Q2

2024

--11-30

false

0001123596

false

false

false

false

14

11

9

7

5

0.01

1

0

1

1

1

1

1

.75

3

0.001

0.001

0

0

0.001

0.001

0

0

0.001

0.001

00011235962024-03-012024-05-31

thunderdome:item

utr:Y

0001123596babb:RightToPurchaseSeriesAPreferredStockMember2023-04-042023-04-04

0001123596babb:RightToPurchaseSeriesAPreferredStockMember2021-03-042021-03-04

0001123596babb:RightToPurchaseSeriesAPreferredStockMember2019-02-222019-02-22

0001123596babb:RightToPurchaseSeriesAPreferredStockMember2017-05-222017-05-22

0001123596babb:RightToPurchaseSeriesAPreferredStockMember2015-08-182015-08-18

xbrli:pure

00011235962013-05-06

iso4217:USDxbrli:shares

0001123596babb:RightToPurchaseSeriesAPreferredStockMember2013-05-06

xbrli:shares

00011235962013-05-062013-05-06

00011235962022-12-072022-12-07

0001123596babb:QuarterlyDividendMember2023-03-132023-03-13

0001123596babb:QuarterlyDividendMember2023-06-062023-06-06

0001123596babb:QuarterlyDividendMember2023-09-122023-09-12

00011235962023-12-112023-12-11

0001123596babb:QuarterlyDividendMember2024-03-062024-03-06

00011235962022-12-012023-05-31

iso4217:USD

00011235962023-12-012024-05-31

00011235962023-03-012023-05-31

00011235962024-05-31

utr:M

00011235962024-02-15

00011235962022-06-01

00011235962022-06-012022-06-01

00011235962023-05-31

0001123596babb:UnopenedStoreMember2023-05-31

0001123596babb:UnopenedStoreMember2024-05-31

0001123596babb:TotalFranchisedOwnedAndLicensedUnitsMember2023-05-31

0001123596babb:TotalFranchisedOwnedAndLicensedUnitsMember2024-05-31

0001123596babb:LicensedUnitsMember2023-05-31

0001123596babb:LicensedUnitsMember2024-05-31

0001123596us-gaap:FranchisedUnitsMember2023-05-31

0001123596us-gaap:FranchisedUnitsMember2024-05-31

00011235962023-11-30

00011235962029-06-012023-11-30

00011235962028-06-012023-11-30

00011235962027-06-012023-11-30

00011235962026-06-012023-11-30

00011235962025-06-012023-11-30

00011235962024-06-012023-11-30

00011235962022-12-012023-11-30

00011235962022-11-30

0001123596babb:ContractLiabilitiesCurrentAndAccruedExpensesAndOtherCurrentLiabilitiesMember2023-11-30

0001123596babb:ContractLiabilitiesCurrentAndAccruedExpensesAndOtherCurrentLiabilitiesMember2024-05-31

0001123596us-gaap:TransferredOverTimeMember2022-12-012023-05-31

0001123596us-gaap:TransferredOverTimeMember2023-12-012024-05-31

0001123596us-gaap:TransferredOverTimeMember2023-03-012023-05-31

0001123596us-gaap:TransferredOverTimeMember2024-03-012024-05-31

0001123596babb:MarketingFundMemberus-gaap:TransferredOverTimeMember2022-12-012023-05-31

0001123596babb:MarketingFundMemberus-gaap:TransferredOverTimeMember2023-12-012024-05-31

0001123596babb:MarketingFundMemberus-gaap:TransferredOverTimeMember2023-03-012023-05-31

0001123596babb:MarketingFundMemberus-gaap:TransferredOverTimeMember2024-03-012024-05-31

0001123596babb:NontraditionalRevenueMemberus-gaap:TransferredOverTimeMember2022-12-012023-05-31

0001123596babb:NontraditionalRevenueMemberus-gaap:TransferredOverTimeMember2023-12-012024-05-31

0001123596babb:NontraditionalRevenueMemberus-gaap:TransferredOverTimeMember2023-03-012023-05-31

0001123596babb:NontraditionalRevenueMemberus-gaap:TransferredOverTimeMember2024-03-012024-05-31

0001123596babb:GiftCardMemberus-gaap:TransferredOverTimeMember2022-12-012023-05-31

0001123596babb:GiftCardMemberus-gaap:TransferredOverTimeMember2023-12-012024-05-31

0001123596babb:GiftCardMemberus-gaap:TransferredOverTimeMember2023-03-012023-05-31

0001123596babb:GiftCardMemberus-gaap:TransferredOverTimeMember2024-03-012024-05-31

0001123596us-gaap:LicenseMemberus-gaap:TransferredOverTimeMember2022-12-012023-05-31

0001123596us-gaap:LicenseMemberus-gaap:TransferredOverTimeMember2023-12-012024-05-31

0001123596us-gaap:LicenseMemberus-gaap:TransferredOverTimeMember2023-03-012023-05-31

0001123596us-gaap:LicenseMemberus-gaap:TransferredOverTimeMember2024-03-012024-05-31

0001123596us-gaap:FranchiseMemberus-gaap:TransferredOverTimeMember2022-12-012023-05-31

0001123596us-gaap:FranchiseMemberus-gaap:TransferredOverTimeMember2023-12-012024-05-31

0001123596us-gaap:FranchiseMemberus-gaap:TransferredOverTimeMember2023-03-012023-05-31

0001123596us-gaap:FranchiseMemberus-gaap:TransferredOverTimeMember2024-03-012024-05-31

0001123596us-gaap:RoyaltyMemberus-gaap:TransferredOverTimeMember2022-12-012023-05-31

0001123596us-gaap:RoyaltyMemberus-gaap:TransferredOverTimeMember2023-12-012024-05-31

0001123596us-gaap:RoyaltyMemberus-gaap:TransferredOverTimeMember2023-03-012023-05-31

0001123596us-gaap:RoyaltyMemberus-gaap:TransferredOverTimeMember2024-03-012024-05-31

0001123596us-gaap:TransferredAtPointInTimeMember2022-12-012023-05-31

0001123596us-gaap:TransferredAtPointInTimeMember2023-12-012024-05-31

0001123596us-gaap:TransferredAtPointInTimeMember2023-03-012023-05-31

0001123596us-gaap:TransferredAtPointInTimeMember2024-03-012024-05-31

0001123596us-gaap:StructuredSettlementAnnuityMemberus-gaap:TransferredAtPointInTimeMember2022-12-012023-05-31

0001123596us-gaap:StructuredSettlementAnnuityMemberus-gaap:TransferredAtPointInTimeMember2023-12-012024-05-31

0001123596us-gaap:StructuredSettlementAnnuityMemberus-gaap:TransferredAtPointInTimeMember2023-03-012023-05-31

0001123596us-gaap:StructuredSettlementAnnuityMemberus-gaap:TransferredAtPointInTimeMember2024-03-012024-05-31

0001123596babb:SignShopMemberus-gaap:TransferredAtPointInTimeMember2022-12-012023-05-31

0001123596babb:SignShopMemberus-gaap:TransferredAtPointInTimeMember2023-12-012024-05-31

