New Zealand Energy Announces First Quarter Results and Operational

Update

VANCOUVER, BRITISH COLUMBIA--(Marketwired - May 30, 2014) - New

Zealand Energy Corp. ("NZEC" or the "Company")

(TSX-VENTURE:NZ)(OTCQX:NZERF) has released the results of its first

quarter ended March 31, 2014. Details of the Company's financial

results are described in the Unaudited Consolidated Interim

Financial Statements and Management's Discussion and Analysis

which, together with further details on the Company's operational

activities, are available on the Company's website at

www.newzealandenergy.com and on SEDAR at www.sedar.com. All amounts

are in Canadian dollars unless otherwise stated.

HIGHLIGHTS

- 19,682 barrels of oil produced and 17,630 barrels of oil sold

during Q1-2014 (Q1-2013: 30,179 and 27,246, respectively)

- Average corporate production during Q1-2014: 219 barrels/day

(net to NZEC)

- Average field netback during Q1-2014 of $62.33 per barrel

(Q1-2013: $45.29 per barrel)

- Total oil sales recorded during Q1-2014 of $2,100,545 (Q1-2013:

$3,061,064), with an additional $362,459 of third-party revenue

(net to NZEC) earned through the Waihapa Production Station

(Q1-2013: $nil)

- New arrangement with gas marketing counterparty commenced May

5, 2014, expected to generate between NZ$250,000 and NZ$1 million

revenue per year (net to NZEC)

- Generated total net proceeds of approximately NZ$1.47 million

through disposal of non-core assets subsequent to March 31,

2014

- Production during May 2014 averaged 201 barrels/day net to

NZEC. See Figure 1 for current status of producing wells and

anticipated near-term activities

To view Figure 1 - NZEC's Production & Development

Wells, please visit the following link:

http://media3.marketwire.com/docs/949153-F1.pdf

FINANCIAL SNAPSHOT

|

|

For the quarter ended March 31, 2014 |

|

Preceding quarter ended December 31, 2013 |

|

Comparative quarter ended March 31, 2013 |

|

|

Production |

19,682 bbl |

|

16,790 bbl |

|

30,179 bbl |

|

|

Sales |

17,630 bbl |

|

13,968 bbl |

|

27,246 bbl |

|

|

Price |

119.15 $/bbl |

|

115.77 $/bbl |

|

112.35 $/bbl |

|

|

Production costs |

44.25 $/bbl |

|

43.39 $/bbl |

|

62.08 $/bbl |

|

|

Royalties |

12.57 $/bbl |

|

10.53 $/bbl |

|

4.98 $/bbl |

|

|

Field netback |

62.33 $/bbl |

|

61.84 $/bbl |

|

45.29 $/bbl |

|

|

Revenue |

6,320,949 |

|

4,108,911 |

|

2,925,258 |

|

|

Total comprehensive income (loss) |

8,452,444 |

|

(5,963,723 |

) |

1,313,397 |

|

|

Finance income (expense) |

(69,854 |

) |

(30,804 |

) |

17,887 |

|

|

Loss per share - basic and diluted |

(0.01 |

) |

(0.06 |

) |

(0.02 |

) |

|

Current assets |

11,952,031 |

|

15,147,197 |

|

48,199,638 |

|

|

Total assets |

124,788,600 |

|

116,782,687 |

|

129,545,992 |

|

|

Total long-term liabilities |

7,626,669 |

|

7,068,585 |

|

3,273,617 |

|

|

Total liabilities |

14,279,266 |

|

15,337,630 |

|

33,939,619 |

|

|

Shareholders' equity |

110,509,334 |

|

101,445,057 |

|

95,606,373 |

|

Note: The abbreviation bbl means barrel or barrels of oil.

As at May 27, 2014, the Company had an estimated $2.8 million in

working capital (excluding materials and supplies of approximately

NZ$2 million).

