Western Atlas Resources Inc. (“

Western Atlas” or

the “

Company”) (TSXV:

WA), is

pleased to announce that pursuant to the Company’s press release

issued on September 3, 2019, the Company has signed a Share

Purchase Agreement to acquire from Gran Colombia Gold Corp.

(“

Gran Colombia”) (TSX:

GCM) all of the outstanding shares of Medoro

Resources International Ltd., and it has closed the first tranche

of its previously announced non-brokered private placement issuing

a total of 22,255,883 flow-through and non-flow through units (the

“

Units”) representing 22,255,883 common shares and

11,127,941 warrants of the Company for C$1,900,000.

In connection with completion of the first

tranche of the placement, the Company paid cash commissions of

C$16,000 and 220,076 finder’s warrants to finders who introduced

certain subscribers. Each finder’s warrant is exercisable for one

common share of Western Atlas at a price of C$0.20 per share for a

period of two years from the closing of this first tranche of the

private placement. All securities issued in connection with the

first tranche of the placement are subject to a hold period

expiring February 10, 2020.

Board Change

Upon closing of the first tranche of the private

placement, the board of directors of Western Atlas was

reconstituted such that Miguel de la Campa, Vice Chairman of Gran

Colombia, has been appointed to the board of the Company. A new

board position will be created and an additional nominee of Gran

Colombia will be nominated for election to the board of Western

Atlas at its next annual general meeting.

“I would like to welcome Miguel de la Campa to

the Company’s board and look forward to working with him. On behalf

of the Company I would like to thank Michael Galego for his support

and contribution to Western Atlas over the course of the past two

years,” commented Fabio Capponi, Chief Executive Officer of Western

Atlas.

Early Warning

Gran Colombia acquired 15,910,588 Units of the

Company in the placement, and now holds an aggregate of 15,910,588

common shares and 7,955,294 share purchase warrants. Gran Colombia

previously did not hold any securities of the Company. The common

shares acquired by Gran Colombia represent approximately 19.9% of

the outstanding common shares of Western Atlas as at closing of the

first tranche of the placement. Assuming the exercise of the share

purchase warrants, Gran Colombia would have control and direction

over 23,865,882 common shares representing approximately 27.1% of

the then outstanding common shares of the Company, after giving

effect to the exercise of Gran Colombia’s warrants but assuming no

exercise of any other outstanding warrants or options of the

Company. Western Atlas has agreed to seek disinterested shareholder

approval for Gran Colombia becoming a “control person” of the

Company at a special meeting of its shareholders to be held on

December 6, 2019. Gran Colombia has undertaken not to

exercise the warrants it purchased in the placement until such

approval has been obtained.

Gran Colombia has acquired the Units for

investment purposes and has no present intention to acquire further

securities of the Company, although it may in the future acquire or

dispose of securities of the Company, through the market, privately

or otherwise, as circumstances or market conditions warrant.

In connection with the closing of the first

tranche of this private placement 0852662 B.C. Ltd.

(“085”) and Fabio Capponi (“Mr.

Capponi”) have acquired 1,200,883 Units of the Company

consisting of 1,200,883 common shares and 600,442 warrants. 085 is

a company owned and controlled by the Company’s CEO, Fabio Capponi.

Upon completion of this first tranche of the private placement, Mr.

Capponi will have control and direction over 16,215,253 common

shares and 725,442share purchase warrants of the Company,

representing approximately 20.3% of the issued and outstanding

common shares of the Company or 21.6% on a partially diluted basis,

assuming the exercise of Mr. Capponi’s warrants and stock options

held by him.

Mr. Capponi has acquired the securities of the

Company for investment purposes and has no present intention to

acquire further securities of the Company, although he may in the

future acquire or dispose of securities of the Company, through the

market, privately or otherwise, as circumstances or market

conditions warrant.

Copies of the early warning reports filed by

Gran Colombia, and Mr. Capponi, in connection with the private

placement will be available under the Company’s profile on SEDAR

(www.sedar.com), or by contacting the Company. The transaction is

also subject to the approval of the TSX Venture Exchange.

About Western Atlas

The Company’s common share are listed on the TSX

Venture Exchange under the symbol WA. Western Atlas is focused on

the acquisition and development of scalable precious metals

projects in premier mining jurisdictions. Western Atlas’s

wholly-owned subsidiary, 5530 Nunavut Inc., which was incorporated

under the laws of Nunavut, and registered under the Business

Corporations Act (Northwest Territories) on November 24, 2016,

holds its interest in the Meadowbank project located in Nunavut,

Canada.

For further information, please visit

our website at www.westernar.com or contact:

Fabio Capponi, Chief

Executive Officer

604-256-4777 or info@westernar.com

Cautionary Statement Regarding

Forward-Looking Information

This news release includes certain

“forward-looking statements” under applicable Canadian securities

legislation that are not historical facts. Forward-looking

statements involve risks, uncertainties, and other factors that

could cause actual results, performance, prospects, and

opportunities to differ materially from those expressed or implied

by such forward-looking statements. Forward-looking statements in

this news release include, but are not limited to, statements with

respect to the Company’s objectives, goals or future plans; the

receipt of the requisite approvals with respect to the business and

operations of the Company. Forward-looking statements are

necessarily based on a number of estimates and assumptions that,

while considered reasonable, are subject to known and unknown

risks, uncertainties and other factors which may cause actual

results and future events to differ materially from those expressed

or implied by such forward-looking statements. Such factors

include, but are not limited to: general business, economic and

social uncertainties; litigation, legislative, environmental and

other judicial, regulatory, political and competitive developments;

delay or failure to receive board, shareholder or regulatory

approvals; those additional risks set out in Western Atlas’s public

documents filed on SEDAR at www.sedar.com; and other matters

discussed in this news release. Although Western Atlas believes

that the assumptions and factors used in preparing the

forward-looking statements are reasonable, undue reliance should

not be placed on these statements, which only apply as of the date

of this news release, and no assurance can be given that such

events will occur in the disclosed time frames or at all. Except

where required by law, Western Atlas disclaims any intention or

obligation to update or revise any forward-looking statement,

whether as a result of new information, future events, or

otherwise.

Reader Advisory

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

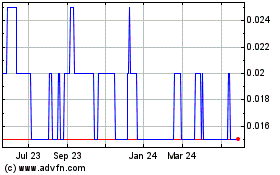

Western Atlas Resources (TSXV:WA)

Historical Stock Chart

From Jan 2025 to Feb 2025

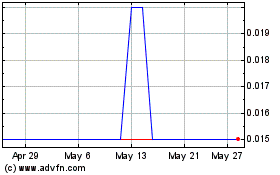

Western Atlas Resources (TSXV:WA)

Historical Stock Chart

From Feb 2024 to Feb 2025