Tornado Global Hydrovacs Reports 2021 Results

April 28 2022 - 7:48PM

Tornado Global Hydrovacs Ltd. (“Tornado” or the “Company”) (TGH:

TSX-V) today reported its audited consolidated financial results

for the quarter and year ended December 31, 2021. The audited

consolidated financial statements and MD&A are available on the

Company’s issuer profile on SEDAR and can be reviewed at

www.sedar.com or on the Company’s web site www.tornadotrucks.com.

Financial and Operating

Highlights (in CAD $000’s except per share

data)

|

|

Three months ended December 31 |

|

Year ended December 31 |

|

|

|

2021 |

|

|

2020 |

|

|

|

2021 |

|

|

2020 |

|

| |

|

|

|

|

|

| Revenue |

$ |

9,494 |

|

$ |

5,186 |

|

|

$ |

32,898 |

|

$ |

30,832 |

|

|

Cost of sales |

|

9,649 |

|

|

4,505 |

|

|

|

26,902 |

|

|

25,557 |

|

| Gross

Profit |

|

(155 |

) |

|

681 |

|

|

|

5,996 |

|

|

5,275 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| Selling and

general administrative expenses |

|

2,283 |

|

|

1,269 |

|

|

|

6,056 |

|

|

4,151 |

|

| Depreciation

and amortization |

|

364 |

|

|

461 |

|

|

|

1,575 |

|

|

1,769 |

|

| Finance

expense |

|

69 |

|

|

51 |

|

|

|

210 |

|

|

168 |

|

| Impairment

(reversal) |

|

189 |

|

|

66 |

|

|

|

953 |

|

|

(108 |

) |

| Accretion

expense |

|

78 |

|

|

92 |

|

|

|

153 |

|

|

142 |

|

| Stock-based

compensation |

|

220 |

|

|

- |

|

|

|

489 |

|

|

- |

|

|

Loss on disposal of fixed assets |

|

- |

|

|

1 |

|

|

|

77 |

|

|

2 |

|

| |

|

|

|

|

|

| Loss before

tax |

|

(3,358 |

) |

|

(1,259 |

) |

|

|

(3,517 |

) |

|

(849 |

) |

|

Income tax recovery (expense) |

|

517 |

|

|

224 |

|

|

|

302 |

|

|

182 |

|

| |

|

|

|

|

|

| Net

loss |

$ |

(2,841 |

) |

$ |

(1,035 |

) |

|

$ |

(3,215 |

) |

$ |

(667 |

) |

| |

|

|

|

|

|

| Net loss per

share - basic and diluted |

$ |

(0.022 |

) |

$ |

(0.008 |

) |

|

$ |

(0.025 |

) |

$ |

(0.005 |

) |

| |

|

|

|

|

|

| EBITDAS

(1) |

$ |

(2,438 |

) |

$ |

(588 |

) |

|

$ |

(60 |

) |

$ |

1,124 |

|

| EBIT

(1) |

$ |

(3,211 |

) |

$ |

(1,115 |

) |

|

$ |

(1,248 |

) |

$ |

(538 |

) |

| |

|

|

|

|

|

| Total

assets |

$ |

25,315 |

|

$ |

27,626 |

|

|

$ |

25,315 |

|

$ |

27,626 |

|

|

Shareholders Equity |

$ |

12,130 |

|

$ |

14,829 |

|

|

$ |

12,130 |

|

$ |

14,829 |

|

1 EBITDAS (earnings (loss) before interest, tax,

depreciation and amortization, non-cash impairment, gain/loss on

disposal of fixed assets and stock-based compensation), EBIT

(earnings before interest and taxes) and Gross Profit (revenue less

cost of sales) are not defined by IFRS. EBIT is the result of the

Company’s EBITDAS less depreciation and amortization expenses,

gains and losses on the disposal of assets, non-cash impairment and

stock-based compensation. While not IFRS measures, EBITDAS, EBIT

and Gross Profit are used by management, creditors, analysts,

investors and other financial stakeholders to assess the Company’s

performance and management from a financial and operational

perspective. Readers are cautioned that EBITDAS and EBIT should not

be considered to be more meaningful than Loss before Tax determined

in accordance with IFRS.

