Allianz SE 2Q 2016 -- Forecast

August 03 2016 - 6:55AM

Dow Jones News

FRANKFURT--The following is a summary of analysts' forecasts for

Allianz SE (ALV.XE) second-quarter results, based on a poll of nine

analysts conducted by Dow Jones Newswires (figures in million

euros, dividend and target price in euro, combined ratio in

percent, according to IFRS). Earnings figures are scheduled to be

released August 5.

===

Operating profit:

-Life & -Asset

2nd Quarter -Total -P/C Health management

AVERAGE 2,391 1,304 835 488

Prev. Year 2,842 1,745 853 505

+/- in % -16 -25 -2.1 -3.5

MEDIAN 2,442 1,310 850 500

Maximum 2,510 1,425 928 539

Minimum 2,074 1,200 603 419

Amount (a) 9 7 7 7

Baader-Helvea 2,442 1,284 894 512

Bankhaus Lampe 2,510 1,310 920 500

Barclays 2,268 -- -- --

Commerzbank 2,479 1,235 928 539

Deutsche Bank 2,384 1,353 806 487

Equinet 2,450 1,200 850 500

Morgan Stanley 2,074 1,322 603 419

Oddo Seydler 2,435 -- -- --

Net Combined

attrib. Ratio

2nd Quarter EBT income (b)

AVERAGE 2,280 1,513 95.4

Prev. Year 2,979 2,018 93.5

+/- in % -23 -25 --

MEDIAN 2,308 1,520 95.5

Maximum 2,403 1,585 96.2

Minimum 2,100 1,457 94.3

Amount (a) 4 5 9

Baader-Helvea -- 1,520 95.2

Bankhaus Lampe 2,300 1,480 95.5

Barclays -- -- 95.7

Commerzbank 2,315 1,521 96.2

Deutsche Bank -- 1,457 95.7

Equinet 2,100 -- 95.0

Morgan Stanley -- -- 94.3

Oddo Seydler -- -- 95.5

Target price Rating DPS 2016

AVERAGE 158.71 positive 6 AVERAGE 7.48

Prev. Quarter 181.67 neutral 1 Prev. Year 7.30

+/- in % -13 negative 1 +/- in % +2.4

MEDIAN 160.00 MEDIAN 7.43

Maximum 180.00 Maximum 7.75

Minimum 141.00 Minimum 7.30

Amount 7 Amount 4

Baader-Helvea 161.00 Buy --

Bankhaus Lampe 180.00 Buy 7.30

Barclays 141.00 Equalweight 7.50

Commerzbank 145.00 Buy --

Deutsche Bank 155.00 Buy 7.36

Equinet 160.00 Buy 7.75

Morgan Stanley -- Underweight --

Oddo Seydler 169.00 Buy --

===

Year-earlier figures are as reported by the company.

(a) Including estimates from analysts who want to remain

anonymous.

(b) Property-casualty.

DJG/voi

(END) Dow Jones Newswires

August 03, 2016 07:40 ET (11:40 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

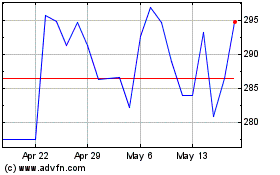

Allianz Ag Muenchen Namen (PK) (USOTC:ALIZF)

Historical Stock Chart

From Jun 2024 to Jul 2024

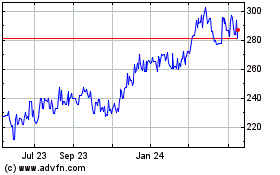

Allianz Ag Muenchen Namen (PK) (USOTC:ALIZF)

Historical Stock Chart

From Jul 2023 to Jul 2024