CORRECTION - Gran Colombia Gold Reports Second Quarter and First Half 2020 Results; Announces Quarterly Dividend Program

August 13 2020 - 8:21PM

Gran Colombia Gold Corp. (TSX: GCM; OTCQX: TPRFF) announced today

the release of its unaudited interim condensed consolidated

financial statements and accompanying management’s discussion and

analysis (MD&A) for the three and six months ended June 30,

2020. All financial figures contained herein are expressed in U.S.

dollars (“USD”) unless otherwise noted.

Gran Colombia also announced today that its

Board of Directors has approved the initiation of the Company’s

quarterly dividend program. The first quarterly dividend of

CA$0.015 per common share will be paid on October 15, 2020 to

shareholders of record as of the close of business on September 30,

2020.

Serafino Iacono, Executive Chairman of Gran

Colombia, commenting on the Company’s latest results, said, “Our

management team has done a very commendable job, implementing the

protocols required to keep our workers safe during the COVID-19

crisis and to keep our mines in operation during a very challenging

situation. We are also pleased to announce the new quarterly

dividend program, something we started contemplating when we

retired 30% of the gold notes ahead of schedule at the end of

March. With our free cash flow strength, we saw an opportunity to

use a portion of the savings in debt service costs to begin paying

a dividend to our shareholders. However, with the onset of the

global pandemic, we waited to see the impact on our operations

before making the final decision. Our production level at Segovia

has steadied the last three months and with the stronger gold

prices so far in the third quarter, our earnings and free cash flow

in the second half of 2020 are shaping up nicely and we are

comfortable to proceed with the dividend program.”

Second Quarter and First Half 2020

Highlights

- Mining operations continued at both

Segovia and Marmato during the second quarter of 2020 despite the

challenges associated with the COVID-19 national quarantine

in Colombia. Gran Colombia also supported its local

communities in Antioquia and Caldas, providing medical equipment,

supplies and sanitation kits to the local hospitals and groceries

to families who have been economically affected by the COVID-19

crisis.

- Gran Colombia’s gold

production in the second quarter of 2020 of 48,228 ounces,

down from 57,882 ounces in the second quarter last year, reflected

the initial adverse impact of the COVID-19 quarantine on Segovia’s

workforce in the first half of April. Protocols implemented by the

Company facilitated increased availability of workers thereafter

and production at Segovia returned to about 95% of normal. Gold

production at Marmato in the second quarter of 2020 was only 62% of

the second quarter last year as the quarantine had a greater impact

on worker availability throughout the quarter. With a total of

104,475 ounces of gold produced in the first half of 2020, down

from 118,483 ounces in the first half of last year, and another

18,111 ounces in July, the Company has updated its 2020 annual

production guidance to a range between 218,000 and 226,000 ounces

of gold.

- Revenue amounted

to $77.1 million in the second quarter of 2020, almost on par with

the second quarter last year, as the 31% year-over-year improvement

in spot gold prices increased the Company’s realized gold price to

an average of $1,696 per ounce sold and compensated for the 24%

lower gold sales volumes attributable to the COVID-19 impact on

production. For the first half of 2020, revenue of $178.1 million

was up 15% over the first half last year.

- Total cash costs

(1) per ounce averaged $713 per ounce in the second

quarter of 2020 compared with $655 per ounce in the second quarter

last year, reflecting the COVID-19 impact on production which

increased fixed production costs on a “per ounce” basis. Higher

spot gold prices increased production taxes by approximately $19

per ounce in the second quarter of 2020 compared with the same

period last year and the Company incurred additional costs to

implement the COVID-19 protocols required to protect the health and

safety of its workers. For the first half of 2020, total cash costs

averaged $686 per ounce compared with $638 per ounce in the first

half last year.

- All-in sustaining

costs (“AISC”) (1) and All-in

costs (1) were $1,045 per ounce and $1,114 per ounce,

respectively, in the second quarter of 2020 compared with $878 per

ounce and $903 per ounce, respectively, in the second quarter last

year. The year-over year increase in these metrics can largely be

attributed to new spending on G&A and social contributions in

Caldas Gold and an increased level of non-sustaining capex for the

Marmato Project. Similar to total cash costs per ounce, the lower

production in the second quarter of 2020 also contributed to an

increase in these “per ounce” metrics. For the first half of 2020,

AISC and All-in costs averaged $954 and $1,034 per ounce,

respectively, compared with $855 and 873 per ounce, respectively,

in the first half last year.

- The Company reported

adjusted EBITDA (1) of $37.6 million for the

second quarter of 2020, up 13% over the second quarter last year.

For the first half of 2020, adjusted EBITDA totalled $88.0 million,

up 29% over the first half last year. The Company’s trailing

12-months’ adjusted EBITDA at the end of June 2020 was $166.2

million, up 13% over 2019.

- Net cash provided by

operating activities in the second quarter of 2020 of $6.4

million, down from $18.2 million in the second quarter last year,

reflected income tax payments in Colombia totalling $35.3 million

compared with only $14.1 million in the second quarter last year.

