TrueContext Reports Annual and Q4 2023 Financial Results

March 19 2024 - 6:00AM

TrueContext Corporation (TSXV: TCXT), (“TrueContext” or the

“Company”) the global leader in field intelligence, announced today

its annual and fourth quarter (Q4) financial results for the period

ended December 31, 2023. All amounts are in US dollars unless

otherwise stated.

Achievements in the 2023 financial year include

strong overall growth in recurring revenue combined with attainment

of profitability in Q3 and $570,000 of operating income in Q4.

TrueContext recently announced the signing of a

definitive agreement relating to an all-cash acquisition by Battery

Ventures. In light of this announcement, the Company will forego

its quarterly earnings call-in connection with these results.

Financial Highlights – 2023 Year

(All results in USD)

- Recurring

revenue for the year-ended December 31, 2023 increased by 15% to

$23.33 million compared to $20.37 million for 2022.

- Total revenue

for the year-ended December 31, 2023 increased by 14% to $24.37

million compared to $21.33 million for 2022.

- Gross margin

for 2023 was $21.23 million or 87% of total revenue compared to

$18.18 million or 85% in 2022. Gross margin on recurring revenue

was 91% for 2023 compared to 90% for 2022.

- Operating loss

was $1.66 million, for the year-ended December 31, 2023 down from

$4.33 million for 2022.

- Net loss for

the year-ended December 31, 2023 was $2.15 million compared to a

net loss of $4.45 million in 2022.

- As at December

31, 2023, the Company’s cash and net working capital balances were

$7.13 million and $1.13 million respectively.

Financial Highlights – 2023 Fourth

Quarter

- Recurring revenue in Q4 2023 increased by 16% to $6.15 million

compared to $5.29 million in Q4 2022 and increased by 3% compared

to $5.96 million in Q3 2023.

- Total revenue for Q4 2023 increased by 13% to $6.31 million

compared to $5.61 million in Q4 2022 and increased by 2% compared

to $6.16 million in Q3 2023.

- Gross margin for Q4 2023 was 89% of total revenue compared to

87% in Q4 2022 and 87% in Q3 2023. Gross margin on recurring

revenue was 92% for Q4 2023 compared to 91% in Q4 2022 and 91% in

Q3 2023.

- Operating income for Q4 2023 was $0.57 million, compared to an

operating loss of $0.45 million in Q4 2022 and an operating loss of

$0.22 million in Q3 2023.

- Net income for Q4 2023 was $0.39 million, compared to a net

loss of $0.55 million in Q4 2022 and a net loss of $0.27 million in

Q3 2023.

Please refer to

https://truecontext.com/about/investor-relations/ for full

financial statements, management discussion and analysis and a

downloadable spreadsheet version of our quarterly information.

About TrueContext

TrueContext is a global leader in field

intelligence. The Company’s field workflows and data collection

capabilities enable enterprise field teams to optimize

decision-making, decrease organizational risk, maximize the uptime

of valuable assets, and deliver exceptional service experiences.

Over 100,000 subscribers use the Company’s product across multiple

use cases, including asset inspection, compliance, installation,

repair, maintenance, and environmental, health & safety with

quantifiable business impacts.

The Company is based in Ottawa, Canada, and

currently trades on the TSXV under the symbol TCXT. “ProntoForms”

and “TrueContext” are registered trademarks of TrueContext Inc., a

wholly owned subsidiary of the Company.

For additional information, please contact:

|

Alvaro Pomboco-Chief Executive Officer TrueContext Corporation

613.599.8288 ext. 1111 apombo@truecontext.com |

Philip Deckco-Chief Executive Officer TrueContext Corporation

416.702.3974pdeck@truecontext.com |

Dave CroucherChief Financial OfficerTrueContext Corporation

613-286-9212dcroucher@truecontext.com |

|

|

|

|

Certain information in this press release may

constitute forward-looking information. This information is based

on current expectations that are subject to significant risks and

uncertainties that are difficult to predict. Actual results might

differ materially from results suggested in any forward-looking

statements. Historical growth levels and results may not be

indicative of future growth levels or results. The proposed

all-cash acquisition of the Company referred to above is subject to

satisfaction of certain customary conditions including court

approval and shareholder approval. The press release relating so

such acquisition linked above contains further details on the

conditions to closing of that transaction. The Company assumes no

obligation to update the forward-looking statements, or to update

the reasons why actual results could differ from those reflected in

the forward looking-statements unless and until required by

securities laws applicable to the Company. There are a number of

risk factors that could cause future results to differ materially

from those described herein. Please see “Risk Factors

Affecting Future Results” in the Company’s annual management

discussion and analysis dated on or about the date of this release

which can be found at www.sedarplus.ca for a discussion of such

factors.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

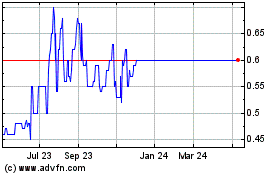

ProntoForms (TSXV:PFM)

Historical Stock Chart

From Feb 2025 to Mar 2025

ProntoForms (TSXV:PFM)

Historical Stock Chart

From Mar 2024 to Mar 2025