Quorum Information Technologies Inc. ("Quorum" or the "Company") (TSX

VENTURE:QIS) today released its Second Quarter (Q2) Fiscal Year (FY) 2011

results. Quorum delivers its dealership management system (DMS),

XSellerator(TM), and related services to automotive dealerships throughout North

America. The Company is both an Integrated Dealership Management System (IDMS)

strategic partner with General Motors Corporation (GM) and an industry partner

with Microsoft. Quorum's XSellerator product is broadly promoted to its target

dealerships throughout North America by these prominent companies.

Maury Marks, Quorum's President and CEO made the following remarks about the

Company's Q2 FY2011 results:

Both 2009 and 2010 were difficult years in the automotive industry. In 2009 GM,

our most significant partner, went through bankruptcy and has since seen a full

recovery. In 2010, as part of GM becoming a leaner organization, they reduced

their North American franchised dealerships by 42%. This resulted in the loss of

approximately 10% of our customers because they were forced to close their

dealerships and the transformation of another 10% of our customers as they moved

away from GM to new OEM's or aftermarket organizations.

Quorum had a forced diversification of our business and now 25% of our customers

operate non-GM franchised dealerships (up from 10% at the beginning of 2009).

The Corporation has changed strategically; we are now an "all makes"

organization, but with a continued key emphasis on GM dealerships. Quorum

supplies our product to GM, Isuzu, Chrysler, Hyundai, Kia, Nissan, Subaru, Saab,

NAPA and Bumper to Bumper franchised dealership customers.

Positive outcomes in Q2 FY2011 include:

-- Continued growth in our dealership count, reaching 249 active dealership

rooftops at the end of Q2 FY2011. We continue to experience small

numbers of dealership losses each quarter as former GM dealerships close

their dealerships after unsuccessfully operating under a new franchise.

-- Quorum posted its eight consecutive quarter of cash flow positive

results. These results are due to a well-managed cost structure and

attaining a critical mass of dealerships that generate significant

recurring support revenues ($1,623K for Q2 FY2011).

-- Quorum, under our GM IDMS contract, received an increased number of GM

integration projects for development and delivery in Q4 FY2011 and Q1

FY2012.

Key financial results summary:

-- Sales decreased by 10% to $1,830K in Q2 FY2011 from $2,031 in Q2 FY2010

and margin after direct costs decreased to $1,059K in Q2 FY2011 compared

to $1,162 in Q2 FY2010, a 9% decrease. The change in sales is due to:

-- A decrease of $194K in net new revenue which was a result of

completing six installations in Q2 FY2011 down from nine

installations in Q2 FY2010.

-- An increase of $66K in recurring support revenue as a result from

having 249 active dealership rooftops at the end of Q2 FY2011 versus

228 at the end of Q2 FY2010.

-- A decrease in integration revenue of $74K due to a reduced number of

GM integration projects.

-- Earnings before interest, taxes, depreciation and amortization (EBITDA)

decreased to $238K in Q2 FY2011 from $412K in Q2 FY2011. The decrease is

largely due to lower net new revenue and the resulting lower gross

margin from this revenue.

-- Net income before taxes decreased to $45K in Q2 FY2011 compared to $322K

in Q2 FY2010. The additional decrease is largely due to a non-cash

foreign exchange gain in FY2010 of $145K.

-- Quorum had net income of $93K in Q2 FY2011 compared to a net income of

$369K in Q2 FY2010.

Our primary focus for 2011 is to grow our quarterly sales and implementation

rates. This is a Company- wide initiative and to support the initiative, we

are:

-- Increasing our qualified lead pipeline with a target to increase the

pipeline by 50% by the end of Q3 FY2011.

-- Investing resources in our sales process to move the process from "good"

to "great".

-- Hiring more sales staff.

-- Developing some innovative product enhancements for release in Q3 and Q4

of 2011. The changes will dramatically change how we demonstrate our

product to new prospects.

Quorum has filed its Q2 2011 consolidated financial statements and notes thereto

as at and for the period ended June 30, 2011 and accompanying management's

discussion and analysis in accordance with National Instrument 51-102 -

Continuous Disclosure Obligations adopted by the Canadian securities regulatory

authorities. Additional information about Quorum will be available on Quorum's

SEDAR profile at www.sedar.com and Quorum's website at www.QuorumDMS.com.