0001123596babb:SignShopMemberus-gaap:TransferredAtPointInTimeMember2023-03-012023-05-31

0001123596babb:SignShopMemberus-gaap:TransferredAtPointInTimeMember2024-03-012024-05-31

0001123596us-gaap:LeaseholdImprovementsMember2024-05-31

0001123596srt:MaximumMember2024-05-31

0001123596srt:MinimumMember2024-05-31

00011235962024-05-312024-05-31

0001123596babb:InternalGrade4Member2024-05-31

0001123596babb:InternalGrade4Member2024-05-312024-05-31

0001123596babb:InternalGrade3Member2024-05-31

0001123596babb:InternalGrade3Member2024-05-312024-05-31

0001123596babb:InternalGrade2Member2024-05-31

0001123596babb:InternalGrade2Member2024-05-312024-05-31

0001123596babb:InternalGrade1Member2024-05-31

0001123596babb:InternalGrade1Member2024-05-312024-05-31

0001123596us-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2024-05-31

0001123596us-gaap:FinancingReceivables60To89DaysPastDueMember2024-05-31

0001123596us-gaap:FinancingReceivables30To59DaysPastDueMember2024-05-31

0001123596us-gaap:FinancingReceivables1To29DaysPastDueMember2024-05-31

0001123596us-gaap:FinancialAssetNotPastDueMember2024-05-31

0001123596babb:VendorRelatedMember2024-05-31

0001123596us-gaap:FranchiseMember2024-05-31

0001123596babb:VendorRelatedMember2023-12-012024-05-31

0001123596us-gaap:FranchiseMember2023-12-012024-05-31

0001123596us-gaap:AccountingStandardsUpdate201613Membersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2023-11-30

0001123596babb:VendorRelatedMemberus-gaap:AccountingStandardsUpdate201613Membersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2023-11-30

0001123596us-gaap:FranchiseMemberus-gaap:AccountingStandardsUpdate201613Membersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2023-11-30

0001123596babb:VendorRelatedMember2023-11-30

0001123596us-gaap:FranchiseMember2023-11-30

0001123596babb:UnitsUnderDevelopmentMember2024-05-31

0001123596babb:MarketingFundMember2022-12-012023-05-31

0001123596babb:MarketingFundMember2023-12-012024-05-31

0001123596babb:MarketingFundMember2023-03-012023-05-31

0001123596babb:MarketingFundMember2024-03-012024-05-31

0001123596babb:LicensingFeesAndOtherIncomeMember2022-12-012023-05-31

0001123596babb:LicensingFeesAndOtherIncomeMember2023-12-012024-05-31

0001123596babb:LicensingFeesAndOtherIncomeMember2023-03-012023-05-31

0001123596babb:LicensingFeesAndOtherIncomeMember2024-03-012024-05-31

0001123596us-gaap:FranchiseMember2022-12-012023-05-31

0001123596us-gaap:FranchiseMember2023-12-012024-05-31

0001123596us-gaap:FranchiseMember2023-03-012023-05-31

0001123596us-gaap:FranchiseMember2024-03-012024-05-31

0001123596us-gaap:RoyaltyMember2022-12-012023-05-31

0001123596us-gaap:RoyaltyMember2023-12-012024-05-31

0001123596us-gaap:RoyaltyMember2023-03-012023-05-31

0001123596us-gaap:RoyaltyMember2024-03-012024-05-31

0001123596us-gaap:SeriesAPreferredStockMember2023-11-30

0001123596us-gaap:SeriesAPreferredStockMember2024-05-31

0001123596us-gaap:FranchiseMember2023-11-30

0001123596us-gaap:FranchiseMember2024-05-31

0001123596babb:MarketingFundMember2023-11-30

0001123596babb:MarketingFundMember2024-05-31

00011235962024-07-12

FORM 10-Q

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Mark One)

|

☒

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended May 31, 2024

|

|

☐

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 0-31555

|

| |

|

BAB, Inc.

(Name of small business issuer in its charter)

|

Delaware

|

36-4389547

|

|

(State or other jurisdiction of incorporation or

organization)

|

(I.R.S. Employer Identification No.)

|

500 Lake Cook Road, Suite 475, Deerfield, Illinois 60015

(Address of principal executive offices) (Zip Code)

Issuer's telephone number (847) 948-7520

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which

registered

|

|

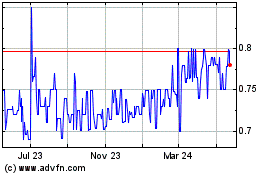

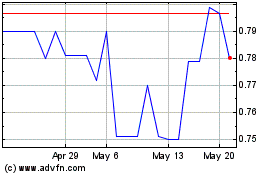

Common Stock

|

BABB

|

OTCQB

|

Indicate by checkmark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by checkmark whether the registrant is a large accelerated filer, accelerated filer, a non-accelerated filer, or a smaller reporting company. Large accelerated filer ☐ Accelerated filer ☐ Non-accelerated filer ☒ Smaller reporting company ☒ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company. Yes ☐ No ☒

As of July 12, 2024 BAB, Inc. had: 7,263,508 shares of Common Stock outstanding.

TABLE OF CONTENTS

|

PART I

|

FINANCIAL INFORMATION

|

3 |

| |

|

|

|

Item 1.

|

Financial Statements

|

3 |

| |

|

|

|

Item 2

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

19 |

| |

|

|

|

Item 3

|

Quantitative and Qualitative Disclosures About Market Risk

|

23 |

| |

|

|

|

Item 4

|

Controls and Procedures

|

23 |

| |

|

|

|

PART II

|

OTHER INFORMATION

|

24 |

| |

|

|

|

Item 1.

|

Legal Proceedings

|

24 |

| |

|

|

|

Item 2

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

24 |

| |

|

|

|

Item 3

|

Defaults Upon Senior Securities

|

24 |

| |

|

|

|

Item 4

|

Mine Safety Disclosures

|

24 |

| |

|

|

|

Item 5

|

Other Information

|

24 |

| |

|

|

|

Item 6

|

Exhibits

|

25 |

| |

|

|

|

SIGNATURE

|

|

26 |

PART I

|

ITEM 1.

|

FINANCIAL STATEMENTS

|

BAB, Inc.

