TSX VENTURE COMPANIES:

ALTO VENTURES LTD. ("ATV")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 31, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

the first three tranches of a Non-Brokered Private Placement announced

December 10, 2010:

Number of Shares: 26,590,000 shares

5,700,000 flow-through shares

Purchase Price: $0.05 per share

Warrants: 18,690,000 share purchase warrants to purchase

18,690,000 shares

Warrant Exercise Price: $0.10 for a one year period

Number of Placees: 51 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

R. Brend Dunlop P 1,000,000 nf/t

Mark Wayne P 1,000,000 nf/t

Mark Wayne P 1,000,000 f/t

Ivano Veschini P 500,000 f/t

Richard Mazur Y 500,000 f/t

Finders' Fees: Norstar Securities Limited Partnership -

$70,000 and 1,400,000 warrants that are

exercisable into common shares at $0.10 per

share for a one year period.

Union Securities Ltd. - $16,680 and 333,600

warrants that are exercisable into common

shares at $0.10 per share for a one year

period. (2nd Tranche) and $1,280 and 25,600

warrants that are exercisable into common

shares at $0.10 per share for a one year

period. (3rd Tranche)

Haywood Securities Inc. - $4,200 and 84,000

warrants that are exercisable into common

shares at $0.10 per share for a one year

period.

MGI Securities Inc. - $16,600 and 332,000

warrants that are exercisable into common

shares at $0.10 per share for a one year

period.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly. Note

that in certain circumstances the Exchange may later extend the expiry date

of the warrants, if they are less than the maximum permitted term.

---------------------------------------------------------------------------

ARCTURUS VENTURES INC. ("AZN")

BULLETIN TYPE: Private Placement-Non-Brokered, Amendment

BULLETIN DATE: December 31, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

the third tranche of a Non-Brokered Private Placement announced December 7,

2010 and December 14, 2010:

Number of Shares: 85,000 flow-through shares

Purchase Price: $0.13 per flow-through share

Warrants: 42,500 flow-through share purchase warrants to

purchase 42,500 shares

Warrant Exercise Price: $0.14 for a two year period

Number of Placees: 1 placee

Amendment to Finder's Fee:

Further to the Exchange bulletins dated December 23, 2010 and December 29,

2010 with respect to the first and second tranche of the private placement,

the finder's fee payable to Limited Market Dealer Inc. has been revised

from $37,000 to $37,500 and from 569,231 Broker Options to 576,923 Broker

Options that are exercisable into units at $0.13 per unit for a two year

period. The units have the same terms as the non-flow-through offering.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly. Note

that in certain circumstances the Exchange may later extend the expiry date

of the warrants, if they are less than the maximum permitted term.

---------------------------------------------------------------------------

AROWAY MINERALS INC. ("ARW")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 31, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

the first tranche a Non-Brokered Private Placement announced November 29,

2010:

Number of Shares: 8,325,750 flow-through shares

4,638,056 non-flow-through shares

Purchase Price: $0.40 per flow-through share

$0.36 per non-flow-through share

Warrants: 4,162,875 flow-through share purchase warrants

to purchase 4,162,875 non-flow-through shares

at $0.50 per share for a one year period

2,319,028 non-flow-through share purchase

warrants to purchase 2,319,028

non-flow-through shares at $0.45 per share for

a one year period

Number of Placees: 203 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Chris Cooper Y 27,778 nf/t

2001 Investments Inc.

(Jubilee Esmail) P 20,000 nf/t

Raymond Billing P 35,000 nf/t

Don Lay P 30,000 nf/t

Glen Cooke P 30,000 nf/t

Michael Winiker P 100,000 nf/t

Sandra McNeely P 30,000 nf/t

Robert Lee P 30,000 nf/t

Bill Griffis P 100,000 nf/t

Matthew Clark P 100,000 f/t

Lynford Evans P 25,000 f/t

Chester Kmiec P 30,000 f/t

Winton Derby P 35,000 f/t

Glen Cooke P 50,000 f/t

Jonathan Goodman P 25,000 f/t

Richard Benedict P 62,500 f/t

William Pollard P 100,000 f/t

Bradley Smith P 25,000 f/t

Gregg Delcourt P 50,000 f/t

Colin Ritchie P 13,000 f/t

Keith Gilbert P 125,000 f/t

David Potok P 13,000 f/t

James Rogers P 62,500 f/t

Finders' Fees: Canaccord Genuity Corp. - $53,104.08 and

142,454 non- transferable Broker Warrants that

are exercisable into common shares at $0.50

per share for a 12 month period.

Leede Financial Markets Inc. - $49,520.00 and

125,640 non-transferable Broker Warrants that

are exercisable into common shares at $0.50

per share for a 12 month period.

Union Securities Ltd. - $16,985.60 and 46,960

non-transferable Broker Warrants that are

exercisable into common shares at $0.50 per

share for a 12 month period.

PI Financial Corp. - $1,600.00 and 4,000

non-transferable Broker Warrants that are

exercisable into common shares at $0.50 per

share for a 12 month period.

Corporate House Equity (Tom Sharp) -

$28,490.16 and 74,273 non-transferable Broker

Warrants that are exercisable into common

shares at $0.50 per share for a 12 month

period.

Mackie Research Capital Corporation -

$3,200.00 and 8,000 non-transferable Broker

Warrants that are exercisable into common

shares at $0.50 per share for a 12 month

period.

Guilford Capital Inc. (Sharad Mistry) -

$3,200.00 and 8,000 non-transferable Broker

Warrants that are exercisable into common

shares at $0.50 per share for a 12 month

period.

Haywood Securities Inc. - $12,080.00 and

31,000 non-transferable Broker Warrants that

are exercisable into common shares at $0.50

per share for a 12 month period.

Momentum PR (Gamxence Gagne-Godbout) -

$9,600.00 and 24,000 non-transferable Broker

Warrants that are exercisable into common

shares at $0.50 per share for a 12 month

period.

Odlum Brown Limited - $3,200.00 and 8,000

non-transferable Broker Warrants that are

exercisable into common shares at $0.50 per

share for a 12 month period.

Topleft Securities Ltd. - $28,400.00 and

75,000 non-transferable Broker Warrants that

are exercisable into common shares at $0.50

per share for a 12 month period.

Cali Van Zant - $800.00 and 2,000

non-transferable Broker Warrants that are

exercisable into common shares at $0.50 per

share for a 12 month period.

D&D Securities Company - $12,000.96 and 33,336

non-transferable Broker Warrants that are

exercisable into common shares at $0.50 per

share for a 12 month period.

Raymond James Ltd. - $91,579.20 and 237,220

non-transferable Broker Warrants that are

exercisable into common shares at $0.50 per

share for a 12 month period.

