TSX VENTURE COMPANIES

BULLETIN TYPE: Cease Trade Order

BULLETIN DATE: March 4, 2010

TSX Venture Tier 2 Company

A Cease Trade Order has been issued by the British Columbia Securities

Commission on March 4, 2010, against the following Company for failing to

file the documents indicated within the required time period:

Period Ending

Symbol Company Failure to File (Y/M/D)

("ABD") Abode Mortgage comparative financial statement 09/08/31

Holdings Corp. interim financial statements 09/11/30

management's discussion & analysis 09/08/31

Upon revocation of the Cease Trade Order, the Company's shares will remain

suspended until the Company meets TSX Venture Exchange requirements. Members

are prohibited from trading in the securities of the company during the

period of the suspension or until further notice.

TSX-X

----------------------------------------------------------------------------

ALIX RESOURCES CORP. ("AIX")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation in connection

with an Option Agreement dated February 9, 2010 between the Company and

David Wright and Associates (the "Vendor") whereby the Company has been

granted an option to acquire an undivided 100% interest in the Money Rock

Property that is located in the Pogo area of Goodpaster Mining District in

the State of Alaska. The aggregate consideration is US$8,160 for

reimbursement of 1010 annual rental payment, $210,000 payable over a 6 year

period and 180,000 common shares payable over a three year period. The

agreement is subject to a 2% net smelter return royalty that is payable to

the vendor of which the Company may buy back 1% for $1,000,000 subject to

further Exchange review and acceptance.

TSX-X

----------------------------------------------------------------------------

BOLD VENTURES INC. ("BOL")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

the first tranche of a Non-Brokered Private Placement announced February 22,

2010:

Number of Shares: 1,300,000 shares

Purchase Price: $0.10 per share

Warrants: 650,000 share purchase warrants to purchase

650,000 shares

Warrant Exercise Price: $0.15 for a one year period

$0.20 in the second year

Number of Placees: 17 placees

Finder's Fee: Union Securities Ltd. will receive a finder's

fee of $8,000 and 80,000 "B" Warrants that are

exercisable into common shares at $0.15 per

share in the first year and at $0.20 per share

in the second year.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly. Note

that in certain circumstances the Exchange may later extend the expiry date

of the warrants, if they are less than the maximum permitted term.

TSX-X

----------------------------------------------------------------------------

CANADIAN OREBODIES INC. ("CO")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pertaining to an

Mineral Property Acquisition Agreement (the "Agreement") dated March 3,

2010, between Canadian Orebodies Inc. (the "Company"), Ultra Lithium Inc.,

and several arms-length parties (collectively the "Vendors"), whereby the

Company can earn an 80% undivided interest in 129 mining claim units (the

"Zigzag Property"), located approximately 60km northeast of Armstrong,

Ontario.

Under the terms of the Agreement, the Company can earn an 80% interest in

the Property by making aggregate cash payments of CDN$100,000, issuing

800,000 common shares and incurring CDN$350,000 in exploration expenditures

over a four year period.

For further details, please refer to the Company's news release dated March

4, 2010.

TSX-X

----------------------------------------------------------------------------

CASSIUS VENTURES LTD. ("CZ.P")

BULLETIN TYPE: Halt

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

Effective at 10:22 a.m. PST, March 4, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to the

provisions of Section 10.9(1) of the Universal Market Integrity Rules.

TSX-X

----------------------------------------------------------------------------

CASSIUS VENTURES LTD. ("CZ.P")

BULLETIN TYPE: Remain Halted

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

Further to TSX Venture Exchange Bulletin dated March 4, 2010, effective at

6:08 a.m. PST, March 5, 2010 trading in the shares of the Company will

remain halted pending receipt and review of acceptable documentation

regarding the Qualifying Transaction pursuant to Listings Policy 2.4.

TSX-X

----------------------------------------------------------------------------

CASTILLIAN RESOURCES CORP. ("CT")

BULLETIN TYPE: Shares for Debt

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to issue

1,201,997 common shares at a deemed value of CDN$0.078 per share to settle

outstanding debt for US$89,895.

Number of Creditors: 1 Creditor

The Company shall issue a news release when the shares are issued and the

debt extinguished.

TSX-X

----------------------------------------------------------------------------

CENTRIC ENERGY CORP. ("CTE")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement, Private

Placement-Non-Brokered

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange Inc. has accepted for filing documentation in

connection with an assignment agreement between the Centric Energy Corp.

(the "Company") and Endeavour Resources Ltd. ("Endeavour") dated December

11, 2009 (the "Agreement"). Under the Agreement, Endeavour will assign to a

wholly-owned subsidiary of the Company, being Centric Energy (Kenya) Limited

("Kenya Subco"), its rights under a Production Sharing Contract ("PSC") with

the Government of the Republic of Kenya over oil and gas concessions Block

10BA located in Kenya. As consideration for the assignment, the Company will

pay US$515,000 to Endeavour and issue to Endeavour 5% of the issued shares

of Kenya Subco.

Under the terms of the PSC, the Company and Kenya Subco will be required to:

1. carry out a minimum three year work program at a minimum cost of

US$3,000,000;

2. pay a US$100,000 signing bonus to the Government of the Republic of

Kenya;

3. pay surface fees of US$145,836 to the Government of the Republic of

Kenya;

4. pay training fees of US$90,000 to the Government of the Republic of

Kenya;

5. post a bank guarantee of US$450,000 (15% of the value of the minimum work

commitment) with the Government of the Republic of Kenya;

6. deliver a guarantee by the Company for US$2,550,000 (85% of the value of

the minimum work program) to the Government of the Republic of Kenya.

The Company has agreed to pay a finder's fee of US$100,000 to Zahur Trading

Co. Ltd. (Azim Nathoo) for introducing the Company to Endeavour and

assisting with negotiation of the Agreement.

