Air France-KLM Drops Order for Two Airbus A380s

March 16 2016 - 1:00PM

Dow Jones News

LONDON—Air France-KLM SA has dropped an order for two Airbus

Group SE A380 superjumbos, arresting order momentum the European

plane maker had recently enjoyed for its struggling flagship

aircraft.

Air France, which operates 10 of the A380s, on Wednesday said it

had dropped the final two A380s it had previously ordered in favor

of three of Airbus's A350-900 long-range planes. Airbus said it

wouldn't comment on discussions with customers.

Air France executives had previously indicated they would

abandon the order for their final A380s, saying the planes were no

longer needed amid changing priorities at the airline.

Airbus has been struggling to find customers for the A380 that

can seat more than 600 passengers and costs more than $400 million

per plane at list price, though buyers typically get discounts.

Airlines have shied away from the plane amid concern it may be

difficult to sell enough seats.

All Nippon Airways late last year agreed to buy three A380s,

ending a prolonged dry spell for new customers to sign up. Iran Air

this year also said it would take 12 of the aircraft, though the

deal hasn't been finalized.

The A380 has been a financial headache for the European plane

maker after a series of development and production problems caused

costs to skyrocket. After more than 15 years of trying to sell the

plane, Airbus has booked firm orders for only 319 A380s, including

the two Air France jets the airline is no longer taking.

Virgin Atlantic Airways Ltd., the airline founded by billionaire

Richard Branson, also has said it doesn't plan to take the 6 A380s

the airline has ordered.

Malaysia Airlines also has said it may shed some of the A380s it

has already received.

Airbus for years lost money on the A380s it delivered because

they cost more to build than airlines were paying. The

Toulouse-based company has said it broke even on A380 deliveries

for the first time last year. Airbus Chief Financial Officer Harald

Wilhelm has pledged the program would break even again this year

and next, though the period thereafter was uncertain and would

require new orders.

Boeing Co, the world's largest plane maker, also has been

struggling to secure deals for its largest aircraft, the 747-8

jumbo. The Chicago-based company this year said it would cut the

pace of production of the plane this year amid a dearth of demand,

while it awaits a rebound in appetite for cargo versions toward the

end of the decade.

Airbus's backlog of orders for A380s also is starting to

dwindle. The plane maker had delivered 182 of the ordered A380

jetliners at the end of last month.

Fabrice Bré gier, the head of Airbus's jetliner unit, has said

securing more A380 deals was a priority.

Qatar Airways Chief Executive Akbar Al Baker last week said the

Doha-based based carrier may exercise an option for three more of

the double-decker planes. Qatar has already ordered 10 of them and

taken delivery of six.

Tim Clark, president of Emirates Airline, the largest customer

of A380s, has said he would take as many as 200 more of the

aircraft if Airbus refreshed the design with new engines. The

European plane maker has held off on committing to such a program

in the near-future, saying it was focused on improving and selling

the current design.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

March 16, 2016 13:45 ET (17:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

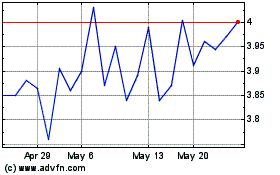

ANA (PK) (USOTC:ALNPY)

Historical Stock Chart

From Jan 2025 to Feb 2025

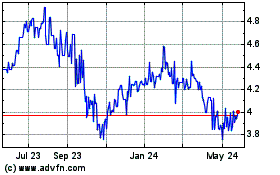

ANA (PK) (USOTC:ALNPY)

Historical Stock Chart

From Feb 2024 to Feb 2025