Timberline and Wolfpack Gold to Merge: Creates Nevada Focused Gold

Exploration Company

COEUR D'ALENE, IDAHO--(Marketwired - Mar 13, 2014) - Timberline

Resources Corporation (NYSEMKT:TLR)(TSX-VENTURE:TBR) ("Timberline"

or the "Company") announced today that it has agreed in principle

to merge with Wolfpack Gold Corp. (TSX-VENTURE:WFP) ("Wolfpack")

creating a pure Nevada focused gold exploration company with a

substantial portfolio of quality assets in a world class

jurisdiction.

The merger is expected to be completed by a plan of arrangement

or other suitable mechanism, and Timberline and Wolfpack have

agreed to an exclusivity period expiring April 22, 2014, during

which time the parties will conduct their respective due diligence.

Upon completion of satisfactory due diligence, the parties will

conclude a definitive agreement.

With the focus on Nevada, it is currently anticipated that prior

to the merger, Timberline will transfer ownership of its partially

permitted Butte Highlands Gold Project in Montana to its existing

shareholders through a spin-out or similar transaction. Timberline

shareholders would retain ownership of the Company's interest in

the Butte Highlands project, and, in addition to the Company's

current pipeline of projects in Nevada, would gain an interest in

Wolfpack's substantial portfolio of Nevada exploration properties.

Similarly, with the focus of the merged company entirely on Nevada

gold projects, Wolfpack anticipates that prior to the merger it

will transfer its ownership of its uranium assets to its

shareholders. The exact mechanism and timing of these transfers has

yet to be finalized and such transfers remain subject to any

necessary shareholder, corporate, and regulatory approvals.

Timberline President and CEO, Paul Dircksen, commented, "We have

successfully advanced our Butte Highlands project to the point that

the final permits appear to be forthcoming soon. With the timing of

the permits in the hands of the regulators, the operation of the

project is in the hands of our joint venture partner, who has

already completed a substantial amount of pre-development work.

With the planned pre-merger spinoff, Timberline's existing

shareholders will continue to benefit fully from the future

developments at Butte Highlands. At the same time, we have been

creating a quality exploration and development portfolio in Nevada,

and this opportunity will allow us to focus on a substantial group

of prospective gold properties in one of the best exploration and

mining jurisdictions in the world. We believe that a partnership

with Wolfpack would enhance the shareholder value of the company

and facilitate access to capital as we advance the properties

toward development and production."

At the time of the merger, Wolfpack is anticipated to have

approximately $6.7 million in its treasury. The transaction is

expected to be structured such that Timberline will acquire all of

the outstanding shares of Wolfpack and, on completion, former

Wolfpack shareholders will hold, as a group, approximately 50% of

the outstanding shares of common stock of Timberline. At closing,

Timberline will consolidate its shares of common stock on a ratio

to be determined by the parties and reconstitute its board of

directors to be comprised of an equal number of directors from each

company. The agreement requires a break fee in the amount of

US$500,000 be paid by a party electing to terminate the agreement

to accept a third party superior proposal.

Under the terms of the letter of intent, Wolfpack has agreed to

provide Timberline with a bridge loan of up to US$1,000,000 to fund

the working capital needs of Timberline during the interim period

prior to the completion of the proposed transaction. Timberline may

draw down an initial US$500,000 and may thereafter request

additional tranches of US$250,000. The loan will mature on the

earlier of completion of the business combination and one year from

the initial draw down under the loan. The amount drawn will bear

interest at 5% during the first six months of the loan and

thereafter at 10% until repaid (in each case compounded annually).

In the event the proposed transaction for any reason does not

complete, Wolfpack will have the exclusive right, on the maturity

date, to be paid the principal amount of the loan and interest in

cash or elect to receive all or a portion thereof in shares of

commons stock of Timberline. Repayment will also be secured by

Timberline's interest in the Seven Troughs property located in

Pershing County, Nevada.

In the event Timberline decides for any reason to terminate

discussions regarding the business combination prior to execution

of the definitive agreement, Timberline will, in consideration for

Wolfpack making the bridge loan, assign a 0.25% net smelter returns

royalty in the Seven Troughs property to Wolfpack.

