Amended Current Report Filing (8-k/a)

May 02 2022 - 5:10AM

Edgar (US Regulatory)

0000945617

true

This amendment is being filed to comply with regulations.

0000945617

2021-03-12

2021-03-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND

EXCHANGE COMMISSION

FORM 8-K/A

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of

the Securities

Exchange Act of 1934

Date of Report

(Date of earliest event reported): March 12, 2021

AMERICAN

CANNABIS COMPANY, INC.

(Exact Name of Registrant

as Specified in its Charter)

Delaware

(State

or other jurisdiction of incorporation or organization) |

Commission

File Number

000-26108 |

90-1116625

(I.R.S.

Employer

Identification

Number) |

2590

Walnut Street #6, Denver,

Colorado 80205

(Address of

Principal Executive Offices and Zip Code)

(303)

974-4770

(Issuer's telephone

number)

(Former Name

or Former Address, if Changed Since Last Report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[

] Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[

] Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[

] Pre-commencement communications pursuant to Rule

14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[

] Pre-commencement communications pursuant to Rule

13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant

to Section 12(b) of the Act:

| Title

of Each Class |

Trading

Symbols |

Name

of Exchange on Which Registered |

| Common |

AMMJ |

NONE |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2

of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company [

]

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Section

1 - Registrant’s Business and Operations

Item

1.01 Entry into a Material Definitive Agreement

On

April 29, 2022, the Registrant and Medihemp, LLC, and its wholly owned subsidiary, SLAM Enterprises, LLC, and Medical Cannabis Caregivers,

Inc., all collectively doing business as "Naturaleaf," (hereafter, "Naturaleaf") entered into an amendment to the

previously disclosed material definitive agreement dated March 11, 2021, disclosed on Form 8-K March 12, 2021.

No

material relationship exists between the parties to the amendment, other than with respect to the original material definitive agreement,

as amended.

The

original material definitive agreement disclosed the Registrant's acquisition of assets from Naturaleaf, including, but not limited to:

Naturaleaf's fixed assets, Medical Marijuana Center licenses, a Medical Cannabis’ Medical Marijuana Infused Product Manufacturer

license, a Medical Marijuana Optional Premises Cultivation license (the "Cannabis Licenses"), customer accounts, intellectual

property, goodwill, and leases. As consideration for the purchase, the Registrant agreed to pay an aggregate purchase price of $2,200,000

in cash and 3,000,000 shares of Registrant's common stock.

The

parties agreed to a payment schedule, requiring the Registrant to first pay an initial non-refundable payment of $20,000, credited against

the Purchase Price. Thereafter, upon the party's completion of due diligence, and their receipt of contingent approval letters for the

transfer of the Cannabis Licenses from the Colorado Marijuana Enforcement Division and the City of Colorado Springs (the "Closing"),

the Registrant agreed to pay Naturaleaf $1,080,000 and issue Naturaleaf, or its designees, 3,000,000 shares of the Registrant's restricted

common stock. The balance of the purchase price of $1,100,000 was payable based upon a promissory note ("Note") issued by the

Registrant, which included 10% interest. The Note was due one year after Closing. On April 30, 2021, the Closing occurred, and the Registrant

paid Naturaleaf $1,080,000 and issued 3,000,000 shares of restricted stock.

Pursuant

to the amendment, the parties agreed to restructure remaining payments due to be made by the Registrant under the Note. The parties agreed

that in consideration of the Registrant's payment of $550,000, and outstanding interest of $110,000, a new promissory note in the principal

amount of $550,000 and 12% interest accruing annually, due April 29, 2023, resolves all Registrant's payments of the purchase price.

The parties entered into the amendment and the Registrant paid the consideration of $550,000 principal and $110,000 in interest.

| Item 9.01 |

Financial

Statements and Exhibits. |

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated

May 2, 2022

AMERICAN

CANNABIS COMPANY, INC.

(Registrant)

By:

/s/ Ellis Smith

Ellis

Smith

Principal

Executive Officer

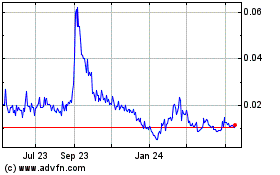

American Cannabis (CE) (USOTC:AMMJ)

Historical Stock Chart

From Feb 2025 to Mar 2025

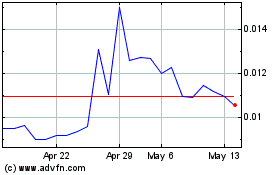

American Cannabis (CE) (USOTC:AMMJ)

Historical Stock Chart

From Mar 2024 to Mar 2025