NowVertical Group Inc. (

TSX-V: NOW)

(

OTCQB: NOWVF) (“

NOW” or the

“

Company”), a leading data analytics and AI

solutions company, today announced audited financial results for

its fourth fiscal quarter ended December 31, 2023. All figures are

in U.S. dollars unless otherwise stated.

“Our operating model is evolving to better align

with our strategic vision, driven by the integration of our

business units. By consolidating formerly distinct businesses into

a cohesive global framework, we are enhancing our solutions and

services, streamlining resources and costs, and leveraging modern

data and AI technologies. This strategic consolidation empowers us

to deliver enhanced value propositions to our key accounts,

collaborating closely with them to achieve tangible business

outcomes and expand sales,” stated Sandeep Mendiratta, Chief

Executive Officer.

Select results for the three months

ended December 31, 2023:

- Revenue was $10.1

million in the three months ended December 31, 2023, an increase of

20% over $8.4 million in the three months ended December 31, 2022.

See year end adjustments below.

- Gross

Profit was $6.3 million or 59% in the three months ended

December 31, 2023, an increase of 75% over $3.6 million or 43% in

the three months ended December 31, 2022.

- Loss

from operations was $0.5 million in the three months ended

December 31, 2023, an increase of 77% over $2.2 million in the

three months ended December 31, 2022.

- Net

loss was $3.6 million in the three months ended December

31, 2023, consistent with a loss of $3.6 million in the three

months ended December 31, 2022.

-

Adjusted EBITDA1 was $0.8 million

in the three months ended December 31, 2023, and increase of 358%

over a $0.3 million loss in the three months ended December 31,

2022.

Select results for the year ended

December 31, 2023:

- Revenue was $51.7

million in the year ended December 31, 2023, an increase of 91%

over $27.7 million in the year ended December 31, 2022. See year

end adjustments below.

- Gross Profit was

$26.7 million in the year ended December 31, 2023, an increase of

130% over $11.6 million in the year ended December 31, 2022.

- Loss from

operations was $0.07 million in the year ended December

31, 2023, an increase of 99% over $7.9 million in the year ended

December 31, 2022.

- Net loss was $5.9

million in the year ended December 31, 2023, an increase of 38%

over $9.5 million in the year ended December 31, 2022.

- Adjusted

EBITDA1 was $5.4 million in the year

ended December 31, 2023, an increase of 378% over a $1.9 million

loss in the year ended December 31, 2022.

________________________1 See NON-IFRS MEASURES at the end

of release

Q4 2023 year end adjustments:

- In Q4 2023 management reviewed its

license reseller arrangements and determined that the Company is an

agent under the current contract arrangements resulting in an

accounting change from gross to net revenue and coupled with a

reversal of deferred revenue and deferred costs. This resulted in a

reallocation of $5.9 million in revenue. Prior to the cost of

revenue reallocation, revenue for the year ended December 31, 2023,

would have been $57.7 million.

- There was a significant devaluation

of the Argentine peso in Q4 2023, resulting in an extraordinary

non-cash accounting impact on the Company’s Argentine subsidiary’s

2023 fourth quarter financial results. If the December 31, 2023,

exchange rate is applied to each quarter proforma, the Company’s

revenue during the three months ended December 31, 2023, would have

been $14.6 million and $62.1 million for the year ended December

31, 2023.

Q4 2023 Business

Highlights:

-

Tier one banking relationships resulted in securing non-dilutive

funding, which was transformational for the business, giving us a

solid footprint in the UK and LATAM (Brazil) and allowing NOW to

deliver projects with an attractive cost base.

- On November

21, 2023, NOW announced new contract wins in its Consumer Goods

vertical, expanding its client roster in the pharmaceutical

industry. This includes collaborations with Takeda Pharmaceutical

and Novo Nordisk in BI, Data Engineering, and data integration to

enhance analytics capabilities and drive innovation. NOW emphasized

its commitment to providing tailored solutions for clients,

combining technology and industry expertise to transform data into

a strategic asset for future AI implementations.

- On December

5, 2023, the Company announced significant contract expansions and

operations in the United Arab Emirates (UAE), establishing a

regional strategic footprint. The expansion showcased successful

collaborations in Consumer Goods, Professional Services, Financial

Services, Industrials, and Government Verticals.

- On December

12, 2023, NOW announced strategic expansions in Peru and Mexico,

along with a new contract with McDonald's LATAM, capitalizing on

the Latin America big data analytics market's projected growth,

reaching over US$12 billion by 2028 and the artificial intelligence

market's anticipated annual growth rate of 18.44%, resulting in a

market size of over US$19 billion by 2030. The Company’s expansion

included collaborating with Google in Peru for predictive analytics

projects with RIMAC Seguros y Reaseguros, strategic consulting in

data governance with DMX in Mexico, and a contract with Arcos

Dorados (McDonald's LATAM) across Latin America.

