BAE Systems Raises Guidance After Pretax Profit Grew on Strong Orders; Launches $1.9 Billion Buyback

August 02 2023 - 2:29AM

Dow Jones News

By Anthony O. Goriainoff

BAE Systems raised its full-year forecast after reporting a rise

in first-half pretax profit reflecting record order books as

governments spend more on defense.

The U.K. defense-and-aerospace group raised its sales guidance

by 200 basis points to 5% to 7%, from previous guidance of 3% to

5%. Underlying earnings before interest and taxes are now seen

rising by between 6% and 8%, up from a range 4% to 6%. Underlying

earnings per share guidance went up 500 bps to 10% to 12%, from a

prior 5% to 7%.

The company said order intake in the first half was 21.1 billion

pounds ($26.96 billion) compared with GBP18 billion last year,

resulting in a record order backlog of GBP66.2 billion.

Pretax profit for the half year was GBP1.2 billion compared with

GBP779 million for the first half of 2022.

Underlying earnings per share--the company's preferred metric,

which strips out exceptional and other one-off items--rose to 29.6

pence a share from 24.5 pence a share in the year-prior period.

Company-compiled underlying EPS consensus was in the 24.3 pence to

27.3 pence range.

BAE--which makes a range of military hardware and software,

mainly in the U.S. and U.K.--generated revenue for the period of

GBP11 billion compared with GBP9.74 billion the year before and a

company-compiled consensus of between GBP11 billion and GBP11.39

billion.

The company added that it has launched a further share buyback

program of up to GBP1.5 billion.

Write to Anthony O. Goriainoff at

anthony.orunagoriainoff@dowjones.com

(END) Dow Jones Newswires

August 02, 2023 03:14 ET (07:14 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

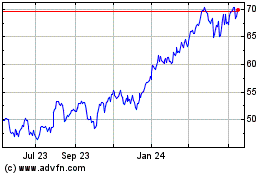

Bae Systems (PK) (USOTC:BAESY)

Historical Stock Chart

From Dec 2024 to Jan 2025

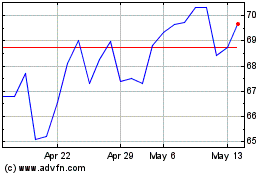

Bae Systems (PK) (USOTC:BAESY)

Historical Stock Chart

From Jan 2024 to Jan 2025