Terra Firma Aims to Sell AWAS Aircraft Leasing Early Next Year

October 19 2016 - 1:20PM

Dow Jones News

The private-equity firm headed by British tycoon Guy Hands for

the second time in less than two years is preparing to sell its

aircraft leasing company, according to people familiar with the

matter, as Chinese buyers help fuel demand for such businesses.

Terra Firma Capital Partners Ltd., which manages about $12.07

billion, aims to sell AWAS Aviation Capital Ltd. in January or

February next year and has hired an investment bank to advise on

the process, according to the people familiar with the plan. Terra

Firma is the majority owner of AWAS, while Canada Pension Plan

Investment Board, Canada's biggest pension fund, holds a minority

stake. CPPIB supports the sale plan, the people said.

The planned sale comes after Terra Firma in March 2015 signaled

expectations to unload the aircraft leasing company, following

AWAS's deal to sell 90 commercial airliners for $4 billion to

Australia's Macquarie Group Ltd. However, that effort didn't lead

to a transaction, fueling on-again, off-again speculation of Terra

Firma's exit strategy for the business.

Now Terra Firma appears to be betting it will have more success

this time finding a buyer following CIT Group Inc.'s deal earlier

this month to sell its commercial air-leasing business to Chinese

conglomerate HNA Group's Avolon unit for $4 billion. Ahead of the

deal, CIT, a U.S. lender, attracted other bidders such as China's

Ping An Insurance (Group) Co., and Japan's Century Tokyo Leasing

Corp, The Wall Street Journal reported in August. The appetite for

aircraft leasing companies among Chinese buyers comes as increasing

air travel from China boosts aircraft demand.

Based in Dublin, AWAS oversees a portfolio of 240 Airbus Group

SE and Boeing Co. commercial aircraft. It has 90 airline customers

including Japan's All Nippon Airways and Russia's Aeroflot,

according to the firm's website.

Among AWAS's bigger peers such as General Electric Co.'s GE

Capital Aviation Services leasing business, it is considered a

niche player. That position could prove attractive for potential

buyers seeking to broaden their existing portfolio. But, it may

deter potential buyers aiming to quickly gain scale through a deal.

Through the CIT transaction, HNA acquired 350 jets.

Write to Ben Dummett at ben.dummett@wsj.com and Art Patnaude at

art.patnaude@wsj.com

(END) Dow Jones Newswires

October 19, 2016 14:05 ET (18:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

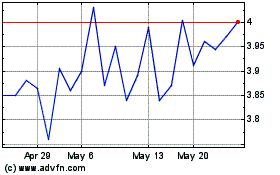

ANA (PK) (USOTC:ALNPY)

Historical Stock Chart

From Dec 2024 to Jan 2025

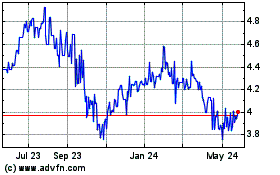

ANA (PK) (USOTC:ALNPY)

Historical Stock Chart

From Jan 2024 to Jan 2025