2024 Business Highlights:

- On January 8,

2024, the Company announced the strategic appointment of directors

David Charron and Chris Ford to the board of directors of the

Company, bringing expertise in capital markets, financial

governance, and technology transformation.

- On January

15, 2024, the Company announced a strategic reorganization,

appointing Sandeep Mendiratta as CEO to fast-track global asset

integration and drive the Company's next growth phase.

- On January

23, 2024, NOW announced successful contract acquisitions totalling

approximately $1.5 million US with key government departments in

Brazil through its A10 subsidiary, showcasing its commitment to

delivering cutting-edge data and analytics solutions to enhance

government functions.

- Effective

February 1, 2024, Christine Nelson assumed the role of Interim

Chief Financial Officer, succeeding Alim Virani. The changes

aligned with NOW’s commitment to a more mature and integrated

operating model, enhancing leadership to pursue growth strategies

and reinforce M&A execution.

- On March 5,

2024, the Company announced a $1.5 million 3-year technology

renewal sale with a long-standing major financial services customer

in South Africa.

- On April 23,

2024, the Company announced a strategic restructure of the

Acrotrend Solutions Limited obligations which aligned the earn-out

compensation payable tied to the overall success of the NOW

business.

Business Outlook

The Company works with private and public sector

clients of all sizes, including some of the world’s largest

corporations. While 70%* of CEOs recognize AI deployment

within their organization as a critical competitive advantage for

the future, 68% also report being stymied by uncertainty around

this space, which makes it challenging to act quickly,

necessitating strong partnerships between large enterprises and

global solution providers like NOW.

The Company's core markets are growing, offering

an estimated $8.6 billion potential in LATAM and $146.4 billion in

NA, UK, and ME for data analytics alone. The projected compound

annual growth rate is estimated at 35.5% globally between 2024 and

2030. Throughout the first quarter of 2024, the Company has

undergone a significant operational realignment. We have

consolidated our operations into two primary markets: Latin America

('LATAM'), North America, UK, Europe, the Middle East and Asia (“NA

& EMEA”). This strategic shift is about consolidation and

establishing a dedicated platform for strategic account growth.

This move is designed to optimize our product units for organic

growth and profitability, demonstrating our commitment to reaching

near-term profitability and expanding our offerings to key

enterprise clientele.

NOW’s strategic direction for 2024 and beyond

involves deepening its connections with key accounts in the NA

& EMEA, and LATAM regions. Through the integration of its

top-tier solutions and services from various business units, the

Company aims to develop highly compelling offerings tailored to the

needs of its strategic partners. With more than 90 strategic

accounts spanning these regions, NOW is actively refining its

approach to delivering value-added solutions and services to each.

This entails a restructuring of its teams to foster a culture of

account-centricity, prioritizing a deep understanding of clients'

challenges and objectives. By doing so, NOW can offer

contextualized solutions and services that directly align with

their business objectives.

________________________* Source: Ernst and Young

Global,

https://www.ey.com/en_gl/newsroom/2023/10/ceos-bet-big-on-generative-ai-to-gain-competitive-edge-despite-hurdles-to-adoption-and-m-and-a-challenges

Investor Webinar

NOW management will hold a quarterly broadcast to discuss Q4

2023 results at 9:30 am ET, Wednesday, May 8, 2024. Participants

will include Sandeep Mendiratta, Chief Executive Officer; Christine

Nelson, Interim Chief Financial Officer; and Andre Garber, Chief

Development Officer. A question-and-answer session will follow.

Investor Conference Call

Registration

Register to watch the webinar here:

bit.ly/NOW-Q4-2023-Webinar

Following the call, a recording of the webinar

and supporting materials will be available on the investor’s

section of the Company’s website at

https://nowvertical.com/news-and-media.

About NowVertical Group

Inc.

The Company is a data analytics and AI solutions

company offering comprehensive solutions, software and services. As

a global provider, we deliver cutting-edge data, technology, and

artificial intelligence (AI) applications to private and public

enterprises. Our solutions form the bedrock of modern enterprises,

converting data investments into business solutions. NOW is growing

organically and through strategic acquisitions. For further details

about NOW, please visit www.nowvertical.com.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

For further information, please contact:

Andre Garber, Chief Development Officer:IR@nowvertical.com

Glen Nelson, Investor Relations and Communications:

glen.nelson@nowvertical.com t: (403) 763-9797

NON-IFRS MEASURES

The non-IFRS financial measures referred to in

this news release are defined below. The management’s discussion

and analysis for the three months and year ended December 31, 2023,

which will be available on the Company’s SEDAR+ profile, also

contains supporting calculations.

“EBITDA” adjusts net income

(loss) before depreciation and amortization expenses, net interest

costs, and provision for income taxes.

"Adjusted EBITDA” adjusts

EBITDA for acquisition accounting revenue adjustments in “Adjusted

Revenue” and items such as acquisition accounting adjustments,

transaction expenses related to acquisitions, transactional gains

or losses on assets, asset impairment charges, non-recurring

expense items, non-cash stock compensation costs, foreign exchange

gains and losses and the full-year impact of cost synergies related

to the reduction of employees.

