SRA Announces First Closing of Equity Financing

March 01 2011 - 4:48PM

Marketwired Canada

Strategic Resource Acquisition Corporation ("SRA") (CNSX:SRZ) is pleased to

announce that it has raised $1,243,976.40 in a first closing in order to advance

its Lagoa Salgada base metal project in south western Portugal.

The first closing of the financing consists of 10,366,470 units at a price of

$0.12 per unit. Each unit consists of one common share and one warrant to

purchase a common share at $0.18 for a period of 18 months from the date of

closing. SRA will use the net proceeds of the proposed financing primarily to

undertake additional drilling, geological and geophysical work, metallurgical

testing and for working capital.

SRA engaged D&D Securities Inc. to act as agent to place, on a best efforts

basis, the units with accredited investors in Canada. SRA has agreed to pay the

agent a cash fee of 8% of the proceeds raised and broker warrants to purchase

common shares at $0.12 per share for a period of 18 months from the date of

closing in the amount of 8% of the number of units sold.

The Lagoa Salgada property in Portugal is located at the northwest extension of

the Iberian Pyrite belt, which hosts numerous past and current producing mines

in both Spain and Portugal. SRA will seek to build on the previous historical

drilling results, do additional work and update the NI 43-101 report that was

prepared for the previous operator of the concession.

SRA is a Toronto-based mineral development company, focused on acquisition and

development of base and precious metal properties in Canada and in low-risk

foreign locations.

This news release contains "forward-looking information" which may include, but

is not limited to, statements with respect to the future financial or operating

performance of the Company and its projects. Often, but not always,

forward-looking statements can be identified by the use of words such as

"plans", "expects", "is expected", "budget", "scheduled", "estimates",

"forecasts", "intends", "anticipates", or "believes" or variations (including

negative variations) of such words and phrases, or state that certain actions,

events or results "may", "could", "would", "might" or "will" be taken, occur or

be achieved. Forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause the actual results, performance

or achievements of the Company to be materially different from any future

results, performance or achievements expressed or implied by the forward-looking

statements. Forward-looking statements contained herein are made as of the date

of this press release and the Company disclaims any obligation to update any

forward-looking statements, whether as a result of new information, future

events or results or otherwise. There can be no assurance that forward-looking

statements will prove to be accurate, as actual results and future events could

differ materially from those anticipated in such statements. The Company

undertakes no obligation to update forward-looking statements if circumstances,

management's estimates or opinions should change, except as required by

securities legislation. Accordingly, the reader is cautioned not to place undue

reliance on forward-looking statements.

Shares outstanding: 23,413,227

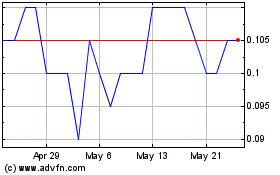

Stria Lithium (TSXV:SRA)

Historical Stock Chart

From Jun 2024 to Jul 2024

Stria Lithium (TSXV:SRA)

Historical Stock Chart

From Jul 2023 to Jul 2024