in

Australia and the Asia-Pacific region; and

- UPSistemas, a Colombian specialist in the integration,

commissioning, maintenance and monitoring of technical

infrastructures, in particular for datacenters. Based in Bogota,

and employing more than 300 people, UPSistemas reports annual

revenue of around €30 million.

NOTE 4 - INVENTORIES

Inventories are as follows:

(in € millions)

September 30, 2024

December 31, 2023

Purchased raw materials and components

627.0

589.5

Sub-assemblies, work in progress

164.4

134.9

Finished products

819.0

736.9

Gross value at the end of the

period

1,610.4

1,461.3

Impairment

(249.6)

(239.0)

NET VALUE AT THE END OF THE

PERIOD

1,360.8

1,222.3

NOTE 5 - TRADE RECEIVABLES

Trade receivables are as follows:

(in € millions)

September 30, 2024

December 31, 2023

Trade receivables

1,153.4

1,065.8

Impairment

(93.5)

(95.9)

NET VALUE AT THE END OF THE

PERIOD

1,059.9

969.9

NOTE 6 - SHARE CAPITAL

Share capital as of September 30, 2024 amounted to

€1,048,982,932 represented by 262,245,733 ordinary shares with a

par value of €4 each, for 262,245,733 theoretical voting rights and

262,144,725 exercisable voting rights (after subtracting shares

held in treasury by the Group as of this date).

Changes in share capital in the first 9 months of 2024 were as

follows:

Number of shares

Par value

Share capital (euros)

Premiums (euros)

As of December 31, 2023

264,031,292

4

1,056,125,168

263,208,950

Cancellation of free shares

(1,785,559)

4

(7,142,236)

(152,857,701)

As of September, 2024

262,245,733

4

1,048,982,932

110,351,249

As of September 30, 2024, the Group held 101,008 shares in

treasury, versus 1,863,478 shares as of December 31, 2023, i.e.

1,762,470 fewer shares corresponding to:

- the net acquisition of 750,000 shares outside of the liquidity

contract mainly for transfer under performance share plans and

employee share ownership plans;

- the transfer of 442,591 shares to employees under performance

share plans;

- the transfer of 299,996 shares under the launch of employee

share ownership plans;

- the net purchase of 15,676 shares under the liquidity

contract;

- the cancellation of 1,785,559 shares.

These transactions led to:

- a cash outflow of €43.8 million under share buybacks, net of

disposals;

- a cash outflow of €1.2 million under the liquidity

contract.

Number of shares

of which number of shares held

by the Group

As of December 31, 2023

264,031,292

1,863,478

Transfer to employees

(742,587)

Share buybacks

750,000

Transactions under the liquidity

contract

15,676

Shares cancellation

(1,785,559)

(1,785,559)

As of September 30, 2024

262,245,733

101,008

of which for transfer to employees

58,526

of which liquidity contract

42,482

of which for shares cancellation

0

NOTE 7 - LONG-TERM AND SHORT-TERM BORROWINGS

7.1 LONG-TERM BORROWINGS

Long-term borrowings can be analyzed as follows:

(in € millions)

September 30, 2024

December 31, 2023

Negotiable commercial paper

71.5

50.0

Bonds

4,230.0

3,500.0

Yankee bonds

0.0

262.7

Lease financial liabilities

228.5

216.3

Other borrowings

123.9

75.3

Long-term borrowings excluding debt

issuance costs

4,653.9

4,104.3

Debt issuance costs

(26.8)

(15.3)

TOTAL

4,627.1

4,089.0

7.2 SHORT-TERM BORROWINGS

Short-term borrowings can be analyzed as follows:

(in € millions)

September 30, 2024

December 31, 2023

Negotiable commercial paper

50.0

115.0

Bonds

0.0

500.0

Yankee bonds

259.7

0.0

Lease financial liabilities

71.4

68.3

Other borrowings

31.2

49.0

TOTAL

412.3

732.3

7.3 CHANGES IN LONG-TERM AND SHORT-TERM BORROWINGS

Changes in long-term and short-term borrowings can be analyzed

as follows:

Variations not impacting cash

flows

(in € millions)

September 30, 2024

Cash flows

Acquisitions

Reclassifications

Translation

adjustments

Other

December 31, 2023

Long-term borrowings

4,627.1

796.9

52.6

(386.6)

(6.1)

81.3

4,089.0

Short-term borrowings

412.3

(700.1)

0.1

386.6

(6.0)

(0.6)

732.3

Gross financial debt

5,039.4

96.8

52.7

0.0

(12.1)

80.7

4,821.3

NOTE 8 - SEGMENT INFORMATION

In accordance with IFRS 8, operating segments are determined

based on the reporting made available to the chief operating

decision maker of the Group and to the Group's management.

Given that Legrand activities are carried out locally, the Group

is organized for management purposes by countries or groups of

countries which have been allocated for internal reporting purposes

into three operating segments:

- Europe, including France, Italy and Rest of Europe (mainly

including Benelux, Germany, Iberia (including Portugal and Spain),

Poland, the United Kingdom and Turkey);

- North and Central America, including Canada, Mexico, the United

States, and Central American countries; and

- Rest of the world, mainly including Australia, China, India and

South America (of which particularly Brazil, Chile and

Colombia).

These three operating segments are under the responsibility of

three segment managers who are directly accountable to the chief

operating decision maker of the Group.

The economic models of subsidiaries within these segments are

quite similar. Indeed, their sales are made up of electrical and

digital building infrastructure products in particular to

electrical installers, sold mainly through third-party

distributors.