For further information see the news release of the Company dated January

27, 2010 which is available under the Company's profile on SEDAR.

Private Placement-Non-Brokered:

TSX Venture Exchange has accepted for filing documentation with respect to

the first tranche of a Non-Brokered Private Placement announced January 28,

2010:

Number of Shares: 16,250,000 shares

Purchase Price: $0.08 per share

Warrants: 16,250,000 share purchase warrants to purchase

16,250,000 shares

Warrant Exercise Price: $0.12 for a two year period. The warrants are

subject to an accelerated exercise provision in

the event the closing price is $0.20 or more

for a period of 10 consecutive trading days at

any time following 4 months and one day after

the date of issuance of the warrants.

Number of Placees: 40 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Alec Edward Robinson Y 975,000

Firebird Global Master Fund, Ltd. Y 3,000,000

Chelmer Investments Corp.

(Darren Devine) Y 875,000

Simon Anderson Y 250,000

Anthony Dutton Y 500,000

Andy Bell Y 625,000

Kenneth Muir P 47,500

David Elliott P 250,000

Lisa Stefani P 200,000

David Lyall P 1,000,000

Cliff Rich P 500,000

Paul Visosky Y 375,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly. Note

that in certain circumstances the Exchange may later extend the expiry date

of the warrants, if they are less than the maximum permitted term.

TSX-X

----------------------------------------------------------------------------

CHRISTOPHER JAMES GOLD CORP. ("CJG")

BULLETIN TYPE: Halt

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

Effective at the opening, March 5, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to the

provisions of Section 10.9(1) of the Universal Market Integrity Rules.

TSX-X

----------------------------------------------------------------------------

CHRISTOPHER JAMES GOLD CORP. ("CJG")

BULLETIN TYPE: Remain Halted

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

Further to TSX Venture Exchange Bulletin dated March 5, 2010, effective at

11:06 a.m. PST, March 5, 2010 trading in the shares of the Company will

remain halted pending receipt and review of acceptable documentation

regarding the Change of Business and/or Reverse Takeover pursuant to

Listings Policy 5.2.

TSX-X

----------------------------------------------------------------------------

ECHELON CAPITAL CORPORATION ("ECO.P")

BULLETIN TYPE: Halt

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

Effective at 9:47 a.m. PST, March 5, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to the

provisions of Section 10.9(1) of the Universal Market Integrity Rules.

TSX-X

----------------------------------------------------------------------------

ECHELON CAPITAL CORPORATION ("ECO.P")

BULLETIN TYPE: Remain Halted

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

Further to TSX Venture Exchange Bulletin dated March 5, 2010, effective at

11:04 a.m. PST, March 5, 2010 trading in the shares of the Company will

remain halted pending receipt and review of acceptable documentation

regarding the Qualifying Transaction pursuant to Listings Policy 2.4.

TSX-X

----------------------------------------------------------------------------

ELECTRA GOLD LTD. ("ELT")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to a

Non-Brokered Private Placement announced February 11, 2010:

Number of Shares: 2,400,000 shares

Purchase Price: $0.05 per share

Warrants: 2,400,000 share purchase warrants to purchase

2,400,000 shares

Warrant Exercise Price: $0.10 for a two year period

Number of Placees: 5 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Kerry Chow P 500,000

Roberto Chu P 100,000

Finder's Fee: PI Financial Corp. receives $12,000 and 240,000

non-transferable warrants, each exercisable for

one share at a price of $0.10 for a two year

period.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly. (Note

that in certain circumstances the Exchange may later extend the expiry date

of the warrants, if they are less than the maximum permitted term.)

TSX-X

----------------------------------------------------------------------------

ENABLENCE TECHNOLOGIES INC. ("ENA")

BULLETIN TYPE: Prospectus-Share Offering

BULLETIN DATE: March 5, 2010

TSX Venture Tier 1 Company

Effective January 27, 2010, the Company's Prospectus dated January 27, 2010

was filed with and accepted by TSX Venture Exchange, and filed with and

receipted by the British Columbia, Alberta, Saskatchewan, Manitoba, Ontario,

Nova Scotia and New Brunswick Securities Commissions, pursuant to the

provisions of the respective Securities Act.

TSX Venture Exchange has been advised that closing occurred on February 4,

2010, for gross proceeds of $28,750,000.

Agent: Paradigm Capital Inc. and Raymond James Ltd.

Offering: 71,875,000 shares (includes 9,375,000 common

shares on the exercise of the Agents' over-

allotment option)

Share Price: $0.40 per share

Agent's Options: 2,875,000 compensation options. Each option is

exercisable into one common share at a price of

$0.40 for a period of eighteen months.

Agents' Commission: $1,725,000

For further information, please refer to the Company's final short form

prospectus dated January 27, 2010.

TSX-X

----------------------------------------------------------------------------

ESPERANZA SILVER CORPORATION ("EPZ")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: March 5, 2010

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect to a

Non-Brokered Private Placement announced March 4, 2010:

Number of Shares: 500,000 shares

Purchase Price: $1.25 per share

Warrants: 500,000 share purchase warrants to purchase

500,000 shares

Warrant Exercise Price: $1.75 for a two year period. If, after the

expiry of Canadian resale restrictions, the

closing price of the Company's shares is $2.20

or greater for a period of 20 consecutive

trading days, the Company may accelerate the

expiry of the warrants, to 21 trading days

after giving notice.

Number of Placees: 1 placee

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly. (Note

that in certain circumstances the Exchange may later extend the expiry date

of the warrants, if they are less than the maximum permitted term.)

TSX-X

----------------------------------------------------------------------------

EXPLOR RESOURCES INC. ("EXS")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the documentation relating to

an arms-length option agreement under which Explor Resources Inc. may

acquire a 100% interest in the Tardif Brook Gold Property consisting of 30

claims in the Restigouche county, located in the Province of New Brunswick

(the "Property").