PROPERTY REVIEW & OUTLOOK

Taranaki Basin

Within the Taranaki Basin, NZEC holds a 100% interest in the

Eltham Permit, a 65% interest in the Alton Permit with L&M

Energy ("L&M"), and a 50% interest in the TWN Licenses and the

TWN Assets with L&M. The Company has lodged an application with

New Zealand Petroleum & Minerals to convert a portion of the

Eltham Permit into a Petroleum Mining Permit, comprising the area

surrounding the Copper Moki and Waitapu oil discoveries. The

Taranaki Basin offers production potential from multiple

prospective formations, ranging from the Kapuni sandstones at a

depth of approximately 4,000 metres, the Tikorangi limestones at

approximately 3,000 metres, the Moki sandstones at approximately

2,500 metres, and the shallower Mt. Messenger and Urenui sandstones

at approximately 2,000 metres. All of NZEC's production to date is

from the Tikorangi and Mt. Messenger formations.

Production and

Processing Revenue

To date the Company the Company has advanced 12 wells to

production: four wells on the Eltham Permit and eight wells on the

TWN Licenses. Total corporate production during the first quarter

of 2014 averaged 219 bbl/d net to NZEC (not including production

from the Waihapa-8 well). On March 29, 2014 the Waihapa-8 well

commenced production, on April 12, 2014 the Toko-2B well

recommenced production following installation of high-volume lift,

and on April 17, 2014 the Waihapa-2 well commenced production

following a successful uphole completion. Production from Toko-2B,

Ngaere-2 and Ngaere-3 is combined into one single gathering

pipeline that goes through the B-train separator at the Waihapa

Production Station. Ngaere-2 and Ngaere-3 were taken offline on

April 12, 2014 in order to allow for full evaluation of Toko-2B's

production performance. Total corporate production during April

2014 averaged 228 bbl/d net to NZEC. Ngaere-2 and Ngaere-3 resumed

production on May 4, 2014, while the Toko-2B well was shut-in to

allow for installation of a permanent power source. Toko-2B resumed

production on May 19, 2014. The Waihapa-2 well produced for eight

days during May and is currently shut-in awaiting evaluation and

installation of an alternative artificial lift method. The Copper

Moki-3 well has been shut-in since early March awaiting

installation of a new pump. Total corporate production during May

2014 averaged 201 bbl/d net to NZEC.

TWN Licenses

NZEC and L&M acquired the TWN Licenses on October 28, 2013

and formed the TWN Joint Arrangement ("TWN JA"), with NZEC as the

operator, to explore and develop the TWN Licenses and operate the

Waihapa Production Station and associated infrastructure. To date,

the TWN JA has advanced eight wells to production for a total of

42,620 bbl produced since closing of the TWN Acquisition (21,310

bbl net to NZEC), with cumulative pre-tax oil sales net to NZEC of

approximately $2,324,833. The wells produce light ~41° API oil that

is delivered by pipeline to the Waihapa Production Station and then

piped to the Shell-operated Omata tank farm, where it is sold at

Brent pricing less standard Shell costs.

Following closing of the TWN Acquisition, the TWN JA immediately

proceeded with the work required to reactivate oil production from

the Tikorangi Formation in six wells drilled by previous operators.

On December 2, 2013, NZEC announced that all six wells had been

reactivated and were flowing into the Waihapa Production Station.

In March 2014, the TWN JA also reactivated oil production from the

Mt. Messenger Formation in a well that had been drilled and

produced from the Mt. Messenger Formation by a previous operator

(Waihapa-8). The Waihapa-8 well produced an average of 20 bbl/d (10

bbl/d net to NZEC) over the last two weeks of May. The TWN JA is

evaluating alternative methods of artificial lift that could

produce the well more effectively than the current heated gas

lift.

The TWN JA continues to evaluate and optimize production from

the reactivated wells. As part of the optimization process, in

April 2014, the TWN JA installed high-volume lift ("ESP") on one of

the reactivated wells (Toko-2B). Toko-2B was chosen as the first

well for ESP installation because the well had a high oil cut of

approximately 20%, but had to be shut-in every few days to allow

the Company to unload a water column that would build up in the

well. The TWN JA expected that an ESP would allow the well to be

produced continuously and would maximize oil recovery. The ESP was

operated initially using a portable generator, which limited the

pumping capacity and did not adequately draw down fluid levels in

the well. In May 2014 the TWN JA connected the Toko-2B high-volume

lift to a permanent power source and is gradually increase the

pumping rate. The Toko-2B well has produced an average of 10 bbl/d

(5 bbl/d net to NZEC) over the last five days, with the ESP pumping

at a rate of 2,500 bbl/d. Current pumping rates are still not

sufficiently drawing down fluid in the well, as evidenced by the

oil cut of 1.2%, which is lower than expected. The TWN JA is

hopeful that higher pumping rates will draw down fluid levels in

the well and allow the oil cut to increase, and is steadily

increasing pumping rates with the expectation of ramping up to

8,000-10,000 bbl/d by June 2, 2014.

