Trending: BAE Systems Shares Slip After It Agrees to Buy Ball's Aerospace Unit for $5.55 Billion

August 17 2023 - 6:45AM

Dow Jones News

1114 GMT - BAE Systems is among the most mentioned companies

across news items over the past five hours, according to Factiva

data. The U.K. defense-and-aerospace group's shares slid Thursday

after it said it is buying buy Ball Corp.'s aerospace business for

$5.55 billion in cash, in a deal expected to boost revenue

visibility and provide a strong growth outlook. The company said

the acquisition of Colorado-headquartered Ball Aerospace, which

provides spacecraft, mission payloads, optical systems, and antenna

systems, will improve its earnings per share and margins in the

first year post-completion, expected in the first half of 2024.

"The strategic and financial rationale is compelling, as we

continue to focus on areas of high priority defence and

Intelligence spending, strengthening our world class multi-domain

portfolio," Chief Executive Charles Woodburn said. The deal looks a

good fit, as BAE is looking to expand in nascent sectors like space

as well as build on its capabilities in electronics, AJ Bell

investment director Russ Mould said in a market comment. The price

tag is the only downside, which looks a touch on the expensive side

and potentially explains the lukewarm reaction, Mould writes.

Shares are down 3.9% at 963.2 pence. Dow Jones & Co. owns

Factiva. (joseph.hoppe@wsj.com)

(END) Dow Jones Newswires

August 17, 2023 07:30 ET (11:30 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

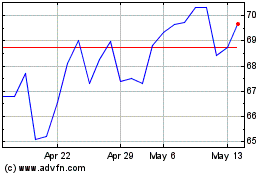

Bae Systems (PK) (USOTC:BAESY)

Historical Stock Chart

From Nov 2024 to Dec 2024

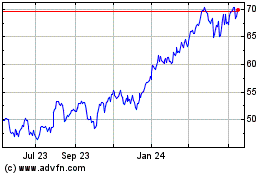

Bae Systems (PK) (USOTC:BAESY)

Historical Stock Chart

From Dec 2023 to Dec 2024