Allied Energy (PINKSHEETS: AGGI) today announced its 2010 fiscal

year results. The Company's financial statements are available at

www.alliedenergy.com and www.otcmarkets.com.

For the 12 months ended December 31, 2010, the Company reported

total revenue of $27.5 million, which was a 135% increase compared

to 2009. The 2010 revenue consisted of $26.4 million turnkey

drilling and $1.1 million oil and gas production. For 2009, the

Company had revenue consisting of $11.1 million turnkey drilling

and $0.5 million oil and gas production.

Net earnings for the 12 months ended December 31, 2010 were

$(0.3) million as compared with $0.3 million for the 12 months

ended December 31, 2009.

The Company's total assets increased to $16.4 million in 2010

compared to $12.1 million in 2009, a 35% increase. In addition, net

cash flows increased to $1.8 million in 2010 from $(0.7) million in

2009, a 351% increase.

The Company serves as the managing general partner for a number

of oil and natural gas development programs. The Company's

aggregate oil and natural gas exploration and development costs for

its programs in 2010 increased to $18.9 million from $6.0 million

in 2009, an increase of 217%. The increase is a direct result of

the Company's continued commitment to its aggressive acquisition

and investment programs including but not limited to increased

participation in horizontal and other drilling programs, including

those in Central-East Texas, well reworks and completions, water

disposal systems, building of gas line infrastructure, and pipeline

construction for its majority-owned subsidiary, Allied Gas

Transmission.

In Grimes County, Texas, the Allied Howard #2H resumed

production on March 12, 2011 and since that date has averaged

approximately 6 million cubic feet of gas per day along with

associated condensate. The Allied Howard #1H continues to produce

at a rate of approximately 2.5 million cubic feet of gas per day

equivalent and has produced nearly $1 million in gross revenue (in

today's prices) since it was turned into production the latter part

of 2010. Although no assurances can be made, the Company estimates

that combined production from both wells of methane gas, natural

gas liquids and condensate should potentially stabilize in the

estimated range of approximately 170 - 200 million cubic feet of

gas per month equivalent, at least for the short-term. To the

extent that production does occur at this level, this equates to a

projected $600,000 of future gross production revenue each month

for the Company, (assuming a net price of $.30 per MCF for gas).

However, both of these wells are anticipated to be subject over

time to production declines of an as-yet undetermined

magnitude.

The Company is scheduled, in the second quarter, to move a rig

on location in order to begin drilling the Allied Howard #3H well

location. The Company also has plans to drill two more horizontal

locations in Grimes County this summer and fall.

In Leon County, Texas, Schlumberger recently completed the

fracking of Allied's first horizontal oil well, the Allied Wallrath

#1H. Initial results have the well flowing at approximately 100

barrels of oil per day (BOPD) without manipulation or

stimulation.

"We are extremely pleased with the results we have seen thus far

for our horizontal programs in Grimes County, Texas and the overall

execution of our business model for 2010," said Scott Harris,

Allied's Chief Executive Officer and President. "In 2011, we

anticipate oil and gas production revenues to be a much higher

percentage of the Company's overall revenues," added Harris. The

Company also generates additional revenues from lease operating

activities including saltwater disposal and gas transmission in

Grimes County, Texas.

At December 31, 2010 in Oklahoma, the Company, either directly

or through its program interests, owned interests in 70 producing

wells and/or wells awaiting hook-up, four wells in various stages

of testing or completion, two wells in process of being drilled,

and 20 additional wells scheduled to commence in 2011. The majority

of these wells in Oklahoma produce from either the Mississippi

Limestone, Burgess Sandstone and/or various coal seam

formations.

No assurances can be made as to the Company's future success

and/or ability to sponsor development programs or other oil and

natural gas projects. Nor can assurances be made as it relates to

present or future production rates or estimated reserves for any

given project. Tremendous risks and uncertainty are associated with

oil and gas drilling, completion, development and production

operations. It is impossible to accurately estimate future rates

and/or declines in production operations for oil, condensate and

natural gas.

About Allied Energy:

Allied Energy, Inc. (PINKSHEETS: AGGI) is an independent energy

development firm primarily engaged in the exploration, development,

and production of oil and natural gas in the continental United

States. These activities include the sale of program interests and

of drilling and operating services. The Company relies upon its

operating companies and other subsidiaries, strategic industry

partners, petroleum geologists, engineers, subcontractors and

support personnel whose combined industry experience is essential

to the success of each project. Allied Energy's strategic focus is

the development of oil and natural gas production and reserves. The

Company firmly believes its oil and natural gas exploration and

development strategy will provide substantial growth to the Company

for years to come. For more information: www.alliedenergy.com

Allied Energy has achieved the "Best of Bowling Green" award for

the category of crude oil and natural gas production for the last

three years and was recently awarded the Bowing Green "Outstanding

Business of the Year" community impact award for 2010.

Forward-Looking and Continuing Statements:

Certain statements in this release and the attached corporate

profile that are not historical facts are "forward-looking

statements" within the meaning of the Private Securities Litigation

Reform Act of 1995. Such statements may be identified by the use of

words such as "anticipate," "believe," "expect," "future," "may,"

"will," "would," "should," "plan," "projected," "intend," and

similar expressions. Such forward-looking statements involve known

and unknown risks including but not limited to geological and

geophysical risks inherent to the oil and gas industry,

uncertainties and other factors that may cause the actual results,

price of oil and natural gas, state of the economy, industry

regulation, reliance upon expert recommendations and opinions,

performance or achievements of the Company to be materially

different from those expressed or implied by such forward-looking

statements. The Company may have varying degrees of working

interest ownership in each well and/or prospect. Thus, gross

revenue projections may not be equal to what is distributed net to

the Company. The Company's future operating results are dependent

upon many factors, including but not limited to the Company's

ability to: (i) obtain sufficient capital or a strategic business

arrangement to fund its expansion plans; (ii) build the management

and human resources and infrastructure necessary to support the

growth of its business; (iii) competitive factors and developments

beyond the Company's control including but not limited to the

strength of the overall economy; and (iv) other risk factors

inherent to the oil and gas industry.

Contact: Heather Age Allied Energy, Inc. 2427

Russellville Road Bowling Green, KY 42101 Phone: 866-256-5836 Fax:

800-251-9322 Website: http://www.alliedenergy.com Email:

info@alliedenergy.com

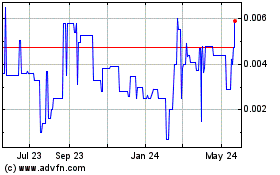

Allied Energy (PK) (USOTC:AGGI)

Historical Stock Chart

From Dec 2024 to Jan 2025

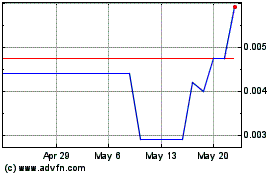

Allied Energy (PK) (USOTC:AGGI)

Historical Stock Chart

From Jan 2024 to Jan 2025