Under the agreement, the Company will pay a consideration of $5,000 in cash

and 50,000 common shares, upon signing.

The vendor retains a 2% NSR royalty, 50% of which (1%) may be repurchased

upon payment of $1,000,000.

For further details, please refer to the Company's press release dated

February 19, 2010.

RESSOURCES EXPLOR INC. ("EXS")

TYPE DE BULLETIN : Convention d'achat de propriete, d'actif ou d'actions

DATE DU BULLETIN : Le 5 mars 2010

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot d'une convention de vente

negociee a distance en vertu de laquelle Ressources Explor inc. (la "

societe ") a acquis un interet de 100 % dans la propriete de Tardif Brook

Gold, comprenant 30 claims miniers situes dans le compte de Restigouche,

dans la province du Nouveau Brunswick.

La contrepartie est de 5 000 $ en especes et 50 000 actions ordinaires,

payable lors de la signature.

Le vendeur a conserve une redevance NSR de 2 % dans la propriete dont 50 %

(1 %) peut etre rachetee pour un montant de 1 000 000 $

Pour plus d'information, veuillez vous referer au communique de presse emis

par la societe le 19 fevrier 2010.

TSX-X

----------------------------------------------------------------------------

FIRST LITHIUM RESOURCES INC. ("MCI")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing an option agreement dated

February 24, 2010 between First Lithium Resources Inc. (the 'Company') and

Ashburton Ventures Inc. (a TSX Venture listed company), whereby the Company

will acquire an 80% interest in the Teels lithium prospect comprised of 120

placer claims located at Teels Marsh, Mineral County, Nevada approximately

54 miles northwest of Clayton Valley.

Total consideration consists of $175,000 in cash payments, 1,250,000 shares

of the Company, and $450,000 in work expenditures over a three year period

commencing after all relevant claims are registered.

TSX-X

----------------------------------------------------------------------------

FINAVERA RENEWABLES INC. ("FVR")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to a

Non-Brokered Private Placement announced February 23 and March 1, 2010:

Number of Shares: 2,848,400 shares

Purchase Price: $0.05 per share

Warrants: 1,424,200 share purchase warrants to purchase

1,424,200 shares

Warrant Exercise Price: $0.10 for a one year period

Number of Placees: 1 placee

No Insider / Pro Group Participation

Finder's Fee: $4,272.00 (3% of amount raised) payable to

Campbell O'Connor & Co.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly. Note

that in certain circumstances the Exchange may later extend the expiry date

of the warrants, if they are less than the maximum permitted term.)

TSX-X

----------------------------------------------------------------------------

FRONTLINE GOLD CORPORATION ("FGC")

(formerly Chrysos Capital Corporation ("CSZ"))

BULLETIN TYPE: Name Change

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

Pursuant to a resolution passed by shareholders on February 26, 2010, the

Company has changed its name from Chrysos Capital Corporation to Frontline

Gold Corporation. There is no consolidation of capital.

Effective at the opening Monday, March 8, 2010, the common shares of

Frontline Gold Corporation will commence trading on TSX Venture Exchange and

the common shares of Chrysos Capital Corporation will be delisted. The

Company is classified as a "Gold and Silver Ore Mining" issuer.

Capitalization: unlimited number of common shares with no par

value of which 48,216,169 shares are issued and

outstanding

Escrow: 28,065,000

Transfer Agent: Computershare Investor Services Inc. - Halifax

and Toronto

Trading Symbol: FGC (new)

CUSIP Number: 35922K 10 6 (new)

TSX-X

----------------------------------------------------------------------------

GALENA INTERNATIONAL RESOURCES LTD. ("GTO")

(formerly Galena International Resources Ltd. ("GTO.P"),

Kernow Resources & Development Ltd. ("KRD"))

BULLETIN TYPE: Qualifying Transaction-Completed/New Symbol, Amalgamation,

Resume Trading, Delist

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Companies

TSX Venture Exchange (the 'Exchange') has accepted for filing Galena

International Resources Ltd.'s (the 'Company' or 'Galena') Qualifying

Transaction (the 'QT') and related transactions, all as principally

described in its filing statement dated February 15, 2010 (the 'Filing

Statement'). As a result, effective at the opening Monday, March 8, 2010,

the Company will no longer be considered a Capital Pool Company and will

resume trading. The QT includes the following matters, all of which have

been accepted by the Exchange:

1. Qualifying Transaction / Amalgamation:

Galena, Kernow Resources & Development Ltd. ("Kernow") and Green Bull Energy

Inc. ("Green Bull") agreed to merge on September 9, 2009 via letter of

intent (the "LOI") which was superseded by an amalgamation agreement dated

November 25, 2009 (the "Amalgamation Agreement"). Pursuant to the terms of

the Amalgamation Agreement, Green Bull and Kernow, have amalgamated by way

of a three-cornered amalgamation under section 277 of the Business

Corporations Act (British Columbia) to form Green Bull Resources Ltd.

("GBR") (the "Amalgamation") and Galena has acquired all of the issued and

outstanding shares of GBR, (collectively the "Merger"). The material terms

of the Merger are:

- Green Bull has merged with Kernow to form GBR, a new British Columbia

corporation; and

- Galena has acquired all of the issued and outstanding shares of GBR in

consideration of the issuance of Galena shares to the former shareholders of

Green Bull and Kernow on the following basis:

o 3:1 basis (three Kernow shares for one new Galena share); and

o 1.864:1 basis (1.864 Green Bull shares for one new Galena share).

Finder's Fee: N/A

Insider / Pro Group Participation: None. At the time the Amalgamation

Agreement was entered into the Company was at arm's length to the Kernow and

Green Bull.

The Exchange has been advised that the above transactions, (which did not

require shareholder approval from Galena's shareholders) was approved by

shareholders of Kernow and Green Bull on December 23, 2009, and December 1,

2009 respectively, have been completed.

