Quorum Releases Q2 Fiscal Year 2010 Results

August 18 2010 - 11:58AM

Marketwired Canada

Quorum Information Technologies Inc. (TSX VENTURE:QIS) ("Quorum" or the

"Company") today released its Second Quarter (Q2) Fiscal Year (FY) 2010 results.

Quorum delivers its dealership management system (DMS), XSellerator(TM), and

related services to dealerships throughout North America. The Company is both an

Integrated Dealership Management System (IDMS) strategic partner with General

Motors Corporation (GM) and a strategic partner with Microsoft. Quorum's

XSellerator product is broadly promoted to its target dealerships throughout

North America by these prominent industry partners.

Maury Marks, Quorum's President and CEO made the following remarks about the

Company's Q2 FY2010 results:

Quorum is focused on responsible growth and exceptional customer care. Our

overriding strategic goals are to continue to expand our customer base through

new sales while generating sustained positive cash flow every quarter. At the

same time, we are committed to providing outstanding service and support to our

loyal customers. Following are highlights of our progress towards those goals in

Q2 FY2010:

-- High Growth Installation Rate - the Company completed 19 rooftop

installations for the six months ended June 30, 2010 compared with three

for the six months ended June 30, 2009. We are on track to beat our

previous company record of 36 rooftop installations for a year.

-- Record Level of Active Dealership Rooftops - at the end of Q2 FY2010, we

set a new company record for total active XSellerator dealership

rooftops at 228. Additionally, we now have a more diverse customer base

as 25% of our dealerships are now non-GM franchised dealerships, up from

10% at June 30, 2009. The Company currently supports GM, Isuzu,

Chrysler, Hyundai, KIA, Nissan, Subaru, NAPA and Bumper to Bumper

dealerships.

-- Customer Driven New Version - during the quarter we released a new

version of our XSellerator software with a significant number of

customer-driven enhancements. Additionally, we are preparing for the

release of a new customer support portal in Q3 of this year.

-- Results - this quarter was one of the strongest financial quarters in

Quorum's history. Our revenues, earnings and cash flows were up when

compared to Q1 FY2010 and Q2 FY2009. We are definitely meeting our goal

to grow responsibly.

The following is a summary of our Q2 FY2010 financial performance:

-- Revenue increased by 24% compared to Q2 FY2009 and 4% compared to Q1

FY2010. When compared to Q2 FY2009, our net new revenue increased by

161% from the installation of nine new dealership rooftops in the

quarter compared to one in Q2 FY2009. With the added growth in our

customer base, our recurring support revenues increased by 7% over Q2

FY2009.

-- Gross Profit margin increased slightly from 55% in both Q2 FY2009 and Q1

FY2010 to 57% in Q2 FY2010. This performance is particularly important

because it was achieved in a high installation quarter and installation

revenue is lower margin revenue compared to our recurring support

revenues.

-- EBITDA (earnings before interest, taxes, depreciation and amortization)

in Q2 FY2010 was $383K versus $250K in Q2 FY2009 and $297K in Q1 FY2010.

We managed to increase our EBITDA despite incurring some added costs

(including staffing) to increase our implementation capacity.

-- Net income for Q2 FY2010 was $330K compared to $3K in Q2 FY2009 and $15K

for Q1 FY2010.

-- Positive quarterly cash flow from operating activities of $305K was

achieved in Q2 FY2010 versus $53K in Q2 FY2009 and $285K in Q1 FY2010.

Net cash outflows for investing and financing activities were $140K in

Q2 FY2010 for a quarterly increase in cash of $165K.

With our sales and installation activity restored, we are focused on balancing

the growth of the Company while remaining fiscally responsible and providing

exceptional customer care. We are excited about the prospects for the rest of

2010.

Quorum has filed its 2010 Q2 consolidated financial statements and notes thereto

as at and for the period ended June 30, 2010 and accompanying management's

discussion and analysis in accordance with National Instrument 51-102 -

Continuous Disclosure Obligations adopted by the Canadian securities regulatory

authorities. Additional information about Quorum will be available on Quorum's

SEDAR profile at www.sedar.com and Quorum's website at www.QuorumDMS.com.

