Tintina Mines Limited Provides Supplemental Disclosure Regarding Proposed Transaction with NSR Resources Inc.

November 19 2019 - 8:54AM

Tintina Mines Limited (“

Tintina” or the

“

Corporation”) (TSXV:TTS) wishes to provide

supplemental disclosure to Tintina’s management information

circular dated October 18, 2019 (the “

Circular”)

in respect of the Annual and Special Meeting of the Shareholders of

the Corporation to be held at 10:00 AM (EST) on November 27, 2019.

The supplemental disclosure will deal specifically with the

proposed transaction (the “

Transaction”) with NSR

Resources Inc. (“

NSR”), focusing on (i) the

formation of the special committees for each of the entities

involved in the Transaction, (ii) the calculation of the premium to

the valuation of NSR, and (iii) the background to the Transaction.

This news release should be read in conjunction with the Circular

as a whole. Capitalized terms not otherwise defined herein have the

meanings ascribed to such terms in the Circular.

Formation of the Special

Committee

Given the potential conflict of interest arising

from the fact that the directors and officers of each of Tintina

and NSR Resources Inc. (“NSR”) are the same

individuals, each of the entities attempted to adopt a process that

addressed this concern to the extent possible. Each entity took the

following steps to reduce the conflict of interest associated with

the Transaction:

- On August 12, 2019, the boards of directors of each entity

formed a special committee (each, a “Special

Committee”) with the objective to have each Special

Committee advise its respective entity on the Transaction and

potential alternatives to the Transaction.

- The Special Committee of each entity was comprised on the same

individuals, being Messrs. Carmelo Marrelli and Ricardo Landeta,

because they were the only independent directors of each entity. In

an effort to mitigate this conflict of interest, a determination

was made that the Chairman of each Special Committee should be

different. Thus, Mr. Carmelo Marrelli acted as the Chairman of the

Special Committee of Tintina and Mr. Ricardo Landeta acted as the

Chairman of the Special Committee of NSR.

- The Chairman of each committee was tasked with taking a lead

role in the process for its respective entity in terms of dealing

with external parties.

Calculation of the Premium to

Valuation

Following receipt of the valuation report from

Richter Advisory Group LLP, Tintina’s Special Committee reviewed

and considered several options relating to the premium to be added

to the value of NSR set out therein. In settling on a 30% premium

to be added to that value, Tintina’s Special Committees considered

the following factors:

- CMPG royalty agreement. NSR has an agreement with CMPG pursuant

to which NSR has a 2% royalty over certain properties in Fourniere

Township, Quebec (the “Royalty”). While the

Royalty is not producing value at this time, there is no expiry/end

date to the Royalty that would limit its potential return in the

future. Tintina’s Special Committee thus concluded that while it is

not possible at this time to determine when, and if, the Royalty

would generate value, its value at the present time, is not nil.

Accordingly, Tintina’s Special Committee took the view that NSR

shareholders should receive some value for the Royalty in the

consideration to be provided for their shares of NSR.

- Market practice. Tintina’s Special Committee reviewed the

premiums added in similar other transactions and considered 30% to

be within the range of market practice.

- Cost of raising capital in the market. Due to the difficulty in

obtaining funding for junior mining issuers in recent years, it was

determined that fees associated with raising the equivalent of the

cash presently held in NSR through a brokered private placement

(taking into account selling commissions, due diligence/marketing

allowances, broker/wholesaler fees, organization + offering

expenses, etc.) would result in Tintina spending a significant

amount (in cash) of what the premium would amount to, making the

Transaction that much more valuable in terms of additions to the

book value of Tintina.

- Addition over book value. Tintina took the view that to

incentivize the NSR shareholders to entertain the transaction, it

had to offer them some amount above book value. If Tintina offered

a small premium or none at all, NSR shareholders would likely not

have thought the transaction to be worthwhile and the alternative

was an orderly liquidation where the cash on hand would be

distributed to the shareholders. Tintina’s Special Committees

considered a range of values between 20% and 40% and based on the

factors noted above, determined that 30% was an appropriate

premium.

Background of the

Transaction

Prior to initiating the process of the proposed

transaction with NSR, Tintina’s board of directors and management

discussed the Corporation’s current financial condition in that

Tintina has a potentially viable mineral property but no funds to

advance it and low prospects of funding becoming available in the

near future. Maintaining the status quo means that Tintina would

likely liquidate imminently, resulting in no additional shareholder

value. Instead, it was determined that an assessment of strategic

alternatives was necessary in order to continue the business and

enhance value for its shareholders.

