Affymax Adopts Tax Benefit Preservation Plan to Protect Net Operating Loss Carryforwards

November 26 2014 - 3:20PM

Business Wire

Affymax, Inc. (OTCQB: AFFY) announced today that its Board of

Directors has adopted a Tax Benefit Preservation Plan, or Rights

Plan, in an effort to preserve the value of its significant net

operating loss carryforwards, or NOLs, in relation to the potential

limitations under Section 382 of the Internal Revenue Code.

The Company had federal NOLs totaling approximately $481 million

at December 31, 2013, a substantial portion of which are limited

due to a prior “ownership change” (as defined in Section 382

of the Internal Revenue Code). The Company’s use of the remaining

NOLs could be substantially limited if the Company experiences

another “ownership change”. In general, an ownership change occurs

if there is a cumulative change in a company’s ownership by

“5-percent shareholders” (as defined in Section 382 of the Internal

Revenue Code) that increases by more than 50 percentage points over

the lowest percentage owned by such stockholders at any time during

the prior three years on a rolling basis. The Company noted that

the Rights Plan is designed to serve the interests of all

stockholders by helping to protect the Company’s ability to use its

NOLs to offset future tax liabilities and is similar to plans

adopted by other companies with significant tax attributes.

In connection with the adoption of the Rights Plan, on November

26, 2014, the Board declared a non-taxable dividend of one

preferred share purchase right, or Right, for each outstanding

share of common stock to the Company’s stockholders of record as of

the close of business on December 8, 2014. While the Rights Plan is

in effect, any person or group that acquires beneficial ownership

of 4.99% or more of the Company’s common stock without approval

from the Board would be subject to significant dilution in their

ownership interest in the Company. Stockholders who currently own

4.99% or more of the common stock will not trigger the Rights

unless they acquire additional shares. In addition, the Board has

established procedures to consider requests to exempt certain

acquisitions of the Company’s securities from the Rights Plan if

the Board determines that doing so would not limit or impair the

availability of the NOLs or is otherwise in the best interests of

the Company.

The Rights will expire on the earliest of (i) 5:00 p.m.,

New York City time, on November 26, 2017, (ii) the time at

which the Rights are redeemed or exchanged under the Rights Plan,

(iii) the repeal of Section 382 or any successor statute

and the Board’s determination that the Rights Plan is no longer

necessary for the preservation of the Company’s NOLs or

(iv) the beginning of a taxable year of the Company to which

the Board determines that no NOLs may be carried forward.

The issuance of the Rights is not a taxable event and will not

affect the Company’s financial condition or results of operations

(including earnings per share).

A copy of the full text of the Rights Plan will be posted on the

Company’s website.

About Affymax

Affymax, Inc. is a biopharmaceutical company based in Cupertino,

California. For additional information, please visit

www.affymax.com.

Cautionary Statement About Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995, including, without limitation, statements relating to the

possibility that the Company may be able to acquire one or more

revenue or income generating assets in the future and the potential

for opportunities to further maximize value for stockholders,

including the potential for a private to public reverse merger,

investments and acquisitions among other alternatives. In some

cases, you can identify forward-looking statements by terminology

such as “may,” “will,” “should,” “expect,” “plan,” “intend,”

“anticipate,” “believe,” “estimate,” “predict,” “potential” or

“continue,” the negative of these terms or other terminology.

Forward-looking statements are based on the opinions and

estimates of management at the time the statements are made and are

subject to certain risks and uncertainties that could cause actual

results to differ materially from those anticipated in the

forward-looking statements. The Company’s actual results may differ

materially from those expressed or implied by these forward-looking

statements based on a number of factors, including the Company’s

failure to acquire one or more revenue or income generating assets

or to identify and execute upon any opportunities to further

maximize value for stockholders, and other risks and uncertainties.

Readers are cautioned that these forward-looking statements and

other statements contained in this press release regarding matters

that are not historical facts, are only estimates or predictions.

Readers are cautioned not to place undue reliance upon these

forward-looking statements, which speak only as of the date of this

press release. The Company undertakes no obligation to update any

forward-looking statements whether as a result of new information,

future events or other factors, except as required by law.

AffymaxMark Thompson, 650-812-8700Chief Financial OfficerThe

Brenner Group

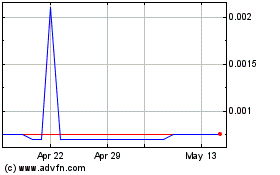

Affymax (CE) (USOTC:AFFY)

Historical Stock Chart

From Feb 2025 to Mar 2025

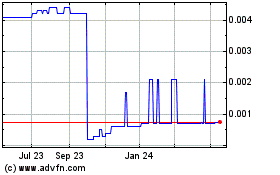

Affymax (CE) (USOTC:AFFY)

Historical Stock Chart

From Mar 2024 to Mar 2025