Tintina Mines Limited (“Tintina” or the “Company”) (TSXV: TTS) is

pleased to announce that it has entered into an agreement dated as

of today’s date with Andean Belt Resources SpA (“ABR”), a mining

exploration company incorporated under the laws of Chile, to

acquire a 65%-75% equity ownership interest in ABR for cash

consideration in the amount of $4,000,000 (USD). As described in

greater detail below, ABR is a related party of the Company. The

terms of the agreement are set out in a term sheet signed by both

of the parties, and it is anticipated that a definitive agreement

regarding the transaction will be negotiated and entered into in

due course.

ABR owns approximately 22,819 hectares across

five different properties in Chile, with the flagship property

being the Domeyko Sulfuros project in Northern Chile. Management

believes that this investment will enable the Company to gain a

majority interest in the ABR portfolio which will also grant it

access to high quality exploration projects located in a

geographically favourable setting in Chile. It is anticipated that,

as a result of the acquisition, the Company will hold between

65%-75% of the issued and outstanding share capital of ABR, with

the exact percentage to be determined based on due diligence and

exchange rates. As described below, this will be a related party

transaction for the Company.

The funds provided as consideration for the

acquisition are intended to be used primarily to finance

exploration and technical studies at the Domeyko Sulfuros property

in Chile. The immediate plan will be to conduct a comprehensive

exploration of the primary sulfide mineralization at the Domeyko

Sulfuros property, with the central objective of advancing the

project towards a resource definition stage supported by reports

generated in accordance with international standards.

“We are excited about this investment, our first

outside of Canada, since this gives us access to a world-class

exploration portfolio with great potential to generate substantial

value to our shareholders,” stated Eugenio Ferrari, CEO and

Director of Tintina Mines.

In addition, the Company also has reached an

agreement with its shareholder and sole creditor, Mr. Juan Enrique

Rassmuss, to fully reorganize the Company’s debt (currently in the

amount of $12,071,484.57 (CAD)). The proposed debt reorganization

would take place through two processes. The first is a partial

conversion through the issuance of the lower of (i) 252,382,833 new

common shares of the Company and (ii) such number of common shares

of the Company that would result in no less than 10% of the common

shares of the Company being in the “public float” (as defined in

the policies of the TSX Venture Exchange), at a price of $0.03 per

common share for an aggregate of up to $7,571,484.57 (CAD). The

second component of the debt reorganization is the restructuring

and reprofiling of the remaining debt (in the amount of

approximately $4,500,000 (CAD)) that is anticipated to enhance the

investment profile of the Company mainly by eliminating the current

shareholders' deficiency and suspending the on-demand condition for

a period of two years. This will be a related party transaction for

the Company and will only be completed subject to the approval of

the investment in ABR.

Both of the transactions described above are

subject to all necessary regulatory and other approvals, including

but not limited to the approval of the TSX Venture Exchange and the

approval of the shareholders of the Company. Additional terms and

details relating to each of the transactions described herein will

be provided in further press releases.

Both of the transactions described above are

“related party transactions” under the policies of the TSX Venture

Exchange and Multilateral Instrument 61-101 Protection of Minority

Security Holders in Special Transactions (“MI 61-101”) due to the

involvement of Mr. Juan Enrique Rassmuss in each transaction. Mr.

Rassmuss is the President and Chairman and a director of the

Company, and also holds approximately 30% of the issued and

outstanding common shares of the Company. With respect to the

investment into ABR, the local ownership entity for the ABR

properties is affiliated with the Rassmuss Group of Companies, a

diversified conglomerate with over 50 years of experience operating

across various industries, including mining, oil and gas,

metallurgy, and textiles in South America. Juan Enrique Rassmuss is

the President and CEO of the Rassmuss Group.

As these are related party transactions,

shareholder approval on a disinterested basis will be required in

order to each of them to proceed. The Company intends to rely on

the exemption from the valuation requirement found in section

5.5(b) of MI 61-101.

With respect to the transactions described in

this press release: (i) there are no finder’s fees payable; and

(ii) the Company is not taking on any long term debt.

Trading in the common shares of the Company is

currently halted and it is not anticipated that trading will resume

prior to the completion of the transactions described herein.

About Tintina

Tintina is a Canadian-based company with over

twenty years of experience in the junior mining industry. Tintina

currently owns two main properties, both of which are located in

Yukon. The common shares of Tintina are listed for trading on the

TSXV under the symbol “TTS”.

Tintina Contact:

Tintina Mines LimitedMr. Jing Peng82 Richmond Street

EastToronto, OntarioM5C 1P1Phone: (416)

848-9888Email: jpeng@marrellisupport.ca

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Forward-looking Statements

This press release contains forward-looking

statements. Forward-looking statements involve known and unknown

risks, uncertainties and assumptions and accordingly, actual

results and future events could differ materially from those

expressed or implied in such statements. You are hence cautioned

not to place undue reliance on forward-looking statements. All

statements other than statements of present or historical fact are

forward-looking statements and the forward-looking statements in

this press release include but are not limited to statements

regarding completion of the transactions described in this press

release on the terms described herein, or at all, and the potential

benefits of such transactions. Forward-looking statements include

words or expressions such as “proposed”, “will”, “subject to”,

“near future”, “in the event”, “would”, “expect”, “prepared to” and

other similar words or expressions. Where the Company expresses or

implies an expectation or belief as to future events or results,

such expectation or belief is based on assumptions made in good

faith and believed to have a reasonable basis. Such assumptions

include, without limitation: that existing the Company will be able

to negotiate definitive terms with respect to the transactions

described herein on the terms as currently expected or at all; and

that the Company will be able to receive all necessary approvals

that are required in order to complete such transactions.

Factors that could cause future results or

events to differ materially from current expectations expressed or

implied by the forward-looking statements include: the risk that

the terms of a definitive agreement cannot be reached or cannot be

reached; the risk that the Company will not obtain all necessary

approvals for the transactions described herein to proceed; general

business, economic, competitive, political and social

uncertainties; the state of capital markets; failure to realize the

anticipated benefits of the transactions described herein; other

unforeseen events, developments, or factors causing any of the

aforesaid expectations, assumptions, and other factors ultimately

being inaccurate or irrelevant; and any risks associated with the

ongoing COVID-19 pandemic.

You can find further information with respect to

these and other risks in filings made with the Canadian securities

regulatory authorities that are available at www.sedarplus.ca. The

Company disclaims any obligation to update or revise these

forward-looking statements, except as required by applicable

law.

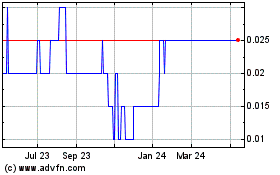

Tintina Mines (TSXV:TTS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Tintina Mines (TSXV:TTS)

Historical Stock Chart

From Dec 2023 to Dec 2024