For the first half of 2020, net cash provided by operating

activities was $38.2 million, up from $38.0 million in the first

half last year.

- Free Cash Flow (1)

in the second quarter of 2020 was also impacted by the increased

level of income tax payments compared with the second quarter last

year. For the first half of 2020, Free Cash Flow amounted to $13.5

million, about $5.6 million lower than the first half last year due

to an increased level of non-sustaining capital and exploration

expenditures.

- The Company’s balance

sheet remained solid with total cash of $87.7 million at

the end of June 2020 and further reduction in the aggregate

principal amount of Gold Notes outstanding to $41.3

million.

- Non-cash fair value changes in

financial instruments totaling $35.4 million in the second quarter

of 2020, largely driven by the Company’s 70% share price

improvement, contributed to a net loss of $18.9

million ($0.27 per share) compared with net income of $0.8 million

($0.02 per share) in the second quarter last year. For the first

half of 2020, the Company reported net income of $5.7 million

($0.13 per share) compared with $8.7 million ($0.18 per share) in

the first half last year. The first half 2020 net income was net of

a $16.7 million charge related to the Caldas Gold RTO

Transaction.

- Adjusted net income

(1) for the second quarter of 2020 was $17.5 million

($0.29 per share), up from $14.2 million ($0.29 per share) in the

second quarter last year. For the first half of 2020, adjusted net

income improved to $38.7 million ($0.66 per share) compared with

$27.2 million ($0.56 per share) in the first half last year. The

year-over-year improvement in adjusted net income for the second

quarter and first half of 2020 largely reflects the positive impact

of higher gold prices in 2020, partially offset by the COVID-19

impact on gold sales volumes in the second quarter of 2020.

- In July 2020, the Company announced

high-grade intercepts from the latest 72 diamond drill holes

totaling 10,523 meters (approximately 33%) of the 2020 in-mine and

near-mine drilling programs at its Segovia

Operations. At Carla, the Company’s fourth mine which is

coming into production later this year, drilling intercepted

high-grade mineralization down-dip below the existing underground

mine development confirming a high-grade intercept from a prior

drilling program. Results at Sandra K and El Silencio continue to

increase the Company’s confidence in the potential to expand

mineral resources at Segovia and add to the mine life for this

project.

- Caldas Gold is making progress in

its action plans to build Colombia’s next major gold

mine. On July 6, 2020, Caldas Gold announced the results

of a Preliminary Feasibility Study (the “2020 PFS”) for its Marmato

Project. On July 29, 2020, Caldas Gold completed a CA$50 million

bought deal private placement of Special Warrants, of which Gran

Colombia acquired CA$20 million to maintain its equity ownership

above 50%. Caldas Gold is also finalizing a private placement

offering of senior secured gold-linked notes expected to raise

between $80 to $90 million and completing a $110 million stream

financing with Wheaton Precious Metals International Ltd., all of

which will fund the planned expansion of mining operations into the

Marmato Deep Zone (“MDZ”) commencing in the second half of this

year.

Selected Financial

Information

| |

Second Quarter |

First Half |

|

|

|

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

| |

|

|

|

|

|

| Operating

data |

|

|

|

|

|

|

Gold produced (ounces) |

|

48,228 |

|

|

57,882 |

|

|

104,475 |

|

|

118,483 |

|

|

Gold sold (ounces) |

|

45,078 |

|

|

59,368 |

|

|

108,779 |

|

|

118,413 |

|

|

Average realized gold price ($/oz sold) |

$ |

1,696 |

|

$ |

1,293 |

|

$ |

1,622 |

|

$ |

1,296 |

|

|

Total cash costs ($/oz sold) (1) |

|

713 |

|

|

655 |

|

|

686 |

|

|

638 |

|

|

AISC ($/oz sold) (1) |

|

1,045 |

|

|

878 |

|

|

954 |

|

|

855 |

|

|

All-in costs ($/oz sold) (1) |

|

1,114 |

|

|

903 |

|

|

1,034 |

|

|

873 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial data ($000’s, except per share

