Olivut Resources Ltd. Announces Innovative Funding Commitment for Up to $18 Million

March 12 2013 - 8:01PM

Marketwired Canada

Olivut Resources Ltd. ("Olivut" or the "Company") (TSX VENTURE:OLV) is very

pleased to announce that it has entered into a Securities Purchase Agreement

(the "Agreement") to raise up to $18 million over approximately the next 36

months in a tranched placement of securities to the Canadian Special Opportunity

Fund, L.P., a fund managed by The Lind Partners, a New York-based asset

management firm (together "Lind") focused on junior natural resource companies.

It is anticipated that the initial cash advance date under the Agreement will

occur on March 13, 2013.

Management believes that this non-exclusive, long term funding commitment

provides Olivut with additional growth capital to confidently proceed forward to

create value for Olivut shareholders. The funding commitment is an innovative

investment structure that is new in Canada. It has been used successfully by

Lind to fund numerous junior mining companies in other markets. Olivut and Lind

have worked together to adapt this structure in order to obtain all required

approvals from the Canadian regulatory bodies and the TSX Venture Exchange (the

"TSXV"). Olivut is pleased to be the first to access capital under this

structure in Canada and is especially positive about this development given the

extremely challenging equity environment for junior financing. Management of

Olivut is very pleased to be working with Lind which has a long track record of

investing in junior mining companies. The Company has confidence in the

supportive nature of Lind and looks forward to the regular periodic influx of

capital to facilitate longer term corporate planning. The non-exclusive nature

of this financing allows the Company the flexibility to pursue additional

funding alternatives as market opportunities arise.

Olivut intends to use the proceeds to supplement its current cash position of

approximately $1.1 million, to continue Olivut's exploration programs and for

working capital purposes.

Subject to the terms and conditions of the Agreement, Lind will invest $500,000

on the initial cash advance date and $200,000 every month (approximately) over

the following 35 months. Tranches may be increased to a maximum of $500,000 upon

mutual agreement between Olivut and Lind and may be less than $200,000 after the

first tranche if any single tranche exceeds 0.55% of the Company's market

capitalization. The initial investment of $500,000 consists of (i) a $300,000

callable, convertible security that may be converted into 689,655 units (each a

"Unit"). The first 500,000 Units issued shall be comprised of one common share

and one warrant (the warrant entitling the holder to purchase one common share,

as further described below) and the remaining Units issued shall be exercisable

for one common share; and (ii) $200,000 to purchase common shares, expected to

be issued on April 9, 2013. A maximum of 500,000 warrants may be issued to Lind.

The convertible security has a term of 36 months with a 0% interest rate and is

unsecured and subordinated. Lind has the right to call the security at any time

commencing upon the earlier of (i) the date six months following the date of the

Agreement or (ii) the date on which the Company terminates the Agreement. The

convertible security may be converted into Units any time after the initial cash

advance date.

The 500,000 warrants that may be issued entitle the holder to purchase common

shares at $0.5957 per share until the date that is 36 months after the initial

cash advance date; half vest immediately and half vest upon the earlier of the

date that is 12 months after the initial cash advance date or immediately upon

termination of the Agreement by the Company.

The number of common shares issued in the subsequent tranches will be calculated

based on a price per common share equal to 92.5% of the Daily Volume Weighted

Average Price ("VWAP") per common share on the TSXV for the 5 days chosen by

Lind out of the 20 trading days preceding such issuance date and provided such

price will not be less than the higher of (i) the closing price per Common Share

or (ii) the volume-weighted average price per Common Share, on the TSXV on the

trading day immediately preceding the relevant cash advance date, in either

case, less the maximum permitted discount under TSXV regulations.

The Agreement includes explicit no shorting provisions (including that Lind, its

affiliates, associates and insiders will not sell Olivut shares that it does not

hold in its inventory and that it does not own outright; pre-sell shares that it

expects to receive or has contracted to receive, where such shares have not yet

been issued and delivered to it; borrow shares to be sold; or borrow shares to

cover a short position), a floor price which enables Olivut to refuse to issue

stock below $0.40 and the option for Olivut to terminate the Agreement at any

time, subject to compliance with the terms of the Agreement.

