Gran Colombia Gold Reports Second Quarter and First Half 2020 Results; Announces Quarterly Dividend Program

August 13 2020 - 6:45PM

Gran Colombia Gold Corp. (TSX: GCM; OTCQX: TPRFF) announced today

the release of its unaudited interim condensed consolidated

financial statements and accompanying management’s discussion and

analysis (MD&A) for the three months ended March 31, 2020. All

financial figures contained herein are expressed in U.S. dollars

(“USD”) unless otherwise noted.

Serafino Iacono, Executive Chairman of Gran

Colombia, commenting on the Company’s latest results, said, “Our

first quarter results continued to show strength, and that was when

gold was more than $100 an ounce lower than where we are now.

Quarterly revenue surpassed $100 million for the first time leading

to adjusted EBITDA of $50 million. Operating cash flow and Free

Cash Flow were up over 50% compared with the first quarter last

year. The balance sheet also got stronger as we built up our

consolidated cash position to about $100 million and by the end of

April, we had reduced our Gold Notes by 40% since the beginning of

the year. We are very pleased that Caldas Gold is up and running

now. Drilling results from the Deep Zone at Marmato continue to be

impressive and the PFS remains on track for mid-year. I am also

very proud of what our Company has been able to do during COVID-19

to help out the communities in which we live and work. These are

definitely unprecedented times and our people have done a

tremendous job keeping our operations going while ensuring we all

do the right thing to keep our workers safe.”

Second Quarter and First Half 2020

Highlights

- Gran Colombia’s gold production in the first

quarter of 2020 was 56,247 ounces produced compared with 60,601

ounces in the first quarter last year. The Company’s mines have

continued to operate during the national quarantine implemented in

Colombia in late March. However, restrictions on movement of people

between communities has limited the availability of workers at the

mines. Although April’s gold production totalled 12,602 ounces,

about 65% of the average monthly volume over the last 12 months,

the situation has improved and the Segovia Operations have been

operating at about 95% of normal since mid-April.

- During the COVID-19 quarantine, the Company has stepped up its

efforts to support the local communities in which it operates,

providing medical equipment, supplies and sanitation kits to the

local hospitals and groceries to families who have been

economically affected by the COVID-19 crisis.

- Revenue amounted to $101.0 million in the

first quarter of 2020, up 30% over the first quarter last year,

getting a boost from the 21% increase in spot gold prices which

increased the Company’s realized gold price to an average of $1,570

per ounce sold compared with $1,298 per ounce sold in the first

quarter last year. The volume of gold sales in the first quarter of

2020 was also up 8% over the first quarter last year, benefitting

from a reduction in mineral inventories following a build up during

the refinery shutdown during the holiday period at the end of

2019.

- Total cash costs (1) per ounce averaged $667

per ounce in the first quarter of 2020 compared with $621 per ounce

in the first quarter last year. Segovia’s total cash costs were

$604 per ounce in the first quarter of 2020 and Marmato’s total

cash costs of $1,215 per ounce reflected the impact of additional

costs associated with the commencement of mine optimization

activities and the adverse impact on production in January of a

temporary explosives shortfall.

- All-in sustaining costs (“AISC”)

(1) and All-in costs (1) of $890 per

ounce and $978 per ounce, respectively, in the first quarter of

2020 reflected increased levels of capital and exploration spending

and arbitration-related costs in G&A, compared with $832 per

ounce and $843 per ounce, respectively, in the first quarter last

year.

- The Company reported adjusted EBITDA (1) of

$50.4 million for the first quarter of 2020, up 43% over the first

quarter last year, benefitting from the stronger revenue

performance in the first quarter of 2020.

- Net cash provided by operating activities in

the first quarter of 2020 of $31.8 million was up 60% over the

first quarter last year fuelling a 57% increase in the Company’s

Free Cash Flow (1) in the first quarter of 2020 to

$17.8 million from $11.3 million in the first quarter last year.

- The Company’s balance sheet strengthened in

the first quarter of 2020 as total cash increased to $99.7 million

at the end of March 2020 from $84.2 million at the end of 2019.