Financial Highlights

Six Months Six Months

Ended June 30, Ended June 30, Q2 Ended June

2010 2009 30, 2010

----------------------------------------------------------------------------

Gross revenue $ 3,977,087 $ 3,532,715 $ 2,031,488

Cost of products and services

sold 1,738,639 1,522,497 869,470

Gross profit 2,238,448 2,010,218 1,162,018

Earnings before interest,

taxes and amortization

(EBITDA) 680,024 619,003 383,246

Net income 345,198 191,497 329,927

Basic earnings per share $ 0.009 $ 0.005 $ 0.008

Fully diluted earnings per

share $ 0.008 $ 0.005 $ 0.008

Weighted average number of

common shares

Basic 39,298,438 39,298,438 39,298,438

Diluted 42,398,938 39,298,438 42,398,938

XSellerator installations - in

the period 19 3 9

XSellerator active dealership

rooftops 228 224 228

----------------------------------------------------------------------------

Q2 Ended June Q1 Ended March Q1 Ended March

30, 2009 31, 2010 31, 2009

----------------------------------------------------------------------------

Gross revenue $ 1,636,363 $ 1,945,599 $ 1,896,352

Cost of products and services

sold 733,227 869,169 789,270

Gross profit 903,136 1,076,430 1,107,082

Earnings before interest,

taxes and amortization

(EBITDA) 249,886 296,777 369,137

Net income 2,679 15,271 188,818

Basic earnings per share $ 0.0001 $ 0.00039 $ 0.00480

Fully diluted earnings per

share $ 0.0001 $ 0.00036 $ 0.00480

Weighted average number of

common shares

Basic 39,298,438 39,298,438 39,298,438

Diluted 39,298,438 42,398,938 39,298,438

XSellerator installations - in

the period 1 10 2

XSellerator active dealership

rooftops 224 221 225

----------------------------------------------------------------------------

About Quorum

Quorum is a North American company focused on developing, marketing,

implementing and supporting its XSellerator(TM) product for GM, Isuzu, Chrysler,

Hyundai, KIA, Nissan, Subaru, NAPA and Bumper to Bumper dealerships. XSellerator

is a dealership and customer management software product that automates,

integrates and streamlines every process across departments in a dealership. One

of the select North American suppliers under General Motors' IDMS program,

Quorum is the second largest DMS provider for GM's Canadian dealerships with 25%

of the market. Quorum is a Microsoft Gold Certified Partner and Field-Level

Managed ISV in both Canada and the United States. Quorum Information

Technologies Inc. is traded on the Toronto Venture Exchange (TSX-V) under the

symbol QIS. For additional information please go to www.QuorumDMS.com.

Forward-Looking Information

This press release contains certain forward-looking statements and

forward-looking information ("forward-looking information") within the meaning

of applicable Canadian securities laws. Forward-looking information is often,

but not always, identified by the use of words such as "anticipate", "believe",

"plan", "intend", "objective", "continuous", "ongoing", "estimate", "expect",

"may", "will", "project", "should" or similar words suggesting future outcomes.

In particular, this press release includes forward-looking information relating

to results of operations, plans and objectives, projected costs and business

strategy. Quorum believes the expectations reflected in such forward-looking

information are reasonable but no assurance can be given that these expectations

will prove to be correct and such forward-looking information should not be

unduly relied upon.

Forward-looking information is not a guarantee of future performance and

involves a number of risks and uncertainties some of which are described herein.

Such forward-looking information necessarily involves known and unknown risks

and uncertainties, which may cause Quorum's actual performance and financial

results in future periods to differ materially from any projections of future

performance or results expressed or implied by such forward-looking information.

These risks and uncertainties include but are not limited to the risks

identified in Quorum's Management's Discussion and Analysis for the year ended

December 31, 2009. Any forward-looking information is made as of the date hereof

and, except as required by law, Quorum assumes no obligation to publicly update

or revise such information to reflect new information, subsequent or otherwise.

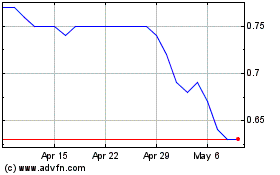

Quorum Information Techn... (TSXV:QIS)

Historical Stock Chart

From Jun 2024 to Jul 2024

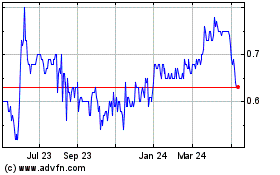

Quorum Information Techn... (TSXV:QIS)

Historical Stock Chart

From Jul 2023 to Jul 2024