Tristar Capital Management Inc. (Jordan Buck)

- $16,960.00 and 43,000 non-transferable

Broker Warrants that are exercisable into

common shares at $0.50 per share for a 12

month period.

Macquarie Private Wealth Inc. - $22,880.00 and

58,000 non-transferable Broker Warrants that

are exercisable into common shares at $0.50

per share for a 12 month period.

Paradigm Capital - $8,000.00 and 20,000

non-transferable Broker Warrants that are

exercisable into common shares at $0.50 per

share for a 12 month period.

RBC Dominion Securities - $4,000.00 and 10,000

non-transferable Broker Warrants that are

exercisable into common shares at $0.50 per

share for a 12 month period.

Secutor Capital Management Corporation -

$33,600.00 and 84,000 non-transferable Broker

Warrants that are exercisable into common

shares at $0.50 per share for a 12 month

period.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly. Note

that in certain circumstances the Exchange may later extend the expiry date

of the warrants, if they are less than the maximum permitted term.

---------------------------------------------------------------------------

AVANTI MINING INC. ("AVT")

BULLETIN TYPE: Private Placement-Non-Brokered, Private Placement - Brokered

BULLETIN DATE: December 31, 2010

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered and Brokered Private Placement announced December 22, 2010:

Number of Shares: 10,152,284 flow-through shares

43,650,794 common shares

Purchase Price: $0.394 per flow-through share

$0.252 per common share

Number of Placees: 6 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

SeAH Holding Corp. Y 43,650,794 nf/t

Finder's Fee: D&D Securities Inc. will receive an 8% cash

finder's fee in the amount of $320,000 for the

Brokered flow-through portion of the private

placement.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

---------------------------------------------------------------------------

AZABACHE ENERGY INC. ("AZA")

BULLETIN TYPE: Reinstated for Trading

BULLETIN DATE: December 31, 2010

TSX Venture Tier 2 Company

Further to the TSX Venture Exchange Bulletin dated November 4, 2010, the

Exchange has been advised that the Cease Trade Order issued by the Alberta

Securities Commission on November 4, 2010 has been revoked.

Effective at the opening Tuesday, January 4, 2011, trading will be

reinstated in the securities of the Company.

---------------------------------------------------------------------------

BONAPARTE RESOURCES INC. ("BON")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 31, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced December 15, 2010 and December

17, 2010:

Number of Shares: 3,000,000 flow-through shares

Purchase Price: $0.40 per share

Warrants: 1,500,000 share purchase warrants to purchase

1,500,000 shares

Warrant Exercise Price: $0.50 for a one year period

Number of Placees: 37 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

John Tognetti P 200,000

Thomas Randall Saunders Y 90,000

Gus Wahlroth P 125,000

Harley Mayers P 300,000

Christopher Wahlroth P 10,000

Jasson Aisenstat P 25,000

Finders' Fees: PI Financial Corp. - $60,080

Canaccord Genuity Corp. - $4,000

Haywood Securities Inc. - $6,400

Global Securities Corporation - $11,440

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly. Note

that in certain circumstances the Exchange may later extend the expiry date

of the warrants, if they are less than the maximum permitted term.

---------------------------------------------------------------------------

CARBON FRIENDLY SOLUTIONS INC. ("CFQ")

BULLETIN TYPE: Delist

BULLETIN DATE: December 31, 2010

TSX Venture Tier 2 Company

Effective at the close of business December 31, 2010, the common shares

will be delisted from TSX Venture Exchange at the request of the Company.

The Company will continue to trade on CNSX.

---------------------------------------------------------------------------

CONWAY RESOURCES INC. ("CWY")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 31, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the documentation with respect

to a Non-Brokered Private Placement announced on December 24, 2010:

Number of Shares: 439,167 flow-through common shares

Purchase Price: $0.06 per flow-through common share

Warrants: 439,167 warrants to purchase 439,167 common

shares

Warrants Exercise Price: $0.10 per share for a period of 12 months

following the closing of the Private Placement

Number of Placees: 4

Insider/Pro Group Participation:

Insider=Y /

Name ProGroup=P / Number of Shares

Laurent Beaudoin Y 141,667

The Company has confirmed the closing of the above-mentioned Private

Placement by way of a press release.

RESSOURCES CONWAY INC. ("CWY")

TYPE DE BULLETIN: Placement prive sans l'entremise d'un courtier

DATE DU BULLETIN: Le 31 decembre 2010

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de la documentation en vertu

d'un placement prive sans l'entremise d'un courtier, tel qu'annonce le 24

decembre 2010:

Nombre d'actions: 439 137 actions ordinaires accreditives

Prix: 0,06 $ par action ordinaire

Bons de souscription: 439 137 bons de souscription permettant

d'acquerir 439 137 actions ordinaires

Prix d'exercice des bons: 0,10 $ pendant une periode de 12 mois suivant

la cloture du placement prive

Nombre de souscripteurs: 4

Participation initie / Groupe Pro:

Initie=Y /

Nom GroupePro=P / Nombre d'actions

Laurent Beaudoin Y 141 667

La societe a confirme la cloture du placement prive precite en vertu d'un

communique de presse.

---------------------------------------------------------------------------

CORNERSTONE CAPITAL RESOURCES INC. ("CGP")

BULLETIN TYPE: Halt

BULLETIN DATE: December 31, 2010

TSX Venture Tier 2 Company

Effective at 5:58 a.m. PST, December 31, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to

the provisions of Section 10.9(1) of the Universal Market Integrity Rules.

---------------------------------------------------------------------------

DIGITAL SHELF SPACE CORP. ("DSS")

(formerly Palatine Capital Corp. ("PLN.P"))

BULLETIN TYPE: Qualifying Transaction-Completed/New Symbol, Name Change,

Private Placement, Resume Trading

BULLETIN DATE: December 31, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's Qualifying

Transaction described in its Filing Statement dated November 16, 2010. As a

result, at the opening on Tuesday, January 4, 2011, the Company will no

longer be considered a Capital Pool Company. The Qualifying Transaction

includes the following:

1. Share Purchase Agreement:

Pursuant to a Share Purchase Agreement dated October 29, 2010, the Company

has acquired all of the issued and outstanding shares of Pypeline Health

Inc. ("Pypeline"). Pypeline is a private company in the business of selling

and producing digital and DVD video aimed at the fitness market and also

licenses its ecommerce and video delivery platform to video producers and

other organizations within the health and fitness market. In consideration,

the Company will issue 29,999,416 shares to the shareholders of Pypeline.

2. Name Change:

Pursuant to a resolution passed by shareholders, the Company has changed

its name as follows. There is no consolidation of capital.

