Sierra Geothermal Power Corp. (TSX VENTURE: SRA) ("SGP") announced

that it is mailing a management circular to its shareholders. The

circular urges shareholders to support the current Board and oppose

an attempt by dissidents to seize control of the Board at a special

meeting scheduled for January 26, 2010.

In a letter to shareholders accompanying the circular, SGP's

President and Chief Executive Officer Gary Thompson cautioned

shareholders that the likely objective of the dissidents is to help

a competitor, Ram Power Corp., to acquire SGP at a discount price.

Below is the text of Mr. Thompson's letter.

Dear Fellow Shareholder,

Your vote has never been more important. A dissident

shareholder, controlled by investor Richard Rule, is attempting for

the second time to take control of your Board. We believe Mr.

Rule's objective is to help our competitor Ram Power, Corp. to

acquire SGP at a discount price.

Your Board is open to all strategic alternatives, including a

transaction if it accurately reflects the value of SGP and your

investment. A discount price transaction is not in the best

interest of SGP's shareholders. We urge you to safeguard your

investment and vote the GREEN proxy against Mr. Rule and in support

of your Board and management.

Evidence for Mr. Rule's Discount Price Objective

Mr. Rule and his associates first disclosed their discount price

objective to us in July 2009, as you will read in detail in the

enclosed Management Circular. At the time Mr. Rule and his

associates were developing a complex financial transaction to

create Ram Power by combining a number of geothermal companies with

a shell company. Mr. Rule wanted SGP to participate in the

transaction at a price equivalent to $0.186 for each SGP share, an

18% discount to our market price then and a 31% discount to our

recent market price of $0.27.

Your Board requested an explanation. Among other issues, your

Board was concerned about the price premium provided to

shareholders of Polaris Geothermal Inc., one of the geothermal

companies involved in the proposed transaction. Put simply, your

Board was aware that Mr. Rule and his associates faced a conflict

of interest. They owned much more of Polaris than SGP. Your board

had to ensure that the price for SGP was fair to all shareholders

and was not providing a benefit to Mr. Rule and his associates at

your expense.

Mr. Rule's Two Attempts to Take Control of SGP

Faced with your Board's questions, Mr. Rule launched his first

attempt to take control of SGP. In July he requisitioned a special

shareholders' meeting to remove your Board and replace it with an

unnamed slate of nominees. This attempt failed as the requisition

was defective.

Meanwhile, the proposed business combination advanced without

SGP and established Ram Power as a new competitor. A company

controlled by Mr. Rule is Ram Power's largest shareholder, with

approximately 10%. This is much greater than Mr. Rule's ownership

of approximately 5% of SGP and suggests that Mr. Rule's interests

lie with Ram Power, not SGP.

On October 1, 2009, Mr. Rule renewed his effort to take control

of your Board and advance Ram Power's agenda. A company he

controls, Exploration Capital Partners 2005 Limited Partnership,

served a second and corrected requisition for a SGP shareholders'

meeting. This time, Mr. Rule wants to increase the number of

directors from six to thirteen and elect seven hand-picked nominees

to form a majority of the Board.

Mr. Rule's Nominees and Their Connections to Ram Power

Each of Mr. Rule's nominees has now or has recently had a

connection to Ram Power or one of its predecessor companies and we

believe that each nominee was chosen for his loyalty to Mr. Rule

and Ram Power's agenda. We believe that if Mr. Rule takes control

of SGP's Board, Ram Power will renew its efforts to acquire SGP at

a discount and that these seven dissident nominees, as a majority

of the Board, will facilitate this.

In summary, we believe that Mr. Rule seeks to pursue Ram Power's

agenda at the expense of the other SGP shareholders. We believe

that Mr. Rule seeks to enhance the value of his much larger

financial stake in Ram Power by acquiring SGP at a discounted value

through control of the Board and allowing Ram Power shareholders to

benefit at your expense.

Your Current Board Deserves Support

Your current Board consists of a majority of independent

directors with a strong track record of good performance and

excellent corporate governance. The Board believes that SGP has

attractive properties, knowledgeable management, a vibrant business

and a promising future. SGP has performed very well against its

peers in challenging economic times.

As you know, we have been able to secure financing and we are

actively pursuing our business plan. With the recent successful

completion of almost $11 million in equity financings and the

support of US$10 million in grants from the U.S. Department of

Energy, our overall plan for our Tier One projects is to advance at

least 50 megawatts to bankable feasibility during 2010. If we

achieve this, we believe we will be on our way to production and

long-term stable revenue.

While your Board is willing to consider any reasonable offer to

acquire SGP, we would only be interested in a transaction that

makes sense for SGP and all of its shareholders, and we intend to

continue to question any effort to be bought out at less than fair

value.

RECOMMENDATION TO SHAREHOLDERS:

The Board urges you to vote on the GREEN proxy AGAINST the

resolution to increase the size of the Board and WITHHOLD your vote

on the resolution to elect seven dissident nominees.

Regardless of the number of shares you own, you must take action

and cast your vote today by completing and returning only the GREEN

proxy.