Consolidated Balance Sheets

| |

|

May 31, 2024

|

|

|

November 30, 2023

|

|

| |

|

(unaudited)

|

|

|

(audited)

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current Assets

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$ |

1,937,678 |

|

|

$ |

1,888,728 |

|

|

Restricted cash

|

|

|

229,919 |

|

|

|

183,944 |

|

|

Receivables

|

|

|

|

|

|

|

|

|

|

Trade accounts and notes receivable (net of allowance for doubtful accounts of $49,618 in 2024 and $28,873 in 2023)

|

|

|

73,131 |

|

|

|

71,681 |

|

|

Marketing fund contributions receivable from franchisees and stores

|

|

|

18,556 |

|

|

|

14,995 |

|

|

Lease receivable

|

|

|

5,937 |

|

|

|

5,900 |

|

|

Prepaid expenses and other current assets

|

|

|

95,813 |

|

|

|

96,544 |

|

|

Total Current Assets

|

|

|

2,361,034 |

|

|

|

2,261,792 |

|

| |

|

|

|

|

|

|

|

|

|

Property, plant and equipment (net of accumulated depreciation of $159,414 in both 2024 and 2023.

|

|

|

- |

|

|

|

- |

|

|

Lease receivable

|

|

|

29,427 |

|

|

|

32,406 |

|

|

Trademarks

|

|

|

461,445 |

|

|

|

461,445 |

|

|

Goodwill

|

|

|

1,493,771 |

|

|

|

1,493,771 |

|

|

Definite lived intangible assets (net of accumulated amortization of $140,502 in 2024 and $138,541 in 2023)

|

|

|

14,384 |

|

|

|

16,345 |

|

|

Operating lease right of use

|

|

|

392,664 |

|

|

|

32,745 |

|

|

Total Noncurrent Assets

|

|

|

2,391,691 |

|

|

|

2,036,712 |

|

|

Total Assets

|

|

$ |

4,752,725 |

|

|

$ |

4,298,504 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

Current Liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

16,502 |

|

|

$ |

3,042 |

|

|

Income tax payable

|

|

|

123,747 |

|

|

|

47,334 |

|

|

Accrued expenses and other current liabilities

|

|

|

307,063 |

|

|

|

325,880 |

|

|

Unexpended marketing fund contributions

|

|

|

227,237 |

|

|

|

201,824 |

|

|

Deferred franchise fee revenue

|

|

|

24,166 |

|

|

|

30,094 |

|

|

Current portion operating lease liability

|

|

|

44,066 |

|

|

|

39,818 |

|

|

Total Current Liabilities

|

|

|

742,781 |

|

|

|

647,992 |

|

| |

|

|

|

|

|

|

|

|

|

Long-term Liabilities (net of current portion)

|

|

|

|

|

|

|

|

|

|

Operating lease liability

|

|

|

363,071 |

|

|

|

- |

|

|

Deferred franchise revenue

|

|

|

157,743 |

|

|

|

162,026 |

|

|

Deferred tax liability

|

|

|

283,653 |

|

|

|

309,293 |

|

|

Total Long-term Liabilities

|

|

|

804,467 |

|

|

|

471,319 |

|

|

Total Liabilities

|

|

$ |

1,547,248 |

|

|

$ |

1,119,311 |

|

| |

|

|

|

|

|

|

|

|

|

Stockholders' Equity

|

|

|

|

|

|

|

|

|

|

Preferred shares -$.001 par value; 4,000,000 authorized; no shares outstanding as of May 31, 2024 and November 30, 2023

|

|

|

- |

|

|

|

- |

|

|

Preferred shares -$.001 par value; 1,000,000 Series A authorized; no shares outstanding as of May 31, 2024 and November 30, 2023

|

|

|

- |

|

|

|

- |

|

|

Common stock -$.001 par value; 15,000,000 shares authorized; 8,466,953 shares issued and 7,263,508 shares outstanding as of May 31, 2024 and November 30, 2023

|

|

|

13,508,257 |

|

|

|

13,508,257 |

|

|

Additional paid-in capital

|

|

|

987,034 |

|

|

|

987,034 |

|

|

Treasury stock

|

|

|

(222,781 |

) |

|

|

(222,781 |

) |

|

Accumulated deficit

|

|

|

(11,067,033 |

) |

|

|

(11,093,317 |

) |

|

Total Stockholders' Equity

|

|

|

3,205,477 |

|

|

|

3,179,193 |

|

|

Total Liabilities and Stockholders' Equity

|

|

$ |

4,752,725 |

|

|

$ |

4,298,504 |

|

SEE ACCOMPANYING NOTES

BAB, Inc.

Consolidated Statements of Income

For the Three and Six Months ended May 31, 2024 and May 31, 2023

(Unaudited)

| |

|

Three months ended May 31,

|

|

|

Six months ended May 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

REVENUES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Royalty fees from franchised stores

|

|

$ |

513,474 |

|

|

$ |

494,933 |

|

|

$ |

973,163 |

|

|

$ |

937,541 |

|

|

Franchise Fees

|

|

|

9,215 |

|

|

|

7,054 |

|

|

|

19,461 |

|

|

|

11,401 |

|

|

Licensing fees and other income

|

|

|

53,513 |

|

|

|

75,674 |

|

|

|

160,101 |

|

|

|

135,994 |

|

|

Marketing fund revenue

|

|

|

306,636 |

|

|

|

286,739 |

|

|

|

566,047 |

|

|

|

525,057 |

|

|

Total Revenues

|

|

|

882,838 |

|

|

|

864,400 |

|

|

|

1,718,772 |

|

|

|

1,609,993 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payroll and payroll-related expenses

|

|

|

231,482 |

|

|

|

231,904 |

|

|

|

487,811 |

|

|

|

503,623 |

|

|

Occupancy

|

|

|

28,950 |

|

|

|

33,759 |

|

|

|

62,291 |

|

|

|

68,407 |

|

|

Advertising and promotion

|

|

|

398 |

|

|

|

4,904 |

|

|

|

762 |

|

|

|

7,705 |

|

|

Professional service fees

|

|

|

37,834 |

|

|

|

25,625 |

|

|

|

89,613 |

|

|

|

78,677 |

|

|

Travel

|

|

|

5,209 |

|

|

|

7,043 |

|

|

|

8,231 |

|

|

|

8,274 |

|

|

Employee benefit expenses

|

|

|

33,829 |

|

|

|

38,548 |

|

|

|

70,633 |

|

|

|

77,870 |

|

|

Depreciation and amortization

|

|

|

981 |

|

|

|

922 |

|

|

|

1,961 |

|

|

|

1,845 |

|

|

Marketing fund expenses

|

|

|

306,636 |

|

|

|

286,739 |

|

|

|

566,047 |

|

|

|

525,057 |

|

|

Other

|

|

|

51,069 |

|

|

|

63,866 |

|

|

|

122,993 |

|

|

|

118,046 |

|

|

Total Operating Expenses

|

|

|

696,388 |

|

|

|

693,310 |

|

|

|

1,410,342 |

|

|

|

1,389,504 |

|

|

Income from operations

|

|

|

186,450 |

|

|

|

171,090 |

|

|

|

308,430 |

|

|

|

220,489 |

|

|

Interest income

|

|

|

16,735 |

|

|

|

5,438 |

|

|

|

32,260 |

|

|

|

5,559 |

|

|

Income before provision for income taxes

|

|

|

203,185 |

|

|

|

176,528 |

|

|

|

340,690 |

|

|

|

226,048 |

|

|

Provision for income taxes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current tax expense

|

|

|

61,349 |

|

|

|

75,823 |

|

|

|

122,140 |

|

|

|

90,023 |

|

|

Deferred tax

|

|

|

(3,849 |

) |

|

|

(25,823 |

) |

|

|

(25,640 |

) |

|

|

(25,823 |

) |

|

Total Tax Provision

|

|

|

57,500 |

|

|

|

50,000 |

|

|

|

96,500 |

|

|

|

64,200 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income

|

|

$ |

145,685 |

|

|

$ |

126,528 |

|

|

$ |

244,190 |

|

|

$ |

161,848 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income per share - Basic and Diluted

|

|

$ |

0.02 |

|

|

$ |

0.02 |

|

|

$ |

0.03 |

|

|

$ |

0.02 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding - Basic and diluted

|

|

|

7,263,508 |

|

|

|

7,263,508 |

|

|

|

7,263,508 |

|

|

|

7,263,508 |

|

|

Cash distributions declared per share

|

|

$ |

0.01 |

|

|

$ |

0.01 |

|

|

$ |

0.03 |

|

|

$ |

0.03 |

|

SEE ACCOMPANYING NOTES

BAB, Inc.