Meanwhile, the Company used $21.1 million from the net proceeds of

a CA$40 million ($30.1 million) private placement completed in

February to redeem 30% of its Gold Notes ahead of schedule. At

April 30, 2020, the aggregate principal amount of Gold Notes

outstanding was down to $41.3 million.

- The Company completed the spin-out of its Marmato

Mining Assets through a reverse takeover transaction. The

Company has a 74.4% interest in the resulting issuer, named Caldas

Gold Corp., which commenced trading on the TSX Venture Exchange on

February 28, 2020 under the symbol “CGC”.

- As of May 15, 2020, the total issued and outstanding

common shares of the Company is 61.3 million and after

inclusion of stock options, warrants and the Convertible

Debentures, the Company’s fully diluted common shares would total

approximately 89.4 million.

- The Company reported net income for the first

quarter of 2020 of $24.3 million ($0.42 per share) compared with

net income of $7.9 million ($0.16 per share) in the first quarter

last year. Adjusted net income (1) for the first

quarter of 2020 was $21.2 million ($0.37 per share), up from $13.0

million ($0.27 per share) in the first quarter last year. The

year-over-year improvement in adjusted net income for the first

quarter of 2020 largely reflects the positive impact of the

Company’s revenue growth resulting from higher gold prices in 2020

and the increased volume of gold sales in the current period.

- The Company has successfully completed Phase 2 of its 2019

infill drilling program in the Zona Baja Deep Zone at

Marmato which focused above the 600 meter level and was

designed to provide enough tonnes and grade in the Measured and

Indicated mineral resource categories within the Main Zone to

support the prefeasibility study (“PFS”) which is currently being

carried out and is expected to be finalized by mid-2020. The

Company’s exploration program was also successful in extending the

recently discovered New Zone along strike to more than 400 meters,

opening up an opportunity for further mineral resource

expansion.

- Gran Colombia recently signed a Letter of Intent with

Renergetica Colombia S.A.S. to acquire, through its Segovia

Operations, a solar project with a total installed

capacity of 11.2 MW of power called “Suarez”, to be located in the

Tolima Region of Colombia.

Selected Financial

Information

| |

|

|

|

First Quarter |

| |

|

|

|

|

2020 |

|

2019 |

|

| |

Operating

data |

|

|

|

|

|

| |

Gold produced (ounces) |

|

|

|

56,247 |

|

60,601 |

|

| |

Gold sold (ounces) |

|

|

|

63,701 |

|

59,045 |

|

| |

Average realized gold price ($/oz sold) |

|

|

$ |

1,570 |

$ |

1,298 |

|

| |

Total cash costs ($/oz sold) (1) |

|

|

|

667 |

|

621 |

|

| |

AISC ($/oz sold) (1) |

|

|

|

890 |

|

832 |

|

| |

All-in costs ($/oz sold) (1) |

|

|

|

978 |

|

843 |

|

| |

|

|

|

|

|

| |

Financial

data ($000’s, except per share amounts) |

|

|

|

|

| |

Revenue |

|

|

$ |

100,976 |

$ |

77,455 |

|

| |

Adjusted EBITDA (1) |

|

|

|

50,437 |

|

35,275 |

|

| |

Net income |

|

|

|

24,255 |

|

7,903 |

|

| |

Per share - basic |

|

|

|

0.42 |

|

0.16 |

|

| |

Per share - diluted |

|

|

|

0.42 |

|

0.16 |

|

| |

Adjusted net income (1) |

|

|

|

21,232 |

|

13,015 |

|

| |

Per share - basic |

|

|

|

0.37 |

|

0.27 |

|

| |

Per share - diluted |

|

|

|

0.31 |

|

0.24 |

|

| |

Net cash provided by operating activities |

|

|

|

31,811 |

|

19,818 |

|

| |

Free cash flow (1) |

|

|

|

17,831 |

|

11,277 |

|

|

|

March 31, |

December 31, |

|

|

|

|

2020 |

|

2019 |

|

|

|

|

|

|

| Balance

sheet ($000’s): |

|

|

|

|

Cash and cash equivalents |

$ |

99,705 |

$ |

84,239 |

|

|

Gold Notes, including current portion – principal amount

outstanding (2) |

|

44,713 |

|

68,750 |

|

|

Convertible Debentures – principal amount outstanding (3) |

CA20,000 |

CA20,000 |

|

- Refer to “Non-IFRS Measures” in the Company’s MD&A.