A number of wells on the TWN Licenses, with previous production

from the Tikorangi Formation, have uphole completion potential in

the shallower Mt. Messenger Formation. The TWN JA has recompleted

one well uphole in the Mt. Messenger Formation (Waihapa-2) and

achieved production from that well in April 2014. This successful

recompletion confirms that production can be achieved from an

uphole reservoir. The Waihapa-2 well had produced an average of 120

bbl/d (60 bbl/d net to NZEC) over a period of eight days in May

with an oil cut of approximately 67%. The presence of sand is not

uncommon in the Miocene Formation, and the downhole pump is

designed to handle some sand. The inflow of water and oil into the

well, however, is drawing in volumes of sand that make the current

artificial lift ineffective. The TWN JA is evaluating alternative

methods of artificial lift which could service both the Waihapa-8

and Waihapa-2 wells.

The TWN JA continues to review well logs, historical drilling

records and seismic data across the TWN Licenses to identify

additional opportunities to advance existing wells to production.

The TWN JA has identified four additional production opportunities

in existing wells on the TWN Licenses: three uphole completions in

the Mt. Messenger Formation and one well that offers production

potential from both a Tikorangi reactivation and a Mt. Messenger

uphole completion. The TWN JA will continue to evaluate these

opportunities with the objective of advancing these wells to

production.

Third-party revenue from the Waihapa Production Station since

closing the TWN Acquisition totals approximately NZ$979,704 to

NZEC. In addition, during February 2014, the TWN JA entered into an

agreement with a gas marketing counterparty to transport gas along

a section of the TAW gas pipeline for a term of four years with a

five-year right of renewal. The arrangement is expected to generate

between NZ$250,000 and NZ$1 million revenue per year (net to NZEC).

First gas commenced flowing on May 5, 2014, with revenue to be

received from the counterparty from July 1, 2014. From May 5 to

July 1, the counterparty will pay all reasonable direct costs and

charges incurred by the Company with regards to this

arrangement.

Eltham

Permit

The Company has drilled ten exploration wells on its 100%-owned

Eltham Permit. Four have been advanced to production. Of the ten

wells drilled on the Eltham Permit, only one well (Wairere-1)

failed to encounter hydrocarbons and was immediately sidetracked.

One well (Copper Moki-4) made an oil discovery in the Urenui

Formation and has been shut-in pending additional economic analysis

and evaluation of artificial lift options. Wairere-1A was drilled

to the Mt. Messenger Formation and encountered hydrocarbon shows,

with completion pending. Arakamu-2 made an oil discovery in the Mt.

Messenger Formation and has been shut-in pending evaluation of

artificial lift options. Waitapu-1 is shut-in pending further

testing or sidetrack to an alternate target and Arakamu-1A, a Moki

Formation well, is suspending pending further evaluation. The

Company continues to assess and reprioritize these Eltham Permit

opportunities as new reservoir data becomes available from the

Company's activities on the TWN Licenses.

To date the Company has produced approximately 260,879 bbl from

its Eltham Permit wells (including oil produced during testing),

with cumulative pre-tax oil sales from inception of approximately

$28.3 million). All of the Eltham Permit wells produce light ~41°

API oil from the Mt. Messenger Formation. Oil is trucked to the

Shell-operated Omata tank farm and sold at Brent pricing less

standard Shell costs. Production from the Eltham wells has been

very stable year to date, averaging 108 bbl/d during the first

quarter of 2014, and 131 bbl/d during May 2014. The Waitapu-2 well

recommenced production on March 6, 2014 following installation of

artificial lift. The Copper Moki-3 well was shut-in during early

March 2014, and is expected to resume production in Q2-2014

following installation of a new pump.