Financial Highlights

Six Months Six Months

Ended Ended Q2 Ended

June 30, 2011 June 30, 2010 June 30, 2011

----------------------------------------------------------------------------

Gross revenue $ 3,741,783 $ 3,977,087 $ 1,829,515

Direct costs 1,618,412 1,738,639 770,837

Margin after direct costs 2,123,371 2,238,448 1,058,678

Earnings (loss) before

interest, taxes and

amortization (EBITDA) 561,265 708,835 238,508

Income (loss) before deferred

income tax 146,593 287,072 44,836

Net income (loss) (7,306) 340,698 92,871

Basic earnings per share $ (0.0002) $ 0.0087 $ 0.0024

Fully diluted earnings per

share $ (0.0002) $ 0.0080 $ 0.0023

Weighted average number of

common shares

Basic 39,298,438 39,298,438 39,298,438

Diluted 39,684,319 42,398,938 39,684,319

XSellerator installations - in

the period 12 19 6

XSellerator active dealership

rooftops 249 228 249

----------------------------------------------------------------------------

Q2 Ended Q1 Ended Q1 Ended

June 30, 2010 March 31, 2011 March 31, 2010

----------------------------------------------------------------------------

Gross revenue $ 2,031,488 $ 1,912,268 $ 1,945,599

Direct costs 869,470 847,575 869,169

Margin after direct costs 1,162,018 1,064,693 1,076,430

Earnings (loss) before

interest, taxes and

amortization (EBITDA) 412,058 322,757 296,777

Income (loss) before deferred

income tax 321,970 101,757 (34,898)

Net income (loss) 368,730 (100,177) (28,032)

Basic earnings per share $ 0.0094 $ (0.0025) $ (0.0007)

Fully diluted earnings per

share $ 0.0087 $ (0.0025) $ (0.0007)

Weighted average number of

common shares

Basic 39,298,438 39,298,438 39,298,438

Diluted 42,398,938 39,684,319 42,398,938

XSellerator installations - in

the period 9 6 10

XSellerator active dealership

rooftops 228 245 221

----------------------------------------------------------------------------

About Quorum

Quorum is a North American company focused on developing, marketing,

implementing and supporting its XSellerator(TM) product for GM, Isuzu, Chrysler,

Hyundai, KIA, Nissan, Subaru, NAPA and Bumper to Bumper dealerships. XSellerator

is a dealership and customer management software product that automates,

integrates and streamlines every process across departments in a dealership. One

of the select North American suppliers under General Motors' IDMS program,

Quorum is the second largest DMS provider for GM's Canadian dealerships with 25%

of the market. Quorum is a Microsoft Silver Certified Partner and Field-Level

Managed ISV in both Canada and the United States. Quorum Information

Technologies Inc. is traded on the Toronto Venture Exchange (TSX-V) under the

symbol QIS. For additional information please go to www.QuorumDMS.com.

Forward-Looking Information

This press release contains certain forward-looking statements and

forward-looking information ("forward-looking information") within the meaning

of applicable Canadian securities laws. Forward-looking information is often,

but not always, identified by the use of words such as "anticipate", "believe",

"plan", "intend", "objective", "continuous", "ongoing", "estimate", "expect",

"may", "will", "project", "should" or similar words suggesting future outcomes.

In particular, this press release includes forward-looking information relating

to results of operations, plans and objectives, projected costs and business

strategy. Quorum believes the expectations reflected in such forward-looking

information are reasonable but no assurance can be given that these expectations

will prove to be correct and such forward-looking information should not be

unduly relied upon.

Forward-looking information is not a guarantee of future performance and

involves a number of risks and uncertainties some of which are described herein.

Such forward-looking information necessarily involves known and unknown risks

and uncertainties, which may cause Quorum's actual performance and financial

results in future periods to differ materially from any projections of future

performance or results expressed or implied by such forward-looking information.

These risks and uncertainties include but are not limited to the risks

identified in Quorum's Management's Discussion and Analysis for the year ended

June 30, 2011. Any forward-looking information is made as of the date hereof

and, except as required by law, Quorum assumes no obligation to publicly update

or revise such information to reflect new information, subsequent or otherwise.

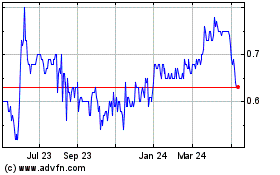

Quorum Information Techn... (TSXV:QIS)

Historical Stock Chart

From Jun 2024 to Jul 2024

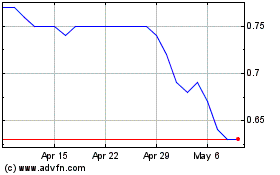

Quorum Information Techn... (TSXV:QIS)

Historical Stock Chart

From Jul 2023 to Jul 2024