Olivut Resources Ltd. Provides Update on Innovative Funding Commitment and Exploration Plans

April 08 2013 - 8:00AM

Marketwired Canada

Olivut Resources Ltd. ("Olivut" or the "Company") (TSX VENTURE:OLV) announces

that it has closed its previously announced private placement of a $300,000

callable, convertible security pursuant to the terms of the Securities Purchase

Agreement (the "Agreement") dated March 12, 2013 to raise up to $18 million over

approximately the next 36 months in a tranched placement of securities to the

Canadian Special Opportunity Fund, L.P., a fund managed by The Lind Partners, a

New York-based asset management firm (together "Lind") focused on junior natural

resource companies.

As previously announced, the convertible security may be converted into 689,655

units (each a "Unit"). The first 500,000 Units issued shall be comprised of one

common share and one warrant (the warrant entitling the holder to purchase one

common share, as further described below) and the remaining Units issued shall

be exercisable for one common share. The convertible security is repayable March

31, 2016 carries a 0% interest rate and is unsecured and subordinated. The

holder has the right to call the security at any time commencing upon the

earlier of (i) September 12, 2013 or (ii) the date on which the Company

terminates the Agreement. The convertible security may be converted into Units

any time. The 500,000 warrants that may be issued on conversion entitle the

holder to purchase common shares at $0.5957 per share until March 31, 2016; half

vested on March 13, 2013 and half vest upon the earlier of March 13, 2014 or

immediately upon termination of the Agreement by the Company.

The convertible security, and any common shares or warrants of Olivut issuable

upon conversion of the convertible security or upon the exercise of any warrants

issued thereunder are subject to resale restrictions pursuant to applicable

securities laws requirements and will not be freely tradable until July 14,

2013.

Subject to the terms and conditions of the Agreement, Lind invested $500,000 on

March 13, 2013 and may invest $200,000 every month (approximately) over the

following 35 months. Tranches may be increased to a maximum of $500,000 upon

mutual agreement between Olivut and Lind and may be less than $200,000 after the

first tranche if any single tranche exceeds 0.55% of the Company's market

capitalization. The initial investment of $500,000 consisted of (i) the $300,000

callable, convertible security discussed above and (ii) $200,000 to purchase

common shares, expected to be issued on April 9, 2013. The number of common

shares to be issued in a tranche will be calculated based on a price per common

share equal to 92.5% of the Daily Volume Weighted Average Price ("VWAP") per

common share on the TSXV for the 5 days chosen by Lind out of the 20 trading

days preceding such issuance date and provided such price will not be less than

the higher of (i) the closing price per Common Share or (ii) the volume-weighted

average price per Common Share, on the TSXV on the trading day immediately

preceding the relevant cash advance date, in either case, less the maximum

permitted discount under TSXV regulations.

As part of the financing, Lind received a commitment fee of $200,000 payable in

505,944 common shares calculated at $0.3953 per share. These commitment fee

shares are qualified by the short form base shelf prospectus of the Company

dated March 11, 2013, as supplemented by the prospectus supplement dated March

12, 2013, both of which are available on SEDAR. Copies of the base prospectus

and the prospectus supplement, as well as any documents incorporated therein by

reference may be obtained on request without charge from the President and Chief

Executive Officer of Olivut, at its offices located at 27010 Highway 16, 14

Mountain Park Properties, Jasper East, Alberta, or by faxing a written request

to (780) 866-3713, by mail to P.O. Box 6690 Hinton, Alberta T7V 1X8 or by

accessing the disclosure documents available through the internet on the

Canadian System for Electronic Document Analysis and Retrieval (SEDAR) website

at www.sedar.com.

Olivut intends to use the proceeds to supplement its current cash position of

approximately $1.5 million, to continue Olivut's exploration programs and for

working capital purposes.

Geophysical analysis is ongoing for the HOAM project on the very large, regional

airborne magnetic survey database with the intent of prioritizing additional

anomalies for follow-up with detailed airborne geophysical surveys and drilling.

Planning is also underway to for a detailed sampling program in Paraguay to be

undertaken in the near term. The intent of the sampling is to pinpoint possible

source locations for the diamonds previously recovered in several stream

drainages.

Olivut is a diamond exploration company with a 100% mineral interest in over

142,000 acres in the HOAM Project in Canada's Northwest Territories and an

agreement with Latin American Minerals Inc. and certain of its Paraguayan

subsidiaries to explore the Itapoty Diamond Project located in central Paraguay,

South America. Please visit www.olivut.com for detailed corporate and project

information.

This press release contains forward-looking statements with respect to the

Company, and matters concerning the raising of additional capital, the business,

operations, strategy, and financial performance of the Company. Actual results

may differ materially from those indicated by such statements. These statements

generally, but not always, can be identified by use of forward-looking words

such as "may", "will", "expect", "estimate", "anticipate", "intends", "believe"

or "continue" or the negative thereof or similar variations. All statements,

other than statements of historical fact, included herein, including, without

limitations statements regarding future production, are forward-looking

statements that involve various risks and uncertainties. There can be no

assurance that such statements will prove to be accurate and actual results and

future events could differ materially from those anticipated in such statements.

Such forward-looking statements are qualified in their entirety by the inherent

risks and uncertainties surrounding future expectations, including that the

estimates and projections regarding the Company's properties are realized.

Forward-looking statements are based on a number of assumptions which may prove

to be incorrect. Unless otherwise stated, all forward looking statements speak

only as of the date of this press release and the Company does not undertake any

obligation to update such statements except as required by law.

Paul Pitman, a Qualified Person as defined by National Instrument 43-101, has

reviewed the contents of this press release that relate to the proposed

exploration programs.

Leni Keough, P.Geo., President and Chief Executive Officer

FOR FURTHER INFORMATION PLEASE CONTACT:

Olivut Resources Ltd.

Leni Keough

President and Chief Executive Officer

(780) 866-2226

www.olivut.com

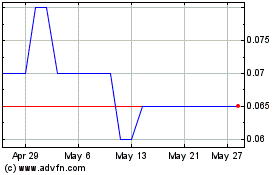

Olivut Resources (TSXV:OLV)

Historical Stock Chart

From May 2024 to Jun 2024

Olivut Resources (TSXV:OLV)

Historical Stock Chart

From Jun 2023 to Jun 2024