NZEC is actively seeking farm-in partnerships to allow the

Company to accelerate exploration of additional high-priority drill

targets on the Eltham Permit.

Alton Permit

During 2014, the Company plans to drill a new exploration well

on the Alton Permit. The current work program for the Alton Permit

requires the Company to drill an exploration well by November 22,

2014. The Company has identified a drill target in the Mt.

Messenger Formation and has initiated the community engagement and

technical assessments required to obtain land access consents and

permits. NZEC is actively seeking farm-in partnerships to allow the

Company to accelerate exploration of additional high-priority drill

targets on the Alton Permit.

East Coast Basin

Within the East Coast Basin, NZEC is the operator of three

permits, with a 100% interest in the Castlepoint Permit, a 100%

interest in the East Cape Permit, and an 80% working interest in

the Wairoa Permit in a joint arrangement with Westech Energy New

Zealand. The Company is actively seeking a farm-in partner for its

East Coast permits, to participate in and fund exploration and

development in the East Coast Basin in return for an interest in

the permits. The Company has received an extension to its drilling

commitment on the Castlepoint Permit, and is currently required to

drill its first exploration well on this permit by November 23,

2014. The Company has identified its preferred drill location and

has initiated the community engagement and technical assessments

required to obtain land access and resource consents. The current

work program for the Wairoa Permit requires the Company to drill an

exploration well by July 2, 2014. The Company has identified the

preferred drill location and has progressed the community

engagement and technical assessments required to obtain land access

and resource consents. The Company applied for but has been unable

to obtain an extension to the work program commitment, and is

considering relinquishing the Wairoa Permit. The Company

anticipates completing fieldwork and geochemical studies on the

East Cape Permit in 2014.

SUMMARY OF QUARTERLY RESULTS

|

|

2014-Q1 $ |

|

2013-Q4 $ |

|

2013-Q3 $ |

|

2013-Q2 $ |

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

124,788,600 |

|

116,782,687 |

|

105,313,813 |

|

127,318,182 |

|

|

Exploration and evaluation assets |

56,876,779 |

|

51,500,037 |

|

55,859,632 |

|

52,357,470 |

|

|

Property, plant and equipment |

54,786,347 |

|

49,169,997 |

|

26,621,043 |

|

26,135,651 |

|

|

Working capital |

5,299,434 |

|

6,878,152 |

|

4,748,797 |

|

9,517,742 |

|

|

Revenues |

6,320,949 |

|

4,108,911 |

|

1,519,010 |

|

2,109,700 |

|

|

Accumulated deficit |

(37,122,556 |

) |

(35,099,834 |

) |

(27,292,947 |

) |

(24,616,053 |

) |

|

Total comprehensive income (loss) |

8,452,444 |

|

(5,963,723 |

) |

1,347,788 |

|

(6,000,775 |

) |

|

Basic (loss) earnings per share |

(0.01 |

) |

(0.06 |

) |

(0.02 |

) |

(0.02 |

) |

|

Diluted (loss) earnings per share |

(0.01 |

) |

(0.06 |

) |

(0.02 |

) |

(0.02 |

) |

|

|

|

2013-Q1 $ |

|

2012-Q4 $ |

|

2012-Q3 $ |

|

2012-Q2 $ |

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

129,545,992 |

|

116,059,939 |

|

98,882,087 |

|

98,814,102 |

|

|

Exploration and evaluation assets |

49,610,922 |

|

37,379,726 |

|

26,377,188 |

|

25,373,718 |

|

|

Property, plant and equipment |

25,793,089 |

|

23,867,758 |

|

16,293,123 |

|

8,674,152 |

|

|

Working capital |

17,533,636 |

|

28,293,845 |

|

45,204,695 |

|

53,844,035 |

|

|

Revenues |

2,925,258 |

|

2,948,041 |

|

3,708,254 |

|

5,910,993 |

|

|

Accumulated deficit |

(22,386,089 |

) |

(19,992,243 |

) |

(17,804,045 |

) |

(15,613,594 |

) |

|

Total comprehensive income (loss) |

1,313,397 |

|

(1,333,805 |

) |

(2,018,634 |

) |

1,317,915 |

|

|

Basic (loss) earnings per share |

(0.02 |

) |

(0.02 |

) |

(0.02 |

) |

0.01 |

|

|

Diluted (loss) earnings per share |

(0.02 |

) |

(0.02 |

) |

(0.02 |

) |

0.01 |

|

RESULTS OF OPERATIONS FOR THE THREE-MONTH PERIOD ENDED MARCH 31,

2014

Revenue

During the three-month period ended March 31, 2014, the Company

produced 19,682 bbl (2013: 30,179 bbl) of oil and sold 17,630 bbl

(2013: 27,246 bbl) for total oil sales of $2,100,545 (2013:

