Strategic Metals to Sell Royalty Interests for US$30 Million With Provisional Increase to US$36 Million

August 03 2012 - 7:30AM

Marketwired Canada

Strategic Metals Ltd. (TSX VENTURE:SMD) ("Strategic") announces that pursuant to

the terms of an August 1, 2012 royalty purchase agreement, Strategic will sell

its royalty interests in three advanced mineral projects to 8248567 Canada

Limited, an arm's length purchaser, for up to US$36 million. The three royalty

interests being sold are:

a. a 5% net profits royalty interest in the Casino copper-molybdenum-gold

deposit, located in the Whitehorse Mining District of the Yukon

Territory and owned by Western Copper and Gold Corporation;

b. a 1% net smelter return royalty interest in the Logtung tungsten

project, located on the Yukon-British Columbia border and owned by Largo

Resources Ltd.; and

c. a 1% net smelter return royalty interest in all mineral production from

the Kink 3 mineral claim that covers a substantial portion of the

Wolverine zinc-silver-lead-copper-gold deposit, located in the Watson

Lake Mining District of the Yukon Territory and owned by Yukon Zinc

Corporation. The 1% royalty interest will be reduced to a 0.5% net

smelter return royalty interest after a total of $500,000 in royalty

payments have been made to the royalty holder.

The sale proceeds to be received by Strategic will consist of:

1. an initial cash payment of US$30 million on the closing of the royalty

sale; and

2. an additional cash payment of US$6 million if the operator of the Casino

project has obtained all necessary permits and authorizations prior to

December 31 2016 to construct and operate the project as a producing

mine as contemplated in a feasibility study prepared for and upon which

the operator makes a positive construction decision. The required

permits and authorizations required as part of the operator's

construction decision will include: (i) a positive decision from the

Yukon Environmental and Socio-Economic Assessment Board; (ii) a positive

decision from the Canadian Environmental Assessment Agency; (iii) a

Quartz Mining License, including the requirement for a reclamation and

closure plan, from the Yukon Government Energy, Mines and

Resources/Minerals Resources Branch; (iv) a Type A Water Use License

from the Yukon Water Board; and (v) a Metal Mining Effluent Regulation

Schedule 2 Amendment from the Government of Canada.

This transaction is subject to TSX Venture Exchange acceptance and is expected

to close on or about August 9, 2012.

For additional information concerning Strategic Metals Ltd. please visit

Strategic's website at www.strategicmetalsltd.com.

About Strategic Metals Ltd.

Strategic is a pre-eminent explorer and claimholder in the Yukon, with an

exceptional portfolio of more than 160 property and royalty interests. Strategic

also owns marketable shares of other resource companies, including 9.6% of ATAC

Resources Ltd., 18.8% of Silver Range Resources Ltd., 28.0% of Rockhaven

Resources Ltd, 19.9% of Precipitate Gold Corp., and 19.9% of Wolverine Minerals

Corp.

CAUTIONARY NOTE: This news release includes certain "forward-looking statements"

including completion of the royalty sale and payment of the additional US$6

million. There can be no assurance that such statements will prove to be

accurate, and actual results and future events could differ materially from

those anticipated in such statements. Factors that could cause actual results to

differ materially from those expected by Strategic are those risks described

herein and from time to time, in the filings made by Strategic with Canadian

securities regulators. Those filings can be found on the Internet at

http://www.sedar.com.

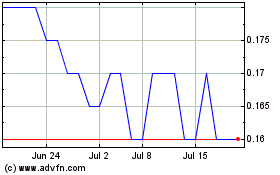

Strategic Metals (TSXV:SMD)

Historical Stock Chart

From Feb 2025 to Mar 2025

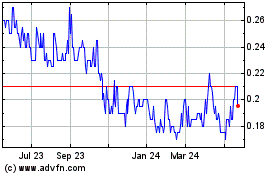

Strategic Metals (TSXV:SMD)

Historical Stock Chart

From Mar 2024 to Mar 2025

Real-Time news about Strategic Metals Ltd New (TSX Venture Exchange): 0 recent articles

More Strategic Metals Ltd. News Articles