2021 Overview

- The Company completed two strategic

actions during the second quarter of 2021.

- The Company moved all production

into its production facility located in Red Deer, Alberta (the “Red

Deer Facility”), effectively tripling the Company’s monthly

production capacity.

- To capitalize on the expected

increase in infrastructure spending in North America and the impact

that such spending will have on construction demand in general and

hydrovac excavation demand in particular, the Company strengthened

its executive management team with the appointment of Brett Newton

as President and Chief Operating Officer of the Company. In January

2022 Mr. Newton assumed the position of Chief Executive Officer and

vacated the position of Chief Operating Officer.

- On July 14, 2021, the Company

entered into a $4,875 term loan and a $3,000 revolving operating

line of credit (together the “Credit Facility”). The term loan was

used to repay the balance of the non-interest bearing vendor

take-back mortgage secured against the Company’s Red Deer Facility

and the revolving operating line of credit will be used for general

working capital purposes.

- The $1.2 USD trillion

infrastructure bill (the “Infrastructure Bill”), previously

ratified by US Congress and passed by US Senate, was signed by the

US President on November 15, 2021, is expected to create a

significant number of jobs in the US to improve broadband, water

suppliers and other public works, which in turn is expected to

increase the demand for hydrovac trucks in US.

- In 2021, the federal government

introduced a clawback provision with respect to the Canada

Emergency Wage Subsidy (the “wage subsidy”) that requires employers

that are public corporations to repay a part of their wage subsidy

claims for a qualifying period, to the extent the compensation paid

to its named executive officers in 2021 exceeds that paid in 2019.

The wage subsidy clawback resulted in the Company being required to

pay back a total of $384 (the “Clawback”) to the federal government

and negatively impacted the Company’s gross profit and EBITDAS by

$269 and $384 respectively.

- Revenue of $32,898 in 2021

increased 6.7% compared to $30,832 in 2020 as customer demand

continued to recover.

- Gross Profit of $5,996 in 2021

increased by $721 compared to $5,275 in 2020 due to increased

revenue and production efficiencies, including labour utilization,

at the Company’s Red Deer Facility. This was offset by reduced wage

subsidy net of the amount repayable ($427 in 2021 compared to

$1,206 in 2020) and one-time, non-recurring expenses discussed

below. Gross Profit was positively impacted by the increased

benefits from cost savings on parts sourced from China, although to

a lesser extent than during 2020 due to increased freight and lead

time. Gross Profit was negatively impacted by increased material

costs experienced in Q4/2021 due to supply chain issues.

- General and administrative expense

of $6,056 in 2021 increased by $1,905 compared to $4,151 in 2020.

The increase was due to general increased employee costs in North

America to handle present and anticipated growth. The wage subsidy

net of the amount repayable was less in 2021 compared to 2020. Also

in 2020 the Company had temporarily laid off 40% of its employees

and senior management and head office employees had taken salary

reductions.

- EBITDAS of negative $60, decreased

by $1,184 compared to $1,124 in 2020, due to factors discussed

below.

- During 2021, the Company recorded a

number of one-time non-recurring items which negatively impacted

the Company’s results. The impact of these adjustments totalled

$2,633 in 2021 and 2/3 of this was related to inventory writedowns

and to asset impairment of non-core hydrovac equipment and rental

units.

- The Company recorded a net loss of

$3,215 in 2021, which represents an increase in the net loss of

$2,548 compared to net loss of $667 in 2020. This was due to the

factors discussed above, plus stock based compensation expense of

$489 which is a non cash item.

4Q/2021 Overview

- During Q4/2021, the Company

recorded a number of one-time non-recurring items which negatively

impacted the Company’s Q4 results and are discussed above.

- Revenue of $9,494, increased 83.1%

compared to $5,186 in Q4/2020 as customer demand continued to

recover.