Effective at the opening on Tuesday January 4, 2011, the common shares of

Digital Shelf Space Corp. will commence trading on TSX Venture Exchange,

and the common shares of Palatine Capital Corp. will be delisted. The

Company is classified as a 'technology' company.

Capitalization: Unlimited shares with no par value of which

44,185,743 shares are issued and outstanding

Escrow: 20,502,601 shares are subject to escrow

Transfer Agent: Computershare Investor Services Inc.

Trading Symbol: DSS (new)

CUSIP Number: 25400J 10 1 (new)

3. Private Placement:

TSX Venture Exchange has accepted for filing documentation with respect to

a Brokered Private Placement announced October 18, 2010:

Number of Shares: 6,786,327 shares

Purchase Price: $0.15 per share

Number of Placees: 96 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Jeffrey Sharpe Y 166,667

R. Hector Mackay-Dunn Y 166,667

Thomas D. Lamb Y 33,000

4. Resume Trading:

Effective at the opening, Tuesday, January 4, 2011, trading in the shares

of the Company will resume.

Company Contact: Jeffrey Sharpe

Company Address: 214 - 1847 W. Broadway

Vancouver BC V6J 1Y6

Company Phone Number: (604) 736-7977

Company Fax Number: (604)736-7944

Company Email Address: info@digitalshelfspace.com

---------------------------------------------------------------------------

EMERALD BAY ENERGY INC. ("EBY")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 31, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced December 10, 2010:

Number of Shares: 4,300,000 shares

Purchase Price: $0.05 per unit

Warrants: 4,300,000 share purchase warrants to purchase

4,300,000 shares

Warrant Exercise Price: $0.12 for a one year period

Number of Placees: 8 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Units

Michael Rice Y 120,000

Finder's Fee: Brant Securities Limited - $5,000 cash and

100,000 finder's option

- Each finder's option is exercisable at a

price of $0.05 per share for a period of one

year

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

---------------------------------------------------------------------------

FANCAMP EXPLORATION LTD. ("FNC")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: December 31, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Brokered Private Placement announced December 7, 2010:

Number of Shares: 1,080,000 flow-through shares

289,000 non-flow-through shares

Purchase Price: $0.65 per flow-through share

$0.52 per non-flow-through share

Warrants: 684,500 share purchase warrants to purchase

684,500 shares

Warrant Exercise Price: $0.90 for an eighteen (18) month period

Number of Placees: 4 placees

Agents' Fees: $9,187.58 and 16,770 finder's options payable

to Secutor Capital Management Corp.

$11,693.28 and 16,770 finder's options payable

to Industrial Alliance Securities Inc.

$38,778.74 and 62,289 finder's options payable

to Limited Market Dealer Inc.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

---------------------------------------------------------------------------

FIRST LITHIUM RESOURCES INC. ("MCI")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 31, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced December 14, 2010:

Number of Shares: 466,666 flow-through shares

Purchase Price: $0.15 per flow-through share

Warrants: 233,333 share purchase warrants to purchase

233,333 shares

Warrant Exercise Price: $0.25 for a one year period

$0.35 in the second year

Number of Placees: 3 placees

Finders' Fees: $3,000 and 20,000 Broker Warrants payable to

NBCN Inc.

$2,500 and 16,666 Broker Warrants

payable to Union Securities Ltd.

$1,500 and 10,000 Broker Warrants payable to

Raymond James Ltd.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

---------------------------------------------------------------------------

FIRST MEXICAN GOLD CORP. ("FMG")

(formerly Auric Development Corporation ("ARC.P"))

BULLETIN TYPE: Qualifying Transaction-Completed/New Symbol, Property-Asset

or Share Purchase Agreement, Private Placement - Brokered, Short Form

Offering Document-Distribution, Name Change and Consolidation, Reinstated

for Trading

BULLETIN DATE: December 31, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange Inc. (the "Exchange") has accepted for filing First

Mexican Gold Corp.'s (formerly Auric Development Corp (the "Company")

Qualifying Transaction described in its filing statement (the "Filing

Statement") dated December 3, 2010. As a result, effective at the opening

January 4, 2011, the trading symbol for the Company will change from ARC.P

to FMG and the Company will no longer be considered a Capital Pool Company.

The Qualifying Transaction includes the following matters, all of which

have been accepted by the Exchange.

Acquisition of all of the issued and outstanding shares of First Mexican

Resources Inc.:

The Exchange has accepted for filing a share exchange agreement dated

September 22, 2010 entered into by the Company, First Mexican Resources

Inc. ("First Mexican") and the First Mexican securityholders under which

the Company will acquire all of the issued and outstanding shares of First

Mexican, a private company incorporated under the laws of British Columbia,

through which the Company will indirectly acquire an option to earn up to

an 80% interest in one of the Hilda Properties located in Mexico. The Hilda

Properties, comprised of the Hilda 30, Hilda 31/32 and Hilda 37/38

properties are located east of Hermosillo, near the village of Guadalupe,

in the Yecora District, State of Sonora, Mexico.

As consideration for the First Mexican shares, the Company has agreed to

pay the following consideration:

In consideration of the First Mexican securities Auric will:

1. issue one common share for every First Mexican share tendered (being

18,151,140 shares), and

2. up to 6,000,000 special warrants (the "Special Warrants").

Pursuant to the terms and conditions of an Amended and Restated Option

Agreement dated December 10, 2009 between First Mexican and Minera

Internacional Milenio S.A. de C.V. ("MIM"), First Mexican has two options

which, taken together, will permit First Mexican to acquire up to an 80%

undivided interest in and to the Hilda Properties.

First Mexican Option:

Pursuant to the Amended and Restated Option Agreement, by expending the

minimum sum of US$239,808 (incurred) on Expenditures or before August 31,

2010 on the Hilda Properties, First Mexican exercised its option (the

"Initial First Mexican Option") and acquired a 60% undivided interest in

the Hilda 30 Property and a 40% interest in the other Hilda 37/38

properties. Within 30 days of the exercise of the Initial First Mexican

Option, advise MIM whether First Mexican wishes to exercise its option (the

"Second First Mexican Option") to acquire an 80% undivided interest in the

Hilda Properties (completed).

