Voxtur Analytics Corp. (TSXV: VXTR; OTCQB: VXTRF) ("Voxtur" or the

"Company"), a North American technology company creating a more

transparent and accessible real estate lending ecosystem, is

pleased to announce the signing of an exclusive platform agreement

with The Mortgage Collaborative (“TMC”), America’s largest

independent cooperative network for the mortgage industry that

includes both community banks and non-bank lenders. Voxtur will

make available to over 250 TMC members its complete digital

ecosystem to support the mortgage lifecycle. More specifically,

Voxtur’s mortgage asset trading platform, Blue Water, will deliver

a software-as-a-service (SaaS) solution to facilitate the purchase

and sale of mortgage assets, including first mortgage agency whole

loans, mortgage servicing rights, second liens, and non-QM

mortgages. The Blue Water platform facilitates pricing, trading,

reviewing, transferring, and funding of mortgage assets and

portfolios in the secondary market.

“This is a tremendous opportunity for Voxtur,

TMC, and its members,” said Gary Yeoman, CEO of Voxtur. “Our

mortgage asset trading platform is built to deliver high volume

trading and create efficient liquidity. We have successfully

deployed similar platforms and I am confident that TMC and its

members will realize value.”

As the market recovers, lenders need increased

revenue and liquidity. For mid to small sized lenders with small

servicing portfolios, operational friction and high costs result in

reduced investor demand and opportunities. Further, smaller

portfolios command lower proceeds which naturally disadvantages

many originators and prohibits optimum liquidity. TMC can now

provide its members with the most sophisticated, efficient, and

unique platform for trading asset portfolios of any size. Blue

Water’s all-digital trading solution verifies critical loan data,

conducts a high-level review of underwriting and investor

eligibility, and offers real-time exception remediation management

to minimize underwriting risk and avoid costly rep and warrant

claims. Blue Water’s data transfer application does not use

sampling, but instead verifies every loan file, and does so at an

attractive price point.

“This is a compelling use case for our members,

and I expect that we will see meaningful adoption," said David

Kittle, Chairman of TMC. "These have been difficult times for so

many of our members and this type of platform will provide

tremendous value to support them in driving revenue and solving for

liquidity needs at scale.”

The Blue Water-TMC platform is expected to go

live within the next few weeks with a soft-launch at the Mortgage

Bankers Association Secondary and Capital Markets Conference and

Expo in New York early next week.

About The Mortgage Collaborative

Based in San Diego, California, the Mortgage

Collaborative was founded in 2013 to empower mortgage lenders

across the country with better financial execution, reduced costs,

enhanced expertise and improved compliance, as well as helping

members access the dynamic and changing consumer base in America.

The cooperative is managed by its founding members, John Robbins,

CMB; David Kittle, CMB; Gary Acosta, CEO of the National

Association of Hispanic Real Estate Professionals (NAHREP); and Jim

Park, former chair of the Asian Real Estate Association of America

(AREAA). Robbins and Kittle are former chairmen of the Mortgage

Bankers Association of America. For more information

visit: http://www.mortgagecollaborative.com/ or contact

tgalluci@mtgcoop.com

About Voxtur

Voxtur is a transformational real estate

technology company that is redefining industry standards in a

dynamic lending environment. The Company offers targeted data

analytics to simplify tax solutions, property valuation and

settlement services throughout the lending lifecycle for investors,

lenders, government agencies and servicers. Voxtur's proprietary

data hub and workflow platforms more accurately and efficiently

value assets, originate and service loans, securitize portfolios

and evaluate tax assessments. The Company serves the property

lending and property tax sectors, both public and private, in the

United States and Canada. For more information, visit

www.voxtur.com.

Forward-Looking Information

This news release contains "forward-looking

information" within the meaning of applicable Canadian securities

legislation. Forward-looking information includes, but is not

limited to, statements with respect to the MCTO and the filing of

the Required Filings. Generally, forward-looking information can be

identified by the use of forward-looking terminology such as

"plans", "expects" or "does not expect", "is expected", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates" or

"does not anticipate", or "believes", or variations of such words

and phrases or state that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be

achieved". Forward-looking information is subject to known and

unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements of

the Company, as the case may be, to be materially different from

those expressed or implied by such forward-looking information.

Such risks, uncertainties and other factors include, but are not

limited to the ability of the Company to successfully launch the

Blue Water-TMC platform; the adoption by TMC members of the

platform; and general business, economic, competitive, political

and social uncertainties. Although the Company has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

information, there may be other factors that cause results not to

be as anticipated, estimated or intended. There can be no assurance

that such information will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking information. The Company does not

undertake to update any forward-looking information, except in

accordance with applicable securities laws.

This forward-looking information is provided as

of the date of this news release and, accordingly, is subject to

change after such date. The Company does not assume any obligation

to update or revise this information to reflect new events or

circumstances except as required in accordance with applicable

laws.

NEITHER THE TSXV NOR ITS REGULATION SERVICES

PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSXV)

ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS

RELEASE.

Voxtur’s common shares are traded on the TSXV

under the symbol VXTR and in the US on the OTCQB under the symbol

VXTRF.

Contact:

Jordan RossChief Investment Officer Tel: (416)

708-9764jordan@voxtur.com

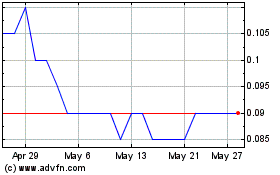

Voxtur Analytics (TSXV:VXTR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Voxtur Analytics (TSXV:VXTR)

Historical Stock Chart

From Dec 2023 to Dec 2024