9 months ended September 30,

2024

(in € millions)

Europe

North and Central

America

Rest of the world

Total

Net sales to third parties

2,604.3

⁽¹⁾

2,528.2

⁽²⁾

1,096.5

6,229.0

Cost of sales

(1,179.3)

(1,208.8)

(594.5)

(2,982.6)

Administrative and selling expenses,

R&D costs

(823.7)

(839.8)

(291.5)

(1,955.0)

Other operating income (expenses)

(33.3)

(59.0)

(9.4)

(101.7)

Operating profit

568.0

420.6

201.1

1,189.7

- of which i/ acquisition-related

amortization, expenses and

income and ii/ impacts related to

disengagement from Russia (impairment of assets and effective

disposal)

· accounted for in

administrative and selling expenses, R&D costs

(19.4)

(57.7)

(7.1)

(84.2)

· accounted for in other

operating income (expenses)

(2.2)

(2.2)

- of which goodwill impairment

0.0

Adjusted operating profit

589.6

478.3

208.2

1,276.1

- of which depreciation and impairment of

tangible assets

(61.1)

(19.2)

(20.3)

(100.6)

- of which amortization and impairment of

intangible assets

(9.0)

(1.4)

(1.0)

(11.4)

- of which amortization and impairment of

development costs

(15.6)

0.0

(1.5)

(17.1)

- of which amortization and impairment of

right-of-use assets

(23.8)

(21.5)

(15.8)

(61.1)

- of which restructuring costs

(13.4)

(26.8)

(10.8)

(51.0)

Capital expenditure

(67.7)

(17.5)

(21.8)

(107.0)

Capitalized development costs

(19.2)

0.0

(1.1)

(20.3)

Net tangible assets

539.2

155.0

143.2

837.4

Total current assets

2,719.2

1,187.5

846.6

4,753.3

Total current liabilities

1,398.7

589.9

452.6

2,441.2

(1) Of which France: €866.0 million.

(2) Of which United States: €2,351.2

million.

9 months ended September 30, 2023

(in € millions)

Europe

North and Central

America

Rest of the world

Total

Net sales to third parties

2,757.5

⁽¹⁾

2,497.6

⁽²⁾

1,052.2

6,307.3

Cost of sales

(1,262.3)

(1,175.3)

(566.6)

(3,004.2)

Administrative and selling expenses,

R&D costs

(806.2)

(822.2)

(263.6)

(1,892.0)

Other operating income (expenses)

(62.3)

(60.8)

(14.2)

(137.3)

Operating profit

626.7

439.3

207.8

1,273.8

- of which i/ acquisition-related

amortization, expenses and

income and ii/ impacts related to

disengagement from Russia (impairment of assets and effective

disposal)

· accounted for in

administrative and selling expenses, R&D costs

(18.3)

(59.1)

(4.0)

(81.4)

· accounted for in other

operating income (expenses)

(8.3)

(8.3)

- of which goodwill impairment

0.0

Adjusted operating profit

653.3

498.4

211.8

1,363.5

- of which depreciation and impairment of

tangible assets

(54.9)

(19.4)

(17.8)

(92.1)

- of which amortization and impairment of

intangible assets

(10.3)

(2.0)

(1.1)

(13.4)

- of which amortization and impairment of

development costs

(21.6)

0.0

(0.8)

(22.4)

- of which amortization and impairment of

right-of-use assets

(21.4)

(19.9)

(14.7)

(56.0)

- of which restructuring costs

(21.3)

(10.2)

(8.2)

(39.7)

Capital expenditure

(72.6)

(20.1)

(18.6)

(111.3)

Capitalized development costs

(21.5)

0.0

(0.9)

(22.4)

Net tangible assets

482.6

160.3

131.1

774.0

Total current assets

3,661.0

1,404.1

874.9

5,940.0

Total current liabilities

2,144.2

543.7

458.1

3,146.0

(1) Of which France: €948.0 million.

(2) Of which United States: €2,306.8

million.

NOTE 9 - SUBSEQUENT EVENTS

External growth

The Group achieved the acquisition - announced on September 3,

2024 - of APP (Australian Plastic Profiles), an Australian cable

management (conduit) leader for all types of buildings. Based in

Sydney, Australian Plastic Profile employs approximately 250 people

and generates an annual revenue of over €100 million.

French Competition Authority’s (Autorité de la concurrence)

investigation

On September 6, 2018, a search of Legrand premises took place.

During the search, Legrand fully cooperated with the relevant

authorities.

On July 4, 2022, Legrand received a statement of objections

(notification de griefs) from the French Competition Authority,

concerning the derogation mechanism with its distributors on the

French market.

On October 20, 2022, Legrand reported that, as part of the

investigation on the derogation mechanism on the French market, one

of Legrand’s French entities has been indicted and ordered to

provide security in the amount of €80.5 million.

On October 30, 2024, Legrand has taken note of the enforceable

decision of the French Competition Authority ordering Legrand to

pay a fine of €43 million for the application of derogated prices

on the French market between 2012 and 2015.

Legrand categorically rejects the allegation made against it and

reserves the right to appeal this decision.

Legrand reiterates its firm commitment to comply strictly with

applicable law, in particular competition law.

This enforceable decision should not have a material impact on

the Group’s 2024 financial statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106229826/en/

Legrand

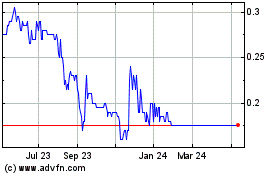

Luminex Resources (TSXV:LR)

Historical Stock Chart

From Oct 2024 to Nov 2024

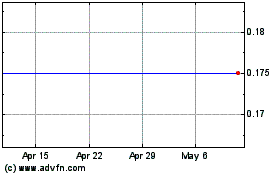

Luminex Resources (TSXV:LR)

Historical Stock Chart

From Nov 2023 to Nov 2024