Consolidated Statements of Cash Flows

For the Six Months ended May 31, 2024 and May 31, 2023

(Unaudited)

| |

|

May 31, 2024

|

|

|

May 31, 2023

|

|

|

Operating activities

|

|

|

|

|

|

|

|

|

|

Net Income

|

|

$ |

244,190 |

|

|

$ |

161,848 |

|

|

Adjustments to reconcile net income to cash flows provided by operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

1,961 |

|

|

|

1,845 |

|

|

Deferred tax expense

|

|

|

(25,640 |

) |

|

|

(25,823 |

) |

|

Provision for uncollectible accounts, net of recoveries

|

|

|

20,745 |

|

|

|

- |

|

|

Noncash lease expense

|

|

|

47,577 |

|

|

|

49,655 |

|

|

Changes in:

|

|

|

|

|

|

|

|

|

|

Trade accounts receivable and notes receivable

|

|

|

(19,253 |

) |

|

|

17,538 |

|

|

Marketing fund contributions receivable

|

|

|

(3,561 |

) |

|

|

(9,555 |

) |

|

Prepaid expenses and other

|

|

|

731 |

|

|

|

68,496 |

|

|

Accounts payable

|

|

|

13,460 |

|

|

|

8,255 |

|

|

Accrued liabilities

|

|

|

57,596 |

|

|

|

20,783 |

|

|

Unexpended marketing fund contributions

|

|

|

25,413 |

|

|

|

68,490 |

|

|

Deferred revenue

|

|

|

(10,211 |

) |

|

|

32,218 |

|

|

Operating lease liability

|

|

|

(40,177 |

) |

|

|

(58,940 |

) |

|

Net Cash Provided by Operating Activities

|

|

|

312,831 |

|

|

|

334,810 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Financing activities

|

|

|

|

|

|

|

|

|

|

Cash distributions/dividends

|

|

|

(217,906 |

) |

|

|

(217,905 |

) |

|

Net Cash Used In Financing Activities

|

|

|

(217,906 |

) |

|

|

(217,905 |

) |

| |

|

|

|

|

|

|

|

|

|

Net (Decrease)/Increase in Cash and Restricted Cash

|

|

|

94,925 |

|

|

|

116,905 |

|

|

Cash and Restricted Cash - Beginning of Period

|

|

|

2,072,672 |

|

|

|

1,902,661 |

|

|

Cash and Restricted Cash - End of Period

|

|

$ |

2,167,597 |

|

|

$ |

2,019,566 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Supplemental disclosure of cash flow information:

|

|

|

|

|

|

|

|

|

|

Interest paid

|

|

$ |

- |

|

|

$ |

- |

|

|

Income taxes paid

|

|

$ |

78,500 |

|

|

$ |

7,500 |

|

|

Non-cash operating activities:

|

|

|

|

|

|

|

|

|

|

Right-of-use operating asset obtained in exchange for operating lease liability

|

|

$ |

401,430 |

|

|

$ |

- |

|

SEE ACCOMPANYING NOTES

BAB, Inc.

Notes to Unaudited Consolidated Financial Statements

For the Three and Six Months Ended May 31, 2024 and May 31, 2023

(Unaudited)

Note 1. Nature of Operations

BAB, Inc. (“the Company”) has three wholly owned subsidiaries: BAB Systems, Inc. (“Systems”), BAB Operations, Inc. (“Operations”) and BAB Investments, Inc. (“Investments”). Systems was incorporated on December 2, 1992, and was primarily established to franchise Big Apple Bagels® (“BAB”) specialty bagel retail stores. My Favorite Muffin (“MFM”) was acquired in 1997 and is included as a part of Systems. Brewster’s (“Brewster’s”) was established in 1996 and the coffee is sold in BAB and MFM locations. SweetDuet® (“SD”) frozen yogurt can be added as an additional brand in a BAB location. Operations was formed in 1995, primarily to operate Company-owned stores of which there are currently none. The assets of Jacobs Bros. Bagels (“Jacobs Bros.”) were acquired in 1999, and any branded wholesale business uses this trademark. Investments was incorporated in 2009 to be used for the purpose of acquisitions. To date there have been no acquisitions.

The Company was incorporated under the laws of the State of Delaware on July 12, 2000. The Company currently franchises and licenses bagel and muffin retail units under the BAB, MFM and SD trade names. At May 31, 2024, the Company had 64 franchise units and 4 licensed units in operation in 20 states. There are 4 units under development. The Company additionally derives income from the sale of its trademark bagels, muffins and coffee through nontraditional channels of distribution including under licensing agreements.

The BAB franchised brand consists of units operating as “Big Apple Bagels®,” featuring daily baked bagels, flavored cream cheeses, premium coffees, gourmet bagel sandwiches and other related products. BAB units are primarily concentrated in the Midwest and Western United States. The MFM brand consists of units operating as “My Favorite Muffin Gourmet Muffin Bakery®” (“MFM Bakery”), featuring a large variety of freshly baked muffins and coffees and units operating as “My Favorite Muffin Your All-Day Bakery Café®” (“MFM Cafe”) featuring these products as well as a variety of specialty bagel sandwiches and related products. The SweetDuet® is a branded self-serve frozen yogurt that can be added as an additional brand in a BAB location. Although the Company doesn't actively market Brewster's stand-alone franchises, Brewster's coffee products are sold in most franchised units.

The Company is leveraging on the natural synergy of distributing muffin products in existing BAB units and, alternatively, bagel products and Brewster's Coffee in existing MFM units. The Company expects to continue to realize efficiencies in servicing the combined base of BAB and MFM franchisees.

The Company has a minority interest in Athletes HQ Systems, Inc. (“AHQ”). AHQ franchises indoor baseball and softball practice and coaching facilities with knowledgeable instructors.

The accompanying condensed consolidated financial statements are unaudited. These financial statements have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission. Certain information and footnote disclosures normally included in financial statements prepared in accordance with U.S. generally accepted accounting principles have been omitted pursuant to such SEC rules and regulations; nevertheless, the Company believes that the disclosures are adequate to make the information presented not misleading. These financial statements and the notes hereto should be read in conjunction with the financial statements and notes thereto included in the Company's Annual Report on Form 10-K for the year ended November 30, 2023 which was filed February 26, 2024. In the opinion of the Company's management, the condensed consolidated financial statements for the unaudited interim period presented include all adjustments, including normal recurring adjustments, necessary to fairly present the results of such interim period and the financial position as of the end of said period. The results of operations for the interim period are not necessarily indicative of the results for the full year.

