Current Report Filing (8-k)

March 07 2017 - 3:32PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): March 7, 2017 (March 1, 2017)

Blue

Sphere Corporation

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

000-55127

|

|

98-0550257

|

|

(State

or other jurisdiction of incorporation)

|

|

(Commission

File Number)

|

|

(IRS

Employer Identification No.)

|

301

McCullough Drive, 4th Floor, Charlotte, North Carolina 28262

(Address

of principal executive offices) (Zip Code)

704-909-2806

(Registrant’s

telephone number, including area code)

(Former

Name or Former Address, if Changed since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

As

used in this Current Report, all references to the terms “we”, “us”, “our”, “Blue Sphere”

or the “Company” refer to Blue Sphere Corporation and its wholly-owned subsidiaries, unless the context clearly requires

otherwise.

Item

1.01

Entry

Into a Material Definitive Agreement

As

reported by the Company on its Current Report on Form 8-K filed on October 31, 2016, on October 25, 2016 the Company completed

a private placement of its securities to JMJ Financial, an accredited investor, thereby agreeing to issue shares of our common

stock, $0.001 par value per share (“Common Stock”), a note and warrants, in exchange for up to USD $1,000,000 (the

“Note Principal”) in accordance with the specified installment schedule. On October 25, 2016, the Company issued to

the investor (i) a non-interest bearing six (6) month promissory note in the amount of the Note Principal plus approximately five

percent (5%) of the actual Note Principal (the “Note”), and (ii) a five (5) year warrant to purchase up to 6,666,666

shares of Common Stock (the “First Warrant”). On December 20, 2016, the Company received the second installment under

the Note in the amount of USD $250,000, and issued a five (5) year warrant to purchase 3,333,333 shares of Common Stock (the “Second

Warrant”). On February 15, 2017, the Company received the third installment under the Note in the amount of USD $250,000,

and issued a five (5) year warrant to purchase 3,333,333 shares of Common Stock (together with the First Warrant and the Second

Warrant, the “Warrants”).

By

letter agreement on March 1, 2017, JMJ Financial agreed to extend specified milestone dates contained in the events of default

under the Note and the Warrants, whereby JMJ Financial conditionally agreed to waive any such default in connection with meeting

such original dates, except to the extent of damages, fees, penalties, liquidated damages, or other amounts or remedies otherwise

resulting from such default, if we trigger an event of default or breach any terms of the Note and the Warrants subsequent to

the letter agreement (the “JMJ Letter Agreement”). Specifically, JMJ Financial agreed to extend (i) the date to receive

conditional approval from The NASDAQ Capital Market from February 28, 2017 to March 31, 2017 and (ii) the date upon which a reverse

split of our Common Stock will become effective from March 15, 2017 to April 15, 2017.

The

foregoing description of the JMJ Letter Agreement does not purport to be complete and is qualified in its entirety by reference

to the full text of the JMJ Letter Agreement attached as Exhibit 10.1 to this Current Report on Form 8-K, and incorporated herein

by reference.

Item

9.01

Financial

Statements and Exhibits.

The

following exhibits are furnished as part of this Current Report on Form 8-K:

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

Blue

Sphere Corporation

|

|

|

|

|

|

|

|

Date: March

7, 2017

|

By:

|

/s/

Shlomi Palas

|

|

|

|

Name:

|

Shlomi

Palas

|

|

|

Title:

|

President

and Chief Executive Officer

|

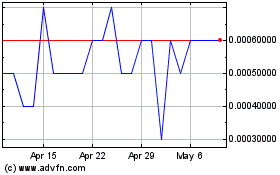

Blue Sphere (CE) (USOTC:BLSP)

Historical Stock Chart

From Jan 2025 to Feb 2025

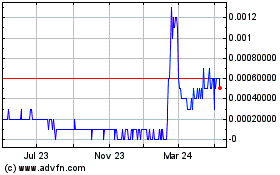

Blue Sphere (CE) (USOTC:BLSP)

Historical Stock Chart

From Feb 2024 to Feb 2025