In addition, the Exchange has accepted for filing the following:

2. Resume Trading, Symbol Change & Delist:

Effective at the opening Monday, March 8, 2010, the common shares of Galena

International Resources Ltd. will resume trading and the common shares of

Kernow Resources & Development Ltd. will be delisted.

Symbol: GTO same symbol as CPC but with .P removed

Capitalization: Unlimited common shares with no par value of

which 22,227,686 common shares are issued and

outstanding

Escrow: 6,805,319 common shares are subject to a 36

month staged release escrow

The Company is classified as a "Mineral Exploration & Development" company.

Company Contact: Randy Turner, CEO, President & Director

Company Address: 1410 - 650 West Georgia Street

Vancouver, BC V6B 4N8

Company Phone Number: (604) 687-6644

Company Fax Number: (604) 687-1448

Company Email Address: rturner@canterraminerals.com

TSX-X

----------------------------------------------------------------------------

GOGOLD RESOURCES INC. ("GGD.P")

BULLETIN TYPE: Halt - Pending an announcement

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

Effective at 12:44 p.m. PST, March 5, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to the

provisions of Section 10.9(1) of the Universal Market Integrity Rules.

TSX-X

----------------------------------------------------------------------------

HATHOR EXPLORATION LIMITED ("HAT")

BULLETIN TYPE: Plan of Arrangement, Amendment

BULLETIN DATE: March 5, 2010

TSX Venture Tier 1 Company

Further to the TSX Venture Exchange Bulletin dated November 24, 2009, the

Exchange provides this addendum with respect to the Arrangement Agreement

(the "Agreement") dated September 14, 2009 between Hathor Exploration

Limited (the 'Company') and Northern Continental Resources Inc. ('NCR').

In conjunction with the Plan of Arrangement effective Monday, November 23,

2009, the Exchange has accepted the Advisory Agreement between the Company

and HSBC Securities (Canada) Inc. ("HSBC"), dated April 6, 2009 (the

"Advisory Agreement"), whereby HSBC will be paid a "Success Fee" upon

closing of the transaction of:

- $250,000 cash; and

- 250,000 brokered warrants to purchase 250,000 common shares of the company

@$1.74 for 2 years.

TSX-X

----------------------------------------------------------------------------

INTENSITY COMPANY INC. ("ITT")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to a

Non-Brokered Private Placement announced March 4, 2010:

Number of Shares: 950,000 Units

(Each Unit consists of one common share and one

share purchase warrant.)

Purchase Price: $0.10 per Unit

Warrants: 950,000 share purchase warrants to purchase

950,000 shares

Warrant Exercise Price: $0.15 for a one year period

Number of Placees: 4 placees

No Insider / Pro Group Participation

No Finder's Fee

TSX-X

----------------------------------------------------------------------------

KIVALLIQ ENERGY CORPORATION ("KIV")

BULLETIN TYPE: Private Placement-Non-Brokered, Amendment

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

Further to the TSX Venture Exchange Bulletin dated February 16, 2010, the

Exchange has accepted an amendment with respect to a Non-Brokered Private

Placement announced January 29, 2010. Wolverton Securities Inc. is NOT

receiving a finder's fee.

TSX-X

----------------------------------------------------------------------------

LORNEX CAPITAL INC. ("LOM")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to a

Non-Brokered Private Placement announced January 28, 2010:

Number of Shares: 3,426,667 shares

Purchase Price: $0.30 per share

Warrants: 1,713,333 share purchase warrants to purchase

1,713,333 shares

Warrant Exercise Price: $0.50 for a two year period

Number of Placees: 48 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Ivano Veschini P 166,000

Colin Quan P 10,000

Finders' Fees: $20,559 cash payable to Consilium Holdings Inc.

(Mike Suk)

$19,404 cash payable to Canaccord Financial

Ltd.

$9,030 cash payable to Jordan Capital Markets

Inc.

28,000 units (comprised of one share and one

half of one warrant with each whole warrant

exercisable at $0.50 for two years) payable to

JDI Holdings Ltd. (Dara Fahy)

$6,972 cash payable to Bolder Investment

Partners Ltd.

25,317 units (same terms as above) payable to

David Benson.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly. Note

that in certain circumstances the Exchange may later extend the expiry date

of the warrants, if they are less than the maximum permitted term.

TSX-X

----------------------------------------------------------------------------

MANITOU GOLD INC. ("MTU")

BULLETIN TYPE: New Listing-IPO-Shares

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

The Company's Initial Public Offering ('IPO') Prospectus dated February 16,

2010, has been filed with and accepted by TSX Venture Exchange, and filed in

Ontario, British Columbia, Alberta, Saskatchewan and Manitoba, and receipted

by the securities regulator in each of these jurisdictions, pursuant to the

provisions of the securities legislations in each of these jurisdictions.

The gross proceeds received by the Company for the Offering were $2,000,000

(8,000,000 units at $0.25 per unit). Each unit consists of one common share

and one-half of one share purchase warrant of the Company. Each warrant will

entitle the holder to acquire one common share at a price of $0.40 until

March 4, 2013. The Company is classified as a 'Mineral

Exploration/Development' company.

Commence Date: At the opening Monday, March 8, 2010, the

common shares will commence trading on TSX

Venture Exchange.

Corporate Jurisdiction: Ontario

Capitalization: Unlimited number of common shares with no par

value of which 21,809,803 common shares are

issued and outstanding

Escrowed Shares: 5,721,470 common shares

Transfer Agent: Equity Transfer & Trust Company

Trading Symbol: MTU

CUSIP Number: 563508 10 0

Agent: Canaccord Financial Ltd.

Agent's Warrants: 900,000 non-transferable share purchase

warrants. One warrant to purchase one share at

$0.40 per share up to March 4, 2013.

For further information, please refer to the Company's Prospectus dated

February 16, 2010.