Second First Mexican Option:

Upon exercising the Initial First Mexican Option and giving notice to MIM

that it intends to exercise the Second First Mexican Option, First Mexican

can acquire an 80% undivided interest in and to the Hilda Properties. First

Mexican can exercise the Second First Mexican Option by:

1. expending an aggregate of not less than US$3,000,000 on Expenditures

(the "Second Expenditures") by no later than October 31, 2014 on one or

more of the Hilda Properties as follows:

(a) US$250,000 on the Hilda Properties on or before December 31, 2010;

(b) A further US$600,000 on the Hilda Properties on or before October

31, 2011;

(c) A further US$650,000 on the Hilda Properties on or before October

31,2012;

(d) A further US$700,000 on the Hilda Properties on or before October

31, 2013; and

(e) A further final amount of US$800,000 on or before October 31, 2014;

Any excess Expenditures incurred in one year may be credited against the

Expenditure commitment in the subsequent years;

2. paying an aggregate of US$100,000 (the "Cash Payments") to MIM on or

before October 31, 2013 as follows:

(a) US$10,000 on or before October 31, 2009 (paid);

(b) US$10,000 on or before January 31, 2010 (paid); and

(c) US$20,000 on or before October 31, 2010 (paid), and US$20,000 on or

before every October 31 thereafter until the US$100,000 cash

consideration is paid in full; and

3. issuing a total of 1,400,000 common shares (the "Share Consideration")

in the capital of First Mexican to MIM as follows:

(a) 200,000 common shares on or before October 31, 2009 (issued); and

(b) 150,000 common shares on or before April 30, 2010 (issued) and every

six months thereafter until the 1,400,000 common shares are issued.

Upon the completion of the Second Expenditures on or before October 31,

2014, the payment of the Cash Payments and the issuance of the Share

Consideration on or before October 31, 2013, First Mexican shall have

acquired an 80% interest in the Hilda Properties.

Special Warrants:

The Company shall issue the Special Warrants to the First Mexican

shareholders. The Special Warrants shall be exercisable into the Company's

shares, on the basis of one Company share for each Special Warrant

exercised, upon the Company satisfying the following milestones and by

paying the Company $0.10 per Special Warrant exercised:

-- Up to 1 million Special Warrants A which will convert into the Company's

shares upon the Company achieving 250,000 inferred ounces gold

equivalent on the Hilda 30 Property;

-- Up to A further 1 million Special Warrants B which will convert into the

Company's shares upon the Company achieving 500,000 inferred ounces gold

equivalent on the Hilda 30 Property;

-- Up to A further 1 million Special Warrants C which will convert into the

Company's shares upon the Company achieving 750,000 inferred ounces gold

equivalent on the Hilda 30 Property;

-- Up to A further 1 million Special Warrants D which will convert into the

Company's shares upon the Company achieving 1,000,000 inferred ounces

gold equivalent on the Hilda 30 Property;

-- Up to A further 1 million Special Warrants E which will convert into the

Company's shares upon the Company achieving 1,000,000 inferred ounces

gold equivalent on the Hilda 30 Property and raising additional proceeds

(after completion of the Qualifying Transaction) of no less than

$5,000,000; and

-- Up to 1 million Special Warrants F which will convert into the Company's

shares upon the Company completing a bankable feasibility study on the

Hilda 30 Property

Pursuant to a Finder's Fee Agreement dated January 2, 2010, the Company

will issue a total of 800,000 common shares to Minegate Resources Capital

Group, an arm's length party to the Company as a finder's fee in connection

with the Qualifying Transaction.

The Exchange has been advised that the above transaction has been

completed. The full particulars of the Company's Qualifying Transaction are

set forth in the Filing Statement, which has been accepted for filing by

the Exchange and which is available under the Company's profile on SEDAR.

Private Placement - Non-Brokered:

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced December 3, 2010:

Number of Shares: 1,860,000 shares

Purchase Price: $0.35 per share

Warrants: 1,860,000 share purchase warrants to purchase

1,860,000 shares

Warrant Exercise Price: $0.50 for a 24 month period

Number of Placees: 31 placees

Agent's Fee: Canaccord Genuity Corp. will receive a cash

commission equal to 8% of the value of the

securities sold (except for those units sold

under the President's List for which a cash

commission of 2.5% will be paid). In addition

Canaccord Genuity Corp. will receive broker

Warrants equal to 8% of the number of units

sold (other than those units sold pursuant to

the President's List for which Canaccord

Genuity Corp. shall receive that number of

broker warrants equal to 2.5%). Each broker

warrant will be exercisable for a period of

two years by the holder to acquire one

additional common share for $0.35.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

Short Form Offering Document:

The Company's Short Form Offering Document dated December 12, 2010 was

filed with and accepted by TSX Venture Exchange on December 13, 2010.

TSX Venture Exchange has been advised that closing occurred on December 29,

2010, for gross proceeds of $1,505,000.

Agent: Canaccord Genuity Corp. (the "Agent")

Offering: 4,300,000 Units. Each Unit consisting of one

(1) common share of the Company and one-half

(1/2) of one (1) transferable common share

purchase warrant ("Warrant") of the Company.

Each whole Warrant will entitle the holder to

purchase one (1) additional common share of

the Company at a price of $0.50 per share for

a period of twenty-four (24) months from the

closing of the Offering.

Unit Price: $0.35 per Unit.

Agent's Commission: A commission of 8% of the gross proceeds

raised under offering (other than those Units

sold pursuant to the President's List on which

the Agent received 2.5% cash commission) being

$120,400. The Agent also received an

administration fee in the amount of $10,000.

Agent's Corporate

Finance Fee: $30,000 in cash and 75,000 Units having the

same terms as the Units under the Offering.

Agents' Warrants: 344,000 non-transferable warrants exercisable

to purchase 344,000 common shares of the

Company at $0.35 per share for a period of

twenty-four (24) months from the closing of

the Offering.

Name Change and Consolidation

Pursuant to a resolution passed by shareholders May 10, 2010, the Company

has consolidated its capital on a 1.1376 old for 1 new basis. The name of

the Company has also been changed to First Mexican Gold Corp.

Effective at the opening January 4, 2011, the common shares of First

Mexican Gold Corp. will commence trading on TSX Venture Exchange, and the

common shares of Auric Development Corporation will be delisted.

The Company is classified as a 'Mineral Exploration' company.

Post - Consolidation

Capitalization: Unlimited shares with no par value of which

31,409,927 shares are issued and outstanding

Escrow: 2,620,000 shares are subject to a 36 month

staged release escrow under the CPC escrow

agreement

4,877,142 shares are subject to a 36 month

staged escrow release under a Tier 2 Value

Escrow Agreement

Transfer Agent: Computershare Investor Services Ltd.

Trading Symbol: FMG (new)

CUSIP Number: 32086A 10 7 (new)

Reinstated for Trading:

Effective at the opening January 4, 2011, trading in the shares of the

Company will resume trading.