A special shareholders' meeting of SGP has been scheduled for

10:00 a.m. on January 26, 2010 at Suite 800 - 885 West Georgia

Street, Vancouver, British Columbia, Canada. The meeting will be

held to consider the proposals to have Mr. Rule's seven hand-picked

nominees appointed to your Board. We believe these nominees are not

up to the task of leading SGP into the future. We urge you to read

the Management Circular and support the current Board and

management.

If you have any questions or need assistance in completing your

GREEN proxy, please call Laurel Hill Advisory Group at toll free

1-888-534-1149 or email at assistance@laurelhillag.com and they

will be happy to help.

Yours truly,

Gary Thompson, Chief Executive Officer, President and

Director

How to Cast Your Vote

The Management Circular and related proxy materials, including

the GREEN proxy, have been mailed to persons who were shareholders

of record as of the close of business on December 15, 2009.

Investors and security holders may obtain a free copy of these

documents on our website at www.sierrageopower.com/proxy at the

Canadian securities regulators web site www.sedar.com and by mail.

You can request the materials by contacting SGP's Investor

Relations department, Sierra Geothermal Power Corp., Suite 500 -

666 Burrard Street, Vancouver, B.C., Canada, V6C 3P6, or by

telephone: 1-800-563-5631, or by email at

info@sierrageopower.com.

SGP and its directors, executive officers and other members of

its management and employees may be deemed to be participants in

the solicitation of proxies from SGP's shareholders in connection

with the proposed acquisition. Information concerning the interests

of SGP's management who are participating in the solicitation is

set forth in the Management Circular.

If you have any questions or need assistance in completing your

GREEN proxy, please call Laurel Hill Advisory Group at toll free

1-888-534-1149 or email at assistance@laurelhillag.com and they

will be happy to help.

About Sierra Geothermal Power Corp.

Sierra Geothermal Power Corp. is a renewable energy company

focused on the exploration and development of clean, sustainable

geothermal power. It is based in Vancouver, British Columbia and

listed on the TSX Venture Exchange under the symbol SRA. Its

portfolio of geothermal projects located in Nevada and California

exceeds 365 square kilometres (90,000 acres) and has a combined

total estimated capacity of greater than 500 MW. SGP intends to

finance development by utilizing a combination of corporate equity,

joint venture partnerships and project debt, with the support of US

government grants and loan guarantees. To find out more about

Sierra Geothermal Power Corp. (TSX VENTURE: SRA) visit our website

at www.sierrageopower.com.

On behalf of the Board of Directors

Gary Thompson, Chief Executive Officer, President and

Director

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This press release contains forward-looking statements.

Forward-looking statements are projections of events, revenues,

income, future economic performance or management's plans and

objectives for future operations. In some cases you can identify

forward-looking statements by the use of terminology such as "may",

"should", "anticipates", "believes", "expects", "intends",

"forecasts", "plans", "future", "strategy", or words of similar

meaning. Forward looking statements in this news release include

statements about SGP's belief that the dissident nominees will

facilitate the acquisition of SGP by Ram Power, Corp. at a discount

price; its belief in its plan to advance at least 50 megawatts to

bankable feasibility during 2010 and that if it achieves this it

will be on its way to production and long-term stable revenue; its

belief that the Board would be interested in a transaction that

makes sense for SGP and all of its shareholders; that the Board

intends to continue to question any effort to be bought out at less

than fair value; and that SGP intends to finance the development of

its portfolio of projects through a combination of equity and/or

joint ventures. These statements are only predictions and involve

known and unknown risks, uncertainties and other factors, including

the risks inherent in our industry, the poor capital markets and

other risks identified by us in our periodic filings on SEDAR

(which can be viewed at www.sedar.com). Any of these risks could

cause our or our industry's actual results, levels of activity,

performance or achievements to be materially different from any

future results, levels of activity, performance or achievements

expressed or implied by these forward-looking statements.

While these forward-looking statements and any assumptions upon

which they are based are made in good faith and reflect our current

judgment regarding the direction of its business, actual results

will almost always vary, sometimes materially, from any estimates,

predictions, projections, assumptions or other future performance

suggested in this press release. Except as required by applicable

law, including the securities laws of Canada, we do not intend to

update any of the forward-looking statements to conform these

statements to actual results.

Neither the TSX Venture Exchange nor its Regulation Services

Provider accepts responsibility for the adequacy or accuracy of

this release.

Contacts: Sierra Geothermal Power Corp. Gary Thompson President

& CEO (604) 683-0332 / 1-800-563-5631 info@sierrageopower.com

Sierra Geothermal Power Corp. Anthony Srdanovic, BA Investor

Relations (604) 642-6179 asrdanovic@sierrageopower.com

www.sierrageopower.com

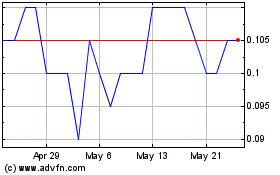

Stria Lithium (TSXV:SRA)

Historical Stock Chart

From Jun 2024 to Jul 2024

Stria Lithium (TSXV:SRA)

Historical Stock Chart

From Jul 2023 to Jul 2024