Company Contact: Guy Mahaffy, Chief Financial Officer

Company Address: 101-957 Cambrian Heights Drive

Sudbury, Ontario P3C 5S5

Company Phone Number: (705) 222-8800

Company Fax Number: (705) 222-8801

Company Email Address: info@manitougold.com

TSX-X

----------------------------------------------------------------------------

MOUNTAIN-WEST RESOURCES INC. ("MWR")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to a

Non-Brokered Private Placement announced February 10, 2010:

Number of Shares: 400,000 shares

Purchase Price: $0.25 per share

Number of Placees: 7 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Frank Diegmann Y 138,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

TSX-X

----------------------------------------------------------------------------

ORSA VENTURES CORP. ("ORN")

BULLETIN TYPE: Company Tier Reclassification

BULLETIN DATE: March 5, 2010

TSX Venture Tier 1 Company

In accordance with Policy 2.5, the Company has not met the requirements for

a Tier 1 company. Therefore, effective Monday, March 8, 2010, the Company's

Tier classification will change from Tier 1 to:

Classification

Tier 2

TSX-X

----------------------------------------------------------------------------

QUATERRA RESOURCES INC. ("QTA")

BULLETIN TYPE: Shares for Services

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to issue

19,565 shares at a deemed price of $1.15 per share in consideration of

certain financial and advisory services provided to the Company pursuant to

an agreement dated April 2, 2009.

The Company shall issue a news release when the shares are issued.

TSX-X

----------------------------------------------------------------------------

RAINY MOUNTAIN ROYALTY CORP. ("RMO")

BULLETIN TYPE: Regional Office Change

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

Pursuant to Policy 1.2, TSX Venture Exchange has been advised of, and

accepted the change of the Filing and Regional Office from Toronto, ON to

Vancouver, BC.

TSX-X

----------------------------------------------------------------------------

SACCHARUM ENERGY CORP. ("SHM.P")

BULLETIN TYPE: Halt

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

Effective at 9:39 a.m. PST, March 5, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to the

provisions of Section 10.9(1) of the Universal Market Integrity Rules.

TSX-X

----------------------------------------------------------------------------

SANDSPRING RESOURCES LTD. ("SSP")

BULLETIN TYPE: Halt

BULLETIN DATE: March 5, 2010

TSX Venture Tier 1 Company

Effective at 7:29 a.m. PST, March 5, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to the

provisions of Section 10.9(1) of the Universal Market Integrity Rules.

TSX-X

----------------------------------------------------------------------------

SANDSPRING RESOURCES LTD. ("SSP")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: March 5, 2010

TSX Venture Tier 1 Company

Effective at 9:00 a.m. PST, March 5, 2010, shares of the Company resumed

trading, an announcement having been made over StockWatch.

TSX-X

----------------------------------------------------------------------------

SAN GOLD CORPORATION ("SGR")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: March 5, 2010

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for expedited filing documentation

pertaining to a Purchase Agreement dated February 12, 2010 between San Gold

Corporation (the 'Company') and Newquest Gold Inc. (Blair Caithness, John

Arnold, Robert Wasslen, Bill Percy, Art Stacey), pursuant to which the

Company may acquire a 100% interest in 4 mineral claims located near

Bissett, Manitoba, known as the Gold Horse Mineral Claims. In consideration,

the Company will pay $50,000 and issue 60,000 shares upon closing. There is

a 3% net smelter return royalty in favour of Golden Canadian Ltd., of which

1% may be purchased within one year of commercial production for the payment

of $1,000,000.

TSX-X

----------------------------------------------------------------------------

SANTA FE METALS CORP. ("SFM")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to a

Non-Brokered Private Placement announced February 19, 2010:

Number of Shares: 11,000,000 shares

Purchase Price: $0.10 per share

Warrants: 5,500,000 share purchase warrants to purchase

5,500,000 shares

Warrant Exercise Price: $0.15 for a two year period

Number of Placees: 37 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

R. Stuart Angus Y 1,000,000

Douglas R. Brett Y 50,000

Drekar Capital Corp.

(Douglas R. Brett) Y 400,000

John R. W. Fox Y 150,000

Renee Garnett P 200,000

David Garnett P 150,000

Pinetree Resource Partnership Y 1,500,000

Thomas W. Seltzer P 100,000

Ian Smith Y 500,000

Clarence Wendt Y 50,000

Finders' Fees: $750 payable to Raymond James Ltd.

$5,750 payable to Canaccord Financial Ltd.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

TSX-X

----------------------------------------------------------------------------

SAVARY CAPITAL CORP. ("SCA.P")

BULLETIN TYPE: Remain Halted

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

Further to TSX Venture Exchange Bulletin dated February 3, 2010, effective

at 11:41 a.m. PST, March 5, 2010 trading in the shares of the Company will

remain halted pending receipt and review of acceptable documentation

regarding the Qualifying Transaction pursuant to Listings Policy 2.4.

TSX-X

----------------------------------------------------------------------------

SEARCH MINERALS INC. ("SMY")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to a

Non-Brokered Private Placement announced February 16, 2010:

Number of Shares: 2,400,000 shares

Purchase Price: $0.35 per share

Warrants: 2,400,000 share purchase warrants to purchase

2,400,000 shares

Warrant Exercise Price: $0.50 for a one year period

Finders' Fees: $51,468.75 payable to George Molyviatis

$7,000 payable to RD Capital Inc.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly. (Note

that in certain circumstances the Exchange may later extend the expiry date

of the warrants, if they are less than the maximum permitted term.)

TSX-X

----------------------------------------------------------------------------

SPRING & MERCER CAPITAL CORP. ("SPN.H")

(formerly Spring & Mercer Capital Corp. ("SPN.P"))

BULLETIN TYPE: Transfer and New Addition to NEX, Symbol Change

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

In accordance with TSX Venture Policy 2.4, Capital Pool Companies, the

Company has not completed a Qualifying Transaction within the prescribed

time frame. Therefore, effective at the opening Monday, March 8, 2010, the

Company's listing will transfer to NEX, the Company's Tier classification

will change from Tier 2 to NEX, and the Filing and Service Office will

change from Vancouver to NEX.