---------------------------------------------------------------------------

FRONSAC CAPITAL INC. ("GAZ")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: December 31, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the documentation relating to

the acquisition, by way of an amalgamation with a wholly-owned subsidiary

of Fronsac Capital Inc. ("Fronsac"), of all the issued and outstanding

shares of Canadian Prodigy Capital Corporation ("Prodigy"), on the

following basis:

a) A new subsidiary of Fronsac has been be constituted;

b) Prodigy and the new subsidiary of Fronsac have been amalgamated. Each

shareholder of Prodigy received one share of Fronsac for each 2 shares

held in Prodigy;

c) Fronsac issued 2,350,000 shares pursuant to the amalgamation. The

distribution of such shares to the Prodigy's shareholders was made on a

pro-rata basis; and

d) At the time of the merger, Prodigy held approximately $585,000 in cash

and short term asset, net of liabilities.

For further information, please refer to the Company's press releases dated

May 10, May 25 and July 14, 2010.

FRONSAC CAPITAL INC. ("GAZ")

TYPE DE BULLETIN: Convention d'achat de propriete, d'actif ou d'actions

DATE DU BULLETIN: Le 31 decembre 2010

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de documents relativement a

l'acquisition, par voie d'une fusion avec un une filiale en propriete

exclusive de Fronsac capital Inc. ("Fronsac"), de toutes les actions emises

et en circulation de Corporation Canadienne de capital Prodige ("Prodige"),

selon les etapes suivantes:

a) Une nouvelle filiale de Fronsac a ete constituee;

b) Prodige et la nouvelle filiale de Fronsac ont ete fusionnees. Chaque

actionnaire de Prodige a recu une action de Fronsac pour chaque tranche

de deux actions de Prodige;

c) Fronsac a emis 2 350 000 actions en vertu de la fusion. La distribution

de ces actions aux actionnaires de Prodige a ete effectuee au pro rata;

et

d) Lors de la fusion, Prodige detenait approximativement 585 000 $ sous

forme d'especes et d'actifs a court terme, net des passifs.

Pour de plus amples renseignements, veuillez vous referer aux communiques

de presse de la societe dates du 10 mai, 25 mai et 14 juillet 2010.

---------------------------------------------------------------------------

GT CANADA MEDICAL PROPERTIES REAL ESTATE INVESTMENT TRUST

("MOB.UN")("MOB.WT")

(formerly GT Canada Medical Properties Inc. ("MOB"))

BULLETIN TYPE: Plan of Arrangement, Property-Asset or Share Purchase

Agreement, Name Change and Consolidation, Prospectus-Trust Investment Unit

Offering, New Listing - Warrants, Resume Trading

BULLETIN DATE: December 31, 2010

TSX Venture Tier 2 Company

Plan of Arrangement:

Pursuant to a special resolution passed by the shareholders of GT Canada

Medical Properties Inc. ("the Company") at a special meeting held on

November 16, 2010, the Company has completed a plan of arrangement under

Section 192 of the Canada Business Corporations Act. The Plan of

Arrangement was completed on December 24, 2010, and resulted in the Company

being converted into a real estate investment trust ("the Trust"). Pursuant

to the Plan of Arrangement, the shareholders of the Company have exchanged

their common shares for units of the Trust ("Units") on the basis of ten

common shares for one Unit.

Effective at the opening, Tuesday, January 4, 2011, the Units of the Trust

will commence trading in substitution for the currently listed common

shares of the Company, and at the same time the common shares of the

Company will be delisted.

For further information please refer to the Company's Management

Information Circular dated October 19, 2010, and available at

www.sedar.com.

Property-Asset or Share Purchase Agreement:

TSX Venture Exchange has accepted for filing documentation relating to the

acquisition of a portfolio of five medical office buildings, including one

property currently under construction for an aggregate purchase price of

$39,950,000 (subject to adjustments), comprised of (i) the assumption by

the Trust of approximately $16,800,000 in mortgage debt, (ii) the issuance

of $1,325,000 in units (each comprised of one Class B LP Unit of GT Canada

Operating Limited Partnership (I) LP (the "Class B LP Units"), a subsidiary

of the Trust and one-half of a warrant, and (iii) approximately $21,800,000

in cash. Each Class B LP Unit will be exchangeable on a one-for-one basis

for Units of the Trust at any time at the option of the holder. Each

warrant is exercisable into one Trust unit at a price of $2.25 for a period

of 12 months

Insider / Pro Group Participation:

Insider=Y / # of Class B LP

Name ProGroup=P / Units and Warrant

Thornley Holdings Limited Y 250,000 Class B LP Units

(Edward Thornley and Daren Thornley) 125,000 Warrants

2171630 Ontario Inc.

(Douglas Friars) Y 75,000 Class B LP Units

37,500 Warrants

Sudbury Medical Holdings Limited Y(i) 312,500 Class B LP Units

156,250 Warrants

(i) As of closing, Thornley Holdings Limited held a 31% indirect in this

entity. However, the economic benefit of the 312,500 Class B LP Units and

156,250 Warrants registered in the name of Sudbury Medical Holdings Limited

are for E. Azzola, C. Kealy and A. Melanson (and not for Thornley Holdings

Limited or any other insiders of the REIT).

Name Change and Consolidation, Resume Trading:

Pursuant to a special resolution passed by shareholders on November 16,

2010, the Company has consolidated its capital on a 10 old for 1 new basis.

The name of the Company has also been changed as follows.

Effective at the opening, Tuesday, January 4, 2011, the Trust Units of GT

Canada Medical Properties Real Estate Investment Trust will commence

trading on TSX Venture Exchange, and the common shares of GT Canada Medical

Properties Inc. will be delisted. The Company is classified as a "Real

Estate Investment Trust".

Post - Consolidation

Capitalization Arrangement: Unlimited trust units with no par value of

which 14,858,350 trust units are issued and

outstanding

Escrow: 417,287 trust units

Transfer Agent: Computershare Investor Services Inc.

Trading Symbol: MOB.UN (new)

CUSIP Number: 36190R 104 (new)

Prospectus-Trust Investment Unit Offering:

Effective December 20, 2010, the Issuer's Prospectus dated December 17,

2010 was filed with and accepted by TSX Venture Exchange, and filed with

and receipted by the British Columbia, Alberta, Saskatchewan, Manitoba,

Ontario, New Brunswick, Nova Scotia, Prince Edward Island, Newfoundland and

Labrador, Northwest Territories, Yukon and Nunavut Securities Commissions,

pursuant to the provisions of the British Columbia, Alberta, Saskatchewan,

Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island,

Newfoundland and Labrador, Northwest Territories, Yukon and Nunavut

Securities Acts.

TSX Venture Exchange has been advised that closing occurred on December 24,

2010, for gross proceeds of CDN$25,550,000.

Agents: Raymond James Ltd., Dundee Securities

Corporation, Desjardins Securities

Corporation, HSBC Securities (Canada) Inc.

and M Partners Inc.