$3,061,064), or $62.33 per bbl (2013: $112.35). Reduced production

compared to the same period in 2013 is the result of production

declines in the Copper Moki wells, which is to be anticipated in

oil wells. Production from the Copper Moki wells has since

stabilized.

During the three-month period ended March 31, 2014, the Company

recorded sales from purchased oil and condensate of $2,588,219 and

$1,491,358, respectively (2013: $nil and $nil). The Company also

received $362,459 (2013: $nil) of processing revenue from the

Company's interest in the Waihapa Production Station.

Total recorded revenue during the three-month period ended March

31, 2014 was $1,878,912 (2013: $2,925,258), which is accounted for

net of royalties of $221,633 (2013: $135,806).

Expenses and Other Items

Production costs related to oil sales during the

three-month period ended March 31, 2014 totalled $780,115 (2013:

$1,691,405) or $44.25 per bbl (2013: $62.08). The decrease in

production costs in Q1-2014 compared to Q1-2013 was from cost

efficiencies due to the installation of production facilities on

the Copper Moki site. Other costs of $4,079,577 are for costs

directly related to the sale of purchased oil and condensate.

During the three-month period ended March 31, 2014, fixed operating

costs represented approximately 74% of total production costs,

giving rise to higher field netbacks in light of reduced production

cost compared to Q1-2013.

Processing costs of $294,622 (2013: $nil) relate to

direct costs associated with the operations of the TWN Assets.

Depreciation costs incurred during the three-month

period ended March 31, 2014 totalled $829,446 (2013: $867,042), or

$37.45 per bbl of oil sold (2013: $31.82). Depreciation is

calculated using the unit-of-production method by reference to the

ratio of production in the period to the related total proved and

probable reserves of oil and natural gas, taking into account

estimated future development costs necessary to access those

reserves.

Stock-based compensation for the three-month period

ended March 31, 2014 resulted in an expense of $249,620 (2013:

$580,017). The decrease is because the Company granted fewer share

purchase options to employees, directors and officers of the

Company.

General and administrative expenses for the three-month

period ended March 31, 2014 totalled $1,823,498 (2013: $1,682,505).

The increase in general and administrative costs corresponds to an

increase in travel and insurance in connection with the TWN

licenses. General and administrative expenses are net of legal fee

rebates received in the amount of $249,444.

Net finance expense for the three-month period ended

March 31, 2014 totalled $69,854 (2013: $17,887). Finance expense

relates accretion of the Company's asset retirement obligations,

presented net of interest earned on the Company's cash and

cash-equivalent balances held in treasury and on term deposits.

During the quarter ended March 31, 2014, the Company incurred more

accretion expense due to an increase in asset retirement

obligations incurred from the acquisition of the TWN Licenses and

TWN Assets.

Foreign exchange loss for the three-month period March

31, 2014 amounted to $216,939 (2013: $316,338). The foreign

exchange loss incurred in the current period is a result of the

strengthening of the New Zealand dollar against the US dollar,

during a period in which the Company's subsidiaries (which have a

New Zealand dollar functional currency) held US dollar denominated

assets and working capital.

Total Comprehensive Income / Loss

Total comprehensive income for the three-month period ended

March 31, 2014 totalled $8,452,444 after taking into account a

foreign translation reserve gain of $10,475,166 on the translation

of foreign operations and monetary items that form part of NZEC's

net investment in foreign operations. Total comprehensive loss for

the three-month period ended March 31, 2013 was $1,313,397.