2. Summary of Significant Accounting Policies

Unaudited Consolidated Financial Statements

The accompanying unaudited Condensed Consolidated Financial Statements of BAB, Inc. have been prepared pursuant to generally accepted accounting principles in the United States of America (“U.S. GAAP”) for interim financial information and the rules and regulations of the United States Securities and Exchange Commission (the “SEC”) for Form 10-Q. The consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries. All intercompany accounts and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of the financial statements and accompanying notes are in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue and expenses and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reported periods. Actual results could differ from those estimates.

Cash and Cash Equivalents

Cash and cash equivalents include cash on hand, demand deposits and treasury notes with banks and equity firms with original maturities of less than 90 days. The balance of bank accounts may, at times, exceed federally insured credit limits. The Company has not experienced any loss in such accounts and believes it is not subject to any significant credit risk related to cash at May 31, 2024.

Accounts Receivable and Notes Receivable

The Company adopted FASB ASC Topic 326, Financial Instruments - Credit Losses, (“CECL”) with an adoption date of December 1, 2023. As a result, the Company changed its accounting policy for allowance for credit losses and the policy pursuant to CECL is disclosed below.

The CECL reserve methodology requires companies to measure expected credit losses on financial instruments based on the total estimated amount to be collected over the lifetime of the instrument. Under the CECL model, reserves may be established against financial asset balances even if the risk of loss is remote or has not yet manifested itself. The Company records specific reserves against account balances of franchisees deemed at-risk when a potential loss is likely or imminent as a result of prolonged payment delinquency (greater than 90 days past due) and where notable credit deterioration has become evident. For financial assets that are not currently deemed at-risk, an allowance is recorded based on expected loss rates derived pursuant to the Company's CECL methodology that assesses four components - historical losses, current conditions, reasonable and supportable forecasts, and a reversion to history, if applicable.

2. Summary of Significant Accounting Policies (Continued)

Accounts Receivable and Notes Receivable (Continued)

The Company considers its portfolio segments to be the following:

Accounts Receivable (Franchise-Related): Most of the Company’s short-term receivables due from franchisees are derived from royalty, advertising and other franchise-related fees.

Notes Receivable: Notes receivable balances primarily relate to the conversion of (1) certain past due franchisee accounts receivable or (2) early franchise termination fees, to notes receivable. These notes are usually not collateralized. A significant portion of these notes have specific reserves recorded against them amounting to $49,618 as of May 31, 2024.

Leases Receivable: Leases receivable consist of a single equipment lease receivable at May 31, 2024. The Company purchased equipment and leased the equipment to a franchisee. The equipment lease is collateralized by the equipment. The outstanding balance of the lease receivable is estimated to equate to the fair value of the equipment collateralizing the lease contracts, and is stated net of the unamortized interest income of $973 at May 31, 2024.

Accounts Receivables (Vendor Related): Receivables due from vendors and distributors consist of royalty receivables related to the sale of certain food products to franchisees through the Company’s network of suppliers and distributors and are included as part of Accounts Receivable.

Receivable balances by portfolio segment as of May 31, 2024 and November 30, 2023 are as follows:

| |

|

May 31,

2024

|

|

|

November 30,

2023

|

|

|

Accounts Receivable (Franchise Related)

|

|

$ |

65,632 |

|

|

$ |

55,781 |

|

|

Accounts Receivable (Vendor Related)

|

|

|

21,750 |

|

|

|

28,895 |

|

|

Notes Receivable

|

|

|

53,923 |

|

|

|

30,873 |

|

|

Lease Receivable, Net of Unamortized Interest

|

|

|

35,364 |

|

|

|

38,306 |

|

| |

|

|

176,669 |

|

|

|

153,855 |

|

|

Less: Allowance for Credit Losses

|

|

|

(49,618 |

) |

|

|

(28,873 |

) |

|

Total Receivables

|

|

|

127,051 |

|

|

|

124,982 |

|

|

Less: Current Portion

|

|

|

(97,624 |

) |

|

|

(92,576 |

) |

|

Long-Term Receivables

|

|

$ |

29,427 |

|

|

$ |

32,406 |

|

The Company's internal credit quality indicators for all portfolio segments primarily consider delinquency. Current and collateralized lease receivables have an internal risk rating of Grade I. The Company does not currently have any uncollateralized lease receivables. Past due lease receivables would be assigned an internal risk rating of Grade II-IV, depending on significance of delinquency. For uncollateralized notes receivable, the Company also considers the status of the franchisee note holder and the term of the note. Notes receivable from current franchisees are considered to have an elevated risk of credit loss based on their common origination from past due franchise accounts receivable but have some indication of collectability given ongoing operations (Internal Grade II). Notes receivable due from payers who no longer have an operating franchise are considered to have a high likelihood of credit loss (Internal Grade III). That likelihood increases if the note is outstanding for longer than one year (Internal Grade IV). At May 31, 2024, all notes receivable were due from former franchisees and had an original term over one year.

2. Summary of Significant Accounting Policies

Accounts Receivable and Notes Receivable (Continued)

Changes in the allowance for credit losses during the six months ended May 31, 2024 were as follows:

| |

|

Accounts

Receivable

(Franchise

Related)

|

|

|

Accounts

Receivable

(Vendor

Related)

|

|

|

Notes

Receivable

|

|

|

Lease

Receivable,

Net

|

|

|

Total

|

|

|

Balance at November 30, 2023

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

28,873 |

|

|

$ |

- |

|

|

$ |

28,873 |

|

|

Adjustments to Allowance for Adoption of ASU 2016-13

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Write-offs

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Recoveries

|

|

|

- |

|

|

|

- |

|

|

|

(2,304 |

) |

|

|

- |

|

|

|

(2,304 |

) |

|

Provision for Credit Losses

|

|

|

- |

|

|

|

- |

|

|

|

23,049 |

|

|

|

- |

|

|

|

23,049 |

|

|

Balance at May 31, 2024

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

49,618 |

|

|

$ |

- |

|

|

$ |

49,618 |

|

The Company considers a receivable past due 31 days after the payment due date. The delinquency status of receivables (other than accounts receivable) at May 31, 2024 was as follows:

| |

|

Current

|

|

|

0-30 days Past Due

|

|

|

30-60 days Past Due

|

|

|

60-90 days past due

|

|

|

Over 90 days past due

|

|

|

Total

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes Receivable

|

|

$ |

43,050 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

10,873 |

|

|

$ |

53,923 |

|

|

Lease Receivable, Net of Unamortized Interest

|

|

|

35,364 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

35,364 |

|

| |

|

$ |

78,414 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

10,873 |

|

|

$ |

89,287 |

|

The fiscal year of origination of the Company's gross notes receivable and lease receivables by risk rating are as follows:

| |

|

2024

|

|

|

2023

|

|

|

2022

|

|

|

2021

|

|

|

2020

|

|

|

Prior

|

|

|

Total

|

|

|

Risk rating

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Internal Grade I

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

35,364 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

35,364 |

|

|

Internal Grade II

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Internal Grade III

|

|

|

24,094 |

|

|

|

18,956 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

43,050 |

|

|

Internal Grade IV

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

10,873 |

|

|

|

10,873 |

|

|

Notes and Lease Receivables, Net of Unamortized Interest

|

|

$ |

24,094 |

|

|

$ |

18,956 |

|

|

$ |

35,364 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

10,873 |

|

|

$ |

89,287 |

|

2. Summary of Significant Accounting Policies (Continued)

Lease Receivable

The Company leases restaurant equipment to a certain franchisee under a sales-type lease agreement. Under the terms of the agreement, title to the equipment passes to the customer once all lease payments have been made and a reasonable buy-out fee is paid. The Company retains title or a security interest in the equipment until such time. The sales and cost of sales are recognized at the inception of the lease. The profit or loss on the issuance of the lease is recorded in the period of commencement. The investment in sales-type leases consists of the sum of the minimum lease payments receivable less unearned interest income and, if applicable, estimated executory cost. Minimum lease payments are part of the lease agreement between the Company (as the lessor) and the franchisee (as the lessee). The discount rate implicit in the lease is used to calculate the present value of minimum lease payments. The minimum lease payments consist of the gross lease payments net of executory costs, if any. Unearned interest income is amortized to income over the lease term to produce a constant periodic rate of return on net investment in the lease. While revenue is recognized at the inception of the lease, the cash flow from the sales-type lease occurs over the course of the lease, which results in interest income and reduction of receivables.

Property, Plant and Equipment

Property, equipment and leasehold improvements are stated at cost less accumulated depreciation and amortization. Depreciation is calculated using the straight-line method over the estimated useful lives of the assets. Estimated useful lives are 3 to 7 years for property and equipment and 10 years, or term of lease if less, for leasehold improvements. Maintenance and repairs are charged to expense as incurred. Expenditures that materially extend the useful lives of assets are capitalized.

Other Assets

Other assets include a minority investment in AHQ Systems, Inc. The shares were issued to BAB, Inc. as compensation for consulting services and are valued at $2,250. The value of the investment is immaterial and has not been adjusted to fair market value.

Advertising and Promotion Costs

The Company expenses advertising and promotion costs as incurred. All advertising and promotion costs were related to the Company’s franchise operations.

Lease Liabilities

The company accounts for leases under ASC 842. Lease arrangements are determined at the inception of the contract. Operating leases are included in operating lease right-of-use (“ROU”) assets and other current and long-term operating lease liabilities on the consolidated balance sheets. Finance leases are included in property and equipment, other current liabilities, and other long-term liabilities on the consolidated balance sheets.

Operating lease ROU assets and operating lease liabilities are recognized based on the present value of the future minimum lease payments over the lease term at commencement date. As most leases do not provide an implicit rate, we use an incremental borrowing rate based on the information available at commencement date in determining the present value of future payments. The operating lease ROU asset also includes any lease payments made and excludes lease incentives and initial direct costs incurred. The lease terms may include options to extend or terminate the lease when it is reasonably certain that the Company will exercise that option. Lease expense for minimum lease payments is recognized on a straight-line basis over the lease term.

2. Summary of Significant Accounting Policies (continued)

Recent Accounting Pronouncements

In December 2023, the FASB issued ASU 2023-09, “Improvements to Income Tax Disclosures” which is intended to simplify various aspects related to accounting for income taxes. ASU 2023-09 removes certain exceptions to the general principles in Topic 740 and also clarifies and amends existing guidance to improve consistent application. The amendments in ASU 2023-09 are effective for public business entities for fiscal years beginning after December 15, 2024, including interim periods therein. Early adoption of the standard is permitted, including adoption in interim or annual periods for which financial statements have not yet been issued. The Company will adopt ASU 2023-09 for fiscal year ending November 30, 2026.

Management does not believe that there are any recently issued and effective or not yet effective accounting pronouncements as of May 31, 2024 that would have or are expected to have any significant effect on the Company’s financial position, cash flows or income statement.

Statement of Cash Flows

The chart below shows the cash and restricted cash within the consolidated statements of cash flows as of May 31, 2024 and 2023 were as follows:

| |

|

May 31, 2024

|

|

|

May 31, 2023

|

|

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

1,937,678 |

|

|

$ |

1,682,226 |

|

|

Restricted cash

|

|

|

229,919 |

|

|

|

337,340 |

|

|

Total cash and restricted cash

|

|

$ |

2,167,597 |

|

|

$ |

2,019,566 |

|

3. Revenue Recognition

Franchise and related revenue

The Company sells individual franchises. The franchise agreements typically require the franchisee to pay an initial, non-refundable fee prior to opening the respective location(s), and continuing royalty fees on a weekly basis based upon a percentage of franchisee net sales. The initial term of franchise agreements are typically 10 years. Subject to the Company’s approval, a franchisee may generally renew the franchise agreement upon its expiration. If approved, a franchisee may transfer a franchise agreement to a new or existing franchisee, at which point a transfer fee is typically paid by the current owner which then terminates that franchise agreement. A franchise agreement is signed with the new franchisee with no franchise fee required. If a contract is terminated prior to its term, it is a breach of contract and a penalty is assessed based on a formula reviewed and approved by management. Revenue generated from a contract breach is termed settlement income by the Company and included in licensing fees and other income.

3. Revenue Recognition

Franchise and related revenue (continued)

Under the terms of our franchise agreements, the Company typically promises to provide franchise rights, pre-opening services such as blueprints, operational materials, planning and functional training courses, and ongoing services, such as management of the marketing fund. The Company considers certain pre-opening activities and the franchise rights and related ongoing services to represent two separate performance obligations. The franchise fee revenue has been allocated to the two separate performance obligations using a residual approach. The Company has estimated the value of performance obligations related to certain pre-opening activities deemed to be distinct based on cost plus an applicable margin, and assigned the remaining amount of the initial franchise fee to the franchise rights and ongoing services. Revenue allocated to preopening activities is recognized when (or as) these services are performed. Revenue allocated to franchise rights and ongoing services is deferred until the store opens, and recognized on a straight-line basis over the duration of the agreement, as this ensures that revenue recognition aligns with the customer’s access to the franchise right.

Royalty fees from franchised stores represent a 5% fee on net retail and wholesale sales of franchised units. Royalty revenues are recognized on an accrual basis using actual franchise receipts. Generally, franchisees report and remit royalties on a weekly basis. The majority of month-end receipts are recorded on an accrual basis based on actual numbers from reports received from franchisees shortly after the month-end. Estimates are utilized in certain instances where actual numbers have not been received and such estimates are based on the average of the last 10 weeks’ actual reported sales.

Royalty revenue is recognized during the respective franchise agreement based on the royalties earned each period as the underlying franchise store sales occur.

There are two items involving revenue recognition of contracts that require us to make subjective judgments: the determination of which performance obligations are distinct within the context of the overall contract and the estimated stand-alone selling price of each obligation. In instances where our contract includes significant customization or modification services, the customization and modification services are generally combined and recorded as one distinct performance obligation.