Offering: 12,775,000 Investment Units

Trust Investment Unit Price: $2.00 per Investment Unit. Each Investment

Unit is comprised of one Unit and one-half

Unit purchase warrant. Each whole warrant

entitles the holder to acquire one Unit at

$2.25 until December 24, 2012.

Agent's Commission: 6.0% of the gross proceeds raised, payable in

cash.

Over-Allotment Option: To purchase up to an additional 15% of the

Investment Units sold pursuant to the

offering, exercisable at any time, in whole or

in part, for a period of 30 days following the

closing date.

For further information, please refer to the Issuer's Prospectus dated

December 17, 2010.

New Listing - Warrants:

Effective at the opening January 4, 2011, the warrants of the Trust will

commence trading on TSX Venture Exchange. The Company is classified as a

"real estate investment trust".

Jurisdiction: Ontario

Capitalization: Unlimited number of warrants with no par value

of which 6,718,750 warrants are issued and

outstanding

Transfer Agent: Computershare Investor Services Inc.

Trading Symbol: MOB.WT (new)

CUSIP Number: 36190R 112 (new)

The warrants were issued pursuant to the Prospectus Offering and to certain

vendors in connection with the acquisition described above. Each whole

warrant entitles the holder to acquire one Unit at a price of $2.25 until

Monday, December 24, 2012.

---------------------------------------------------------------------------

GENOIL INC. ("GNO")

BULLETIN TYPE: Property-Asset or Share Disposition Agreement

BULLETIN DATE: December 31, 2010

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation pursuant to a

Share Purchase Agreement dated November 25, 2010 (the "Agreement"). As per

the terms of the Agreement, the Company will acquire 100% interest in Two

Hills Environmental Inc. (the "Vendor"). In consideration the Company will

pay $100,000 cash, issue 2,500,000 common shares at a price of $0.295 per

share and 250,000 share purchase warrants. Each warrant is exercisable at a

price of $0.295 per share until November 17, 2013. In addition, the Company

will issue 250,000 common shares at a price of $0.295 per share to a debtor

and litigant of Two Hills to satisfy that party.

---------------------------------------------------------------------------

GOWEST AMALGAMATED RESOURCES LTD. ("GWA")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: December 31, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Brokered Private Placement announced November 30, 2010:

Number of Shares: 9,379,837 flow-through shares

Purchase Price: $0.275 per share

Number of Placees: 35 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Fraser Elliot Y 182,000

Janet O'Donnell Y 40,000

Darren Koningen Y 364,000

Dennys Van Fleet P 200,000

Mark Wayne P 250,000

Timothy Churchhill-Smith P 73,000

Matthew MacIsaac P 727,500

Tom English P 364,000

Gordon Love P 90,909

David Elliot P 140,000

Andrew Williams P 110,500

Agent's Fee: Salman Partners Inc. - $154,259.62 cash

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

---------------------------------------------------------------------------

HALO RESOURCES LTD. ("HLO")

BULLETIN TYPE: Private Placement-Non-Brokered, Brokered

BULLETIN DATE: December 31, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Brokered and Non-Brokered Private Placement announced December 8, 2010:

Number of Shares: 2,745,000 shares (Non-Brokered)

2,600,000 shares (Brokered)

3,655,000 shares

Purchase Price: $0.50 per share

Warrants: 1,372,500 share purchase warrants to purchase

1,372,500 shares (Non-Brokered)

1,300,000 share purchase warrants to purchase

1,300,000 shares (Brokered)

1,827.500 share purchase warrants to purchase

1,827,500 shares

Warrant Exercise Price: $0.60 for a two year period

Number of Placees: 29 placees (Non-Brokered)

3 placees (Brokered)

1 placee

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Pinetree Resource Partnership Y 1,000,000

William Lee Y 10,000

Jason Gold P 12,000

Derek Cathcart Y 25,000

Douglas Eickmeier P 100,000

Harvey Lim Y 9,500

075331 B.C. Ltd. (Marc Cernovitch) Y 20,000

Gary Ostry Y 8,000

Lynda Bloom Y 20,000

Tom Healy Y 20,000

RBC Global Asset Management

As Manager & Trustee for

RBC Global Precious Metals Fund Y 2,000,000

HudBay Minerals Inc. Y 3,655,000

Finders' Fees: All Group Financial Services Inc. - $17,000 -

25,000 Finder's Warrants that are exercisable

into units at $0.60 per share to December 23,

2012 with the same terms as the offering

Union Securities Ltd. - $420 and 1,200

Finder's Warrants that are exercisable into

units at $0.60 per share to December 23, 2012

with the same terms as the offering

First Canadian Capital Corp. - $10,150 and

29,000 Finder's Warrants that are exercisable

into units at $0.60 per share to December 23,

2012 with the same terms as the offering

CIBC World Markets - $3,500 and 10,000

Finder's Warrants that are exercisable into

units at $0.60 per share to December 23, 2012

with the same terms as the offering

PowerOne Capital Markets - $35,000 and 100,000

Finder's Warrants that are exercisable into

units at $0.60 per share to December 23, 2012

with the same terms as the offering

Loewen, Ondaatje, McCutcheon Limited - $70,000

and 200,000 Broker Warrants that are

exercisable into units at $0.60 to December

23, 2012 with the same terms as the offering.

D&D Securities Inc. - $21,000 and 60,000

Broker Warrants that are exercisable into

units at $0.60 to December 23, 2012 with the

same terms as the offering.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly. Note

that in certain circumstances the Exchange may later extend the expiry date

of the warrants, if they are less than the maximum permitted term.

---------------------------------------------------------------------------

HOUSTON LAKE MINING INC. ("HLM")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 31, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced December 16, 2010:

Number of Shares: 3,125,000 flow-through shares

Purchase Price: $0.16 per unit

Warrants: 1,562,500 share purchase warrants to purchase

1,562,500 common shares

Warrant Exercise Price: $0.25 for a period of two years

Number of Placees: 1 placee

No Insider / Pro Group Participation

Finder's Fee: Limited Market Dealer Inc. - $40,000 cash and

250,000 finder's warrants

- Each finder warrant is exercisable at a

price of $0.16 for a period of two years

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

---------------------------------------------------------------------------

HULDRA SILVER INC. ("HDA")

BULLETIN TYPE: Private Placement-Non-Brokered, Amendment

BULLETIN DATE: December 31, 2010

TSX Venture Tier 2 Company

Further to the bulletin dated December 29, 2010 with respect to a private

placement of 1,799,000 units at a price of $0.52 per unit, TSX Venture

Exchange has been advised that Brant Securities Inc. will not be receiving

a finder's fee under this private placement. Union Securities will receive

a finder's fee of $6,864 and 13,200 warrants that are exercisable into

common shares at $0.75 per share for an 18-month period.

