Rio2 Limited (“

Rio2” or the

“

Company”) (TSXV: RIO; OTCQX: RIOFF; BVL: RIO)

announces that it has closed its private placement, as announced on

April 8, 2024, and April 9, 2024. A total of 59,030,000 common

shares of the Company (the “

Shares”) were sold at

a price of $0.39 per Share (the “

Offering Price”)

for gross proceeds to the Company of $23,021,700 (the

“

Offering”).

The Company entered into an agency agreement

with Eight Capital and a syndicate of agents, including Cantor

Fitzgerald Canada Corporation, Echelon Capital Markets, Pollitt

& Co. Inc. and Raymond James Ltd., under which the Company

sold, on a brokered “best efforts” basis, 25,640,000 Shares at the

Offering Price pursuant to the listed issuer financing exemption

available under Part 5A of National Instrument 45-106 – Prospectus

Exemptions (the "LIFE offering") and 33,390,000 shares at the

Offering Price pursuant to other exemptions under NI 45-106 and in

accordance with other applicable securities laws in qualifying

jurisdictions. The agents received a cash commission of

$900,000.

The Company plans to use the net proceeds from

the Offering in preparation for the construction financing of the

Fenix Gold Project later in 2024. Use of proceeds will go towards

completing lead order purchases for the mine construction,

permitting activities, environmental monitoring, community

relations activities, payment of concession fees and general

corporate purposes. Final acceptance by the TSX Venture Exchange

(the “TSXV”) of the Offering is subject to the

completion of customary post-closing filings.

Certain insiders of the Company participated in

the Offering and subscribed for an aggregate of 2,438,500 shares

for aggregate proceeds of $951,015. The participation by such

insiders is considered a “related party transaction” within the

meaning of Multilateral Instrument 61-101 - Protection of Minority

Security Holders in Special Transactions (“MI

61-101”). The Company relied on exemptions from the

formal valuation and minority shareholder approval requirements of

MI 61-101 contained in sections 5.5(a) and 5.7(1)(a) of MI 61-101

in respect of such insider participation as neither the fair

market value (as determined under MI 61-101) of the subject

matter of, nor the fair market value of the consideration for, the

transaction, insofar as it involves the interested parties, does

not exceed 25% of the Company’s market capitalization (as

determined under MI 61-101). The Company did not file a material

change report in respect of the participation of the insiders in

the Offering at least 21 days before closing of the Offering as

the participation of the insiders was not determined at that

time.

This news release shall not constitute an offer

to sell or the solicitation of an offer to buy securities in the

United States, nor shall there be any sale of the securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful. The securities being offered have not been, nor will they

be, registered under the United States Securities Act of 1933, as

amended (the “U.S. Securities Act”) or under any

U.S. state securities laws, and may not be offered or sold in the

United States or to “U.S. Persons” (as that term is defined in Rule

902(k) of Regulation S under the U.S. Securities Act) absent

registration or an applicable exemption from the registration

requirements of the U.S. Securities Act, as amended, and applicable

state securities laws.

ABOUT RIO2 LIMITED

Rio2 is a mining company with a focus on

development and mining operations with a team that has proven

technical skills as well as successful capital markets track

record. Rio2 is focused on taking its Fenix Gold Project in Chile

to production in the shortest possible timeframe based on a staged

development strategy. Rio2 and its wholly owned subsidiary, Fenix

Gold Limitada, are companies with the highest environmental

standards and responsibility with the firm conviction that it is

possible to develop mining projects that respect the three axes

(Social, Environment, Economics) of sustainable development. As

related companies, we reaffirm our commitment to apply

environmental standards beyond those that are mandated by

regulators, seeking to protect and preserve the environment of the

territories that we operate in.

Forward-Looking Statements

This news release contains forward-looking

statements and forward-looking information (collectively

“forward-looking information”) within the meaning of applicable

securities laws relating to Rio2’s planned development and

financing of the Fenix Gold Project and other aspects of Rio2’s

anticipated future operations and plans. In addition, without

limiting the generality of the foregoing, this news release

contains forward-looking information pertaining to the following:

the intended use of proceeds of the Offering; the receipt of TSXV

approval of the Offering; and other matters ancillary or incidental

to the foregoing.

All statements included herein, other than

statements of historical fact, may be forward-looking information

and such information involves various risks and uncertainties.

Forward-looking information is often, but not always, identified by

the use of words such as “seek”, “anticipate”, “plan”, “continue”,

“forecast”, “estimate”, “expect”, “may”, “will”, “project”,

“predict”, “potential”, “targeting”, “intend”, “could”, “might”,

“should”, “believe”, and similar expressions. The forward-looking

information is based on certain key expectations and assumptions

made by Rio2’s management which may prove to be incorrect,

including but not limited to: market conditions; expectations

concerning prevailing commodity prices, exchange rates, interest

rates, applicable royalty rates and tax laws; capital efficiencies;

legislative and regulatory environment of Chile; future production

rates and estimates of capital and operating costs; estimates of

reserves and resources; anticipated results of capital

expenditures; the sufficiency of capital expenditures in carrying

out planned activities; performance; the availability and cost of

financing, labor and services; and Rio2’s ability to access capital

on satisfactory terms.

Rio2 believes the expectations reflected in the

forward-looking information in this news release are reasonable,

but no assurance can be given that these expectations will prove to

be correct and such forward-looking information in this news

release should not be unduly relied upon. Actual results and

outcomes may differ materially from what is expressed or

forecasted in such forward-looking information. A description of

assumptions used to develop such forward-looking information and a

description of risk factors that may cause actual results to differ

materially from forward-looking information can be found in Rio2’s

disclosure documents on the SEDAR+ website at www.sedarplus.ca.

These risks and uncertainties include, but are not limited to:

risks and uncertainties relating to market conditions, receipt of

regulatory approvals and management’s ability to anticipate and

manage the factors and risks referred to herein.

Forward-looking information included in this

news release are made as of the date of this news release and such

information should not be relied upon as representing its views as

of any date after the date of this news release. Rio2 has attempted

to identify important factors that could cause actual results,

performance or achievements to vary from those current expectations

or estimates expressed or implied by the forward-looking

information. However, there may be other factors that cause

results, performance or achievements not to be as expected or

estimated and that could cause actual results, performance or

achievements to differ materially from current expectations. Rio2

disclaims any intention or obligation to update or revise any

forward-looking information, whether as a result of new

information, future events or otherwise, except as expressly

required by applicable securities legislation.

To learn more about Rio2 Limited, please visit:

www.rio2.com or Rio2's SEDAR profile at www.sedar.com.

ON BEHALF OF THE BOARD OF RIO2

LIMITED

Alex BlackExecutive Chairman Email:

alex.black@rio2.comTel: +51 99279 4655

Kathryn JohnsonExecutive Vice President, CFO

& Corporate SecretaryEmail: kathryn.johnson@rio2.com Tel: +1

604 762 4720

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts the responsibility for the adequacy

or accuracy of this release.

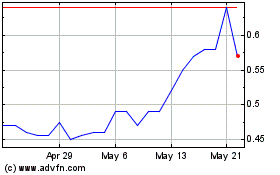

Rio2 (TSXV:RIO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Rio2 (TSXV:RIO)

Historical Stock Chart

From Nov 2023 to Nov 2024