amounts) |

|

|

|

|

|

|

Revenue |

$ |

77,134 |

|

$ |

77,610 |

|

$ |

178,110 |

|

$ |

155,065 |

|

|

Adjusted EBITDA (1) |

|

37,563 |

|

|

33,198 |

|

|

88,000 |

|

|

68,473 |

|

|

Net (loss) income |

|

(18,578 |

) |

|

768 |

|

|

5,677 |

|

|

8,671 |

|

|

Per share - basic |

|

(0.27 |

) |

|

0.02 |

|

|

0.13 |

|

|

0.18 |

|

|

Per share - diluted |

|

(0.27 |

) |

|

0.02 |

|

|

0.13 |

|

|

0.18 |

|

|

Adjusted net income (1) |

|

17,504 |

|

|

14,164 |

|

|

38,736 |

|

|

27,179 |

|

|

Per share - basic |

|

0.29 |

|

|

0.29 |

|

|

0.66 |

|

|

0.56 |

|

|

Per share - diluted |

|

0.24 |

|

|

0.25 |

|

|

0.56 |

|

|

0.49 |

|

|

Net cash provided by operating activities (4) |

|

6,431 |

|

|

18,217 |

|

|

38,242 |

|

|

38,035 |

|

|

Free cash flow (1) (4) |

|

(4,375 |

) |

|

7,751 |

|

|

13,456 |

|

|

19,028 |

|

|

|

|

|

|

|

|

June 30, |

|

December 31, |

|

|

|

|

2020 |

|

|

2019 |

|

|

|

|

|

|

| Balance

sheet ($000’s): |

|

|

|

|

Cash and cash equivalents |

$ |

87,749 |

|

$ |

84,239 |

|

|

Gold Notes, including current portion – principal amount

outstanding (2) |

|

41,300 |

|

|

68,750 |

|

|

Convertible Debentures – principal amount outstanding (3) |

CA20,000 |

|

CA20,000 |

|

- Refer to “Non-IFRS Measures” in the

Company’s MD&A.

- The Gold Notes are recorded in the

Interim Financial Statements at fair value. At June 30, 2020 and

December 31, 2019, the carrying amounts of the Gold Notes

outstanding were $43.5 and $69.0 million, respectively.

- The Convertible Debentures are

recorded in the Interim Financial Statements at fair value. At June

30, 2020 and December 31, 2019, the carrying amount of the

Convertible Debentures outstanding was $23.7 million and $21.1

million, respectively.

- Net of income taxes paid of $35.3

million in the second quarter of 2020 ($14.1 million in the second

quarter of 2019) and $42.6 million in the first half of 2020 ($30.4

million in the first half of 2019).

Second Quarter and First Half 2020

Results Webcast

As a reminder, Gran Colombia will host a

conference call and webcast on Friday, August 14, 2020 at 10:00

a.m. Eastern Time to discuss the results.

Webcast and call-in details are as follows:

|

|

Live Event link:International:North America Toll Free:Colombia Toll

Free:Conference ID:

|

https://edge.media-server.com/mmc/p/oc7986ix1 (514) 841-21571 (866)

215-550801 800 9 156 92449825338 |

A replay of the webcast will be available at

www.grancolombiagold.com from Friday, August 14, 2020 until Friday,

September 18, 2020.

About Gran Colombia Gold

Corp.

Gran Colombia is a Canadian-based mid-tier gold

producer with its primary focus in Colombia where it is currently

the largest underground gold and silver producer with several mines

in operation at its high-grade Segovia Operations. Gran Colombia

owns approximately 57.5% of Caldas Gold Corp., a Canadian mining

company currently advancing a prefeasibility study for a major

expansion and modernization of its underground mining operations at

its Marmato Project in Colombia. Gran Colombia’s project pipeline

includes its Zancudo Project in Colombia together with an

approximately 20% equity interest in Gold X Mining Corp. (TSXV:

GLDX) (Guyana – Toroparu) and an approximately 26% equity interest

in Western Atlas Resources Inc. (“Western Atlas”) (TSX-V: WA)

(Nunavut – Meadowbank).

Additional information on Gran Colombia can be

found on its website at www.grancolombiagold.com and by reviewing

its profile on SEDAR at www.sedar.com.

Cautionary Statement on Forward-Looking

Information:

This news release contains "forward-looking

information", which may include, but is not limited to, statements

with respect to the continuation of operations during the COVID-19

situation, production guidance and anticipated business plans or

strategies. Often, but not always, forward-looking statements can

be identified by the use of words such as "plans", "expects", "is

expected", "budget", "scheduled", "estimates", "forecasts",

"intends", "anticipates", or "believes" or variations (including

negative variations) of such words and phrases, or state that

certain actions, events or results "may", "could", "would", "might"

or "will" be taken, occur or be achieved. Forward-looking

statements involve known and unknown risks, uncertainties and other

factors which may cause the actual results, performance or

achievements of Gran Colombia to be materially different from any

future results, performance or achievements expressed or implied by

the forward-looking statements. Factors that could cause actual

results to differ materially from those anticipated in these

forward-looking statements are described under the caption "Risk

Factors" in the Company's Annual Information Form dated as of March

30, 2020 which is available for view on SEDAR at www.sedar.com.

Forward-looking statements contained herein are made as of the date

of this press release and Gran Colombia disclaims, other than as

required by law, any obligation to update any forward-looking

statements whether as a result of new information, results, future

events, circumstances, or if management's estimates or opinions

should change, or otherwise. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, the reader is

cautioned not to place undue reliance on forward-looking

statements.

For Further Information,

Contact:Mike DaviesChief Financial Officer(416)

360-4653investorrelations@grancolombiagold.com

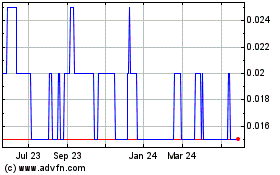

Western Atlas Resources (TSXV:WA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Western Atlas Resources (TSXV:WA)

Historical Stock Chart

From Nov 2023 to Nov 2024