---------------------------------------------------------------------------

HULDRA SILVER INC. ("HDA")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 31, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement disclosed December 22, 2010:

Number of Shares: 1,625,000 shares

Purchase Price: $0.60 per share

Warrants: 1,625,000 share purchase warrants to purchase

1,625,000 shares

Warrant Exercise Price: $0.75 for a two year period

Number of Placees: 3 placees

Finder's Fee: Brant Securities Ltd. will receive a finder's

fee of $36,000 and 60,000 warrants that are

exercisable into common shares at $0.75 per

share for an 18 month period.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly. Note

that in certain circumstances the Exchange may later extend the expiry date

of the warrants, if they are less than the maximum permitted term.

---------------------------------------------------------------------------

INTEGRA GOLD CORP. ("ICG")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 31, 2010

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced December 23, 2010 and December

31, 2010:

Number of Shares: 512,000 flow-through shares

3,338,000 non flow-through shares

Purchase Price: $0.50 per flow-through share

$0.45 per non-flow-through share

Warrants: 1,925,000 share purchase warrants to purchase

1,925,000 shares

Warrant Exercise Price: $0.70 for a one year period

$0.80 in the second year

Number of Placees: 16 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Munday Homes Sales Ltd. Y 2,168,000 nf/t

Munday Estates Ltd. Y 400,000 nf/t

Gaylene Munday Y 400,000 nf/t

John de Jong Y 40,000 f/t

Diana Mark Y 10,000 f/t

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly. Note

that in certain circumstances the Exchange may later extend the expiry date

of the warrants, if they are less than the maximum permitted term.

---------------------------------------------------------------------------

J.A.G. LTEE (LES MINES) ("JML")

BULLETIN TYPE: Warrant Term Extension

BULLETIN DATE: December 31, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the documentation to extend

the expiry date of the following Warrants:

Number of Warrants: 1,080,000

Original Expiry

Date of Warrants: December 31, 2009, subsequently extended to

December 31, 2010

New Expiry Date of Warrants: December 31, 2011

Exercise Price of Warrants: $0.30

These Warrants were issued pursuant to a Private Placement including a

total of 2,160,000 shares and 1,080,000 Warrants, which was accepted for

filing by TSX Venture Exchange effective on January 7, 2009.

LES MINES J.A.G. LTEE ("JML")

TYPE DE BULLETIN: Prolongation des bons de souscription

DATE DU BULLETIN: Le 31 decembre 2010

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte les documents deposes aux fins de

prolongation de la date d'echeance des bons de souscription (les " bons ")

suivants:

Nombre de bons: 1 080 000

Date initiale

d'echeance des bons: Le 31 decembre 2009, subsequemment

prolongee jusqu'au 31 decembre 2010 Nouvelle

date d'echeance des bons : Le 31 decembre 2011

Prix d'exercice des bons: 0,30 $

Ces bons ont ete emis en vertu d'un placement prive comprenant 2 160 000

actions et 1 080 000 bons de souscription, tel qu'accepte par Bourse de

croissance TSX le 7 janvier 2009.

---------------------------------------------------------------------------

LEISURE CANADA INC. ("LCN")

BULLETIN TYPE: Warrant Term Extension

BULLETIN DATE: December 31, 2010

TSX Venture Tier 1 Company

TSX Venture Exchange has consented to the extension in the expiry date of

the following warrants:

Private Placement:

# of Warrants: 45,561,268

Original Expiry

Date of Warrants: December 31, 2010

New Expiry Date of Warrants: June 30, 2011

Exercise Price of Warrants: $0.25

These warrants were issued pursuant to a private placement of 91,122,535

shares with 45,561,268 share purchase warrants attached, which was accepted

for filing by the Exchange effective September 10, 2009.

TSX Venture Exchange has consented to the extension in the expiry date of

the following warrants:

Private Placement:

# of Warrants: 1,342,500

Original Expiry

Date of Warrants: December 31, 2010

New Expiry Date of Warrants: June 30, 2011

Exercise Price of Warrants: $0.25

These warrants were issued pursuant to a private placement of 2,685,000

shares with 1,342,500 share purchase warrants attached, which was accepted

for filing by the Exchange effective July 27, 2009.

---------------------------------------------------------------------------

MINATI CAPITAL CORP. ("MNN.P")

BULLETIN TYPE: Suspend-Failure to Complete a Qualifying Transaction within

the Prescribed Time

BULLETIN DATE: December 31, 2010

TSX Venture Tier 2 Company

Further to the TSX Venture Exchange Bulletin dated December 1, 2010,

effective at the opening Tuesday, January 4, 2011, trading in the shares of

the Company will be suspended, the Company having failed to complete a

Qualifying Transaction within the prescribed time.

Members are prohibited from trading in the securities of the Company during

the period of the suspension or until further notice.

---------------------------------------------------------------------------

NORTHERN TIGER RESOURCES INC. ("NTR")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 31, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced December 15, 2010:

Number of Shares: 5,202,500 Class A common shares

4,493,500 flow-through shares

Purchase Price: $0.35 per unit

$0.40 per flow-through share

Warrants: 2,601,250 share purchase warrants to purchase

2,601,250 Class A common shares

Warrant Exercise Price: $0.45 for a period of two years

Number of Placees: 67 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Thomas Relling P 212,500

Bernard Leroux P 300,000

Sara Relling P 87,500

David Lyall P 150,000

Marc Leroux P 50,000

Sheri Weichel P 50,000

Brad Mercer P 20,000

Thomas Relling P 125,000 FT

Robert Disbrow P 250,000 FT

Topiary Holdings P 250,000 FT

Kevin Campbell P 62,500 FT

Kevin Gould P 125,000 FT

John Frome P 100,000 FT

Brad Mercer Y 20,000 FT

Greg Hayes Y 35,000 FT

Finders' Fees: Casmir Capital LP - $114,102 cash and 307,755

agent's options

Haywood Securities Inc. - $64,750 cash and

170,625 agent's options Odlum Brown Limited -

$1,593 cash and 4,550 agent's options

National Bank Financial - $6,300 cash and

15,750 agent's options

Canaccord Genuity Corp. - $18,165 cash and

46,900 agent's options

Leob Aron & Company Ltd. - $4,214 cash and

12,040 agent's options

Mackie Research Capital Corporation - $2,450

cash and 7,000 agent's options

- Each agent option is exercisable at a price

of $0.45 per share for a period of two years.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

---------------------------------------------------------------------------

NOVUS ENERGY INC. ("NVS")

BULLETIN TYPE: Company Tier Reclassification

BULLETIN DATE: December 31, 2010

TSX Venture Tier 2 Company

In accordance with Policy 2.5, the Company has met the requirements for a

Tier 1 company. Therefore, effective January 4, 2011, the Company's Tier

classification will change from Tier 2 to:

Classification

Tier 1

---------------------------------------------------------------------------

PACGEN BIOPHARMACEUTICALS CORPORATION ("PGA")

BULLETIN TYPE: Shares for Debt

BULLETIN DATE: December 31, 2010

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 149,125 shares to settle outstanding debt for $15,236.