Gift Card Breakage Revenue

The Company sells gift cards to its customers in its retail stores and through its Corporate office. The Company’s gift cards do not have an expiration date and are not redeemable for cash except where required by law. Revenue from gift cards is recognized upon redemption in exchange for product and reported within franchisee store revenue and the royalty and marketing fees are paid and shown in the Condensed Consolidated Statements of Income. Until redemption, outstanding customer balances are recorded as a liability. An obligation is recorded at the time of sale of the gift card and it is included in accrued expenses on the Company’s Condensed Consolidated Balance Sheets.

The liability is reduced when the gift cards are redeemed by a franchise. Although there are no expiration dates for our gift cards, based on our analysis of historical gift card redemption patterns, we can reasonably estimate the amount of gift cards for which redemption is remote, which is referred to as “breakage.” The Company recognizes gift card breakage proportional to actual gift card redemptions on a quarterly basis and the corresponding revenue is included in licensing fees and other revenue. Significant judgments and estimates are required in determining the breakage rate and will be reassessed each quarter.

3. Revenue Recognition (continued)

Nontraditional and rebate revenue

As part of the Company’s franchise agreements, the franchisee purchases products and supplies from designated vendors. The Company may receive various fees and rebates from the vendors and distributors on product purchases by franchisees. In addition, the Company may collect various initial fees, and those fees are classified as deferred revenue in the balance sheet and straight lined over the life of the contract as deferred revenue in the balance sheet. The Company does not possess control of the products prior to their transfer to the franchisee and products are delivered to franchisees directly from the vendor or their distributors. The Company recognizes the rebates as franchisees purchase products and supplies from vendors or distributors and recognizes the initial fees over the contract life and the fees are reported as licensing fees and other income in the Condensed Consolidated Statements of Income.

Marketing Fund

Franchise agreements require the franchisee to pay continuing marketing fees on a weekly basis, based on a percentage of franchisee sales. Marketing fees are not paid on franchise wholesale sales. The balance sheet includes marketing fund cash, which is the restricted cash, accounts receivable and unexpended marketing fund contributions. Although the marketing fees are not separate performance obligations distinct from the underlying franchise right, the Company acts as the principal as it is primarily responsible for the fulfillment and control of the marketing services. As a result, the Company records marketing fees in revenues and related marketing fund expenditures in expenses in the Condensed Consolidated Statement of Income. The Company historically presented the net activities of the marketing fund within the balance sheet in the Condensed Consolidated Balance Sheet. While this reclassification impacts the gross amount of reported revenue and expenses the amounts will be offsetting, and there is no impact on net income.

Disaggregation of Revenue

The following table presents disaggregation of revenue from contracts with customers for the three months and six months ended May 31, 2024 and 2023:

| |

|

For three

months ended

May 31, 2024

|

|

|

For three

months ended

May 31, 2023

|

|

|

For six

months ended

May 31, 2024

|

|

|

For six

months ended

May 31, 2023

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue recognized at a point in time

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sign Shop revenue

|

|

$ |

- |

|

|

$ |

2,022 |

|

|

$ |

1,379 |

|

|

$ |

2,179 |

|

|

Settlement revenue

|

|

|

1,000 |

|

|

|

6,000 |

|

|

|

26,610 |

|

|

|

12,500 |

|

|

Total revenue at a point in time

|

|

|

1,000 |

|

|

|

8,022 |

|

|

|

27,989 |

|

|

|

14,679 |

|

|

Revenue recognized over time

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Royalty revenue

|

|

|

513,474 |

|

|

|

494,933 |

|

|

|

973,163 |

|

|

|

937,541 |

|

|

Franchise fees

|

|

|

9,215 |

|

|

|

7,054 |

|

|

|

19,461 |

|

|

|

11,401 |

|

|

License fees

|

|

|

5,978 |

|

|

|

5,443 |

|

|

|

11,956 |

|

|

|

9,589 |

|

|

Gift card revenue

|

|

|

313 |

|

|

|

1,796 |

|

|

|

3,159 |

|

|

|

2,100 |

|

|

Nontraditional revenue

|

|

|

46,222 |

|

|

|

60,413 |

|

|

|

116,997 |

|

|

|

109,626 |

|

|

Marketing fund revenue

|

|

|

306,636 |

|

|

|

286,739 |

|

|

|

566,047 |

|

|

|

525,057 |

|

|

Total revenue over time

|

|

|

881,838 |

|

|

|

856,378 |

|

|

|

1,690,783 |

|

|

|

1,595,314 |

|

|

Grand total

|

|

$ |

882,838 |

|

|

$ |

864,400 |

|

|

$ |

1,718,772 |

|

|

$ |

1,609,993 |

|

3. Revenue Recognition (continued)

Contract balances

The balance of contract liabilities includes franchise fees, license fees and vendor payments that have ongoing contract rights and the fees are being straight lined over the contract life. Contract liabilities also include marketing fund balances and gift card liability balances.

| |

|

May 31, 2024

|

|

|

November 30, 2023

|

|

|

Liabilities

|

|

|

|

|

|

|

|

|

|

Contract liabilities - current

|

|

$ |

481,823 |

|

|

$ |

458,162 |

|

|

Contract liabilities - long-term

|

|

|

157,743 |

|

|

|

162,026 |

|

|

Total Contract Liabilities

|

|

$ |

639,566 |

|

|

$ |

620,188 |

|

| |

|

May 31, 2024

|

|

|

November 30, 2023

|

|

|

Contracts at beginning of period

|

|

$ |

620,188 |

|

|

$ |

692,360 |

|

| |

|

|

|

|

|

|

|

|

|

Revenue Recognized during period

|

|

|

(724,651 |

) |

|

|

(1,685,740 |

) |

|

Additions during period

|

|

|

744,029 |

|

|

|

1,613,568 |

|

|

Contracts at end of period

|

|

$ |

639,566 |

|

|

$ |

620,188 |

|

Transaction price allocated to remaining performance obligations (franchise agreements and license fee agreement) for the year ended November 30:

|

2024

|

|

$ |

15,328 |

|

(a)

|

|

2025

|

|

|

26,005 |

|

|

|

2026

|

|

|

25,780 |

|

|

|

2027

|

|

|

19,133 |

|

|

|

2028

|

|

|

18,600 |

|

|

|

Thereafter

|

|

|

77,063 |

|

|

|

Total

|

|

$ |

181,909 |

|

|

|

(a) represents the estimate for the remainder of 2024

|

4. Units Open and Under Development

Units which are open or under development at May 31, 2024 and 2023 are as follows:

| |

|

May 31, 2024

|

|

|

May 31, 2023

|

|

|

Stores open:

|

|

|

|

|

|

|

|

|

|

Franchisee-owned stores

|

|

|

64 |

|

|

|

67 |

|

|

Licensed Units

|

|

|

4 |

|

|

|

3 |

|

| |

|

|

68 |

|

|

|

70 |

|

| |

|

|

|

|

|

|

|

|

|

Unopened stores with Franchise Agreements

|

|

|

4 |

|

|

|

4 |

|

| |

|

|

|

|

|

|

|

|

|

Total operating units and units with Franchise Agreements

|

|

|

72 |

|

|

|

74 |

|

5. Earnings per Share

The following table sets forth the computation of basic and diluted earnings per share:

| |

|

For the three months ended:

|

|

|

For the six months ended:

|

|

| |

|

May 31, 2024

|

|

|

May 31, 2023

|

|

|

May 31, 2024

|

|

|

May 31, 2023

|

|

|

Numerator:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income available to common shareholders

|

|

$ |

145,685 |

|

|

$ |

126,528 |

|

|

$ |

244,190 |

|

|

$ |

161,848 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Denominator:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average outstanding shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted common stock

|

|

|

7,263,508 |

|

|

|

7,263,508 |

|

|

|

7,263,508 |

|

|

|

7,263,508 |

|

|

Earnings per Share - Basic

|

|

$ |

0.02 |

|

|

$ |

0.02 |

|

|

$ |

0.03 |

|

|

$ |

0.02 |

|

6. Goodwill and Other Intangible Assets

Accounting Standard Codification (“ASC”) 350 “Goodwill and Other Intangible Assets” requires that assets with indefinite lives no longer be amortized, but instead be subject to annual impairment tests.