Based on a weighted average shares outstanding balance of

170,873,459, the Company realized a $0.01 basic and diluted loss

per share for the three-month period ended March 31, 2014. During

the three-month period ended March 31, 2013, the Company realized a

$0.02 basic and diluted loss per share, based on a weighted average

share balance of 121,933,549.

On behalf of the Board of Directors

John Proust, Chief Executive Officer & Director

About New Zealand Energy Corp.

NZEC is an oil and natural gas company engaged in the

production, development and exploration of petroleum and natural

gas assets in New Zealand. NZEC's property portfolio collectively

covers approximately 1.91 million acres of conventional and

unconventional prospects in the Taranaki Basin and East Coast Basin

of New Zealand's North Island. The Company's management team has

extensive experience exploring and developing oil and natural gas

fields in New Zealand and Canada, and takes a multi-disciplinary

approach to value creation with a track record of successful

discoveries. NZEC plans to add shareholder value by executing a

technically disciplined exploration and development program focused

on the onshore and offshore oil and natural gas resources in the

politically and fiscally stable country of New Zealand. NZEC is

listed on the TSX Venture Exchange under the symbol NZ and on the

OTCQX International under the symbol NZERF. More information is

available at www.newzealandenergy.com or by emailing

info@newzealandenergy.com.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as such term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

FORWARD-LOOKING INFORMATION

This document contains certain forward-looking information

and forward-looking statements within the meaning of applicable

securities legislation (collectively "forward-looking statements").

The use of the word "expectation", "will", "expect", "expectation",

"continue", "continuing", "could", "should", "further", "pending",

"anticipates", "hopes", "intend", "objective", "become",

"potential", "look forward", "increasing", "evaluating" and similar

expressions are intended to identify forward-looking statements.

These statements involve known and unknown risks, uncertainties and

other factors that may cause actual results or events to differ

materially from those anticipated in such forward-looking

statements including, without limitation, the speculative nature of

exploration, appraisal and development of oil and natural gas

properties; uncertainties associated with estimating oil and

natural gas reserves and resources; uncertainties in both daily and

long-term production rates and resulting cash flow; volatility in

market prices for oil and natural gas; changes in the cost of

operations, including costs of extracting and delivering oil and

natural gas to market, that affect potential profitability of oil

and natural gas exploration and production; the need to obtain

various approvals before exploring and producing oil and natural

gas resources; exploration hazards and risks inherent in oil and

natural gas exploration; operating hazards and risks inherent in

oil and natural gas operations; the Company's ability to generate

sufficient cash flow from production to fund future development

activities; market conditions that prevent the Company from raising

the funds necessary for exploration and development on acceptable

terms or at all; global financial market events that cause

significant volatility in commodity prices; unexpected costs or

liabilities for environmental matters; competition for, among other

things, capital, acquisitions of resources, skilled personnel, and

access to equipment and services required for exploration,

development and production; changes in exchange rates, laws of New

Zealand or laws of Canada affecting foreign trade, taxation and

investment; failure to realize the anticipated benefits of

acquisitions; and other factors as disclosed in documents released

by NZEC as part of its continuous disclosure obligations. Such

forward-looking statements should not be unduly relied

upon.

The Company believes the expectations reflected in those

forward-looking statements are reasonable, but no assurance can be

given that these expectations will prove to be correct. Actual

results could differ materially from those anticipated in these

forward-looking statements. The forward-looking statements

contained in the document are expressly qualified by this

cautionary statement. These statements speak only as of the date of

this document and the Company does not undertake to update any

forward-looking statements that are contained in this document,

except in accordance with applicable securities laws.

New Zealand Energy Corp.John ProustChief Executive Officer &

DirectorNorth American toll-free: 1-855-630-8997New Zealand Energy

Corp.Rhylin BailieVice President Communications & Investor

RelationsNorth American toll-free:

1-855-630-8997info@newzealandenergy.comwww.newzealandenergy.com

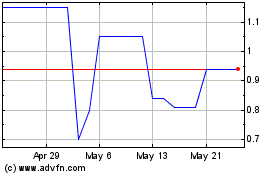

New Zealand Energy (TSXV:NZ)

Historical Stock Chart

From Nov 2024 to Dec 2024

New Zealand Energy (TSXV:NZ)

Historical Stock Chart

From Dec 2023 to Dec 2024