West High Yield Announces Private Placement

August 12 2019 - 10:30AM

West High Yield (W.H.Y.) Resources Ltd. (the

"

Company") (TSXV: WHY) announces that it proposes

to complete a non-brokered private placement of Units

("

Units”). Each Unit will consist of one

Common Share in the capital of the Company (a "

Common

Share") and one-third of one Common Share purchase Warrant

(a "

Warrant"). Each whole Warrant would entitle

the holder to purchase one additional Common Share at an exercise

price of $0.45 for a period of one year from the date of issuance

of the Warrant. There is no minimum subscription for this offering

and a maximum of 11,200,000 Units will be issued at a price of

$0.25 per Unit for gross proceeds of up to $2,800,000.

The Company may pay finder’s fees on all or a

portion of the private placement to eligible persons seeking

subscribers to the financing, all in accordance with applicable

securities laws and the policies of the TSX Venture Exchange (the

"Exchange"). The proposed private placement is

subject to receipt of all necessary regulatory approvals including

the approval of the Exchange. The Company confirms that, as of the

date of this press release, there is no "material fact" or

"material change" (as those terms are defined under applicable

securities laws) related to the Company which has not been

generally disclosed.

Assuming the maximum offering is completed,

approximately $2,500,000 of the net proceeds are expected to be

used for the permit application and Industrial Mineral Mine Permit

application for the Company's Record Ridge deposit near Rossland,

British Columbia and the balance of the net proceeds will be used

for the Kingston Process Metallurgy Inc. Pre-Feasibility Study

Stage 2 discussed in the Company’s press release of May 1, 2019 and

general corporate purposes. If the offering is not fully

subscribed, the Company will apply the proceeds to the above uses

in priority and in such proportions as the board of directors and

management of the Company determine is in the best interests of the

Company. Although the Company intends to use the proceeds of the

offering as described above, the actual allocation of proceeds may

vary from the uses set out above, depending upon future operations,

events or opportunities.

About West High Yield

West High Yield is a publicly traded junior

mining exploration company focused on the acquisition, exploration

and development of mineral resource properties in Canada with a

primary objective to locate and develop economic gold, nickel and

magnesium properties.

| For further information please

contact: |

|

| |

|

| Frank

MarascoPresident and Chief Executive

OfficerWest High Yield (W.H.Y.) Resources

Ltd.Telephone: (403)

660-3488Facsimile: (403)

206-7159Email:

frank@whyresources.com |

Dwayne

VinckChief Financial Officer West

High Yield (W.H.Y.) Resources Ltd.Telephone: (403)

257-2637Facsimile: (403)

206-7159Email: vinck@shaw.ca |

Reader Advisory

This press release contains forward-looking

statements and forward-looking information within the meaning of

applicable securities laws. The use of any of the words "expect",

"anticipate", "continue", "estimate", "objective", "ongoing",

"may", "will", "project", "should", "believe", "plans", "intends"

and similar expressions are intended to identify forward-looking

information or statements. More particularly and without

limitation, this press release contains forward looking statements

and information concerning the terms of the proposed non-brokered

private placement of Units, the proposed use of proceeds and the

Company's business plans. The forward-looking statements and

information are based on certain key expectations and assumptions

made by the Company. Although the Company believes that the

expectations and assumptions on which such forward-looking

statements and information are based are reasonable, undue reliance

should not be placed on the forward looking statements and

information because the Company can give no assurance that they

will prove to be correct.

Forward-looking information is based on the

opinions and estimates of management at the date the statements are

made, and are subject to a variety of risks and uncertainties and

other factors that could cause actual events or results to differ

materially from those anticipated in the forward-looking

information. Some of the risks and other factors that could cause

the results to differ materially from those expressed in the

forward-looking information include, but are not limited to:

general economic conditions in Canada and globally; industry

conditions, including governmental regulation; failure to obtain

industry partner and other third party consents and approvals, if

and when required; the availability of capital on acceptable terms;

the need to obtain required approvals from regulatory authorities;

stock market volatility; competition for, among other things,

skilled personnel and supplies; changes in tax laws; and the other

factors. Readers are cautioned that this list of risk factors

should not be construed as exhaustive.

Readers are cautioned not to place undue

reliance on this forward-looking information, which is given as of

the date hereof, and to not use such forward-looking information

for anything other than its intended purpose. The Company

undertakes no obligation to update publicly or revise any

forward-looking information, whether as a result of new

information, future events or otherwise, except as required by

applicable law.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this press release.

Not for distribution in the United States. This

news release does not constitute an offer to sell or a solicitation

of an offer to buy any securities in the United States. The

securities of the Company will not be registered under the United

States Securities Act of 1933, as amended (the "U.S. Securities

Act") and may not be offered or sold within the United States or

to, or for the account or benefit of U.S. persons except in certain

transactions exempt from the registration requirements of the U.S.

Securities Act.

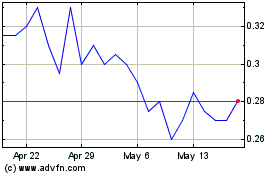

West High Yield Resources (TSXV:WHY)

Historical Stock Chart

From Oct 2024 to Nov 2024

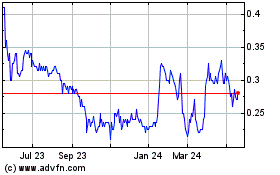

West High Yield Resources (TSXV:WHY)

Historical Stock Chart

From Nov 2023 to Nov 2024