Following the guidelines contained in ASC 350, the Company tests goodwill and intangible assets that are not subject to amortization for impairment annually or more frequently if events or circumstances indicate that impairment is possible. The Company has elected to conduct its annual test during the first quarter. During the quarter ended February 29, 2024 and February 28, 2023, management qualitatively assessed goodwill to determine whether testing was necessary. Factors that management considers in this assessment include macroeconomic conditions, industry and market considerations, overall financial performance (both current and projected), changes in management and strategy, and changes in the composition and carrying amounts of net assets. If this qualitative assessment indicates that it is more likely than not that the fair value of a reporting unit is less than it’s carrying value, a quantitative assessment is then performed. Based on a review of the First Quarter goodwill assessment during the current quarter, management does not believe that an impairment exists at May 31, 2024.

7. Lease Receivable

The Company leases restaurant equipment to a certain franchise under a sales-type lease agreement. The lease agreement does not contain any non-lease components. The lease term is for a period of seven years, beginning June 1, 2022 and ending June 1, 2029. The lease requires weekly payments of $121 for a total 365 payments, and a final optional buy-out payment of $4,800, which management believes estimates residual value. At May 31, 2024, management does not believe the unguaranteed residual asset value of $4,800 to be impaired.

During the six months ending May 31, 2024, the Company recorded interest income from the lease receivable of $200.

The sales lease is included in the balance sheet at the current value of the lease payments at a 1.25% discount rate, which reflects the rate implicit in the lease agreement.

Future minimum lease payments receivable as of May 31, 2024 are as follows:

| |

|

|

Undiscounted

Rent Payments

|

|

|

Year Ending November 30:

|

|

|

|

|

|

|

2024

|

|

|

$ |

3,142 |

|

|

2025

|

|

|

|

6,283 |

|

|

2026

|

|

|

|

6,404 |

|

|

2027

|

|

|

|

6,283 |

|

|

2028

|

|

|

|

6,283 |

|

|

thereafter

|

|

|

|

7,942 |

|

|

Total Undiscounted Lease Payments

|

|

|

|

36,337 |

|

| |

|

|

|

|

|

|

Unamortized interest income

|

|

|

|

(973 |

) |

|

Lease receivable, net

|

|

|

$ |

35,364 |

|

| |

|

|

|

|

|

|

Short-term lease receivable

|

|

|

$ |

5,937 |

|

|

Long-term lease receivable

|

|

|

|

29,427 |

|

|

Total lease receivable

|

|

|

$ |

35,364 |

|

8. Lease Commitments

The Company rents its office under an operating lease which requires it to pay base rent, real estate taxes, insurance and general repairs and maintenance. The lease effective during the quarter was signed in June of 2018, effective October 1, 2018, expiring on March 31, 2024. On February 15, 2024, a lease amendment was signed, effective April 1, 2024 for a 6-year period, expiring March 31, 2030, with an option to renew for a 5-year period. The amendment continues to require the Company to pay base rent, real estate taxes, insurance and general repairs and maintenance. The amendment includes a ten-month rent abatement over the lease term, specifically defined in the agreement, and tenant allowance in the amount of $158,940. The tenant allowance is to be applied evenly to the 62 months that were not abated. The renewal option has not been included in the measurement of the lease liability.

Monthly rent expense is recognized on a straight-line basis over the term of the lease. At May 31, 2024 the remaining lease term was 70 months. The lease amendment is reflected in the balance of the Lease Liability on the balance sheet at the present value of the lease payments using an 8.50% discount rate. The discount rate was considered to be an estimate of the Company’s incremental borrowing rate.

Gross future minimum annual rental commitments as of May 31, 2024 are as follows:

| |

|

|

Undiscounted

Rent Payments

|

|

|

Year Ending November 30:

|

|

|

|

|

|

|

2024

|

|

|

$ |

45,546 |

|

|

2025

|

|

|

|

77,737 |

|

|

2026

|

|

|

|

80,837 |

|

|

2027

|

|

|

|

84,024 |

|

|

2028

|

|

|

|

96,163 |

|

|

Thereafter

|

|

|

|

136,725 |

|

|

Total Undiscounted Rent Payments

|

|

|

$ |

521,032 |

|

| |

|

|

|

|

|

|

Present Value Discount

|

|

|

|

(113,895 |

) |

|

Present Value

|

|

|

$ |

407,137 |

|

| |

|

|

|

|

|

|

Short-term lease liability

|

|

|

$ |

44,066 |

|

|

Long-term lease liability

|

|

|

|

363,071 |

|

|

Total Operating Lease Liability

|

|

|

$ |

407,137 |

|

9. Income Taxes

For the three months ended May 31, 2024, the Company recorded current and deferred tax expense of $57,500 for an effective tax rate of 28.3% compared to $50,000 of current and deferred tax expense for the three months ended May 31, 2023 for an effective tax rate of 28.3%.

For the six months ended May 31, 2024, the Company recorded current and deferred tax expense of $96,500 for an effective tax rate of 28.3% compared to $64,200 of current and deferred tax expense for the six months ended May 31, 2023 for an effective tax rate of 28.4%.

10. Stockholder’s Equity

On June 06, 2024 the Board of Director (“Board”) declared a $0.01 quarterly cash distribution, payable on July 12, 2024 to shareholders of record as of June 24, 2024. On March 6, 2024 the Board declared a $0.01 quarterly cash distribution, payable on April 12, 2024 to shareholders of record as of March 21, 2024. On December 11, 2023 the Board declared a $0.02 cash distribution/dividend per share, $0.01 quarterly and $0.01 special to stockholders of record as of December 27, 2023, paid January 16, 2024.

On September 12, 2023 the Board declared a $0.01 distribution/dividend per share to stockholders of record as of September 28, 2023, payable October 18, 2023. On June 6, 2023 the Board declared a $0.01 distribution/dividend per share to stockholders of record as of June 22, 2023, paid on July 11, 2023. On March 13, 2023 the Board declared a $0.01 distribution/dividend per share to stockholders of record as of March 30, 2023, paid on April 19, 2023. On December 07, 2022 the Board declared a $0.02 cash distribution/dividend per share, $0.01 quarterly and $0.01 special, to stockholders of record as of December 22, 2022, paid January 11, 2023.