Gran Colombia Announces CA$14 Million Investment in Caldas Gold to Fund the Juby Project Acquisition Closing on July 2, 2020

June 30 2020 - 6:07PM

Gran Colombia Gold Corp. (TSX: GCM; OTCQX: TPRFF) announced today

that it has acquired 7,000,000 common shares of Caldas Gold Corp.

(“Caldas Gold”) in a non-brokered private placement at a price of

CA$2.00 per share for a total investment of CA$14,000,000 (the

“Private Placement”). The proceeds of the Private Placement will be

used by Caldas Gold on July 2, 2020 to complete the acquisition of

South American Resources Corp. (“SARC”). SARC has completed the

acquisition of certain mining assets in Northeastern Ontario,

including a 100% interest in the Juby Project and a 25% joint

venture interest in certain claims adjoining the Juby Project. The

common shares acquired by Gran Colombia are subject to a four-month

hold period expiring on October 31, 2020.

The Juby Project is an advanced

exploration-stage gold project located approximately 15 km

west-southwest of the town of Gowganda and 100 km south-southeast

of the Timmins gold camp within the Shining Tree area in the

southern part of the Abitibi greenstone belt. Over 14,000 acres are

controlled through the patented claims of the Juby Project covering

10 km strike length on the mineralized trend.

Prior to the completion of Private Placement,

Gran Colombia owned, directly or indirectly, or exercised control

or direction over, 37,547,100 common shares and 7,500,000 share

purchase warrants of Caldas Gold (the “Warrants”), with each

Warrant entitling Gran Colombia to acquire one common share of

Caldas Gold. The 37,547,100 common shares represented

approximately 74.4% of the total number of issued and outstanding

common shares of Caldas Gold prior to the Private Placement and if

all of the Warrants were exercised, Gran Colombia would have owned,

directly or indirectly, or exercised control or direction over,

45,047,100 common shares, or approximately 77.7% of the total

number of issued and outstanding common shares of Caldas Gold on a

partially diluted basis prior to the Private Placement.

After the completion of the Private Placement,

Gran Colombia now owns, directly or indirectly, or exercises

control or direction over, 44,547,100 common shares of Caldas Gold,

representing approximately 77.5% of the total number of issued and

outstanding common shares, resulting in a 3.1% change to Gran

Colombia’s holdings of common shares of Caldas Gold. If all of the

Warrants were exercised, Gran Colombia would own, directly or

indirectly, or exercise control or direction over, 52,047,100

common shares, or approximately 80.1% of the total number of issued

and outstanding Common Shares, resulting in an increase of 2.4% to

Gran Colombia’s holdings of common shares of Caldas Gold on a

partially diluted basis after the completion of the Private

Placement.

In connection with the acquisition of SARC,

Caldas Gold will issue 20,000,000 common shares (the “Consideration

Shares”) to current shareholders of SARC and will have funded

SARC’s acquisition of the Juby Project and adjoining claims.

Certain shareholders of SARC have entered into voluntary lock-up

agreements with Caldas Gold pursuant to which such security

holders, holding approximately 87% of the Consideration Shares,

have agreed to voluntarily lock-up their Consideration Shares for a

period of two years from the closing date of the Transaction. No

insiders of Caldas Gold or Gran Colombia will receive any of the

Consideration Shares. Following the acquisition of SARC, Gran

Colombia will have a 57.5% equity interest in the issued and

outstanding shares of Caldas Gold.

About Gran Colombia Gold

Corp.

Gran Colombia is a Canadian-based mid-tier gold

producer with its primary focus in Colombia where it is currently

the largest underground gold and silver producer with several mines

in operation at its high-grade Segovia Operations. Gran Colombia

owns approximately 77% of Caldas Gold Corp., a Canadian mining

company currently advancing a prefeasibility study for a major

expansion and modernization of its underground mining operations at

its Marmato Project in Colombia. Gran Colombia’s project pipeline

includes its Zancudo Project in Colombia together with an

approximately 21% equity interest in Gold X Mining Corp. (TSXV:

GLDX) (Guyana – Toroparu) and an approximately 20% equity interest

in Western Atlas Resources Inc. (“Western Atlas”) (TSX-V: WA)

(Nunavut – Meadowbank).

Additional information on Gran Colombia can be

found on its website at www.grancolombiagold.com and by reviewing

its profile on SEDAR at www.sedar.com.

Cautionary Statement on Forward-Looking

Information:

This news release contains "forward-looking

information", which may include, but is not limited to, statements

with respect to anticipated business plans or strategies. Often,

but not always, forward-looking statements can be identified by the

use of words such as "plans", "expects", "is expected", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates", or

"believes" or variations (including negative variations) of such

words and phrases, or state that certain actions, events or results

"may", "could", "would", "might" or "will" be taken, occur or be

achieved. Forward-looking statements involve known and unknown

risks, uncertainties and other factors which may cause the actual

results, performance or achievements of Gran Colombia to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements. Factors that could cause actual results to differ

materially from those anticipated in these forward-looking

statements are described under the caption "Risk Factors" in the

Company's Annual Information Form dated as of March 30, 2020 which

is available for view on SEDAR at www.sedar.com. Forward-looking

statements contained herein are made as of the date of this press

release and Gran Colombia disclaims, other than as required by law,

any obligation to update any forward-looking statements whether as

a result of new information, results, future events, circumstances,

or if management's estimates or opinions should change, or

otherwise. There can be no assurance that forward-looking

statements will prove to be accurate, as actual results and future

events could differ materially from those anticipated in such

statements. Accordingly, the reader is cautioned not to place undue

reliance on forward-looking statements.

For Further Information,

Contact:Mike DaviesChief Financial Officer(416)

360-4653investorrelations@grancolombiagold.com

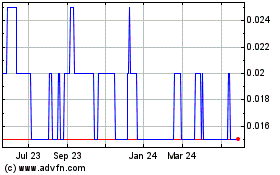

Western Atlas Resources (TSXV:WA)

Historical Stock Chart

From Jan 2025 to Feb 2025

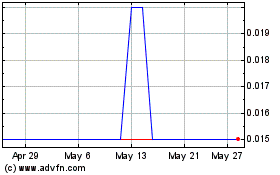

Western Atlas Resources (TSXV:WA)

Historical Stock Chart

From Feb 2024 to Feb 2025