Airbus Group SE's A380 superjumbo program hit fresh turbulence

after Singapore Airlines Ltd.—the aircraft's first buyer and

currently its second-largest customer—said it won't renew the lease

for its first plane.

The lease on the A380 expires in October next year and "we have

decided not to extend it," Singapore Airlines told The Wall Street

Journal on Wednesday.

The decision isn't a fateful blow for the program, Airbus's

biggest and costliest jet. But it is another symbolic hit for the

double-deck aircraft, for which Airbus has struggled to find

customers after investing about $15 billion to develop.

Airbus in July announced it would slash production of the A380

to 12 planes a year in 2018 from 27 last year. The backlog of A380s

to be delivered has eroded during years of no or few orders.

The A380's size has become its disadvantage as airlines prefer

relatively smaller planes such as the Airbus A350 and rival Boeing

Co.'s 787 Dreamliner that can fly nonstop to their ultimate

destinations, bypassing major hubs such as London Heathrow and

Singapore's Changi Airport. The demand for point-to-point

connectivity has grown faster than the traffic at major hub

airports in recent years.

Airbus will again start losing money building A380 planes at the

lower production rate, the plane maker based in Toulouse, France,

has said. Last year was the first in which Airbus didn't lose money

on the A380 program since it embarked on developing the superjumbo

jet in 2000.

The Singapore flag carrier currently operates 19 of the jets.

The first five were taken on a 10-year lease deal with Airbus.

"Decisions will be made on the four others later," a Singapore

Airlines spokesman said.

Brendan Sobie, an analyst at CAPA Center for Aviation, expects

Singapore Airlines to return all five of the early A380 jets in its

fleet. "Their fleet plan and strategy has always been to replace

those aircraft. Early model airplanes come with limitations and

Singapore Airlines never wanted to be stuck with remarketing these

five airplanes," Mr. Sobie said.

Initial-production jets are generally less popular with airlines

as they are heavier and often come with teething problems as

manufacturers work out kinks. But Singapore Airlines' decision to

give up its lease will put at least one secondhand plane on the

market, potentially weakening already softened demand for new

A380s.

Singapore Airlines isn't the only airline turning its back on

some of its A380 jets. Malaysia Airlines has decided to replace its

A380 jets with the smaller A350 jets and is looking for customers

to buy or lease its six jets, the airline's chief Peter Bellew told

The Wall Street Journal in a recent interview.

Air France-KLM SA this year said it had dropped plans to take

the last two A380s it had ordered.

Other airlines have pulled the plug even earlier. Airbus this

year announced that French carrier Air Austral had canceled an

order for two A380s, the latest in a raft of voided purchases of

the plane. Previously, the India-based Kingfisher Airlines Ltd.,

founded by Vijay Mallya, ordered the plane before the carrier

controversially folded in 2012. Russia's No. 2 carrier Transero

also was a buyer before it closed last year. Japan's Skymark

Airlines Inc. had ordered the A380 before the contract was voided

over payment issues.

There are also doubts about some A380s in the Airbus order

backlog. Virgin Atlantic Airways Ltd., the British airline founded

by Richard Branson, has ordered six of the planes but has no plans

to introduce them into service. The carrier this year also

announced plans to buy Airbus's A350-1000 long-haul plane, a more

modern, twin-engine widebody. Ireland-based lessor Amedeo has

ordered 20 of the planes but so far failed to place them with

airline customers.

The Singapore Airlines A380s are owned by German leasing company

Doric GmbH, which will need to find a customer for the returning

plane in the next 12 months. The leasing firm had no immediate

comment.

Airbus wouldn't comment on the Singapore Airlines decision,

saying it doesn't discuss individual airline fleet plans.

"We are confident in the market for secondhand A380s, which can

be leased or acquired at attractive rates. This will offer a great

opportunity for new entrants with new business models to start

operating the A380," a company spokesman said by email.

Fabrice Bré gier, who oversees Airbus's commercial

plane-building unit, has said finding more A380 customers was a

priority. The availability of used superjumbo jets could allow new

operators to get a taste for the plane with a lower financial

commitment than buying a brand-new A380, he has said.

Despite years of trying, Airbus has struggled to win new orders

for the A380, which costs $432.6 million each at list price.

Airlines have shied away from the superjumbo jet that can seat more

than 600 people, worried about how to fill all its seats.

International Consolidated Airlines Group SA chief executive

Willie Walsh this year said he would consider taking some used

A380s to augment the 12 now in service with British Airways. Mr.

Walsh has said taking secondhand planes would make more sense than

exercising more expensive options for new A380s.

The biggest success for the A380 is Emirates Airline, by far the

largest customer. The Dubai-based carrier, the world's largest by

international traffic, operates a fleet of more than 80 of the

four-engine planes and has placed orders for 142 of the jets.

The A380 program received a rare boost when Japan's All Nippon

Airways Co. in December ordered three of the planes. Iran Air also

has announced plans to take 12 of the Airbus flagship plane as part

of a $27 billion deal with the European plane maker. The deal

remains to be completed, absent U.S. export approvals and

financing.

Write to Gaurav Raghuvanshi at gaurav.raghuvanshi@wsj.com and

Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

September 14, 2016 09:45 ET (13:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

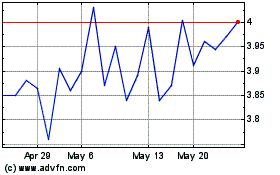

ANA (PK) (USOTC:ALNPY)

Historical Stock Chart

From Oct 2024 to Nov 2024

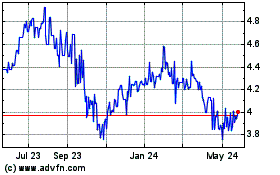

ANA (PK) (USOTC:ALNPY)

Historical Stock Chart

From Nov 2023 to Nov 2024