As of March 8, 2010, the Company is subject to restrictions on share

issuances and certain types of payments as set out in the NEX policies.

The trading symbol for the Company will change from SPN.P to SPN.H. There is

no change in the Company's name, no change in its CUSIP number and no

consolidation of capital. The symbol extension differentiates NEX symbols

from Tier 1 or Tier 2 symbols within the TSX Venture.

TSX-X

----------------------------------------------------------------------------

SWIFT POWER CORP. ("SPC")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to a

Non-Brokered Private Placement announced February 19, 2010:

Number of Shares: 1,346,154 shares

Purchase Price: $0.26 per share

Warrants: 1,346,154 share purchase warrants to purchase

1,346,154 shares

Warrant Exercise Price: $0.35 for a one year period

Number of Placees: 1 placee

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Fort Chicago Pipelines

(Canada) Ltd. Y 1,346,154

No Finder's fee.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly. Note

that in certain circumstances the Exchange may later extend the expiry date

of the warrants, if they are less than the maximum permitted term.)

TSX-X

----------------------------------------------------------------------------

TIMES TELECOM INC. ("TTT")

BULLETIN TYPE: New Listing-Shares

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

Effective at the opening Monday, March 8, 2010, the shares of the Company

will commence trading on TSX Venture Exchange pending confirmation that the

distribution of its shares has been effected. The Company is classified as a

'Telecom' company.

Corporate Jurisdiction: British Columbia

Capitalization: unlimited common shares with no par value of

which 90,000,000 common shares are issued and

outstanding

Escrowed Shares: 31,881,492 common shares

Transfer Agent: Computershare Investor Services Inc.

Trading Symbol: TTT

CUSIP Number: 887373 10 8

Sponsoring Member: Research Capital Corp.

For further information, please refer to the Company's Prospectus dated

December 11, 2009.

Company Contact: Norman Tsui

Company Address: Suite 400, North Tower

5811 Cooney Road

Richmond, BC V6X3M1

Company Phone Number: (604) 279-8787 ext 1875

Company Fax Number: (604) 279-8775

Company Email Address: norman.tsui@timestelecom.ca

TSX-X

----------------------------------------------------------------------------

TORCH RIVER RESOURCES LTD. ("TCR")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange (the "Exchange") conditionally accepts the Amendment to

Option Agreement (the "Amended Agreement") between the Company and various

non-Arms Length parties (the "Vendors). Under the terms of the Amended

Agreement, the purchase price for the Mount Copeland Property (the

"Property) has now changed to an aggregate of $175,000 cash and 1,880,000

common shares. The Vendors will still retain a 2.75% Gross Royalty on the

Property.

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Dr William Pfaffenberger Y 370,000

This transaction was announced in the Company's press release dated February

25, 2010.

TSX-X

----------------------------------------------------------------------------

TYNER RESOURCES LTD. ("TIP")

BULLETIN TYPE: Halt

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

Effective at 6:05 a.m. PST, March 5, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to the

provisions of Section 10.9(1) of the Universal Market Integrity Rules.

TSX-X

----------------------------------------------------------------------------

VAULT MINERALS INC. ("VMI")

BULLETIN TYPE: Halt

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

Effective at 10:48 a.m. PST, March 5, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to the

provisions of Section 10.9(1) of the Universal Market Integrity Rules.

TSX-X

----------------------------------------------------------------------------

VAULT MINERALS INC. ("VMI")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

Effective at 12:16 p.m. PST, March 5, 2010, shares of the Company resumed

trading, an announcement having been made over StockWatch.

TSX-X

----------------------------------------------------------------------------

VERENA MINERALS CORPORATION ("VML")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to a

Brokered Private Placement announced February 19, 2010 and March 1, 2010:

Number of Shares: 24,000,000 shares

Purchase Price: $0.25 per share

Warrants: 24,000,000 share purchase warrants to purchase

24,000,000 shares

Warrant Exercise Price: $0.50 for a two year period

Number of Placees: 82 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Robert F. Rose P 280,000

Wendy Rose P 100,000

Rose Jacobs Holdings Ltd. P 200,000

K. Andrew Gustajtis P 80,000

Graham Saunders P 100,000

Mark Eaton I 2,000,000

Michael Morrison P 120,000

Peter Dunlop P 280,000

Richard Gray P 80,000

Scott Wigle P 120,000

Simon Marcotte P 160,000

Tim Foote P 160,000

Peter Tagliamonte Y 160,000

Bill Godson P 100,000

Elizabeth Falconer P 100,000

Peter L. Winnell P 80,000

Paul Pint P 40,000

R.W. Cairns P 60,000

Mary Cairns P 50,000

Catherine Gignac P 80,000

Suzanne Duras P 80,000

Kevin Williams P 100,000

Stephen G. Roman P 340,000

Micahel G. Fowler P 40,000

Botho von Bose P 100,000

Helio B. Diniz Y 100,000

Agent's Fee: An issuance of 1,200,000 common shares and

1,200,000 agent's options to D&D Securities

Company. Each agent's option is exercisable

into one common share and one common share

purchase warrant at a price of $0.25 per option

for a two year period. Each warrant is

exercisable into one common share at a price of

$0.50 per share for a two year period.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company has

issued a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). Note that in certain

circumstances the Exchange may later extend the expiry date of the warrants,

if they are less than the maximum permitted term.

