Amazon Posts Another Blockbuster Profit

July 28 2016 - 3:50PM

Dow Jones News

Amazon.com Inc. reported another record profit and its fifth

straight quarter in the black as it continued to reap new sales

from Prime memberships and its relentless push to deliver goods

ever faster.

Revenue gained 31%, helping push Amazon to a new all-time profit

mark, its third straight quarter doing so, helped along by rising

sales at its cloud computing unit.

Shares of the company rose 2.3% to $769 in after-hours

trading.

Amazon appears finally to be delivering on a long-held hope from

investors of consistent profitability. The Seattle company hadn't

had five consecutive profitable quarters since 2012 as it pumped

much of its sales back into product and infrastructure development,

including massive suburban warehouses to feed customers'

appetites.

For the second quarter, Amazon recorded an $857 million profit,

or $1.78 a share, compared with $92 million, or 19 cents, a year

earlier, as sales rose to $30.4 billion from $23.19 billion.

Analysts were expecting a profit of $1.11 a share, according to the

average estimate compiled by Thomson Reuters.

Amazon had forecast sales of between $28 billion and $30.5

billion.

Helping prop up results was the Amazon Web Services cloud

computing division, which rents computing power to other companies.

AWS increased revenue to $2.89 billion, up from $1.82 billion a

year earlier. The unit appears on track to exceed Amazon Chief

Executive Jeff Bezos's goal of reaching $10 billion in sales this

year.

For the third quarter, the company forecast net sales between

$31 billion and $33.5 billion, compared with analysts' views of

$31.63 billion.

Amazon is no longer just the dominating force in online retail.

It overtook Wal-Mart Stores Inc. by market capitalization a year

ago and is pushing into brick-and-mortar with a bookstore in its

hometown of Seattle and several others planned across the U.S. And

the retailer is a major focal point for brands and manufacturers

betting that consumers are willing to buy more goods online like

clothing and food.

And to keep customers using its $99-per-year Prime unlimited

shipping membership, Amazon has fattened the program up with

exclusive streaming television shows and music as well as a

one-hour delivery service for some goods in a number of cities. It

said this month it will offer Prime for the first time to customers

in India, where it has pledged $5 billion in investment since

2014.

Amazon has been casting about to find new ways to contain

shipping costs that have accelerated more quickly than sales in

recent quarters, including a 42% jump in this year's first three

months and 37% in 2015's holiday quarter. For the second quarter,

Amazon reported a 44% rise in shipping expenses to $3.36

billion.

The company has taken over more of its own delivery, including

the expensive final leg of a package's journey, known as the last

mile. It is leasing 40 planes to carry goods and branded bought

truck trailers.

Rival eBay Inc. reported its second straight sales gain earlier

this month and issued a cheery outlook.

Write to Greg Bensinger at greg.bensinger@wsj.com

(END) Dow Jones Newswires

July 28, 2016 16:35 ET (20:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

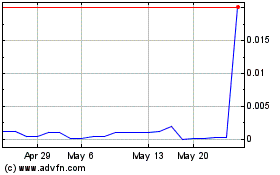

BB Liquidating (CE) (USOTC:BLIAQ)

Historical Stock Chart

From Nov 2024 to Dec 2024

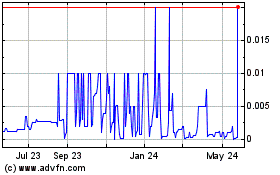

BB Liquidating (CE) (USOTC:BLIAQ)

Historical Stock Chart

From Dec 2023 to Dec 2024