Cautionary Note Regarding Non-IFRS

Measures

This news release refers to certain non-IFRS

measures. These measures are not recognized under IFRS, do not have

a standardized meaning prescribed by IFRS, and are, therefore,

unlikely to be comparable to similar measures presented by other

companies. Rather, these measures are provided as additional

information to complement those IFRS measures by providing further

understanding of the Company’s results of operations from

management’s perspective. The Company’s definitions of non-IFRS

measures used in this news release may not be the same as the

definitions for such measures used by other companies in their

reporting. Non-IFRS measures have limitations as analytical tools

and should not be considered in isolation nor as a substitute for

analysis of the Company’s financial information reported under

IFRS. The Company uses non-IFRS financial measures, including

“EBITDA” and “Adjusted EBITDA”. These non-IFRS measures provide

investors with supplemental measures of our operating performance

and eliminate items that have less bearing on our operational

performance or operating conditions and thus highlight trends in

our core business that may not otherwise be apparent when relying

solely on IFRS measures. The Company believes that securities

analysts, investors and other interested parties frequently use

non-IFRS financial measures in the evaluation of issuers. The

Company’s management also uses non-IFRS financial measures to

facilitate operating performance comparisons from period to period

and to prepare annual budgets and forecasts.

Forward‐Looking Statements

This news release contains forward-looking

information and forward-looking statements within the meaning of

applicable Canadian securities laws (together “forward-looking

statements”), including, without limitation regarding the benefits

to be derived from the Company’s efforts, the results of the

restructuring, the alignment of management and the business unit

leaders, and timing of certain payments by the Company.

Forward-looking statements are necessarily based upon a number of

estimates and assumptions that, while considered reasonable by

management, are inherently subject to significant business,

economic and competitive uncertainties, and contingencies.

Investors are cautioned that forward-looking statements are not

based on historical facts but instead reflect the Company’s

expectations, estimates or projections concerning future results or

events based on the opinions, assumptions and estimates of

management considered reasonable at the date the statements are

made. Forward-looking statements generally can be identified by the

use of forward-looking words such as “may”, “should”, “will”,

“could”, “intend”, “estimate”, “plan”, “anticipate”, “expect”,

“believe” or “continue”, or the negative thereof or similar

variations. Forward-looking statements involve known and unknown

risks, uncertainties and other factors that may cause future

results, performance, or achievements to be materially different

from the estimated future results, performance or achievements

expressed or implied by the forward-looking statements and the

forward-looking statements are not guarantees of future

performance. Although the Company believes that the expectations

reflected in such forward-looking statements are reasonable, such

statements involve risks and uncertainties, and undue reliance

should not be placed thereon, as unknown or unpredictable factors

could have material adverse effects on future results, performance

or achievements of the Company. Among the key factors that could

cause actual results to differ materially from those projected in

the forward-looking statements are the following: timing and

receipt of regulatory approvals, adverse market conditions; risks

inherent in the data analytics and artificial intelligence sectors

in general; regulatory and legislative changes; that future results

may vary from historical results; inability to obtain any requisite

future financing on suitable terms; any inability to realize the

expected benefits and synergies of acquisitions; that market

competition may affect the business, results and financial

condition of the Company and other risk factors identified in

documents filed by the Company under its profile at

www.sedarplus.com, including the Company’s managements’ discussion

and analysis for the year ended December 31, 2023 dated May 6, 2024

and the prospectus supplement (including all documents incorporated

by reference therein) dated February 22, 2023. Should one or more

of these risks or uncertainties materialize, or should assumptions

underlying the forward-looking statements prove incorrect, actual

results may vary materially from those described herein as

intended, planned, anticipated, believed, estimated or expected.

Although the Company has attempted to identify important risks,

uncertainties and factors which could cause actual results to

differ materially, there may be others that cause results not to be

as anticipated, estimated or intended and such changes could be

material. All of the forward-looking statement contained in this

press release are qualified by the foregoing cautionary statements,

and there can be no guarantee that the results or developments that

we anticipate will be realized or, even if substantially realized,

that they will have the expected consequences or effects on our

business, financial condition or results of operation. Unless

otherwise noted or the context otherwise indicates, the

forward-looking statements contained herein are provided as of the

date hereof, and the Company does not intend, and does not assume

any obligation, to update the forward-looking statements except as

otherwise required by applicable law. Investors are cautioned that,

trading in the securities of the Company should be considered

highly speculative.

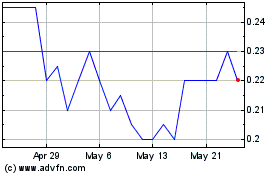

NowVertical (TSXV:NOW)

Historical Stock Chart

From Nov 2024 to Dec 2024

NowVertical (TSXV:NOW)

Historical Stock Chart

From Dec 2023 to Dec 2024