TSX-X

----------------------------------------------------------------------------

VIRGINIA ENERGY RESOURCES INC. ("VAE")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: March 5, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for expedited filing documentation of an

Agreement dated September 14, 2009 between the Issuer and Big Red Diamond

Corporation (the "Vendor") whereby the Company has been grated the exclusive

option to purchase 100% undivided interest to the Strategis Property in the

Otish Mountains of Quebec (the "Property").

The consideration payable to the Vendor consists of $50,000 cash and 635,000

common shares of the Company.

In accordance with an Assignment and Novation Agreement dated January 15,

2010 between the Company and the Vendor and Geotest Corporation and Natalie

Hansen the Property is subject to a 2% Net Smelter Return Royalty in favour

of the Vendor (0.5%), Geotest and Hansen (each 0.75%) of which 1.5% may be

purchased by the Company at any time for a cash payment of $1,500,000

($500,000 for each 0.5%).

TSX-X

----------------------------------------------------------------------------

XTIERRA INC. ("XAG")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: March 5, 2010

TSX Venture Tier 1 Company

TSX Venture Exchange (the "Exchange") has accepted for filing documentation

with respect to the first tranche of a Non-Brokered Private Placement

announced January 19, 2010:

Number of Shares: 19,775,000 shares

Purchase Price: $0.20 per share

Warrants: 9,887,500 share purchase warrants to purchase

9,887,500 shares

Warrant Exercise Price: $0.30 until March 1, 2010

Number of Placees: 3 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Pacific Road Holdings NV Y 10,017,500

Pacific Road Resources

(Fund A) Y 1,241,250

Pacific Road Resources

(Fund B) Y 1,241,250

Finder's Fee: $21,350 and 122,000 compensation warrants

payable to MGI Securities Inc. Each

compensation warrant is exercisable into one

common share and one-half a common share

purchase warrant at a price of $0.20 per

compensation warrant until March 1, 2011. Each

whole warrant is exercisable into one common

share at a price of $0.30 per share until March

1, 2011.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company has

issued a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). Note that in certain

circumstances the Exchange may later extend the expiry date of the warrants,

if they are less than the maximum permitted term.

TSX-X

----------------------------------------------------------------------------

ZEDI INC. ("ZED")

BULLETIN TYPE: Normal Course Issuer Bid

BULLETIN DATE: March 5, 2010

TSX Venture Tier 1 Company

TSX Venture Exchange has been advised by the Company that pursuant to a

Notice of Intention to make a Normal Course Issuer Bid dated March 3, 2010,

it may repurchase for cancellation, up to 4,738,601 shares in its own

capital stock. The purchases are to be made through the facilities of TSX

Venture Exchange during the period March 12, 2010 to March 11, 2011.

Purchases pursuant to the bid will be made by FirstEnergy Capital Corp. on

behalf of the Company.

TSX-X

----------------------------------------------------------------------------

NEX COMPANIES

EACOM TIMBER CORPORATION ("ETR")

(formerly Eacom Timber Corporation ("ETR.H"))

BULLETIN TYPE: Change of Business, Private Placement-Non-Brokered,

Graduation from NEX to TSX Venture, Symbol Change

BULLETIN DATE: March 5, 2010

NEX Company

TSX Venture Exchange has accepted for filing the Company's Change of

Business, which includes the acceptance of the following transactions:

1. Acquisition

The acquisition of the Big River sawmill located in Saskatchewan from Domtar

Pulp and Paper Products in consideration of $3 million cash.

The Company is classified as a 'Timber' company.

Capitalization: unlimited shares with no par value of which

70,295,344 shares are issued and outstanding

Escrowed: 8,036,250 common shares

Escrow Term: 18 months

In addition, the Exchange has accepted for filing the following:

2. Private Placement-Non-Brokered

TSX Venture Exchange has accepted for filing documentation with respect to a

Non-Brokered Private Placement announced October 7, 2009:

Number of Shares: 10,000,000 shares

Purchase Price: $0.30 per share

Warrants: 10,000,000 share purchase warrants to purchase

10,000,000 shares

Warrant Exercise Price: $0.60 for a one year period

Number of Placees: 56 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Units

Ivano Veschini P 100,000

Prussian Capital Corporation P 165,000

Delia Barbosa P 50,000

Thomas English P 200,000

William H. Burk P 80.000

Terrance Salman P 100,000

Mathew Gaasenbeek P 100,000

Robert Sali P 240,000

Shain Mottahed P 40,000

3. Graduation from NEX to TSX Venture:

The Company has met the requirements to be listed as a TSX Venture Tier 2

Company. Therefore, effective on March 8, 2010, the Company's listing will

transfer from NEX to TSX Venture, the Company's Tier classification will

change from NEX to Tier 2 and the Filing and Service Office will change from

NEX to Vancouver.

Effective at the opening Monday, March 8, 2010, the trading symbol for the

Company will change from ETR.H to ETR.

TSX-X

----------------------------------------------------------------------------

HARMONY GOLD CORP. ("H")

(formerly Harmony Gold Corp. ("H.H"))

BULLETIN TYPE: Change of Business, Private Placement-Non-Brokered,

Graduation from NEX to TSX Venture, Symbol Change

BULLETIN DATE: March 5, 2010

NEX Company

Change of Business:

TSX Venture Exchange has accepted for filing Harmony Gold Corp.'s (the

"Company" or "Harmony") Change of Business (the "COB") and related

transactions, all as principally described in its Filing Statement dated

February 12, 2010 (the "Filing Statement"). The COB includes the following

matters, all of which have been accepted by the Exchange:

1. Property-Asset or Share Purchase Agreement:

The Company has the signed an option agreement dated November 11, 2009 (the

"Option Agreement") with Full Metal Minerals Ltd. (a Tier 2 TSXV listed

Company - "Full Metal"), whereby the Company has the option to purchase up

to a 60% interest in the Lucky Shot property (the Property") located in the

Talkeetna Recording District, Alaska.