- Gross Profit of negative $155, decreased by $836 compared to

$681 in Q4/2020 principally due to adjustments discussed below and

reduced wage subsidy net of the amount repayable ($427 in 2021

compared to $1,206 in 2020). Gross Profit was negatively impacted

by increased material costs experienced in Q4/2021 due to supply

chain issues.

- EBITDAS of negative $2,438, increased by $1,850 compared to

negative $588 in Q4/2020, due to factors discussed above.

- Net loss of $2,841 increased by $1,806 compared to a net loss

of $1,035 in Q4/2020. This was due to the factors discussed above

and stocked-based compensation of $220 (2020 – $nil) which is a non

cash item.

- During Q4/2021, the Company recorded a number of one-time

non-recurring items which negatively impacted the Company’s Q4/2021

results. The impact of these adjustments totalled $1,463 in Q4 2021

and 2/3 of this was related to inventory writedown and to asset

impairment of non-core hydrovac equipment and rental units.

Segmented information (in CAD

$000’s)

|

Year ended December 31, 2021 |

North America |

China |

Corporate |

Total |

|

Revenue |

$ |

32,898 |

|

$ |

- |

|

$ |

- |

|

$ |

32,898 |

|

| Cost of

sales |

|

26,902 |

|

|

- |

|

|

- |

|

|

26,902 |

|

|

Selling and general administrative |

|

4,601 |

|

|

404 |

|

|

1,051 |

|

|

6,056 |

|

|

EBITDAS |

$ |

1,395 |

|

$ |

(404 |

) |

$ |

(1,051 |

) |

$ |

(60 |

) |

| |

|

|

|

|

| |

|

|

|

|

|

Three months ended December 31, 2021 |

North America |

China |

Corporate |

Total |

|

Revenue |

$ |

9,494 |

|

$ |

- |

|

$ |

- |

|

$ |

9,494 |

|

| Cost of

sales |

|

9,649 |

|

|

- |

|

|

- |

|

|

9,649 |

|

|

Selling and general administrative |

|

1,760 |

|

|

196 |

|

|

327 |

|

|

2,283 |

|

|

EBITDAS |

$ |

(1,915 |

) |

$ |

(196 |

) |

$ |

(327 |

) |

$ |

(2,438 |

) |

| |

|

|

|

|

Notes: Non-IFRS Measures - Readers are cautioned

that EBITDAS is not a recognized financial measure under IFRS and

as such EBITDAS should not be considered to be more meaningful than

Loss before Tax determined in accordance with IFRS.

Outlook

Management believes the Company’s business will

continue to strengthen and expects the Company’s production and

sales of hydrovac trucks in North America in 2022 to continue to

grow and capitalize on the significantly increased capacity of its

owned facility in Red Deer over the long term for the following

reasons:

- A strengthened senior executive

management team.

- Expanded capacity and manufacturing

and production efficiencies from the Red Deer Facility, which is

fully operational.

- Expected increased spending on

infrastructure in North America, particularly in the US as a result

of the Infrastructure Bill.

- The Company’s commitment to

continuous improvement of its hydrovac truck design which in the

Company’s view has compelling advantages over hydrovac trucks

currently offered in the market.

- The Company anticipates adding new

innovative products to our product lines that cover infrastructure,

telecom and oil and gas industries.

- Secured key manufacturing

components, including chassis for customers, into future years

through strategic relationships.

- Strengthened dealer relationships

in both Canada and US to meet the expected demand increase.

- Expanded North American coverage

for maintenance warranty and repair to better serve customers.

- The majority of the one-time,

non-recurring expenses accrued in 2021 were non cash and totalled

$2,633.

- The improved market environment

experienced during the second half of 2021 is expected to continue

into 2022 as customer confidence and spending levels continue to

recover.

Limiting factors on the Company’s ability to

meet increased demand could include the possibility of chassis

supply chain interruption due to chip shortages at the chassis

manufacturer level and other supply chain issues related to other

key components caused by the pandemic and exacerbated by the

Russian invasion of Ukraine. However, management believes that it

will be able to manage these supply chain issues.