In analyzing its options, Tintina considered the

potential of being acquired by another entity. However, based on

past experience, this was determined not to be a viable option.

Tintina then considered the potential for

acquiring a new target, of which NSR’s circumstances presented a

practical opportunity for this. Tintina was aware of NSR’s cash

position, that NSR recently sold its main mineral property and the

fact that NSR found itself in a complementary position to Tintina

(in possession of funding but with no viable properties to

advance). Furthermore, just like Tintina, maintaining the status

quo for NSR meant that it would likely liquidate imminently,

resulting in no additional shareholder value.

Tintina considered the following potential

benefits of the Transaction:

- The complementary positions of each of Tintina and NSR meant

that Tintina could use NSR’s funds to continue the exploration and

advancement of its existing properties, generating value to

Tintina’s shareholders.

- The costs and fees associated with the maintenance of each

entity, such as audits, insurance, executive/management/board

costs, transfer agent services and legal services would be reduced

as they would need to be conducted for one entity only. In that

regard, an aggregate reduction in costs was estimated to be

approximately $100,000.

- Tintina’s largest shareholder would be diluted, generating a

larger public float that could have positive effects on the

attractiveness and liquidity of Tintina’s shares.

- There was potential to generate additional value through the

Royalty.

Based on this assessment, the Transaction was

determined to be the best possible outcome for the shareholders of

each of the entities involved.

About Tintina

Tintina is a Canadian-based company with over

twenty years of experience in the junior mining industry. Tintina

currently owns two main properties, both of which are located in

Yukon. The common shares of Tintina are listed for trading on the

TSXV under the symbol “TTS”.

For further information, please

contact:

Tintina Mines LimitedMr. Jing

Peng82 Richmond Street EastToronto, Ontario M5C 1P1 Phone:

(416) 848-9888 Email: jpeng@marrellisupport.ca

Forward-looking Statements

This press release contains forward-looking

statements. Forward-looking statements involve known and unknown

risks, uncertainties and assumptions and accordingly, actual

results and future events could differ materially from those

expressed or implied in such statements. You are hence cautioned

not to place undue reliance on forward-looking statements. All

statements other than statements of present or historical fact are

forward-looking statements, including statements with respect to

the LOI and the likelihood that the definitive agreement(s) will be

entered into and that the Transaction will be consummated on the

terms and timeline provided herein or at all, the benefits of the

Transaction to Tintina and NSR and the receipt of all required

approvals including without limitation the shareholders of NSR and

applicable stock exchanges. Forward-looking statements include

words or expressions such as “proposed”, “will”, “subject to”,

“near future”, “in the event”, “would”, “expect”, “prepared to” and

other similar words or expressions. Factors that could cause future

results or events to differ materially from current expectations

expressed or implied by the forward-looking statements include

general business, economic, competitive, political and social

uncertainties; the state of capital markets; risks relating to (i)

the ability of the Tintina and NSR to fulfill the terms of the

Combination Agreement and complete the Transaction (ii) the impact

on the respective businesses, operations and financial condition of

Tintina and NSR resulting from the announcement of the Transaction

and/or the failure to complete the Transaction on terms described

or at all, (iii) a third party competing bid materializing prior to

the completion of the Transaction, (iv) delay or failure to receive

board, shareholder regulatory or court approvals, where applicable,

or any other conditions precedent to the completion of the

Transaction, (v) unforeseen challenges in integrating the

businesses of Tintina and NSR, (vi) failure to realize the

anticipated benefits of the Transaction, (vii) other unforeseen

events, developments, or factors causing any of the aforesaid

expectations, assumptions, and other factors ultimately being

inaccurate or irrelevant; and other risks described in Tintina’s

and NSR’s documents filed with Canadian securities regulatory

authorities. You can find further information with respect to these

and other risks in filings made with the Canadian securities

regulatory authorities and available at www.sedar.com. We disclaim

any obligation to update or revise these forward-looking

statements, except as required by applicable law.

Neither the TSXV nor its Regulation Services Provider

(as that term is defined in the policies of the TSXV) accepts

responsibility for the adequacy or accuracy of this press

release.

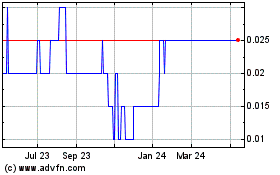

Tintina Mines (TSXV:TTS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Tintina Mines (TSXV:TTS)

Historical Stock Chart

From Jan 2024 to Jan 2025