BAE Systems Raises Guidance on Strong Defense Orders -- Update

August 02 2023 - 4:10AM

Dow Jones News

By Anthony O. Goriainoff

BAE Systems raised its full-year forecast after reporting a

strong first-half, reflecting record order books as governments

spend more on defense.

The U.K. defense-and-aerospace group said Wednesday that it now

expects sales to rise between 5% and 7%, from previous guidance of

3% to 5%, driven by accelerated spending on the U.K.

Dreadnought-class submarine program, as well as strong demand and

operational performance across all sectors.

Underlying earnings before interest and taxes are expected to

grow between 6% and 8%, from 4% to 6% previously, while underlying

earnings per share guidance has been boosted to 10% to 12%, from 5%

to 7%.

The company's order intake in the first half year ended June 30

was 21.1 billion pounds ($26.96 billion) compared with GBP18

billion for the same period a year earlier, resulting in a record

order backlog of GBP66.2 billion. BAE said it expects a continued

strong order flow for the rest of this year.

Pretax profit for the half year was GBP1.2 billion compared with

GBP779 million for the first half of 2022.

Underlying earnings per share--the company's preferred metric,

which strips out exceptional and other one-off items--rose to 29.6

pence a share from 24.5 pence a share in the year-prior period.

Company-compiled underlying EPS consensus was in the 24.3 pence to

27.3 pence range.

BAE--which makes a range of military hardware and software,

mainly in the U.S. and U.K.--generated revenue for the period of

GBP11 billion compared with GBP9.74 billion the year before and a

company-compiled consensus of between GBP11 billion and GBP11.39

billion.

The company added that it has launched a further share buyback

program of up to GBP1.5 billion.

"With a record order backlog and good operational performance,

we're well positioned to continue delivering sustained growth in

the coming years, giving us confidence to continue investing in new

technologies, facilities, highly-skilled jobs and in our local

communities," Chief Executive Charles Woodburn said.

BAE said it has made significant long-term strategic progress

with the Aukus trilateral defense agreement between Australia, the

U.K. and the U.S., which will see Australia purchase its first

nuclear-powered submarine-defense program.

The company is also in advanced talks with international

partners on the Global Combat Air Program, it said, adding that it

remains well aligned with U.S. national defense strategy

priorities.

"These multi-national endeavors further highlight our global

reach and the scale and longevity of our business," BAE said.

The company has increased its free cash guidance for 2023 by

GBP600 million to over GBP1.8 billion following strong cash

generation in the first half which it expects to continue

throughout the year. The company reported free cashflow of GBP1.95

billion in 2022.

Government spending on defense has surged in the wake of

Russia's invasion of Ukraine early last year, driven by the war

there as well as longer-term threats.

Last month industry peer Thales--the French

aerospace-and-defense group--narrowed its sales-growth guidance for

the year after posting higher earnings in the first half, while

Italian defense company Leonardo also confirmed its outlook.

Shares at 0809 GMT were up 52 pence, or 5.6%, at 985.20

pence.

Write to Anthony O. Goriainoff at

anthony.orunagoriainoff@dowjones.com

(END) Dow Jones Newswires

August 02, 2023 04:55 ET (08:55 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

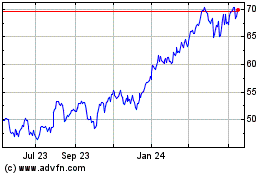

Bae Systems (PK) (USOTC:BAESY)

Historical Stock Chart

From Dec 2024 to Jan 2025

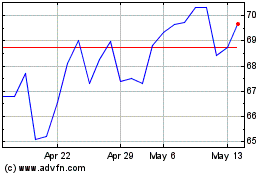

Bae Systems (PK) (USOTC:BAESY)

Historical Stock Chart

From Jan 2024 to Jan 2025