- The Gold Notes are recorded in the Interim Financial Statements

at fair value. At March 31, 2020 and December 31, 2019, the

carrying amounts of the Gold Notes outstanding were $44.4 and $69.0

million, respectively.

- The Convertible Debentures are recorded in the Interim

Financial Statements at fair value. At March 31, 2020 and December

31, 2019, the carrying amount of the Convertible Debentures

outstanding was $15.1 million and $21.1 million, respectively.

Second Quarter and First Half 2020

Results Webcast

As a reminder, Gran Colombia will host a

conference call and webcast on Friday, August 14, 2020 at 10:00

a.m. Eastern Time to discuss the results.

Webcast and call-in details are as follows:

|

Live Event link: |

https://edge.media-server.com/mmc/p/oc7986ix |

|

International: |

1 (514) 841-2157 |

|

North America Toll Free: |

1 (866) 215-5508 |

|

Colombia Toll Free: |

01 800 9 156 924 |

|

Conference ID: |

49825338 |

A replay of the webcast will be available at

www.grancolombiagold.com from Friday, August 14, 2020 until Friday,

September 18, 2020.

About Gran Colombia Gold

Corp.

Gran Colombia is a Canadian-based mid-tier gold

producer with its primary focus in Colombia where it is currently

the largest underground gold and silver producer with several mines

in operation at its high-grade Segovia Operations. Gran Colombia

owns approximately 74% of Caldas Gold Corp., a Canadian mining

company currently advancing a prefeasibility study for a major

expansion and modernization of its underground mining operations at

its Marmato Project in Colombia. Gran Colombia’s project pipeline

includes its Zancudo Project in Colombia together with an

approximately 21% equity interest in Gold X Mining Corp. (TSXV:

GLDX) (Guyana – Toroparu) and an approximately 20% equity interest

in Western Atlas Resources Inc. (“Western Atlas”) (TSX-V: WA)

(Nunavut – Meadowbank).

Additional information on Gran Colombia can be

found on its website at www.grancolombiagold.com and by reviewing

its profile on SEDAR at www.sedar.com.

Cautionary Statement on Forward-Looking

Information:

This news release contains "forward-looking

information", which may include, but is not limited to, statements

with respect to the continuation of operations during the COVID-19

situation, production guidance and anticipated business plans or

strategies. Often, but not always, forward-looking statements can

be identified by the use of words such as "plans", "expects", "is

expected", "budget", "scheduled", "estimates", "forecasts",

"intends", "anticipates", or "believes" or variations (including

negative variations) of such words and phrases, or state that

certain actions, events or results "may", "could", "would", "might"

or "will" be taken, occur or be achieved. Forward-looking

statements involve known and unknown risks, uncertainties and other

factors which may cause the actual results, performance or

achievements of Gran Colombia to be materially different from any

future results, performance or achievements expressed or implied by

the forward-looking statements. Factors that could cause actual

results to differ materially from those anticipated in these

forward-looking statements are described under the caption "Risk

Factors" in the Company's Annual Information Form dated as of March

30, 2020 which is available for view on SEDAR at www.sedar.com.

Forward-looking statements contained herein are made as of the date

of this press release and Gran Colombia disclaims, other than as

required by law, any obligation to update any forward-looking

statements whether as a result of new information, results, future

events, circumstances, or if management's estimates or opinions

should change, or otherwise. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, the reader is

cautioned not to place undue reliance on forward-looking

statements.

For Further Information,

Contact:Mike DaviesChief Financial Officer(416)

360-4653investorrelations@grancolombiagold.com

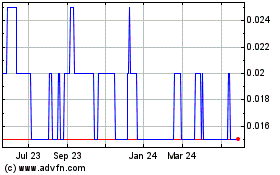

Western Atlas Resources (TSXV:WA)

Historical Stock Chart

From Oct 2024 to Nov 2024

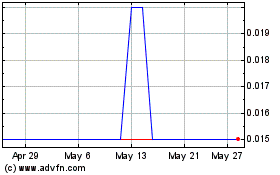

Western Atlas Resources (TSXV:WA)

Historical Stock Chart

From Nov 2023 to Nov 2024