Janus Capital's Revenue and Profit Decline

July 26 2016 - 9:40AM

Dow Jones News

Janus Capital Group Inc. posted revenue and profit declines in

its second quarter as investment management fees declined.

The asset manager said its complex-wide assets increased to

$194.7 billion as of June 30, up from $191.3 billion in the

previous quarter and $192.5 billion last year. The increase

includes $3.1 billion of market-related appreciation and $300

million of exchange-traded product net inflows.

Janus also had fixed-income inflows of $400 million and

fundamental equity inflows of $300 million. Mathematical equity had

long-term net outflows of $0.7 million.

In all, the Denver-based firm, home to famed bond investor Bill

Gross—who joined the firm after departing Pacific Investment

Management Co. in 2014— reported a profit of $39 million, or 21

cents a share, down from $44.7 million, or 23 cents a share, a year

earlier.

Revenue fell 7.4% to $251.9 million from a year prior, as

investment management fees fell 6.8%.

Analysts polled by Thomson Reuters expected a per-share profit

of 22 cents on revenue of $256 million.

Total operating expenses decreased 3.1% due to lower employee

compensation expenses.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

July 26, 2016 10:25 ET (14:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

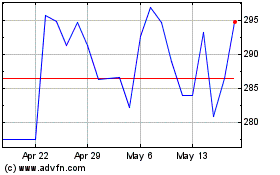

Allianz Ag Muenchen Namen (PK) (USOTC:ALIZF)

Historical Stock Chart

From Jun 2024 to Jul 2024

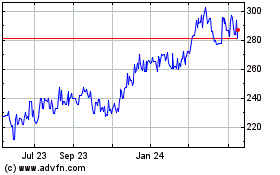

Allianz Ag Muenchen Namen (PK) (USOTC:ALIZF)

Historical Stock Chart

From Jul 2023 to Jul 2024

Real-Time news about Allianz Ag Muenchen Namen (PK) (OTCMarkets): 0 recent articles

More Allianz Se (QX) News Articles