Completion of the proposed business combination is subject to a

number of conditions, including satisfactory completion of due

diligence by each of the parties, execution of a mutually

acceptable definitive agreement by April 22, 2014, and receipt by

both Wolfpack and Timberline of all stock exchange and third party

approvals, including shareholder approval if required. Advancement

of the bridge loan and any conversion thereof into Timberline

shares, is subject to receipt by both parties of stock exchange

approval.

About Timberline Resources

Timberline Resources Corporation is exploring and developing

advanced-stage gold properties in the western United States.

Timberline holds a 50-percent carried interest ownership stake in

the Butte Highlands Joint Venture in Montana. Timberline's

exploration is primarily focused on the major gold districts of

Nevada, where it is advancing its flagship Lookout Mountain Project

toward a production decision while exploring a pipeline of quality

earlier-stage projects at its South Eureka Property and elsewhere.

Timberline management has a proven track record of discovering

economic mineral deposits that are developed into profitable

mines.

Timberline is listed on the NYSEMKT where it trades under the

symbol "TLR" and on the TSX Venture Exchange where it trades under

the symbol "TBR".

About Wolfpack

Wolfpack Gold's mandate is to advance low cost heap leach and

high grade underground gold projects towards production in the

western United States. The advanced Adelaide and Castle-Black Rock

projects have previous operating histories as open pit heap leach

operations before closing due to low gold prices in the 1980's.

With quality assets in a world class jurisdiction, a budgeted

three-year plan and an exploration team with documented exploration

discoveries in Nevada, Wolfpack Gold is positioned to advance new

and existing discoveries towards production. In addition, the

Company has a 100% interest, with no holding costs, on 115,000+

acres (46,400 ha) of private mineral rights in New Mexico,

including the Crownpoint and Hosta Butte uranium deposits. These

deposits contain an indicated resource of 26.6 MM pounds U3O8 at an

average grade of 0.105% 4 eU3O8 and an inferred resource of 6.1 MM

pounds U3O8 at an average grade of 0.110 eU3O8 (Beahm, 2012). A

portion of these resources are under NRC license.

Forward-looking Statements

Statements contained herein that are not based upon current or

historical fact are forward-looking in nature and constitute

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934. Such forward-looking statements reflect the Company's

expectations about its future operating results, performance and

opportunities that involve substantial risks and uncertainties.

These statements include but are not limited to statements

regarding the proposed spin-off of the Company's Butte Highlands

project, timing for permitting at the Butte Highlands project, the

completion of the proposed combination with Wolfpack Gold and the

potential for enhanced value to shareholders and the facilitation

of financing following the merger with Wolfpack, completion of

satisfactory due diligence and potential development and production

of the properties of the combined company and other such similar

statements . When used herein, the words "anticipate", "believe",

"estimate", "upcoming", "plan", "target", "intend" and "expect" and

similar expressions, as they relate to Timberline Resources

Corporation, its subsidiaries, or its management, are intended to

identify such forward-looking statements. These forward-looking

statements are based on information currently available to the

Company and are subject to a number of risks, uncertainties, and

other factors that could cause the Company's actual results,

performance, prospects, and opportunities to differ materially from

those expressed in, or implied by, these forward-looking

statements. Factors that could cause or contribute to such

differences include, but are not limited to, risks related to the

timing and completion of the proposed transaction with Wolfpack

Gold, unsatisfactory results of due diligence, the receipt of a

superior proposal by one of the parties, failure to receive

necessary regulatory or shareholder approvals, risks and

uncertainties related to mineral estimates, risks related to the

inherently dangerous activity of mining, and other such factors,

including risk factors discussed in the Company's Annual Report on

Form 10-K for the year ended September 30, 2013. Except as required

by Federal Securities law, the Company does not undertake any

obligation to release publicly any revisions to any forward-looking

statements.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Timberline Resources CorporationPaul DircksenCEO208.664.4859

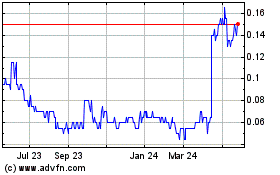

Timberline Resources (TSXV:TBR)

Historical Stock Chart

From Dec 2024 to Jan 2025

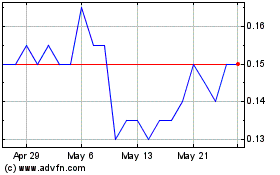

Timberline Resources (TSXV:TBR)

Historical Stock Chart

From Jan 2024 to Jan 2025