To exercise the option, Harmony must:

(a) make a cash payment of $2,000,000 (which includes the reimbursement

of $1,500,000 incurred by Full Metal to complete the drill program as set

out in Phase I of the Technical Report) to Full Metal on the later of (A)

the fifth business day following acceptance of the Option Agreement by the

Exchange (the "Acceptance Date") and (B) the date that all of the parties

have confirmed that they are satisfied with their due diligence as

contemplated by the Option Agreement (the "Satisfaction Date");

(b) issue to Full Metal an aggregate of 4,000,000 Harmony Shares as

follows:

(i) 2,000,000 Harmony Shares on the later of (A) the fifth business day

following the Acceptance Date and (B) the Satisfaction Date; and

(ii) 2,000,000 Harmony Shares on completion of construction of an

underground access production ramp as recommended in Phase II of the

Technical Report;

(c) incur, before December 31, 2012, an aggregate of $8,000,000 in

expenditures on the claims to be incurred to complete construction of the

underground access production ramp as recommended in Phase II of the

Technical Report it being acknowledged that if prior to the later of:

(i) the fifth Business Day following the Acceptance Date; and

(ii) the Satisfaction Date.

Full Metal has expended additional funds to complete construction of the

underground access production ramp as recommended in Phase II of the

Technical Report, Harmony will reimburse Full Metal for such expenditures

and Harmony will be required to make such reimbursement on the later of (A)

the fifth business day following the Acceptance Date and (B) the

Satisfaction Date in order to meet its obligations under the Option

Agreement, provided that such reimbursement by Harmony to Full Metal will be

credited against the $8,000,000 expenditure obligation under the Option

Agreement.

Harmony will issue an aggregate of an additional 8,000,000 shares to Full

Metal as follows:

(a) 3,000,000 Harmony Shares to Full Metal on completion of the

processing of a bulk sample of not less than 7,500 tonnes, as recommended in

Phase II of the Technical Report; and

(b) 5,000,000 Harmony Shares on commencement of commercial production

on the claims.

All 12,000,000 shares that will be issued to Full Metals will be subject to

a three year escrow agreement as described in Policy 5.4, commencing on the

date of this bulletin.

The Company is classified as a 'Mineral Exploration' company.

Insider / Pro Group Participation: N/A

In addition, the Exchange has accepted for filing the following:

2. Private Placement-Non-Brokered:

TSX Venture Exchange has accepted for filing documentation with respect to a

Non-Brokered Private Placement announced November 9, 2009 and amended on

February 2, 2010:

Number of Shares: 14,147,521 shares

Purchase Price: $0.35 per share

Warrants: 7,073,760 share purchase warrants to purchase

7,073,760 shares

Warrant Exercise Price: $0.65 for a one year period

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Robert Kerr P 30,000

ABC Capital Management P 100,000

Shaun Chin P 50,000

Azim Dhalla P 50,000

Craig Engelsman Y 200,000

Jerry Minni Y 100,000

Finders' Fees: $1,400 and 4,000 finder warrants payable to

Raymond James Ltd.

$40,000 and 114,285 finder warrants payable to

Phoenix Communications Group Inc.

$2,100 and 6,000 finder warrants payable to

Shafin Harji

$44,260 and 126,458 finder warrants payable to

Talisman Venture Partners Ltd.

$6,160 and 17,600 finder warrants payable to

Progressive Investor Relations

$7,840 and 22,400 finder warrants payable to

BBS Securities Inc.

$20,272 and 57,920 finder warrants payable to

Union Securities Ltd.

$16,084 and 45,954 finder warrants payable to

Lisa Rossler

$17,080 and 48,800 finder warrants payable to

USC Commodity Ltd.

$25,200 and 72,000 finder warrants payable to

Ashley James

$3,718 and 10,624 finder warrants payable to

Sean Gibson

$13,048 and 37,280 finder warrants payable to

Steve Parhar

$28,266 and 80,760 finder warrants payable to

Rundle Capital Ltd.

$11,480 and 32,800 finder warrants payable to

Mackie Research Capital

$88,410 and 252,600 finder warrants payable to

Canaccord Financial Ltd.

$14,736 and 42,103 finder warrants payable to

Spectre Investments Inc.

$14,896 and 42,560 finder warrants payable to

Rory S. Godinho Law Corporation

- Each finder warrant is exercisable at $0.65

for a twelve month period

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

3. Graduation from NEX to TSX Venture, Symbol Change

The Company has met the requirements to be listed as a TSX Venture Tier 2

Company. Therefore, effective at the opening Monday, March 8, 2010, the

Company's listing will transfer from NEX to TSX Venture, the Company's Tier

classification will change from NEX to Tier 2 and the Filing and Service

Office will change from NEX to Vancouver.

Effective at the opening Monday, March 8, 2010, the trading symbol for the

Company will change from H.H to H.

Capitalization: Unlimited shares with no par value of which

14,773,981 shares are issued and outstanding

Escrowed: 94,000 common shares

Company Contact: Craig Engelsman

Company Address: Suite 200, 551 Howe Street

Vancouver, BC V6C 2C2

Company Phone Number: (778) 370-0519

Company Fax Number: (604) 683-4499

Company Email Address: cengelsman@harmonygold.com

TSX-X

----------------------------------------------------------------------------

PEBERCAN INC. ("PBC.H")

BULLETIN TYPE: Delist

BULLETIN DATE: March 5, 2010

NEX Company

Effective at the open of business Monday, March 8, 2010, the common shares

will be delisted from TSX Venture Exchange at the request of the Company.

TSX-X

----------------------------------------------------------------------------

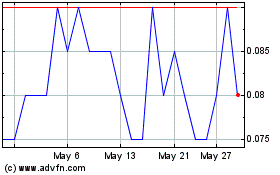

Minnova (TSXV:MCI)

Historical Stock Chart

From Apr 2024 to May 2024

Minnova (TSXV:MCI)

Historical Stock Chart

From May 2023 to May 2024