Gran Colombia Announces Upgrade From Fitch Ratings to ‘B+’; Provides Details for the Quarterly Repayment of Its Gold Note...

October 15 2020 - 4:50PM

Gran Colombia Gold Corp. (TSX: GCM; OTCQX: TPRFF) announced today

that Fitch Ratings has upgraded it to ‘B+’ from ‘B‘ with a Stable

Outlook. In its commentary regarding the rating action, Fitch

Ratings stated that the upgrade reflects the improvement in Gran

Colombia’s capital structure due to strong free cash flow and

capital raising that has led to substantial debt repayment.

Fitch Ratings noted several key rating drivers

including (i) positive strategic decisions over the past 12 months

that have given it a stronger balance sheet and have lowered risk,

including the spin out of Marmato to Caldas Gold and the planned

spin out of Zancudo to ESV Resources, (ii) turnaround in the

Company’s net cash position, (iii) solid free cash flow, (iv)

single-asset risk and (v) competitive cost structure. Additional

information with respect to this rating may be found at

www.fitchratings.com.

Quarterly Gold Notes

Repayment

Gran Colombia also announced today the details

for the forthcoming quarterly repayment of its 8.25% Senior Secured

Gold-Linked Notes due 2024 (the “Gold Notes”) (TSX: GCM.NT.U) as

follows:

|

Payment date: |

|

November 2, 2020 |

|

|

|

|

|

Record date: |

|

October 26, 2020 |

|

|

|

|

|

Cash payment amount: |

|

Approximately US$0.11377257 per US$1.00 principal amount of Gold

Notes issued and outstanding representing an amortization payment

of the principal amount of approximately US$0.07517084 per US$1.00

principal amount of Gold Notes and a gold premium of approximately

US$0.03860173 per US$1.00 principal amount of Gold Notes. Based on

the London P.M. Fix on October 15, 2020 of US$1,891.90 per ounce,

the aggregate amount of the cash payments on the Payment Date will

be US$4,370,289, of which US$2,887,500 will be applied to reduce

the aggregate principal amount of the Gold Notes issued and

outstanding and the balance represents the Gold Premium. |

|

|

|

|

|

Principal amount issued and outstanding: |

|

As of today’s date, there is a total of US$38,412,500 principal

amount of Gold Notes issued and outstanding. After this quarterly

repayment, the aggregate principal amount of the Gold Notes will be

reduced to US$35,525,000. |

Arbitration Related to Termination of

Long-Term Supply Agreement

The Company had a long-term supply agreement to

sell all of its production to a single customer in Colombia which

was terminated in January 2019. On May 10, 2019, the Company

received notice of a request to settle the dispute, as permitted

under the supply agreement, under the Rules of Arbitration of the

International Chamber of Commerce (“ICC”). The Company was notified

today by the ICC that it has dismissed the customer’s claims on the

basis of breach of the supply agreement.

About Gran Colombia Gold

Corp.

Gran Colombia is a Canadian-based mid-tier gold

producer with its primary focus in Colombia where it is currently

the largest underground gold and silver producer with several mines

in operation at its high-grade Segovia Operations. Gran Colombia

owns approximately 53.5% of Caldas Gold Corp. (TSX-V: CGC; OTCQX:

ALLXF), a Canadian mining company currently advancing a major

expansion and modernization of its underground mining operations at

its Marmato Project in Colombia. Gran Colombia’s project pipeline

includes its Zancudo Project in Colombia together with an

approximately 20% equity interest in Gold X Mining Corp. (TSXV:

GLDX) (Guyana – Toroparu) and an approximately 26% equity interest

in Western Atlas Resources Inc. (“Western Atlas”) (TSX-V: WA)

(Nunavut – Meadowbank).

Additional information on Gran Colombia can be

found on its website at www.grancolombiagold.com and by reviewing

its profile on SEDAR at www.sedar.com.

Cautionary Statement on Forward-Looking

Information:

This news release contains "forward-looking information", which

may include, but is not limited to, statements with respect

repayment of the Gold Notes. Often, but not always, forward-looking

statements can be identified by the use of words such as "plans",

"expects", "is expected", "budget", "scheduled", "estimates",

"forecasts", "intends", "anticipates", or "believes" or variations

(including negative variations) of such words and phrases, or state

that certain actions, events or results "may", "could", "would",

"might" or "will" be taken, occur or be achieved. Forward-looking

statements involve known and unknown risks, uncertainties and other

factors which may cause the actual results, performance or

achievements of Gran Colombia to be materially different from any

future results, performance or achievements expressed or implied by

the forward-looking statements. Factors that could cause actual

results to differ materially from those anticipated in these

forward-looking statements are described under the caption "Risk

Factors" in the Company's Annual Information Form dated as of March

30, 2020 which is available for view on SEDAR at www.sedar.com.

Forward-looking statements contained herein are made as of the date

of this press release and Gran Colombia disclaims, other than as

required by law, any obligation to update any forward-looking

statements whether as a result of new information, results, future

events, circumstances, or if management's estimates or opinions

should change, or otherwise. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, the reader is

cautioned not to place undue reliance on forward-looking

statements.

For Further Information,

Contact:Mike DaviesChief Financial Officer(416)

360-4653investorrelations@grancolombiagold.com

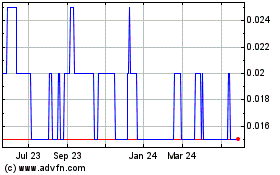

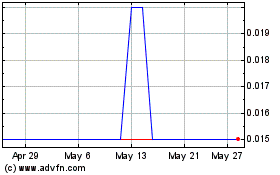

Western Atlas Resources (TSXV:WA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Western Atlas Resources (TSXV:WA)

Historical Stock Chart

From Nov 2023 to Nov 2024