About Tornado Global Hydrovacs

Ltd.

The Company designs and manufactures hydrovac

trucks as well as provides heavy duty truck maintenance operations

in central Alberta. It sells hydrovac trucks to excavation service

providers in the infrastructure and industrial construction and oil

and gas markets. Hydrovac trucks use high pressure water and vacuum

to safely penetrate and cut soil to expose critical infrastructure

for repair and installation without damage. Hydrovac excavation

methods are quickly becoming a standard in the North America to

safely excavate in urban areas and around critical infrastructure

greatly reducing infrastructure damage and related fatalities. In

China, the Company’s subsidiary is used principally to source

certain parts to the Company’s North America operations.

For more information about Tornado Global

Hydrovacs Ltd., visit www.tornadotrucks.com or contact:

|

Brett NewtonPresident and Chief Executive OfficerPhone: (416)

522-6390Email: bnewton@tghl.ca |

|

Advisory

Certain statements contained in this news

release constitute forward-looking statements. These statements

relate to future events. All statements other than statements of

historical fact are forward-looking statements. The use of the

words “anticipates”, “should”, ‘‘may”, “expected”, “expects”,

“believes” and other words of a similar nature are intended to

identify forward-looking statements. These statements involve known

and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking statements. Although Tornado

believes these statements to be reasonable, no assurance can be

given that these expectations will prove to be correct and such

forward-looking statements included in this news release should not

be unduly relied upon. Such statements include those with respect

to: (i) management belief that the Company’s business will continue

to strengthen; (ii) management’s expectation that the Company’s

production and sales of hydrovac trucks in North America in 2022

will continue to grow; (iii) management’s expectation that the

Company will be able to capitalize on the significantly increased

capacity of its owned facility in Red Deer over the long term; (iv)

the expectation that the Infrastructure Bill will lead to an

increase in infrastructure spending and result in job creations and

increased demand for construction and hydrovac trucks; (v) the

Company’s outlook for the 2022 fiscal year generally; (vi) the

Company’s expectation of adding new innovative products to its

product lines that cover infrastructure, telecom and oil and gas

industries; (vii) management’s belief in the positive impact of

securing key manufacturing components, including chassis, for

customers into future years through strategic relationships; (viii)

management’s belief in the positive impact of strengthened dealer

relationships in both Canada and US; (ix) management’s belief in

the positive impact of expanded North American coverage for

maintenance warranty and repair; and (x) the Company’s ability to

meet increased demand may be limited by factors including chassis

supply chain interruption due to chip shortages at the chassis

manufacturer level and other supply chain issues related to other

key components. These statements involve known and unknown risks,

uncertainties and other factors that may cause actual results or

events to differ materially from those anticipated in such

forward-looking statements. Actual results could differ materially

from those anticipated in these forward-looking statements as a

result of prevailing economic conditions, and other factors, many

of which are beyond the control of Tornado. Although Tornado

believes these statements to be reasonable, no assurance can be

given that these expectations will prove to be correct and such

forward-looking statements included in this news release should not

be unduly relied upon. The forward-looking statements contained in

this news release represent Tornado’s expectations as of the date

hereof and are subject to change after such date. Tornado disclaims

any intention or obligation to update or revise any forward-looking

statements whether as a result of new information, future events or

otherwise, except as may be required by applicable securities

regulations.

Neither the Exchange nor its Regulation

Service Provider (as that term is defined in policies of the

Exchange) accepts responsibility for the adequacy or accuracy of

this news release.

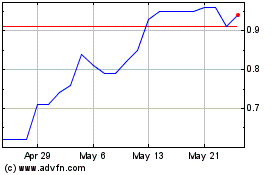

Tornado Infrastructure E... (TSXV:TGH)

Historical Stock Chart

From Nov 2024 to Dec 2024

Tornado Infrastructure E... (TSXV:TGH)

Historical Stock Chart

From Dec 2023 to Dec 2024