BRUSSELS—About 35 multinationals, including brewer

Anheuser-Busch InBev NV, will be required to pay roughly €700

million ($765 million) in additional taxes in Belgium after

European Union regulators ruled they had benefited from an illegal

tax break.

After an 11-month investigation, the European Commission, the

bloc's top antitrust regulator, concluded Monday that a Belgian

tax-discount plan for multinationals amounted to "a very serious

distortion of competition within the EU's single market," and

ordered Belgium to recover the unpaid taxes.

Other companies facing back-tax demands as a result of the

decision include BP PLC, German chemicals giant BASF SE and Pfizer

Inc., a person familiar with the case said.

The tax bill dwarfs an earlier ruling against Starbucks Corp.

and Fiat Chrysler Automobiles in October, setting an ominous new

benchmark in an expanding inquiry into tax deals that has ensnared

major U.S. multinationals including Apple Inc. and Amazon.com

Inc.

It comes at a sensitive time for Belgium-based AB InBev, which

is in the middle of a complicated $108 billion deal to buy the

world's second-largest brewer, SAB Miller PLC of London.

Belgian Finance Minister Johan Van Overtveldt warned that the

EU's decision, if implemented, would have considerable consequences

for the companies concerned, and that the reimbursement itself

would be complex.

The tax scheme, in place since 2005, allowed certain

corporations to reduce their tax base by between 50% and 90% to

discount for so-called excess profits that allegedly result from

being part of a multinational group, the commission said.

At a news conference, EU antitrust chief Margethe Vestager said

the scheme had given "carte blanche to double non-taxation" of

certain multinationals in Belgium. Ms. Vestager declined to name

the companies affected, but she stressed that they were primarily

European, seeking to deflect criticism that she has focused too

much of her firepower on U.S. multinationals.

A person familiar with the matter said the largest beneficiaries

of the Belgian scheme—and therefore those likely to face the

biggest back-tax bills—were AB InBev, Swedish industrial company

Atlas Copco, BP, BASF, Belgian telecommuications operator Belgacom,

now known as Proximus Group, French retailer Celio and

vehicle-component manufacturer Wabco.

AB InBev confirmed in a statement that it benefits from the type

of Belgian tax ruling deemed illegal by Brussels. It said it was

disappointed by the EU's decision and was confident that it had

always complied with "Belgian and international tax

provisions."

"We will consider our options, taking into account the reactions

by the Belgian authorities," the company said—leaving the door open

to an appeal with the EU's top courts in Luxembourg.

BASF said it was closely following the case, adding it was one

of the largest taxpayers in Belgium. Atlas Copco declined to

comment, citing a "quiet period" before its results later this

month. A spokesman for Wabco said the company was reviewing the

EU's announcement and would "issue its own statement in due

course." BP declined to comment.

Other companies involved didn't respond to requests for

comment.

Tax experts warned that the EU's decision would create

uncertainty for corporate directors, and risked driving investment

away from Belgium.

"The reputation of Belgium as an investment location will

certainly be damaged as trust and legal certainty is key," said

Dirk Van Stappen, a tax partner at KPMG in Belgium and professor at

the University of Antwerp.

Mr. Van Overtveldt said Belgian authorities would hold further

negotiations with EU regulators, and didn't rule out lodging an

appeal with the bloc's top courts in Luxembourg, depending on the

outcome of those talks.

Geert De Neef, a Brussels-based partner with international tax

consultancy Taxand, said multinationals might consider moving their

headquarters to London, the Netherlands or Luxembourg, where

headline corporate tax rates are lower than Belgium's 34%. "Then

you don't need special tricks, you know it is acceptable for the

European Commission," Mr. De Neef said.

The EU's widening tax inquiry has also drawn criticism from the

U.S. government over its apparent disproportionate targeting of

American companies, which have been targeted with four separate

probes.

Responding directly to such criticism on Monday, Ms. Vestager

said the latest ruling would affect mainly European multinationals.

Of the €700 million in back taxes to be repaid, €500 million would

come from European companies, she said.

"I, of course, hear the criticism that this is about U.S.

companies, which it is obviously not," Ms. Vestager said. "What we

are interested in is fair competition."

The multinationals that benefited are from a variety of sectors,

but are generally involved in producing goods, Ms. Vestager

said.

The tax probes are a top political priority for European policy

makers, who are under pressure to show that the biggest companies

are paying their fair share during an age of austerity. But tax

experts complain that the inquiry might have repercussions for

investment in Europe because it risks overturning thousands of

long-established corporate tax structures.

EU regulators have so far closed two probes, into Starbucks's

tax affairs in the Netherlands and Fiat Chrysler Automobiles NV's

in Luxembourg. The EU ruled in October that both companies had

benefited from illegal tax deals and ordered the governments to

reclaim between €20 million and €30 million from each company.

Both decisions are expected to be appealed at the EU's courts in

Luxembourg, a process that can take years. The governments involved

in the investigation have denied giving special treatment, and the

companies have denied receiving it.

Write to Tom Fairless at tom.fairless@wsj.com

(END) Dow Jones Newswires

January 11, 2016 13:25 ET (18:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

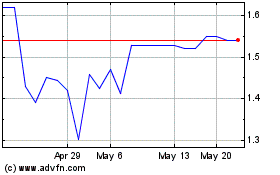

Proximus (PK) (USOTC:BGAOY)

Historical Stock Chart

From Feb 2025 to Mar 2025

Proximus (PK) (USOTC:BGAOY)

Historical Stock Chart

From Mar 2024 to Mar 2025