Amended Current Report Filing (8-k/a)

February 15 2023 - 7:33AM

Edgar (US Regulatory)

0000835662

true

--12-31

Amendment No.1

0000835662

2023-01-06

2023-01-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K/A

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of report (date of earliest event reported): January 6, 2023

AIXIN

LIFE INTERNATIONAL, INC.

(Exact

Name of Registrant as Specified in its Charter)

0-17284

(Commission

File No.)

| Colorado |

|

84-1085935 |

(State

of

Incorporation) |

|

(I.R.S.

Employer

Identification

No.) |

| |

|

|

Hongxing

International Business Building 2, 14th FL, No. 69 Qingyun South Ave., Jinjiang

District

Chengdu

City, Sichuan Province, China |

|

610021 |

| (Address

of Principal Executive Offices) |

|

(ZIP

Code) |

Registrant’s

telephone number, including area code: 86-313-6732526

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405

of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities

registered pursuant to Section 12(g) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

AIXN |

|

OTCQX |

Cautionary

Note Regarding Forward-Looking Statements:

Any

statements contained in this Current Report on Form 8-K that are not historical facts are forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are generally identifiable by use of the words

“believes,” “expects,” “intends,” “anticipates,” “plans to,” “estimates,”

“projects,” or similar expressions. Such statements may include, but are not limited to, statements about the Company’s

planned acquisitions, the purchase price to be paid for such acquisitions and the future performance of the businesses to be acquired,

and other statements that are not historical facts. Such statements are based upon the beliefs and expectations of the Company’s

management as of this date only and are subject to risks and uncertainties that could cause actual results to differ materially. Therefore,

investors are cautioned not to place undue reliance on these forward-looking statements. The Company undertakes no obligation to revise

or publicly release the results of any revision to these forward-looking statements, whether as a result of new information, future events

or otherwise, other than as required by applicable law.

Item

5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

Pursuant

to resolutions adopted by the Board of Directors and the holders of a majority of the outstanding shares of common stock of AiXin

Life International, Inc. (“our Company,” “we,” “us” and words of similar import), on January

6, 2023, we filed an amendment to our Articles of Incorporation with respect to a proposed 1 for 2 “reverse” split of our

common stock (the “Amendment”). A copy of the Amendment is included as Exhibit 3.1 to this Report.

Completion

of the proposed reverse stock split was to be effected on a date determined by our Board of Directors only upon receipt of notice

from the Financial Industry Regulatory Authority (“FINRA”) that it would process the proposed reverse stock split.

We have received notice from FINRA and our common stock will begin trading on a post-split basis on market opening on Friday, February

17, 2023.

As

a result of the reverse split, every two shares of our issued and outstanding common stock will be automatically combined and converted

into one issued and outstanding share of common stock, par value $0.0001 per share. Our common stock will continue to trade on the OTCQB

Venture Exchange. For a period of twenty business days, a “D” will be placed on our ticker symbol. After 20 business days

the symbol will revert back to AIXN. Our common stock post-split will be assigned a new CUSIP number, 009603200. Effective upon the completion

of the reverse stock split, we will have approximately 24,999,945 shares of outstanding common stock.

No

fractional shares of common stock will be issued as a result of the reverse stock split. Stockholders of record who would otherwise be

entitled to receive a fractional share will receive a cash payment in lieu thereof. The reverse stock split impacts all holders of

AiXin’s common stock proportionally and will not impact any stockholder’s percentage ownership of common stock.

AIXIN

has chosen its transfer agent, Securities Transfer Corporation (“SCT”), to act as exchange agent for the reverse stock split.

Stockholders owning shares via a bank, broker or other nominee will have their positions automatically adjusted to reflect the reverse

stock split and will not be required to take further action in connection with the reverse stock split, subject to brokers’ particular

processes. SCT can be reached at (469) 633-0101.

Notwithstanding

the reverse stock split, our Articles of Incorporation, as amended, will provide that we are authorized to issue 500 million shares of

common stock and 20 million shares of preferred stock. Since the number of shares of common stock we will be authorized to issue will

remain the same despite the 1 for 2 reverse stock split, the number of shares of common stock outstanding will represent a decrease on

a percentage basis compared to the number of our authorized shares of common stock.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| Dated:

February 15, 2023 |

|

| |

|

|

| Aixin

Life International, Inc. |

|

| |

|

|

| By:

|

/s/

Quanzhong Lin |

|

| |

Quanzhong

Lin |

|

| |

Chief

Executive Officer |

|

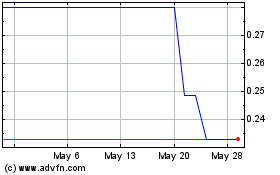

AiXin Life (QB) (USOTC:AIXN)

Historical Stock Chart

From Oct 2024 to Nov 2024

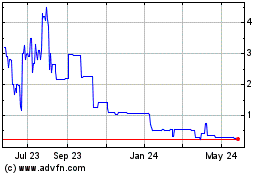

AiXin Life (QB) (USOTC:AIXN)

Historical Stock Chart

From Nov 2023 to Nov 2024