As part of the financing, Lind will receive a commitment fee of $200,000 payable

in 505,944 common shares.

Common shares issued in approximately monthly tranches and for the commitment

fee will be qualified for resale in Canada by a prospectus and issued to Lind

utilizing an exemption from United States securities laws. The convertible

security and underlying common shares and warrants will be issued under

exemptions from Canadian and United States securities laws and will be subject

to a four month hold period. Shareholders will be updated on a quarterly basis

regarding the number of shares issued. If tranches deviate from $200,000 a press

release will explain the funding details.

The Agreement, and any issuance of securities made thereunder, is subject to

receipt of all required regulatory approvals including the approval of the TSXV

and applicable securities regulatory authorities. In connection with the

Agreement, Olivut will file the Agreement and a supplement to the final base

shelf prospectus that it currently has filed with the securities regulators in

Alberta, Ontario and British Columbia. Olivut and Lind have jointly applied for

and obtained an order for exemptive relief from certain requirements of the

securities laws of such jurisdictions. The Company's current base shelf

prospectus is filed on SEDAR and is available at www.sedar.com.

Olivut is a diamond exploration company with a 100% mineral interest in over

142,000 acres in the HOAM Project in Canada's Northwest Territories and an

agreement with Latin American Minerals Inc. and certain of its Paraguayan

subsidiaries to explore the Itapoty Diamond Project located in central Paraguay,

South America. Please visit www.olivut.com for detailed corporate and project

information.

The Lind Partners, LLC is a New York-based asset management firm that manages

the Canadian Special Opportunity Fund, L.P. and the Australian Special

Opportunity Fund, L.P. The Lind team has been investing in junior natural

resource companies since 2009 and has completed more than 35 direct investment

transactions - similar to this investment in Olivut - for more than $385 million

of total transaction value, mainly in Australian publicly traded junior

companies in mining, oil & gas, biotech and clean tech.

This press release contains forward-looking statements with respect to the

Company, and matters concerning the raising of additional capital, the business,

operations, strategy, and financial performance of the Company. Actual results

may differ materially from those indicated by such statements. These statements

generally, but not always, can be identified by use of forward-looking words

such as "may", "will", "expect", "estimate", "anticipate", "intends", "believe"

or "continue" or the negative thereof or similar variations. All statements,

other than statements of historical fact, included herein, including, without

limitations statements regarding future production, are forward-looking

statements that involve various risks and uncertainties. There can be no

assurance that such statements will prove to be accurate and actual results and

future events could differ materially from those anticipated in such statements.

Such forward-looking statements are qualified in their entirety by the inherent

risks and uncertainties surrounding future expectations, including that the

estimates and projections regarding the Company's properties are realized.

Forward-looking statements are based on a number of assumptions which may prove

to be incorrect. Unless otherwise stated, all forward looking statements speak

only as of the date of this press release and the Company does not undertake any

obligation to update such statements except as required by law.

This news release does not constitute an offer to sell or a solicitation of an

offer to buy any of the securities in the United States. The securities have not

been and will not be registered under the United States Securities Act of 1933,

as amended (the "U.S. Securities Act"), or any state securities laws and may not

be offered or sold within the United States or to United States persons unless

registered under the U.S. Securities Act and applicable state securities laws or

an exemption from such registration is available. This news release is not for

distribution to United States newswire services or for dissemination in the

United States.

FOR FURTHER INFORMATION PLEASE CONTACT:

Olivut Resources Ltd.

Leni Keough, P. Geo.

President and Chief Executive Officer

(780) 866-2226

www.olivut.com

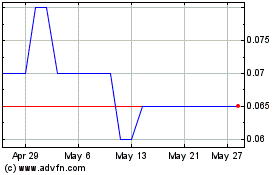

Olivut Resources (TSXV:OLV)

Historical Stock Chart

From May 2024 to Jun 2024

Olivut Resources (TSXV:OLV)

Historical Stock Chart

From Jun 2023 to Jun 2024