Number of Creditors: 3 Creditors

Insider / Pro Group Participation: N/A

Insider=Y / Amount Deemed Price

Creditor Progroup=P / Owing per Share # of Shares

Dr. Lewis Choi Y $2,625 $0.10 26,250

The Company shall issue a news release when the shares are issued and the

debt extinguished.

---------------------------------------------------------------------------

PACIFIC SAFETY PRODUCTS INC. ("PSP")

BULLETIN TYPE: Halt

BULLETIN DATE: December 31, 2010

TSX Venture Tier 1 Company

Effective at 5:58 a.m. PST, December 31, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to

the provisions of Section 10.9(1) of the Universal Market Integrity Rules.

---------------------------------------------------------------------------

PACIFIC SAFETY PRODUCTS INC. ("PSP")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: December 31, 2010

TSX Venture Tier 1 Company

Effective at 10:30 a.m., PST, December 31, 2010, shares of the Company

resumed trading, an announcement having been made over StockWatch.

---------------------------------------------------------------------------

PRODIGY GOLD INC. ("PDG")

(formerly Kodiak Exploration Limited ("KXL"))

BULLETIN TYPE: Name Change

BULLETIN DATE: December 31, 2010

TSX Venture Tier 2 Company

Pursuant to a resolution passed by Directors, the Company has changed its

name as follows. There is no consolidation of capital.

Effective at the opening Tuesday, January 4, 2011, the common shares of

Prodigy Gold Inc. will commence trading on TSX Venture Exchange, and the

common shares of Kodiak Exploration Limited will be delisted. The Company

is classified as a 'Junior Natural Resource Mining' company.

Capitalization: Unlimited shares with no par value of which

166,024,357 shares are issued and outstanding

Escrow: 0 shares

Transfer Agent: Computershare Trust Company of Canada

Trading Symbol: PDG (new)

CUSIP Number: 74283A 10 0 (new)

---------------------------------------------------------------------------

REALM ENERGY INTERNATIONAL CORPORATION ("RLM")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 31, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced November 22, 2010:

Number of Shares: 20,000,000 shares

Purchase Price: $0.75 per share

Warrants: 20,000,000 share purchase warrants to purchase

20,000,000 shares

Warrant Exercise Price: $1.00 for a two year period

Number of Placees: 22 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Quantum Partners LP Y 1,600,000

Ivano Veschini P 200,000

Robert Sali P 500,000

Tom English P 100,000

Mohan Nair P 33,333

Finders' Fees: $439,350 and 400,000 Units payable to

Peninsula Merchant Syndications Corp. (Sameh

Magid).

176,333 Units payable to BMO Nesbitt Burns

Inc.

200,000 Units payable to Canaccord Genuity

Corp.

200,000 Units payable to Paradigm Capital Inc.

- Each Unit consists of one share and one

share purchase warrant with the same terms as

the Private Placement.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

(Note that in certain circumstances the Exchange may later extend the

expiry date of the warrants, if they are less than the maximum permitted

term.)

---------------------------------------------------------------------------

URACAN RESOURCES LTD. ("URC")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: December 31, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Brokered Private Placement announced December 16, 2010:

Number of Shares: 11,571,634 flow-through shares

11,024,000 non-flow-through shares

Purchase Price: $0.30 per flow-through share

$0.25 per non-flow-through shares

Warrants: 16,809,817 share purchase warrants to purchase

16,809,817 shares

Warrant Exercise Price: $0.40 for a two year period

Number of Placees: 36 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Tom Garagan Y 25,000 NFT

Clive Johnson Y 1,000,000 NFT

Gordon Keep Y 330,000 NFT

Gregg Sedun Y 500,000 NFT

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

---------------------------------------------------------------------------

WPC RESOURCES INC. ("WPQ")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 31, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced December 17, 2010:

Number of Shares: 3,000,000 shares

Purchase Price: $0.155 per share

Warrants: 3,000,000 share purchase warrants to purchase

3,000,000 shares

Warrant Exercise Price: $0.25 for a one year period

$0.30 in the second year

Number of Placees: 2 placees

Finder's Fee: $23,250 finder's fee plus $13,950 due

diligence fee payable to Limited Market Dealer

Inc.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

---------------------------------------------------------------------------

YORKTON VENTURES INC. ("YVI.P")

BULLETIN TYPE: New Listing-CPC-Shares, Resume Trading

BULLETIN DATE: December 31, 2010

TSX Venture Tier 2 Company

Further to the bulletin dated December 24, 2010, effective at the opening,

January 4, 2011, trading in the shares of the Company will resume.

---------------------------------------------------------------------------

NEX COMPANIES:

NET SOFT SYSTEMS INC. ("NSS.H")

BULLETIN TYPE: Shares for Debt, Correction

BULLETIN DATE: December 31, 2010

NEX Company

Further to TSX Venture Exchange Bulletin dated December 23, 2010, the

Bulletin should have read in part as follows:

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 21,258,892 shares to settle outstanding debt for $1,062,944.60.

The rest of the bulletin remains unchanged.

---------------------------------------------------------------------------

VALPARAISO ENERGY INC. ("VPO.H")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 31, 2010

NEX Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced March 15, 2010

Number of Shares: 4,703,333 shares

Purchase Price: $0.06 per share

Warrants: 2,351,167 share purchase warrants to purchase

2,351,667 shares

Warrant Exercise Price: $0.10 for a one year period

Number of Placees: 14 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Milton Erickson Y 740,000

Norman Mackenzie Y 710,000

William J. Wylie Y 83,333

285876 Alberta Ltd.

(Kathleen Mackenzie) Y 500,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

---------------------------------------------------------------------------

ZUNI HOLDINGS INC. ("ZNI.H")

BULLETIN TYPE: Halt

BULLETIN DATE: December 31, 2010

NEX Company

Effective at 5:58 a.m. PST, December 31, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to

the provisions of Section 10.9(1) of the Universal Market Integrity Rules.

---------------------------------------------------------------------------

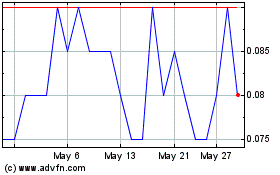

Minnova (TSXV:MCI)

Historical Stock Chart

From Apr 2024 to May 2024

Minnova (TSXV:MCI)

Historical Stock Chart

From May 2023 to May 2024